#BTC

- Technical indicators show Bitcoin consolidating with MACD turning positive, suggesting potential upward momentum

- Fundamental factors including halving anticipation and institutional adoption provide strong long-term support

- Market sentiment remains divided but institutional interest continues to grow with new financial products

BTC Price Prediction

BTC Technical Analysis: Consolidation Phase with Bullish Potential

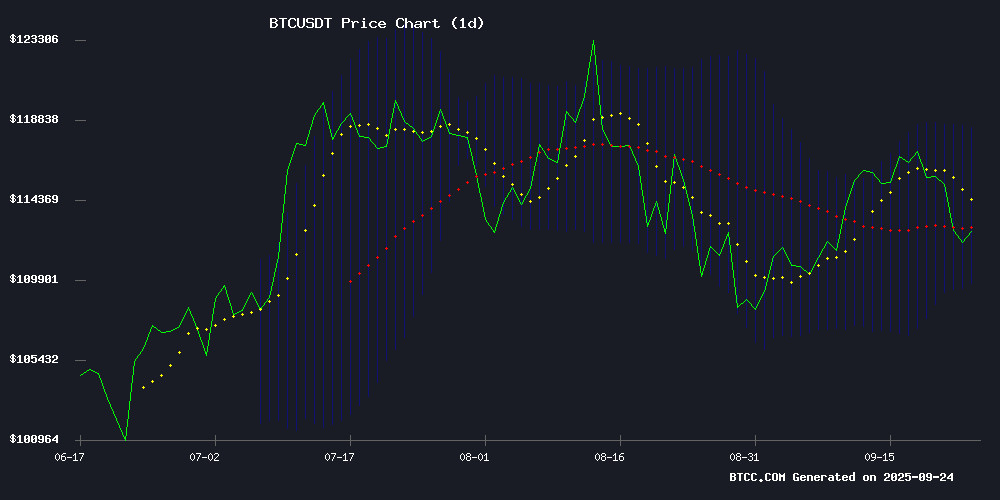

According to BTCC financial analyst James, Bitcoin is currently trading at $112,464.50, slightly below its 20-day moving average of $114,078.99, indicating a short-term consolidation phase. The MACD shows a slight improvement with the histogram turning positive at 141.79, suggesting weakening downward momentum. Bitcoin is trading within the Bollinger Bands with support at $109,711.58 and resistance at $118,446.39. James notes that holding above the lower band could signal a potential rebound toward the middle band at $114,078.99.

Market Sentiment: Mixed Signals with Strong Fundamental Backdrop

BTCC financial analyst James observes that market sentiment presents a mixed picture. Positive developments include growing bitcoin halving anticipation, Tether's potential $500 billion valuation, and increasing crypto millionaires reaching 241,700 in 2025. However, concerns arise from Bitcoin dipping below key support levels and altcoin competition. James emphasizes that institutional interest remains strong with Fold's Bitcoin rewards card launch and Peter Brandt advocating 10% Bitcoin allocations, providing solid fundamental support for long-term growth.

Factors Influencing BTC's Price

Bitcoin Halving Anticipation Grows as FY Energy Promises Passive Income Through Cloud Mining

Bitcoin maintains its position above $114,000 as global markets brace for the 2026 halving event. Historical trends suggest significant price appreciation post-halving, though investors remain cognizant of delayed profit realization periods.

FY Energy emerges as a disruptive force in cloud mining, offering automated 24-hour profit settlements and eco-friendly solutions. The platform's $20 trial bonus eliminates entry barriers, allowing users to experience daily USD payouts before committing capital.

Market participants increasingly view such cloud mining solutions as hybrid instruments - generating immediate cash flow while maintaining long-term crypto exposure. The platform's flexible contracts cater to both novice and experienced miners seeking to capitalize on Bitcoin's cyclical momentum.

Bitcoin Dips Below Key Support as PayFi Altcoins Gain Traction

Bitcoin's failure to hold the $112,500 support level has triggered a strategic reassessment among investors, with many shifting focus toward early-stage utility projects. The flagship cryptocurrency now hovers near $118,838, marking a 0.5% daily decline despite maintaining a robust 74% yearly gain. Market sentiment remains divided—some analysts anticipate a rebound toward $125,000, while others warn of potential downside risks.

Meanwhile, PayFi tokens are emerging as the market's new darlings, bridging traditional payment systems with decentralized finance. Their rapid ascent on exchange trending lists signals growing institutional and retail interest, echoing the fervor of the 2021 DeFi boom. September's atypical 8% gain for Bitcoin—its strongest performance for the month on record—adds another layer of complexity to the current market calculus.

Tether Eyes $500B Valuation in Massive $20B Private Placement

Tether, the dominant force in stablecoins, is negotiating a private equity raise that could redefine its market position. The company seeks $15-$20 billion for a 3% stake, potentially valuing the firm at half a trillion dollars—placing it alongside tech titans like OpenAI and SpaceX. Cantor Fitzgerald is advising on the offering, which would involve newly issued shares.

The move comes amid staggering financial performance. Q2 saw $4.9 billion in net profit, with reserves covering liabilities by $5.4 billion. Notably, Tether holds $8.9 billion in Bitcoin—a strategic reserve that underscores its crypto-native roots. Prospective investors have already begun due diligence through a dedicated data room.

Market dominance remains unchallenged. USDT's $172.8 billion market cap dwarfs second-place USDC's $74 billion, despite Circle's recent public listing. This fundraising could further cement Tether's lead in the stablecoin arena.

Bitcoin Sentiment Split as $70K–$100K Predictions Rise, Santiment Says

Bitcoin's next major price movement is igniting fierce debate across social media platforms, with sentiment data revealing a sharp divide between bearish and bullish outlooks. On-chain analytics firm Santiment reports the loudest calls clustering around two opposing ranges: $70K–$100K on the downside versus $130K–$160K on the upside.

