#ETH

- Technical Breakout Potential: ETH is testing key support levels with bullish MACD momentum suggesting upward movement potential

- Institutional Adoption Catalyst: Wall Street's growing preference for Ethereum and tokenization projects create strong fundamental support

- Supply-Demand Dynamics: Exchange supply at 9-year lows combined with institutional accumulation creates favorable price pressure

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Despite Short-Term Pressure

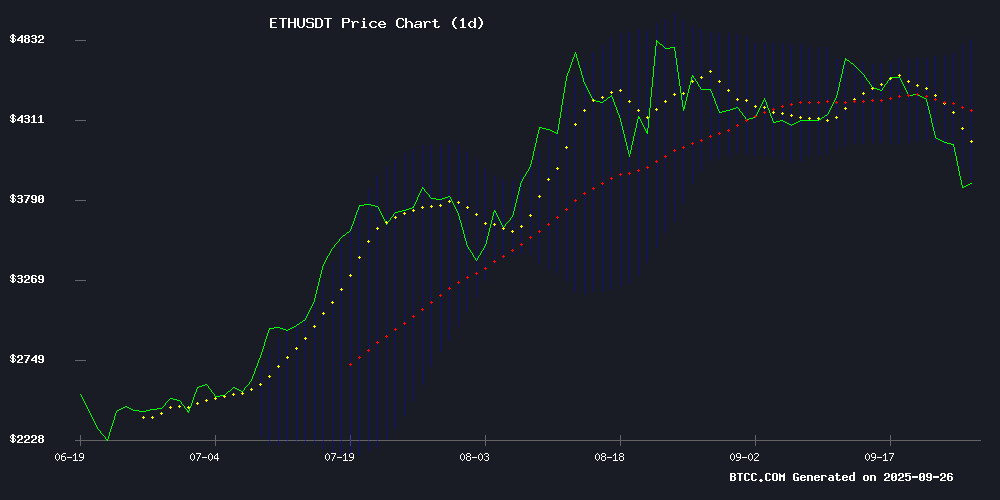

ETH is currently trading at $3,946.39, below its 20-day moving average of $4,382.40, indicating potential short-term resistance. However, the MACD indicator shows positive momentum with a value of 97.23, suggesting underlying strength. The Bollinger Bands position ETH NEAR the lower band at $3,938.50, which often serves as a support level. According to BTCC financial analyst Olivia, 'The technical setup suggests ETH is testing key support levels while maintaining bullish momentum indicators. A break above the 20-day MA could trigger a move toward the upper Bollinger Band at $4,826.'

Market Sentiment: Institutional Adoption Drives Ethereum's Long-Term Outlook

Recent developments including Vitalik Buterin's PeerDAS scalability breakthrough and Ethereum's emergence as Wall Street's preferred blockchain for institutional investment are creating strong fundamental support. The supply of ETH on exchanges hitting a 9-year low indicates significant accumulation by mid-sized investors. BTCC financial analyst Olivia notes, 'The combination of technical innovation and institutional adoption creates a compelling case for Ethereum's long-term growth. The tokenization of traditional assets like Nasdaq-listed shares on ethereum demonstrates real-world utility beyond speculative trading.'

Factors Influencing ETH's Price

Vitalik Buterin Unveils PeerDAS as Ethereum's Scalability Breakthrough

Ethereum co-founder Vitalik Buterin has identified PeerDAS technology as the cornerstone of the upcoming Fusaka upgrade, marking a pivotal advancement in blockchain scalability. The innovation enables nodes to verify blocks through data sampling rather than full downloads—leveraging erasure coding to maintain decentralization while processing more transactions.

Network demand was spotlighted as Ethereum processed six blobs per block for the first time, signaling escalating rollup adoption. PeerDAS mirrors techniques from cybersecurity, fragmenting data to optimize storage without compromising security—a solution to Ethereum's long-standing scalability trilemma.

Ethereum's Summer Surge: August-September 2025 Rally Leads Crypto Gains

Ethereum has cemented its position as the standout performer of 2025's crypto markets, with August and September delivering extraordinary returns. The asset currently trades at $4,174, having shattered the $4,000 psychological barrier during a September rally that rewarded early investors.

