According to an exclusive report by foreign media outlet The Big Whale , international financial communications giant SWIFT is collaborating with several large international banks (including BNP Paribas and BNY Mellon) to select Ethereum's Layer 2 network Linea as a blockchain testing platform, attempting to "move" its traditional cross-border payment messaging system onto the chain.

The project, driven by Ethereum core developer ConsenSys, has attracted participation from over ten global financial institutions and will enter the actual deployment phase in the coming months. An insider at a participating bank stated, "This collaboration has the potential to bring about a major technological transformation for the global interbank payment system."

If this cooperation is officially announced in the future, it will not only be a technological milestone, but may also mark a historic turning point: the widespread application of blockchain and stablecoins is shaking the technological foundations of old financial infrastructure such as SWIFT, forcing them to take the first step in transformation.

Who is SWIFT and how important is it?

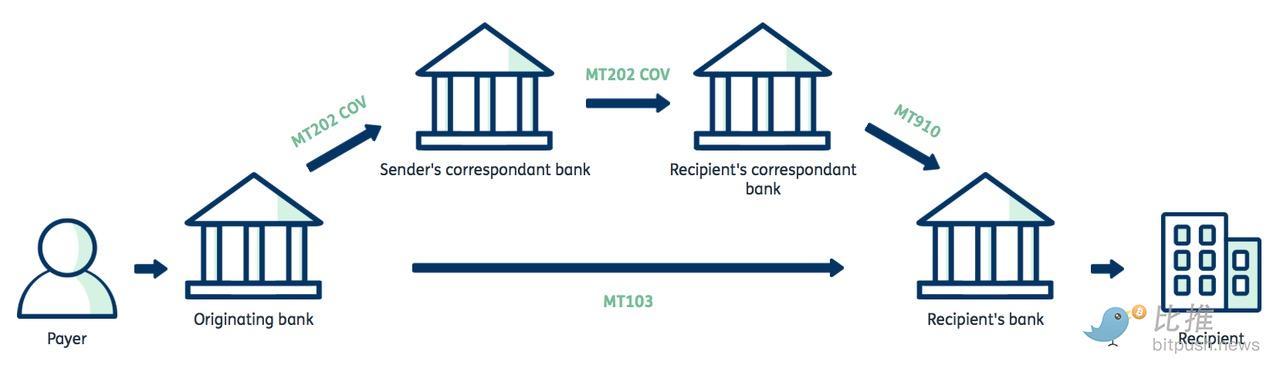

SWIFT (Society for Worldwide Interbank Financial Telecommunication) was founded in 1973 and is headquartered in Belgium. It is a "super hub" used to transmit financial messages (such as payment instructions, clearing confirmations, funds settlements, etc.) between banks around the world.

Simply put, SWIFT is like a "super WeChat group" covering banks around the world. It doesn't handle specific services like deposits and remittances, but is only responsible for securely transmitting instructions between banks about how much money A should transfer to B.

SWIFT currently connects over 11,000 financial institutions worldwide, covering over 200 countries and regions, and processes over 42 million financial messages daily. It serves as the "nerve center" for global trade, cross-border remittances, securities trading, and clearing.

However, this highly centralized network system also faces many pain points:

Inefficiency : Cross-border payment cycles can take 1-3 business days, depending on the number of intermediary banks and national regulations.

High fees : Every transaction involves intermediary bank charges;

Poor transparency : The payment path and status are unclear and difficult to track;

Geopolitical risks : In recent years, SWIFT has been used repeatedly as a financial sanctions tool (such as Russia being removed from SWIFT), exposing its highly centralized strategic sensitivity.

In this context, blockchain technology's inherent characteristics of decentralization, transparency, and high efficiency are seen as a potential answer to breaking SWIFT's "old structure."

Why Linea?

Linea is an Ethereum Layer 2 network developed by Consensys. It uses ZK-Rollup (zero-knowledge rollup) technology and has the following significant advantages:

Privacy protection: ZK technology allows verification of transaction authenticity without exposing the data itself, meeting banks' dual requirements for compliance and confidentiality.

High performance and low cost: Compared to the Ethereum main chain, Layer 2 can handle larger transaction volumes and lower fees;

Compatible with Ethereum mainnet: seamlessly integrate with existing stablecoins, RWA, and DeFi components;

Enterprise-grade support: Backed by Consensys, it has the capabilities and reputation to serve large institutions.

Compared to other chains, Linea provides a "regulatory-friendly, high-performance on-chain environment", making it an ideal choice for SWIFT under current compliance pressures.

Market data shows that after the news leaked, the price of Linea tokens rose by more than 14% on the same day and is still firmly above the rising range, performing far better than the broader market.

What does SWIFT on the chain mean?

If SWIFT were to migrate part or all of its messaging system to blockchain, the following impacts would occur:

1. Reduce cross-border payment costs and time

On-chain systems running on L2 architectures like ZK-Rollup can achieve transaction confirmation within seconds, significantly reducing intermediary processes and associated costs. This represents a significant improvement over the current SWIFT payment system, which often takes three days to process.

2. Improve financial transparency and traceability

On-chain records can be queried and audited by authorized parties, greatly enhancing anti-money laundering and compliance capabilities. At the same time, real-time visibility of transaction status also enhances the transparency and trust of financial transactions.

3. Achieve more flexible asset settlement

In the future, SWIFT will not only be able to transmit "payment instructions," but also "assets themselves." On-chain assets such as stablecoins, government bonds, and bills can be implemented as smart contracts, thus achieving settlement finality.

4. Build a global unified payment standard

Blockchain technology is inherently universal, unlike the fragmented standards of traditional finance. By building unified standards based on this technology, SWIFT is poised to lead the next generation of global payments infrastructure.

Who will benefit first? Who might be left behind?

Potential winners:

Ethereum Ecosystem : Linea’s integration with SWIFT will bring huge capital flows and application scenarios to the Ethereum mainnet;

Stablecoin issuers (such as USDC and DAI): will play a key role in on-chain settlement;

On-chain compliance service providers (e.g., Chainalysis, Fireblocks): benefit from the demand for regulatory-friendly infrastructure;

Modular DeFi component developers : provide underlying functions such as account systems, AML tools, and payment interfaces.

Potential victims of oppression:

Correspondent banks : They profit from being “transfer channels” in the SWIFT system. If these channels are replaced by on-chain smart contracts, their business models will be challenged.

Established clearing houses and payment networks : If they cannot quickly move to the blockchain, they may be marginalized;

Payment systems in technologically backward countries : gradually losing competitiveness in the face of global chain payment systems.

summary

This isn't SWIFT's first foray into blockchain. It has previously partnered with Chainlink to explore cross-chain communication and with Euroclear to test digital bond clearing. However, this move to migrate its core messaging system to a public blockchain environment like Linea represents its most decentralized approach yet.

Whether SWIFT will actually go blockchain-based in the future remains to be officially announced. But even if it's only in the testing phase, it's enough to send a strong signal: the "old order" of the global cross-border payments system is undergoing a technologically driven revolution.

Author: Bootly

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush