#XRP

- Technical Support Holding: XRP is defending the critical $2.71 support level with increased trading volume, suggesting institutional accumulation at current prices

- DeFi Momentum Building: mXRP vaults approaching $20 million in locked value and Flare's FXRP launch creating new utility opportunities

- Institutional Infrastructure Growth: Ripple's institutional solutions providing 24/7 liquidity and addressing global debt solutions, enhancing long-term adoption prospects

XRP Price Prediction

XRP Technical Analysis

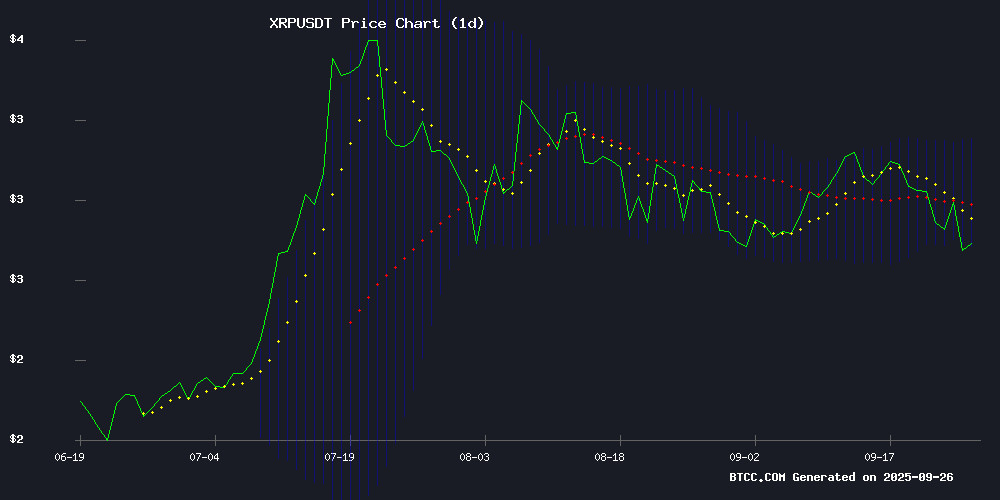

XRP is currently trading at $2.76, slightly below its 20-day moving average of $2.97, indicating short-term bearish pressure. The MACD shows a positive histogram of 0.0189, suggesting potential momentum building despite the negative signal line. XRP is testing the lower Bollinger Band at $2.76, which often serves as a support level. According to BTCC financial analyst Olivia, 'The technical setup shows XRP is at a critical juncture. Holding above the $2.71 support with rising trading volume could signal a rebound toward the middle Bollinger Band at $2.97.'

XRP Market Sentiment Analysis

Market sentiment for XRP is mixed amid broader cryptocurrency volatility. Negative headlines about XRP sliding 6% following Bitcoin's decline are balanced by positive developments in DeFi adoption and institutional interest. BTCC financial analyst Olivia notes, 'While short-term sentiment is bearish due to market-wide liquidations, the underlying fundamentals remain strong with mXRP vaults approaching $20 million and new DeFi opportunities emerging through Flare's FXRP launch. Institutional solutions providing 24/7 liquidity add long-term bullish catalysts.'

Factors Influencing XRP's Price

XRP Slides 6% as Bitcoin Drop Slashes Bullish Sentiment

XRP’s rally above $2.90 collapsed under heavy selling pressure on September 25, with a $277 million volume spike driving the price back to $2.75. The downturn erased over $18 billion in market value within a week, solidifying resistance at $2.80 and leaving traders eyeing $2.70 as the next support level.

Institutional selling dominated the session, with XRP sliding 5.83% between September 25–26. A sharp rejection at $2.80 triggered a volume surge of 276.77 million—more than double the 24-hour average. Despite SEC approval of the first U.S. XRP ETF, optimism waned amid Federal Reserve Chair Powell’s caution on valuations and rising Treasury yields.

Price action revealed a 6.3% intraday range, with sellers cementing a distribution zone after the $2.80 rejection. Recovery attempts stalled at $2.81–$2.82, reinforcing resistance. A late-session bounce of 1.09% from $2.75 to $2.78 offered fleeting relief, but the breach of $3.00 psychological support underscores lingering downside risks.