September's price action demonstrates Ethereum's unique capacity to generate outsized returns during volatile periods. Traders who positioned themselves during May's recovery phase are now reaping the benefits of this carefully timed momentum shift.

August's 18.7% monthly gain—the largest in six years—marked a dramatic reversal from June's 5.97% decline. This performance establishes Ethereum's summer months as critical windows for both short-term traders and long-term holders.

Ethereum Price Faces Key Test at $3,650 as Mid-Sized Sharks Dominate Accumulation

Ethereum's market dynamics are shifting as mid-sized holders—often referred to as 'sharks'—increase their accumulation while whales reduce exposure. The cryptocurrency, now trading near $3,865 after a 13% weekly drop from highs above $4,400, is testing critical support levels. Wealth inequality on the network is rising again, marked by a climbing Gini coefficient, signaling consolidation among larger addresses.

Joao Wedson, Founder and CEO of Alphractal, notes that entities holding 10,000 to 100,000 ETH are driving this trend, filling the void left by institutional whales. Despite the correction, Ethereum's macro bullish structure remains intact, with Bollinger Band resistance capping recent rallies.

FalconX Pioneers Ethereum Staking Yield Derivatives for Institutional Investors

FalconX, a premier digital asset prime broker, has executed the first forward rate agreements (FRAs) linked to Ethereum staking yields. This innovation introduces a fixed-income layer to crypto markets, enabling institutions to hedge or speculate on ETH's native yield volatility. The derivatives are benchmarked to the Treehouse Ethereum Staking Rate (TESR), a daily index designed to standardize ETH staking returns akin to traditional finance benchmarks like SOFR.

Ethereum staking demand has surged in 2025, fueled by billions in ETH ETF inflows and corporate treasury interest. Validator data shows over 860,000 ETH (approximately $3.7 billion) queued for staking—the highest backlog in two years. TESR's framework mirrors the "Decentralized Offered Rates" initiative, aiming to create crypto-native equivalents of legacy rate benchmarks.

Sharpbet Pioneers Stock Tokenization on Ethereum Amid Market Volatility

SharpLink Gaming (Nasdaq: SBET) has become the first U.S. public company to tokenize its SEC-registered common stock natively on the Ethereum blockchain. The announcement coincides with ETH's price retreating below $4,000, underscoring the tension between institutional adoption and market turbulence.

The Minneapolis-based sports gaming firm partnered with Robert Leshner's Superstate to explore compliant secondary trading of tokenized shares via automated market makers. Superstate will serve as digital transfer agent, leveraging its 'Opening Bell' platform for on-chain issuance.

'Tokenizing SharpLink's equity directly on Ethereum is more than a technical milestone—it's a statement about where we believe global capital markets are headed,' said Joseph Chalom, SharpLink's co-CEO. The move signals growing institutional interest in blockchain infrastructure despite crypto market headwinds.

Ethereum Supply on Exchanges Hits 9-Year Low Amid Institutional Accumulation

Ethereum balances on centralized exchanges have plummeted to their lowest level since 2016, with just 14.8 million ETH remaining—a 50% decline over two years. The accelerated outflow since mid-July underscores a strategic shift toward long-term holding and yield-generating alternatives like staking and DeFi protocols.

Glassnode and CryptoQuant data reveal a stark reduction in exchange-held ETH, with the supply ratio hitting 0.14, matching 2016 levels. This exodus signals diminished selling pressure and reinforces bullish sentiment for Ethereum's price trajectory as institutional players accumulate.

Ethereum Eyes $4,750 Recovery Amid Bearish Pressure

Ethereum's price trajectory shows signs of resilience despite recent bearish momentum, with technical indicators pointing to a potential rebound. The cryptocurrency has dipped 5.55% to $3,931.22, but oversold conditions suggest an upcoming recovery phase. Analysts project targets between $4,150 and $4,750 within 4-6 weeks, contingent on holding immediate support at $3,815.

Diverging views dominate the analyst community. CoinCu aligns with bullish technicals, forecasting $4,752.94 by December 2025, while CoinCodex warns of a possible drop to $2,166.41. The 20-day SMA at $4,401.58 and strong support at $3,647.63 frame critical technical levels for Ethereum's next move.

