If the deal goes through, Tether would join the ranks of the world's most valuable private companies, alongside OpenAI and SpaceX.

Tether raises another $20 billion, wants to reach a valuation of $500 billion. Photo: CryptoPolitan

Tether raises another $20 billion, wants to reach a valuation of $500 billion. Photo: CryptoPolitan

The $500 billion gamble

- Tether , the world's largest issuer of the stablecoin USDT , is in talks to raise $15-20 billion , at a valuation of around $500 billion .

Tether is evaluated a raise from a selected group of high-profile key investors, to maximize the scale of the Company's strategy across all existing and new business lines (stablecoins, distribution ubiquity, AI, commodity trading, energy, communications, media) by several…

— Paolo Ardoino 🤖 (@paoloardoino) September 24, 2025

- Bloomberg sources said that this Capital is equivalent to about 3% of the company's shares and will be called from a small group of strategic investors. Tether CEO Paolo Ardoino emphasized that the goal of the Capital mobilization is to expand the company's strategic scale across all existing and new business segments - from stablecoins, global distribution, AI, commodity trading, energy, media to telecommunications - exponentially.

- Cantor Fitzgerald - the prestigious Wall Street bank formerly run by former US Secretary of Commerce Howard Lutnick - is the main advisor for this deal. Cantor Capital holds about 5% of Tether shares, which were once valued at 600 million USD. If the company reaches a valuation of 500 billion USD, the value of this investment could swell to 25 billion USD, a figure enough to change Cantor's position in the traditional financial industry.

- If successful, Tether will become one of the most valuable private companies in the world , on par with Sam Altman's OpenAI or Elon Musk's SpaceX.

Huge potential

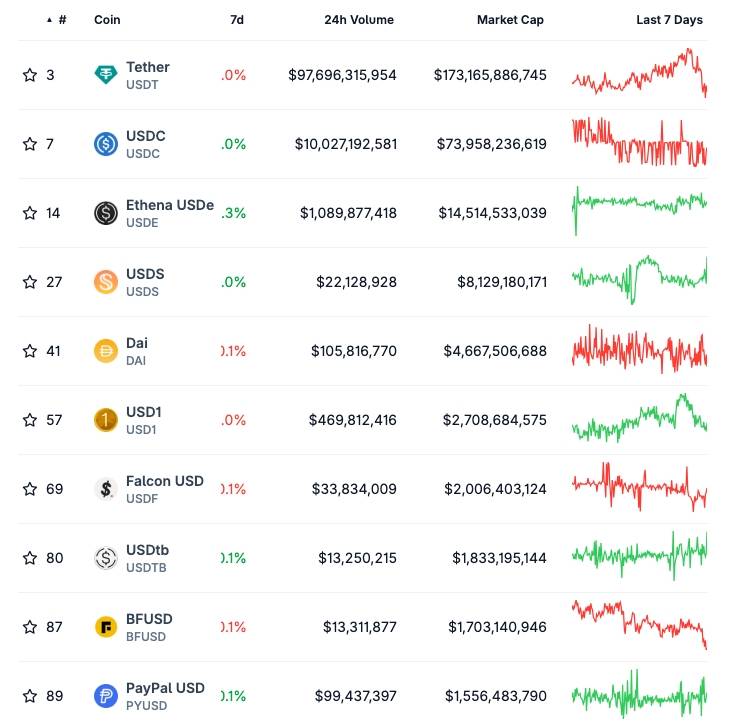

- To understand why Tether dares to aim for the huge figure of 500 billion USD, we need to look at the current dominance of USDT . With 173.2 billion USD in capitalization, USDT holds 76% of the global market share, far surpassing its closest competitor, Circle (USDC), which only holds about 20% with 73.9 billion USD.

Ranking of top stablecoins by market Capital . Source: CoinGecko (September 24, 2025)

Ranking of top stablecoins by market Capital . Source: CoinGecko (September 24, 2025)

- USDT has become the default currency of the crypto market - from Spot Trading, Derivative, to cross-border payments. With reserves mainly in short-term US Treasury bonds, Tether earns billions of dollars in profit each quarter thanks to interest. This helps the company both ensure liquidation and own a legal "money printing machine".

- Tether is also considered the most profitable company in the crypto industry. In the second quarter of 2025, Tether reported a net profit of $4.9 billion .

Challenges await

- The global regulatory landscape is adding momentum to Tether. The Commodity Futures Trading Commission (CFTC) has proposed allowing stablecoins as collateral in Derivative markets – a move that could legitimize stablecoins at the national level, opening the door for USDT to penetrate deeper into the traditional financial system.

- Meanwhile, the stablecoin market has just set a record circulating supply of over $200 billion, reflecting the increasingly important Vai of stablecoins as a new financial infrastructure layer. And Tether, with its overwhelming position , is the biggest beneficiary. Moreover, Tether has just launchedits own stablecoin USAT for the US market, promoting it as fully compliant with US regulations under the GENIUS Act .

- However, the road to 500 billion USD is not full of roses .

Transparency: Tether has been criticized several times for not fully disclosing details of its reserve assets.

Legal: The US and Europe are both tightening regulations on stablecoins, which could put Tether 's business model at risk.

Competition: Circle (USDC) is expanding its banking partnerships and recently had a $30 billion IPO , PayPal has also launched its own stablecoin. Not to mention a series of other projects that have also launched their own stablecoin solutions such as Arc (Circle), Tempo (Stripe + Paradigm), Stable and Plasma (Tether), Converge (Ethena), mUSD (Metamask), USDm (MegaETH), USD1 (World Liberty Financial).

Coin68 synthesis