#XRP

- Technical Convergence: XRP testing critical Bollinger Band support with bullish MACD divergence signaling potential reversal

- Institutional Catalysts: Ripple's partnerships with BlackRock and VanEck through Securitize integration providing fundamental strength

- Pattern Recognition: Falling wedge formation and October breakout predictions suggesting upward momentum potential

XRP Price Prediction

XRP Technical Analysis: Critical Support Test Underway

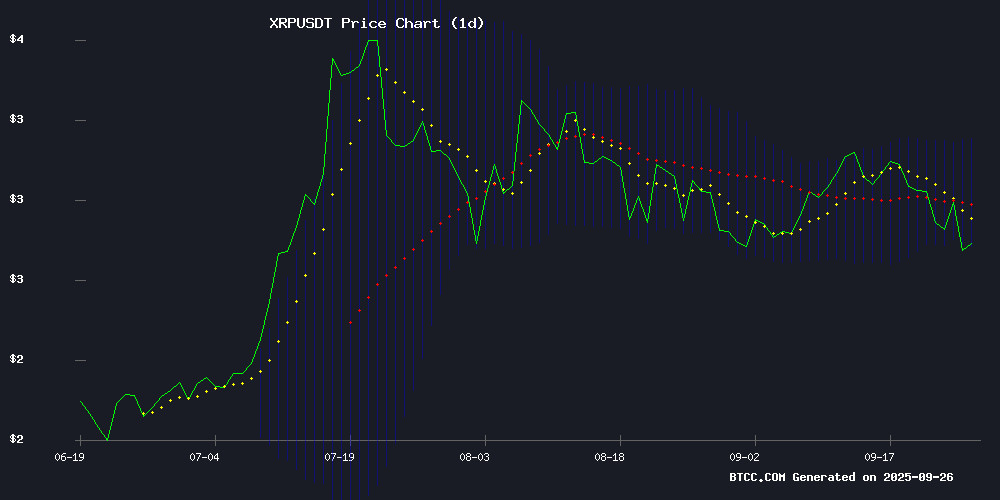

XRP is currently trading at $2.7596, testing the lower Bollinger Band at $2.7556 which serves as immediate support. The price sits below the 20-day moving average of $2.9652, indicating short-term bearish pressure. However, the MACD shows a positive divergence with the histogram at 0.0702, suggesting potential momentum shift. According to BTCC financial analyst Robert, 'The convergence at the Bollinger Band lower boundary combined with MACD bullish signals could indicate a reversal pattern formation if support holds.'

Mixed Market Sentiment Amid Fundamental Developments

Recent news highlights both challenges and opportunities for XRP. The 6% price drop erased $18 billion in market value, yet analysts predict an October breakout based on technical patterns. Significant developments include Ripple's partnership with Securitize to integrate RLUSD stablecoin with BlackRock and VanEck tokenized funds, along with Flare's FXRP launch driving 5 million XRP surge. BTCC financial analyst Robert notes, 'While short-term volatility persists, the institutional partnerships and DeFi integration provide strong fundamental support for long-term growth.'

Factors Influencing XRP's Price

XRP Tumbles 6% as Volume Spike Erases $18 Billion Market Value

XRP's market capitalization plummeted by $18 billion over the past week, with the cryptocurrency shedding 10.22% of its value and breaching the psychologically critical $3.00 level. A surge in trading volume to 276.77 million during the 17:00 UTC sell-off at $2.80 starkly contrasted with the 108.42 million daily average, signaling intense distribution pressure.

Despite the SEC's landmark approval of the first U.S. XRP ETF, bullish sentiment evaporated as Federal Reserve Chairman Jerome Powell's valuation warnings and rising Treasury yields triggered a broad crypto retreat. The afternoon session saw concentrated selling cap rallies at $2.80, creating a resistance zone that stifled recovery attempts throughout the trading day.

Institutional activity provided fleeting support during the final hour, with a 1.09% bounce from $2.75 to $2.78 between 00:50-00:57 GMT. Market technicians note the breakdown establishes $2.80-$2.82 as new supply zones, with the day's 6.3% trading range between $2.92 and $2.74 reflecting persistent bearish control.

XRP Analyst Predicts October Breakout Amid Falling Wedge Pattern

Dark Defender, a prominent cryptocurrency analyst, has spotlighted XRP's technical setup, suggesting an impending breakout that could catch the market off guard. The token has repeatedly tested key support at $2.85 while facing resistance NEAR $3.13, now consolidating within a falling wedge pattern since July.