SharpLink to Tokenize Nasdaq-Listed SBET Shares on Ethereum

SharpLink Gaming, Inc. announced plans to tokenize its Nasdaq-listed SBET shares directly on the Ethereum blockchain, marking a first for public companies. Superstate, chaired by Ethereum co-founder Joseph Lubin, will serve as the Digital Transfer Agent, utilizing its Opening Bell platform for compliant onchain issuance.

The initiative aims to showcase blockchain's potential to enhance shareholder value and market efficiency. "Tokenizing SharpLink’s equity on Ethereum is a statement about the future of global capital markets," Lubin said. The partnership will also explore automated market maker (AMM)-based trading for tokenized equity.

Ethereum Emerges as Wall Street's Preferred Blockchain for Institutional Investment

Ethereum's institutional appeal continues to grow, with BitMine Chairman Tom Lee championing its neutrality at Korea Blockchain Week 2025. "It's a truly neutral chain that gives confidence to both institutions and governments," Lee stated, positioning ETH as the prime blockchain for long-term corporate treasury strategies.

Wall Street's adoption hinges on Ethereum's impartial infrastructure. "Nobody suspects hidden advantages or manipulation here," Lee emphasized, highlighting how ETH's transparency meets institutional demands for fairness. This trust factor accelerates Ethereum's penetration into traditional finance.

Government interest compounds Ethereum's institutional case. The platform has become a testing ground for federal blockchain initiatives, with Lee noting its potential to underpin emerging token economies. "When agentic AI and robots require transactional frameworks, much of that activity will naturally flow to Ethereum," he predicted.

Centrifuge Launches Tokenized S&P 500 Index Fund on Coinbase's Base Network

Centrifuge, a leader in real-world asset tokenization, has introduced the first licensed S&P 500 index fund on blockchain. The Janus Henderson Anemoy S&P 500 Fund (SPXA) is now live on Base, an Ethereum layer-2 network developed by Coinbase.

This marks a milestone as the first tokenized index fund licensed by S&P Dow Jones Indices. The fund enables 24/7 trading of the S&P 500, offering transparent holdings and broader access to one of the world's most recognized equity benchmarks.

FalconX served as an anchor investor, while Wormhole will facilitate cross-chain expansion. Janus Henderson, managing nearly $500 billion in assets, acts as sub-investment manager, with Centrifuge's Anemoy overseeing operations.

The launch underscores the growing trend of tokenizing traditional financial instruments like equities and funds. Proponents highlight benefits such as operational efficiency, faster settlements, and continuous market access.

Centrifuge, with deep expertise in tokenizing private credit since 2017, positions SPXA as its entry into public equity markets. The move signals accelerating institutional adoption of blockchain for mainstream financial products.

Ethereum's Cost Basis Under Scrutiny as ETF Demand Cools

Ethereum's market dynamics are shifting as institutional interest wanes. The cryptocurrency has declined 10% over the past month, now hovering near $4,000 amid broader crypto market weakness. Macroeconomic uncertainty has dampened institutional participation, with reduced ETF inflows and treasury purchases.

The realized price for accumulating Ethereum addresses—currently around $3,000—has emerged as a critical support level. This metric surged from $1,700 to $2,900 between June and September, fueled by BitMine's treasury strategy pivot and spot ETF approvals. BitMine alone has accumulated $10 billion in ETH during this period.

Market observers are divided on whether this support will hold. The confluence of slowing institutional demand and macroeconomic headwinds creates a precarious balance for Ethereum's valuation.

How High Will ETH Price Go?

Based on current technical indicators and market fundamentals, ETH shows potential for significant upside movement. The current price of $3,946.39 faces immediate resistance at the 20-day moving average of $4,382.40. A successful break above this level could target the upper Bollinger Band at $4,826.30. BTCC financial analyst Olivia suggests, 'With strong institutional accumulation and supply constraints, ETH could challenge the $4,750 level in the medium term, representing approximately 20% upside from current levels.'

| Price Level | Significance | Potential Timeline |

|---|---|---|

| $4,382 | 20-day MA Resistance | Short-term (1-2 weeks) |

| $4,826 | Upper Bollinger Band | Medium-term (2-4 weeks) |

| $4,750 | Technical Target | Medium-term (3-6 weeks) |