By Dong Jing and Bao Yilong, Wall Street Journal

Ethereum fell below the $3,900 mark, hitting a new low in nearly seven weeks, continuing the momentum of a sharp pullback in cryptocurrencies since this week. The entire cryptocurrency market has evaporated more than $140 billion in market value .

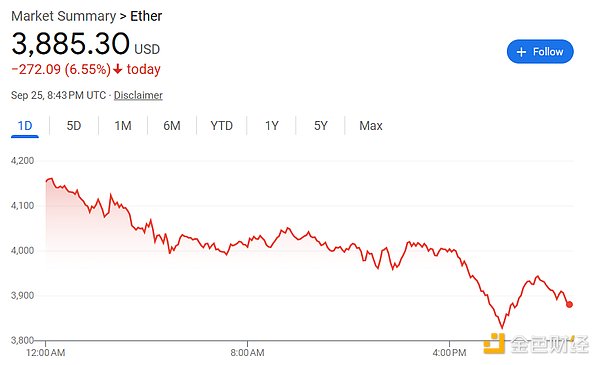

In the early morning of September 26, Ethereum, the world's second largest cryptocurrency, fell by more than 7% at one point, hitting a low of $3,823, and then rebounded slightly, but the intraday decline was still 6.55%.

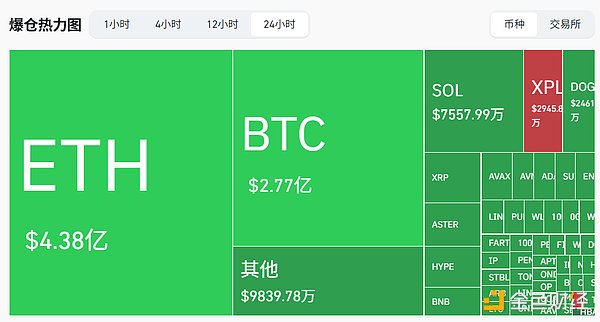

Coinglass shows that in the past 24 hours, nearly 250,000 people worldwide had their positions liquidated, with the total amount of liquidations exceeding US$1.1 billion .

A liquidation heat map shows that Bitcoin and Solana ranked second and third, respectively, in terms of liquidation size, trailing only Ethereum. As of late trading in New York on Thursday, Bitcoin had fallen 3.62%, breaking below the key support level of $110,000, while Solana had plummeted 7.2%, marking its sixth consecutive day of decline.

Cooling institutional inflows have exacerbated selling pressure . Investors have withdrawn nearly $300 million from US-listed Ethereum ETFs since Monday, when a sudden market drop forced liquidations of $1.7 billion worth of long bets, impacting nearly all major cryptocurrencies.

According to Rachael Lucas, a cryptocurrency analyst at BTC Markets, Ethereum’s pullback stems from a “cooling of institutional inflows” and “technical indicators pointing to short-term pressure .” Lucas warned that if Ethereum falls below $3,800, it is expected to trigger more liquidations.

Although the supply of Ethereum on exchanges has fallen to a nine-year low, suggesting that long-term holders are hoarding coins, the selling behavior of long-term holders offsets the positive impact of new capital inflows , leaving Ethereum caught in a tug-of-war between bulls and bears.

Selling by long-term holders offsets positive signals

While Ethereum’s exchange supply continues to decline to a nine-year low, indicating that investors are withdrawing tokens from centralized platforms for long-term holding, the market is still facing selling pressure from long-term holders.

Over the past month, investors have bought more than 2.7 million Ethereum, worth more than $11.3 billion , demonstrating strong confidence in Ethereum's long-term potential.

However, Ethereum’s activity metric, which measures the behavior of long-term holders, has been trending upward, and a rise generally means these investors are selling rather than hoarding.

The analysis pointed out that the selling behavior of long-term holders offset the bullish pressure of new capital inflows, putting Ethereum into a stalemate between two opposing market forces.

If long-term holders continue to sell heavily, Ethereum prices could fall further, which would completely shatter the current bullish outlook .