The Relative Strength Index's approach toward oversold territory hints at a potential reversal. 'Disbelief in the market only strengthens the case for surprise,' the analyst noted, maintaining that XRP's bullish structure remains intact despite recent stagnation.

October could mark the culmination of this compression phase. Historical patterns suggest such wedges often resolve with violent breakouts—a scenario that WOULD align with XRP's history of dramatic moves when least expected.

Liquid Staking Debuts On XRP Ledger, What mXRP Means For Investors

Midas, in collaboration with Axelar, has introduced the first liquid staking token for XRP, dubbed mXRP. This innovation allows investors to earn yields from the XRP DeFi ecosystem, enhancing the altcoin's utility. The token will be issued on the XRP Ledger EVM via the Axelar bridge, enabling seamless transfers.

Panek Mekras, co-founder of Anodos Finance, highlighted that mXRP is a yield-bearing version of XRP, designed to appreciate against XRP's price. Yields, potentially reaching 8-10% APY, are generated through strategies like lending, market making, and DeFi protocol deposits. Investors need only hold mXRP to benefit, as asset managers leverage locked XRP to execute profit-generating strategies.

Why Did XRP Sink Today?

XRP (XRP -6.60%) tumbled 6.8% on Thursday as broader market sentiment soured ahead of key inflation data. The decline mirrored losses in the S&P 500 (^GSPC -0.50%) and Nasdaq (^IXIC -0.50%), both down 0.5% as investors braced for Friday's PCE report—the Federal Reserve's preferred inflation gauge.

Banking-sector jitters weighed heavily on the payments-focused cryptocurrency. Market participants unwound Leveraged positions after the Fed delivered a more conservative rate cut than some traders had anticipated. "Lower rates typically boost risk assets like XRP," noted one analyst, "but the market's disappointment created a cascade of liquidations."

Despite Ripple's growing institutional adoption, the token's price action continues to defy expectations. The blockchain's utility for cross-border settlements hasn't translated into consistent valuation gains. "Bank adoption doesn't equal price appreciation," observed a sector strategist. "XRP's utility in payment rails doesn't guarantee speculative demand."

XRP Whale Movement Sparks Speculation Amid Mixed Market Sentiment

A transfer of 20 million XRP worth $58 million from Upbit to an unknown wallet has drawn attention to Ripple's token. Such large movements often signal long-term holding strategies, potentially reducing exchange supply and creating accumulation opportunities. Market participants interpret this as a bullish signal, though broader conditions remain uncertain.

Derivatives data reveals extreme optimism, with Binance showing 78% long positions versus 22% shorts. This lopsided positioning suggests traders anticipate further upside, but carries inherent risks. The Network Value to Transactions (NVT) ratio's 197% spike simultaneously warns of overvaluation, creating a potentially volatile scenario where price corrections could accelerate.

The interplay between whale accumulation and overheated metrics presents a complex picture. While reduced exchange liquidity typically supports prices, the derivatives imbalance and elevated NVT suggest caution. XRP's near-term trajectory may depend on whether spot market demand can absorb selling pressure if leveraged positions unwind.

XRP Ledger Gains Momentum in 2025 Amid ETF Launches and Global Expansion

The XRP Ledger (XRPL) has seen a remarkable resurgence in 2025 following Ripple's settlement with the SEC, which clarified XRP's non-security status. This regulatory clarity has unlocked institutional interest and accelerated ecosystem growth.

Spot XRP ETFs from major asset managers like Grayscale Investments and REX-Osprey have brought significant capital inflows. Meanwhile, the XRPL community has demonstrated strong global engagement with 19 events across continents, from Seoul to Paris.

Brad Garlinghouse, Ripple's CEO, recently praised the Seoul community's inaugural event, signaling continued corporate support for grassroots adoption efforts. The removal of legal uncertainties has also enabled faster network development, including progress on an EVM-compatible sidechain.

Ripple Partners with Securitize to Integrate RLUSD Stablecoin with BlackRock and VanEck Tokenized Funds

Ripple has announced a strategic partnership with Securitize, positioning its RLUSD stablecoin as a liquidity solution for tokenized institutional funds managed by BlackRock and VanEck. The collaboration enables instant conversion of fund shares—specifically BlackRock's $BUIDL and VanEck's $VBILL—into RLUSD, providing continuous access to on-chain yield.

