ASTER, the native coin of the Binance-backed decentralized exchange Aster, has been the biggest gainer today, rising 20% in the past 24 hours. This comes despite increased selling pressure across the entire crypto market.

With increased demand from “smart investors” and increased buying across the market, ASTER is poised to reclaim All-Time-High and possibly reach new price peaks.

Two bullish signals put ASTER in position for further growth

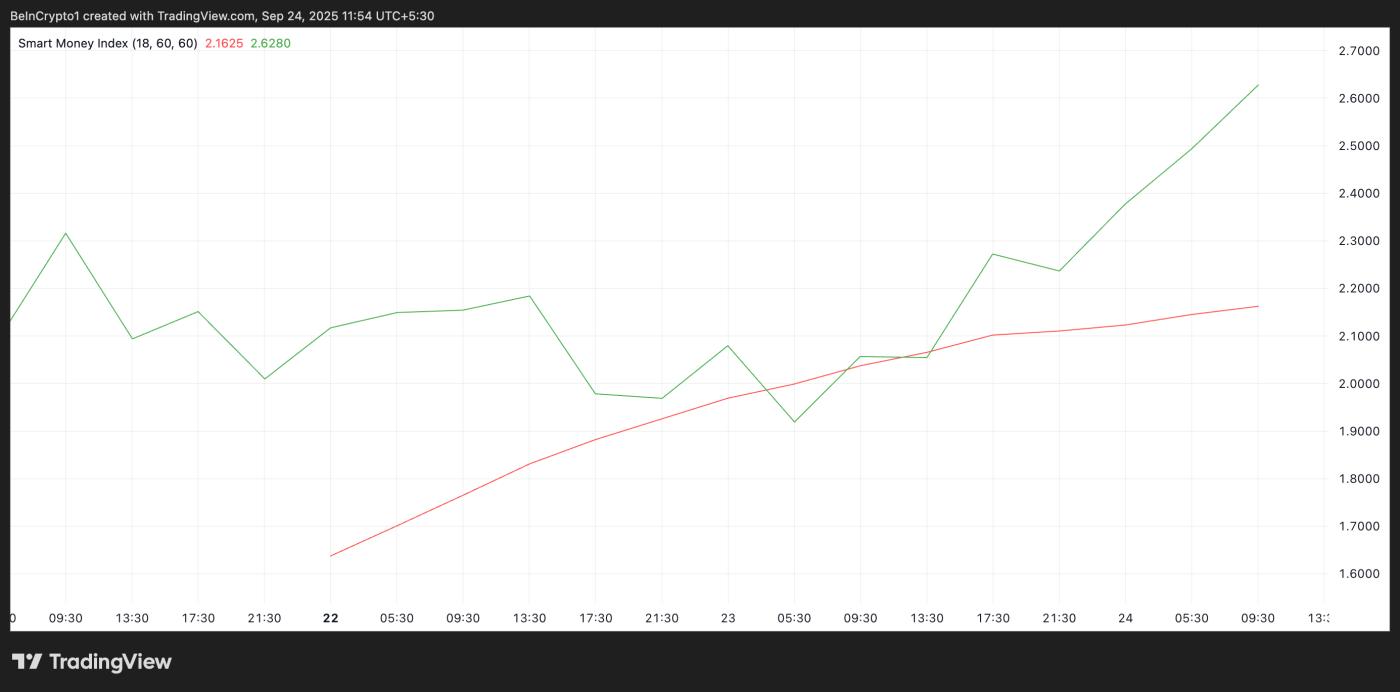

Data from the ASTER/USD 4-hour chart shows that the Token 's Smart Money Index (SMI) has been steadily increasing since its launch on September 17, 2023. This shows that the price increase is receiving strong support from key investors.

To stay updated on TA and the Token market: Want more Token insights like this? Subscribe to Editor Harsh Notariya's Daily Crypto Newsletter here .

ASTER Smart Money Index. Source: TradingView

ASTER Smart Money Index. Source: TradingViewAt the time of writing, the momentum indicator is at 2.62 and remains in an uptrend.

Smart money refers to Capital managed by institutional investors or experienced traders with deeper insight into market trends and timing. SMI tracks their activity by analyzing intraday price movements. Specifically, it compares selling in the morning, when retail investors dominate, with buying in the afternoon, when institutions are more active.

