Avalanche price has sunk into a correction after falling by 16% from its highest point this month. This plunge has coincided with the recent crypto market crash. Still, the AVAX price may be ripe for a bullish surge to $50 as transactions in the network soar.

Avalanche Price Technicals Point to a Surge to $50

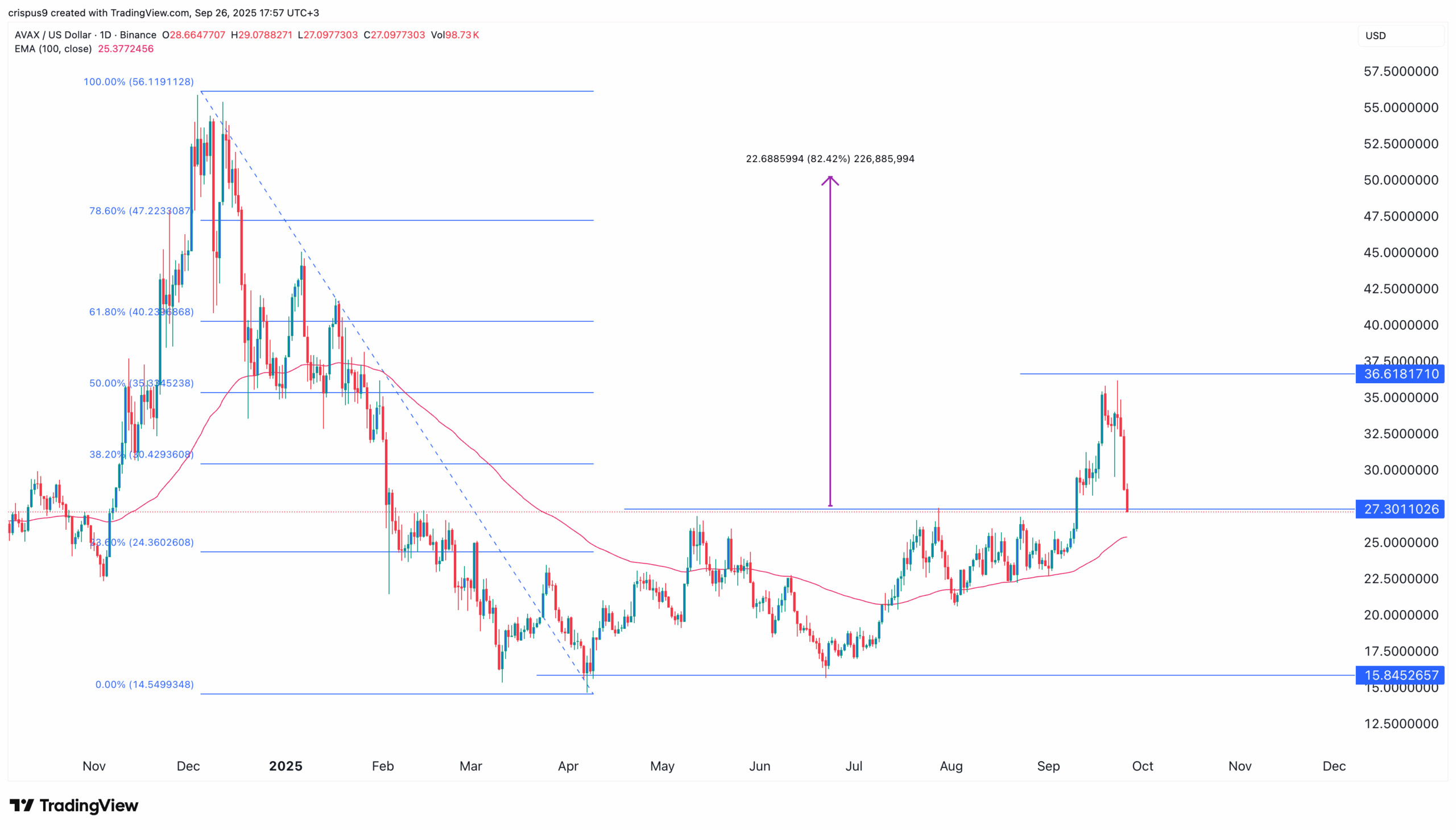

The daily timeframe shows that the Avalanche price could be on the cusp of a strong bull run. It recently formed a double-bottom pattern at $15.84 and a neckline at $27. This pattern normally leads to a strong bullish breakout.

AVAX crypto price made a breakout above the neckline on September 9. In most cases, a bullish continuation is usually confirmed by a retest of a crucial support. It has now retested the neckline at $27, confirming the bullish breakout.

Avalanche crypto price remains above the 100-day Exponential Moving Average (EMA), which is a bullish sign. Therefore, the most likely AVAX price forecast for 2025 is bullish. The next important target is the psychological point at $50, up by 82% from the current level.

On the other hand, a drop below the key support at $20 will invalidate the bullish Avalanche crypto forecast.

Avalanche Crypto Transactions Are Soaring

The AVAX price has numerous fundamental catalysts that will help to push it higher in the coming weeks.

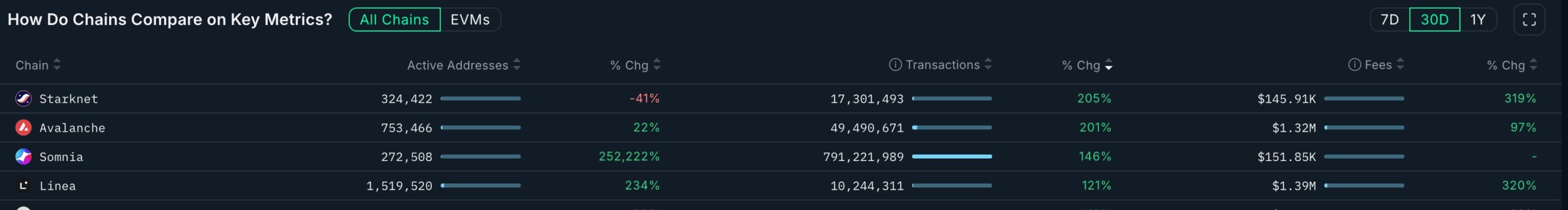

The first major one is that the number of transactions in the network has jumped in to past few weeks, making it one of the fastest growing blockchains. These transactions jumped by 201% in the last 30 days to almost 50 million.

The surge in transactions happened as the number of active addresses using the network rose by 22% to 753,455.

One reason for the surge in transactions is the ongoing growth of its real-world asset tokenization industry. Data shows that Avalanche’s total value locked in the RWA industry soared by 50% to $726 million. This makes it the fourth-biggest chain in RWA after Ethereum, ZkSync, and Polygon.

Its role in the RWA industry will accelerate after Anthony Scaramucci’s Skybridge Capital said that it will bring over $300 million in assets to its network. Also, it recently partnered with Mirae Capital Management, a company with over $316 billion in assets to its network.

Avalanche price will also rise as the Securities and Exchange Commission (SEC) considers several spot AVAX ETFs and as its role in areas like decentralized finance and NFTs rise. Also, some companies have started to accumulate AVAX tokens for their treasuries.