Unless significant organizational changes occur, Ethereum is likely destined to underperform indefinitely.

By Andrew Kang, Partner at Mechanism

Compiled by AididiaoJP, Foresight News

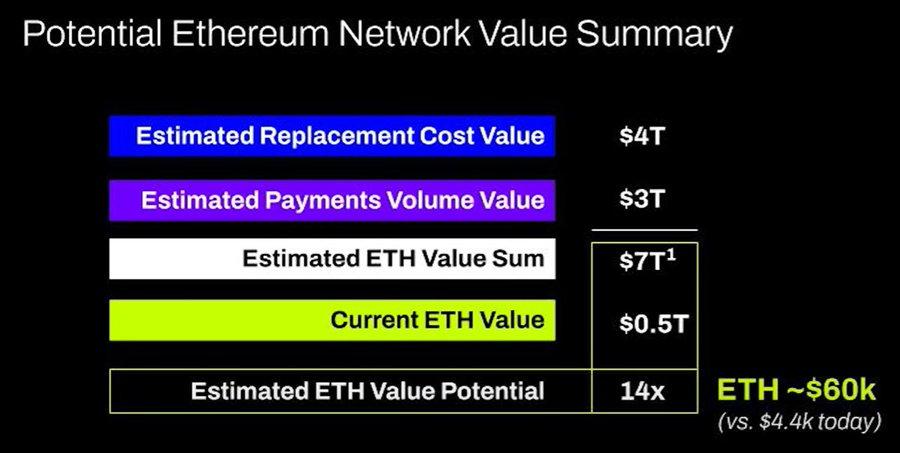

Tom Lee's ETH theory is one of the dumbest concoctions of financial illiteracy I've seen from a prominent analyst in recent times. Let's break it down. Tom Lee's theory is based on the following:

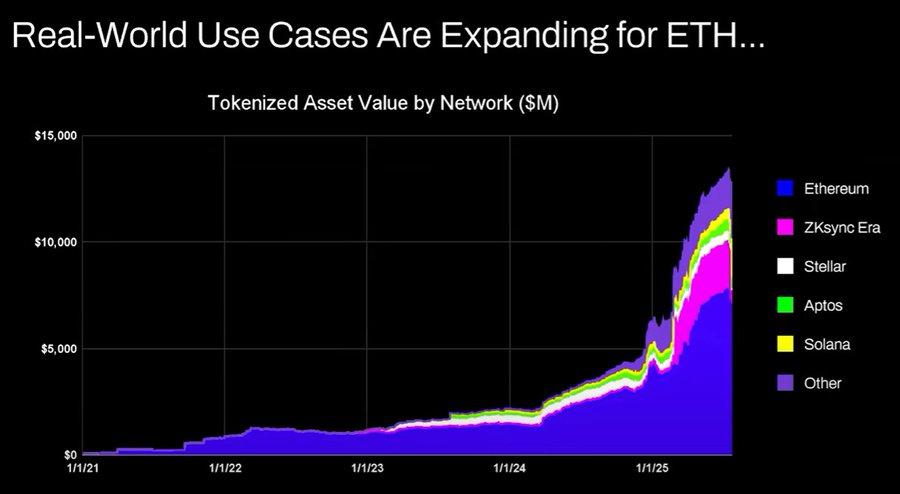

- Stablecoins and RWA adoption

- The analogy of digital oil

- Institutions will purchase and pledge ETH, tokenize assets while ensuring the security of the network, and use it as operating capital.

- The value of ETH will be equal to the sum of the value of all financial infrastructure companies

- Technical Analysis

The argument goes something like this: stablecoin and tokenized asset activity is increasing, which should drive transaction volume, and thus ETH fees and revenue. On the surface, this makes sense, but if you spend a few minutes and a bit of brainpower crunching the numbers, you’ll see that’s not the case.

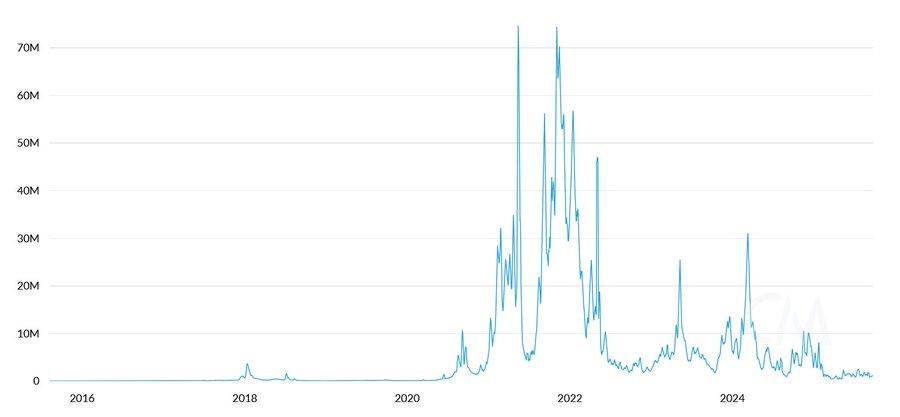

Daily ETH transaction fees (USD)

Tokenized asset value and stablecoin trading volume have grown 100-1000x since 2020. Tom Lee’s argument fundamentally misunderstands how value accrues and might lead you to think fees would grow proportionally, but in reality they remain almost identical to 2020 levels.