The integration extends Securitize's capabilities on the XRP Ledger, amplifying Ripple's footprint in tokenized finance. "Making RLUSD available as an exchange option for tokenized funds bridges traditional finance and crypto," said Jack McDonald, Ripple's SVP of Stablecoins. The MOVE signals growing institutional adoption of blockchain-based asset management solutions.

XRP’s Perfect Support Test Hints at a Potential Breakout Ahead

XRP, one of the top crypto assets this week, faced significant declines before stabilizing at $2.82. A flawless Fibonacci bounce now suggests a potential uptrend, with $2.79 acting as a critical support level.

Crypto analyst 'CasiTrades' notes the macro 0.5 Fibonacci retracement has held firm during the correction. For bullish momentum to solidify, XRP must break above $2.97 and reclaim the 0.382 level at $3. Failure could lead to a retest of $2.79 or a deeper slide toward $2.58.

Recent volatility included a dramatic wick down to $2.70, marking the end of consolidation. Traders are watching RSI levels closely for signs of exhaustion or continuation.

XRP Faces Critical Resistance Zone as Analysts Watch for Breakout or Correction

XRP's price action hinges on a decisive move above or below the $2.97–$3 resistance zone. A clean hold above this level could signal the start of Wave 3 bullish momentum, while rejection may trigger a deeper pullback.

Crypto analyst CasiTrades notes the $2.79 support held perfectly during recent testing, with buyers demonstrating strength at this Fibonacci-defended level. The 0.5 macro Fib level continues to anchor XRP's price during broader market corrections.

Market structure remains unconvirmed despite the promising bounce. XRP must clear and sustain above $2.97—the 0.854 retracement and Wave 1 bottom—to invalidate bearish scenarios. Ultimate confirmation would come with a flip of the $3 level, coinciding with the 0.382 macro Fibonacci retracement zone.

XRP Dips Amid Broader Crypto Market Struggles and Fed Rate Cut Speculation

Cryptocurrencies face continued pressure following a market-wide flash crash earlier this week, with XRP sliding 4.4% as investors digest shifting Federal Reserve policy expectations. The digital asset's decline mirrors broader crypto market weakness as traders reassess risk appetite in light of economic data.

New jobless claims fell to 218,000 last week, while Q2 GDP was revised upward to 3.8% - the strongest quarterly performance in over two years. These indicators complicate the Fed's rate cut trajectory, with markets now pricing in fewer reductions than previously anticipated. "Risk management" remains the watchword from Chair Jerome Powell, who characterized June's cut as precautionary rather than the start of an aggressive easing cycle.

The crypto sector typically thrives under loose monetary policy, making extended higher rates particularly punitive for speculative assets. XRP's underperformance today reflects this macro sensitivity, though technical factors from the recent leverage flushout may also be contributing to volatility.

Flare's FXRP Launch Sparks 5M XRP Surge as DeFi Integration Goes Live

Flare Networks achieved a significant milestone with its FXRP launch, as the entire 5 million XRP mint cap was filled within four hours of mainnet deployment. This marks the first instance where XRP holders can participate in decentralized finance without liquidating their holdings, enabled by Flare's FAssets system.

The rapid adoption underscores growing demand for XRP utility in DeFi. Hugo Philion, a key figure in the project, noted institutional interest typically begins at the $100M threshold—a level this community-driven initiative has yet to reach. "All community-driven. Now, wait for institutional adoption," Flare Networks stated regarding the organic demand.

Alongside FXRP, the introduction of an XRP-backed stablecoin creates novel opportunities for yield generation and lending protocols. Market observers anticipate this development may catalyze broader institutional participation in XRP-based DeFi solutions.

How High Will XRP Price Go?

Based on current technical indicators and market developments, XRP shows potential for significant movement in the coming weeks. The convergence of technical support levels with positive fundamental developments creates an interesting setup.

| Timeframe | Conservative Target | Bullish Target | Key Levels |

|---|---|---|---|

| Short-term (1-2 weeks) | $3.10-$3.30 | $3.50-$3.70 | Resistance: $3.17, Support: $2.75 |

| Medium-term (1-2 months) | $3.80-$4.20 | $4.50-$5.00 | Breaking $3.50 crucial for higher targets |

BTCC financial analyst Robert suggests: 'The falling wedge pattern combined with institutional adoption through BlackRock and VanEck partnerships could propel XRP toward $4.00-$4.50 if current support holds and volume increases.'