When this indicator is trending up, as with ASTER, it shows that smart money is accumulating assets, hinting at further price increases.

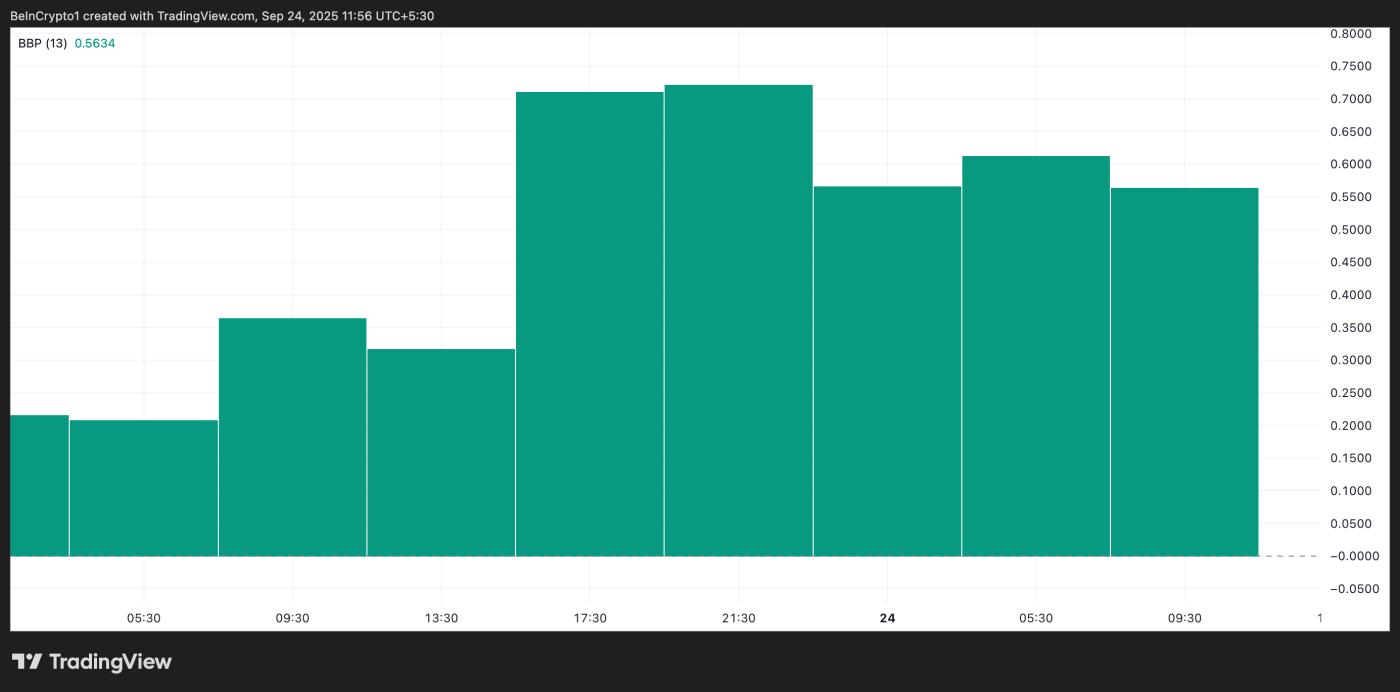

Furthermore, the structure of ASTER's Elder-Ray indicator confirms the bullish bias for this altcoin among spot market investors. At the time of writing, the indicator's value is 0.53, above the zero line.

ASTER Elder-Ray Index. Source: TradingView

ASTER Elder-Ray Index. Source: TradingViewThe Elder-Ray indicator measures the strength of buyers and sellers in the market by comparing the buying pressure (Bull Power) and the selling pressure (Bear Power). When the value is positive, the market is experiencing more buying pressure than selling pressure, suggesting a potential uptrend.

This confirms that accumulation is underway for ASTER, strengthening the case for further upside.

Market waiting for breakout or correction

At the time of writing, ASTER is trading at $2.2011, just below the newly formed high, which creates resistance above at $2.2194. If demand increases, the Token could break through this barrier to reach a new All-Time-High .

ASTER Price Analysis. Source: TradingView

ASTER Price Analysis. Source: TradingViewHowever, if profit-taking kicks in, this could invalidate this bullish outlook. In that case, ASTER could give up some of its recent gains and drop to $1.8601.