Historical patterns suggest lower price predictions dominating conversation often precede upward momentum, while excessive chatter about higher targets tends to foreshadow short-term pullbacks. Current social volume charts show increasing focus on sub-$100K levels, with $70K–$100K mentions outpacing bullish calls—a dynamic Santiment interprets as classic fear, uncertainty, and doubt (FUD).

Retail traders are showing growing impatience with Bitcoin's recent sideways action, fueling negative sentiment. This behavioral pattern frequently marks local bottoms, as markets tend to move contrary to majority expectations when pessimism peaks.

Crypto Millionaires Surge to 241,700 in 2025 as Bitcoin Dominates Wealth Creation

The cryptocurrency sector has minted 241,700 millionaires globally as of June 2025, a 40% annual increase, according to the Crypto Wealth Report by Henley & Partners and New World Wealth. Total crypto wealth now stands at $3.3 trillion, up 45% from 2024 levels.

Bitcoin remains the primary wealth generator, accounting for 45% of crypto millionaires. The number of BTC millionaires jumped 70% to 145,100, while 17 of the world's 36 crypto billionaires built fortunes primarily through Bitcoin. An elite group of 450 individuals now holds over $100 million in digital assets.

Institutional adoption and global usage are driving this historic wealth accumulation. Nearly 590 million people—7.4% of the global population—now own cryptocurrency, with half holding Bitcoin. Yet crypto millionaires represent just 0.4% of the world's 60 million millionaires tracked by UBS.

"Crypto wealth is fundamentally reshaping global mobility patterns and investment strategies," noted Dominic Volek of Henley & Partners. The report highlights deepening ties between digital asset ownership and cross-border capital flows.

Peter Brandt Advocates 10% Bitcoin Allocation in Long-Term Wealth Strategy

Legendary trader Peter Brandt, with five decades of market experience, proposes a disciplined approach to wealth accumulation. His formula allocates 70% to S&P 500 index funds, 20% to real estate, and controversially designates 10% exclusively to Bitcoin—the only cryptocurrency he endorses for wealth preservation.

"Bitcoin is the asset that matters," Brandt asserts, positioning it as a hedge against fiat currency erosion. The strategy deliberately excludes altcoins, reflecting Brandt's conviction in Bitcoin's unique value proposition among digital assets.

The 70% equity allocation through SPY provides market beta, while real estate offers inflation-resistant tangible assets. This tripartite structure emphasizes steady compounding over speculative trading, particularly cautioning younger investors against excessive risk-taking in volatile markets.

Top 6 Free Bitcoin Cloud Mining Platforms in 2025

Bitcoin cloud mining is gaining traction as traditional mining becomes increasingly impractical due to rising costs and technical barriers. In 2025, platforms like ZA Miner are leading the charge, offering free signup bonuses and daily payouts to attract retail investors.

ZA Miner stands out with its $100 bonus and a user base exceeding 120,000 in the USA. The platform's transparent contracts and guaranteed daily payouts make it a compelling choice for both beginners and seasoned crypto enthusiasts.

Cloud mining eliminates the need for expensive hardware and high electricity bills, democratizing access to Bitcoin rewards. This shift is reshaping how investors engage with cryptocurrency, moving away from capital-intensive setups to more accessible, remote solutions.

Bitcoin Stabilizes at $112K as Market Eyes Next Rally

Bitcoin's sharp retreat from its $124,000 all-time high has found footing near $112,000, a level now being tested as a potential springboard for renewed bullish momentum. The dip—seen by analysts as a healthy flush of speculative positions—coincides with historical support from late August and aligns with the lower boundary of a descending channel on daily charts.

Technical indicators suggest seller exhaustion without overbought conditions, leaving room for a rebound toward $120,000. Institutional demand continues to underpin the market, with liquidity flows hinting at accumulation during this consolidation phase.

Fold Launches Bitcoin Rewards Card in Partnership with Stripe and Visa

Fold Holdings, Inc. unveiled its Fold Bitcoin Credit Card on September 23, 2025, marking a strategic collaboration with payment giants Stripe and Visa. The card enables users to earn up to 3.5% back in Bitcoin (BTC) on purchases, operating on the Visa network and leveraging Stripe's issuing infrastructure.

The rewards structure is designed to simplify Bitcoin acquisition through everyday spending, with the highest tier requiring engagement with other Fold services. "Our credit card delivers straightforward value and democratizes Bitcoin access," said CEO Will Reeves. "No complex categories, staking, or exchange requirements—just automatic Bitcoin earnings with every transaction."

Unlike traditional rewards cards, the Fold product credits Bitcoin directly to user accounts instantly. This move signals growing institutional integration of cryptocurrency into mainstream financial products.

Is BTC a good investment?

Based on current technical and fundamental analysis, Bitcoin presents a compelling investment opportunity according to BTCC financial analyst James. The technical indicators show Bitcoin in a consolidation phase with the MACD showing signs of recovery. Fundamentally, the upcoming halving event, institutional adoption through products like Fold's Bitcoin rewards card, and growing recognition from seasoned analysts like Peter Brandt support long-term value appreciation.

| Metric | Current Value | Significance |

|---|---|---|

| Current Price | $112,464.50 | Trading below 20-day MA |

| MACD Histogram | 141.79 | Positive momentum building |

| Bollinger Band Position | Middle of range | Consolidation pattern |

| Key Support | $109,711.58 | Critical level to maintain |

While short-term volatility may continue, the combination of technical recovery signals and strong fundamental drivers suggests Bitcoin remains a viable investment for portfolio diversification.