XRP's DeFi Momentum Builds as mXRP Vaults Approach $20 Million in Locked Value

XRP holders are flocking to mXRP, the token's first native liquid staking solution, with nearly $20 million now locked in vaults. Demand surged after Axelar's initial 6.5 million token capacity filled within 48 hours, prompting a cap increase to 10 million tokens.

The mXRP protocol unlocks yield opportunities for previously dormant XRP through an EVM-compatible sidechain. Stakers receive wrapped mXRP tokens offering targeted 8% APY, with vault assets deployed by risk curators like Hyperithm for market-making strategies.

This rapid adoption signals pent-up demand for XRP-based DeFi solutions, potentially revitalizing utility for one of crypto's oldest yet underutilized assets.

XRP Price Prediction: Targeting $3.20 Recovery Within 2 Weeks Despite Current Bearish Momentum

Ripple's XRP has dipped 7.57% in the past 24 hours to $2.76, testing critical support levels. Technical indicators suggest an oversold condition, setting the stage for a potential rebound toward $3.15-$3.20 within two weeks. The MACD remains bearish, but historical patterns hint at accumulation phases preceding rallies.

Analyst forecasts diverge sharply, with PricePredictions.com projecting a medium-term target of $9.22 based on algorithmic models. More conservative estimates from InvestingHaven and LiteFinance cluster around the $3.30 resistance zone, citing Elliott Wave theory and breakout potential. Market sentiment appears bifurcated—short-term traders focus on the descending wedge pattern while long-term holders note Ripple's legal clarity as a structural bullish factor.

XRP Consolidates Near $2.85 as Flare’s FXRP Launch Opens New DeFi Opportunities

XRP hovers at $2.85, marking a 4.3% weekly decline after a volatile 2025 rally. The token now consolidates between $2.50 and $3.50, with critical support at the 20-week EMA of $2.75. Technical indicators paint a mixed picture: Bollinger Bands suggest a range-bound market ($1.87-$3.54), while the RSI at 58.8 leans slightly bullish. A decisive break above $3.20 could target $3.50, whereas losing $2.70 support may trigger a retest of $2.50.

Flare Network’s FXRP v1.2 launch introduces transformative utility for XRP holders, enabling seamless participation in DeFi ecosystems. This development could fundamentally alter XRP’s value proposition beyond payment corridors. Market observers anticipate sideways movement through September’s end unless Bitcoin regains momentum to lift the broader altcoin market.

XRP Institutional Flows Highlight Market Volatility Amid Fed Policy Uncertainty

XRP's price trajectory remains tethered to U.S. Federal Reserve policy shifts, with a 0.37% dip to $2.83 on September 25, 2025 reflecting market unease. Fed Chair Jerome Powell's data-dependent stance has amplified crypto volatility, with CME FedWatch pricing a 91% probability of a 25-basis-point October rate cut.

Institutional activity continues to dictate XRP's near-term momentum. The August 23 surge to $3.09—fueled by dovish Fed commentary and professional investor inflows—demonstrates lingering bullish positioning. Current consolidation below the $3.30 resistance leaves the token exposed to potential downside, with critical support at $2.00. A breakout could catalyze a rally toward $5-$8.

XRP Defends $2.71 Support Amid Surging Trading Volume

XRP's market activity shows resilience as it holds the $2.71 support level, with trading volume spiking 23.44% to $6.71 billion despite a minor price dip. The cryptocurrency currently trades at $2.84, up 0.42% over 24 hours, while weekly performance remains down 7.4%.

Analyst Ali Martinez notes the defense of $2.71 as critical for maintaining bullish potential. The Relative Strength Index at 42.92 suggests room for upward momentum if buying pressure increases, with $3.60 emerging as a plausible near-term target should the support level hold.

Market interest appears undiminished by recent price action, as evidenced by the substantial volume increase. This divergence between price and volume often precedes trend reversals in cryptocurrency markets.

Will Institutional Demand Drive XRP Crypto Higher in 2025?

XRP price prediction gains traction as Ripple's RLUSD stablecoin achieves critical integrations with BlackRock's BUIDL fund and VanEck's VBLL. The token's institutional appeal is further amplified by the XRPR ETF, which attracted $33.57 million in assets within days of launch.

RLUSD's inclusion in Securitize's platform enables instant liquidity redemption, positioning Ripple as a bridge between traditional finance and blockchain. This real-world utility could catalyze XRP's price trajectory as adoption grows.