There are several reasons for this:

- Ethereum network upgrade makes transactions more efficient

- Stablecoin and tokenized asset activity flows to other public chains

- Tokenizing low-velocity assets doesn't generate much in fees. The value of the token isn't proportional to the revenue generated in ETH. Someone could tokenize a $100 million bond, and if it trades every two years, how much would that generate in ETH fees? $0.10? A single USDT transaction might generate more than that.

You can tokenize trillions of dollars worth of assets, but if those assets don’t move frequently, then it might only add $100,000 in value to ETH.

Will blockchain transaction volume and generated fees grow? Yes, but the majority of these fees will be captured by other public blockchains with stronger business development teams. Competitors see an opportunity to bring traditional financial transactions on-chain and are aggressively seizing the market. Solana, Arbitrum, and Tempo are achieving most of the early major wins. Even Tether is supporting two new Tether chains, Plasma and Stable, both of which aim to shift USDT transaction volume onto their own chains.

Oil is a commodity. The real price of oil, adjusted for inflation, has traded in the same range for over a century, with periodic surges and declines. I agree with Tom that ETH can be considered a commodity, but that's not directly bullish, and I'm not sure what Tom is trying to say here!

Institutions will buy and stake ETH

Have major banks and other financial institutions already bought ETH on their balance sheets? No.

Have they announced any plans to do so? No.

Do banks hold onto gas because they have to keep paying for energy? No, it doesn't really matter; they just pay for it when they need it.

Will banks buy shares in the custodians they use? No.

Come on, this once again reflects a fundamental misunderstanding of the accumulation of value and is pure delusion.

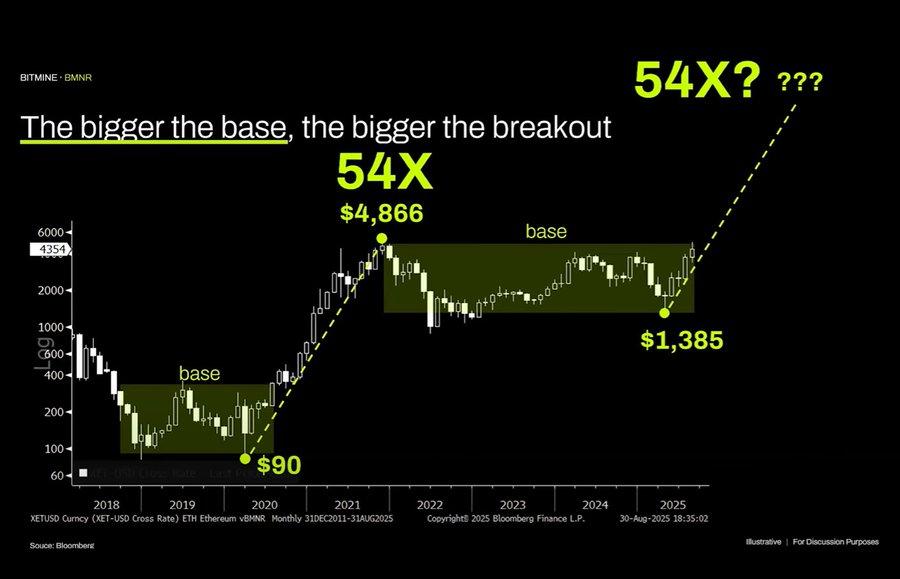

I actually quite like technical analysis and believe it can be very valuable when viewed objectively. Unfortunately, Tom Lee seems to be drawing arbitrary lines through technical analysis to support his biases.

Looking objectively at this chart, the most striking observation is that Ethereum has been in a prolonged range. This isn't dissimilar to how crude oil prices have also traded in a wide range over the past three decades. Not only are we range-bound, but we recently hit the top of the range, failing to break through resistance. If anything, the technical picture for Ethereum is bearish. I wouldn't rule out the possibility of a prolonged period of range-bound trading between $1,000 and $4,800. Just because an asset has previously experienced a parabolic rise doesn't mean it will continue indefinitely.

Crude oil prices

The long-term ETH/BTC chart is also misinterpreted. While it's certainly in a long-term range, the past few years have been dominated by a downtrend, with a recent bounce at long-term support. The downtrend is driven by a saturated narrative for Ethereum and a failure of fundamentals to justify the valuation increase, which remain unchanged.

Ethereum's valuation is primarily derived from financial illiteracy. This can indeed create a sizable market capitalization; just look at XRP. But valuations derived from financial illiteracy are not infinite. Broader macro liquidity allows ETH's market capitalization to be sustained, but unless significant organizational change occurs, it is likely destined to underperform indefinitely.