#ADA

- Technical Positioning: ADA trades below key moving averages but shows oversold conditions that often precede rebounds

- Fundamental Support: Cardano's $50 million DeFi initiative provides underlying value despite market headwinds

- Critical Levels: The $0.80 support and $0.87 resistance levels will determine near-term price direction

ADA Price Prediction

ADA Technical Analysis: Oversold Conditions Signal Potential Rebound

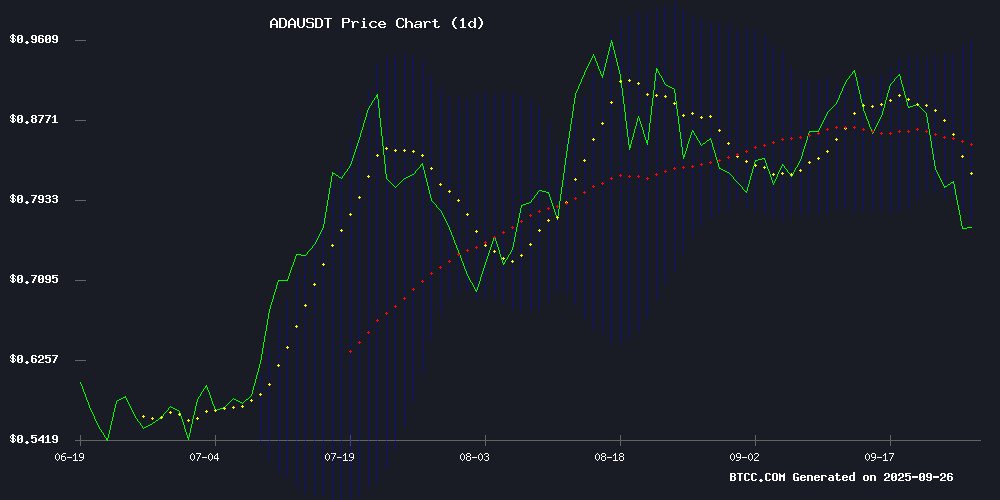

According to BTCC financial analyst John, ADA currently trades at $0.7774, below its 20-day moving average of $0.8657, indicating short-term bearish pressure. However, the MACD shows positive momentum with the histogram at 0.0275, suggesting potential upward movement. The Bollinger Bands position ADA NEAR the lower band at $0.7728, which often indicates oversold conditions and possible bounce opportunities.

John notes that 'the technical setup shows ADA testing crucial support levels while exhibiting oversold signals that historically precede recoveries. The $0.77-$0.80 zone represents a critical defense line for bulls.'

Mixed Sentiment Surrounds ADA Amid Fundamental Developments

BTCC financial analyst John observes that recent Cardano headlines present a complex picture. While the platform's $50 million DeFi initiative provides fundamental support, technical challenges and bearish signals create near-term uncertainty. 'The market sentiment appears cautiously optimistic,' John comments. 'The oversold conditions and institutional DeFi investments counterbalance the current bearish technical outlook, creating potential for consolidation before any significant move.'

Factors Influencing ADA's Price

Cardano's $50M DeFi Push Bolsters ADA Amid Technical Challenges

Cardano (ADA) holds steady above $0.79 as the Cardano Foundation unveils a $50 million liquidity fund aimed at expanding its DeFi and Real-World Asset ecosystem. The initiative, one of the largest treasury deployments in Cardano's history, targets stablecoin adoption and liquidity pool growth.

Short-term technical indicators suggest ADA is oversold, prompting cautious trading sentiment. However, the foundation's revenue-sharing model—15% of profits returning to the treasury monthly, 85% reinvested—signals long-term confidence in ecosystem expansion.

Cardano (ADA) Price Outlook: Bearish Signals Cloud Path to $3.10 ATH

Cardano's ADA struggles to regain momentum as technical indicators point to continued downward pressure. The altcoin trades at $0.7740, down 6.12% in 24 hours, with critical resistance at $0.814 and support at $0.806. A break below could test $0.800.

Market capitalization holds steady at $27.72 billion despite the bearish trend. The Moving Average sits ominously above current price levels at $0.861, while MACD's bearish crossover suggests further declines. Late-2025 projections show potential gains, but analysts remain skeptical about reclaiming the $3.10 all-time high before 2026.

Cardano Faces Critical Test at $0.80 Support Level Amid Market Downturn

Cardano (ADA) is battling to defend the $0.80 support level, a threshold analysts deem critical for any sustained recovery. The token currently trades at $0.7739, reflecting a 6% decline over 24 hours and a 16.5% weekly drop. This downturn coincides with regulatory developments that could pave the way for institutional exposure through ETF products.

Grayscale’s Digital Large Cap Fund ETF, launched on September 19, includes a 1% allocation to ADA—marking the first regulated multi-asset crypto product to feature Cardano. Trader Ali Martinez emphasized on September 24 that holding $0.80 is essential for ADA to rebound toward $0.95. Failure to maintain this level risks triggering deeper corrections.

Technical analyst Sssebi noted ADA’s rejection at the $0.85 resistance zone, suggesting the Relative Strength Index must signal oversold conditions before a meaningful bounce. 'ADA might dip between low $0.70 and high $0.60—a good time to buy and open longs,' he projected.

ADA Price Prediction: Cardano Eyes $0.87 Recovery Amid Oversold Signals

Cardano's ADA token has dipped 6.22% to $0.77, but technical indicators suggest a potential 13% rebound toward $0.87 resistance. Oversold RSI and Bollinger Band positioning hint at a near-term recovery opportunity, with analysts divided but cautiously optimistic.

The 20-day SMA at $0.87 presents a key hurdle, while $0.73 stands as strong support. InvestingHaven's bullish $1.88 long-term target contrasts with Changelly's conservative $1.02 near-term projection, creating a $0.78-$1.02 potential range for the cryptocurrency.

Is ADA a good investment?

Based on current technical and fundamental analysis, ADA presents a mixed investment case. The cryptocurrency shows oversold conditions with potential for short-term recovery, but faces significant resistance levels. Here's a summary of key metrics:

| Metric | Current Value | Implication |

|---|---|---|

| Current Price | $0.7774 | Below 20-day MA, bearish short-term |

| 20-day Moving Average | $0.8657 | Key resistance level |

| MACD Histogram | +0.0275 | Positive momentum building |

| Bollinger Band Position | Near Lower Band | Oversold conditions present |

As BTCC financial analyst John suggests, 'Investors should consider ADA's strong fundamentals against current technical challenges. The $0.80 support level remains critical - a sustained break above could signal renewed bullish momentum.'