The rapid accumulation of assets in the XRPR ETF underscores mounting institutional interest. With $30 million secured in three days and a subsequent 10% growth, the fund demonstrates concrete demand for XRP exposure.

Black Swan Capitalist Proposes XRP as Solution to Global Debt Crisis

Global sovereign debt has surged past $315 trillion as of September 2025, with the U.S. accounting for $36.2 trillion—122% of its GDP. Traditional systems buckle under the strain as the U.S. adds $1 trillion in debt quarterly. Versan Aljarrah of Black Swan Capitalist argues that restructuring through tokenization, with XRP as neutral liquidity, offers a viable reset.

Tokenized assets reached $15.2 billion in 2025, an 85% annual increase. The World Economic Forum and Boston Consulting Group project the market could hit $10–16 trillion by 2030. Aljarrah’s thesis hinges on blockchain’s ability to convert unsustainable debt into tradable digital assets, with XRP’s neutrality positioning it as a linchpin.

XRP Community Evaluates Based Eggman ($GGs) as Leading Crypto Presale Contender in 2025

The XRP community is shifting its focus toward utility-driven projects as the 2025 market cycle heats up. Based Eggman ($GGs), a memecoin built on Coinbase's Base network, is emerging as a standout presale alternative. Its ecosystem integrates gaming, streaming, and microtransactions, with the $GGs token serving as the backbone for rewards and liquidity.

With a capped supply of 389 million tokens, $GGs emphasizes low-fee transactions and social logins to reduce onboarding friction. The project's tangible use cases—from in-game leaderboards to creator tipping—are drawing comparisons to established assets like XRP in crypto investment forums.

Investors are scrutinizing presale opportunities that demonstrate immediate utility rather than speculative hype. $GGs’ design as a cultural connector for digital communities positions it among the few memecoins with a functional roadmap beyond viral appeal.

XRP Price Breaks Below Key Support Amid Market-Wide Liquidation Pressure

XRP plunged below the $3.00 psychological level on September 25, erasing recent gains as crypto markets faced broad-based selling pressure. The token now teeters near the $2.80 support zone—a critical threshold that could determine near-term price direction.

Liquidation cascades across derivatives markets triggered the downturn, compounded by profit-taking near resistance levels. Technical analysts note XRP's repeated failure to breach the $3.18-$3.20 range created downward momentum, with the asset testing $2.75 during the selloff.

Despite bullish catalysts including the debut of REX-Osprey's XRP ETF and SEC-fast-tracked ETF launches scheduled for October, the token saw $68.63 million in outflows this week. Market participants appear unfazed by institutional developments, focusing instead on macroeconomic risks and leverage unwinds.

Ripple Institutional Solutions Unlock 24/7 Liquidity for Investors

Ripple is aggressively positioning its stablecoin, Ripple USD (RLUSD), as a linchpin between traditional finance and the digital asset ecosystem. Strategic partnerships with financial heavyweights and blockchain innovators are reshaping institutional access to real-time liquidity and yield-bearing assets.

The collaboration with Securitize stands out, enabling holders of BlackRock's BUIDL and VanEck's VBILL tokenized treasury funds to convert assets into RLUSD via smart contracts. This innovation delivers round-the-clock liquidity, merging the stability of on-chain yields with the agility of a stablecoin. These tokenized funds collectively manage $2.07 billion across seven blockchains, underscoring institutional demand.

RLUSD operates under a New York Department of Financial Services (NYDFS) Trust Company Charter, ensuring stringent regulatory compliance. Backed 1:1 by high-quality liquid assets, the stablecoin has surged to a $741 million market cap since its late 2024 debut, gaining traction in cross-border payments, DeFi liquidity pools, and institutional portfolios.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a compelling investment case with calculated risk. The cryptocurrency is currently trading at $2.76, showing resilience above the key $2.71 support level despite market volatility.

| Metric | Current Value | Significance |

|---|---|---|

| Current Price | $2.76 | Testing key support |

| 20-day MA | $2.97 | Potential resistance level |

| MACD Histogram | +0.0189 | Building positive momentum |

| Bollinger Lower Band | $2.76 | Critical support zone |

BTCC financial analyst Olivia suggests, 'XRP's technical positioning near support levels combined with growing DeFi adoption and institutional interest creates a favorable risk-reward scenario. The $20 million in locked mXRP value and new DeFi infrastructure developments provide fundamental support for potential price appreciation toward the $3.20 target within the coming weeks.'