This article is machine translated

Show original

Plasma's template might be more like Ethena, whose valuation in its pre-IPO round was only a few tens of megabytes (the same valuation as Echo's). Tier-one projects with good VC odds really don't need to be that expensive. New projects with over 300 megabytes in VC rounds are simply worse off buying ETH.

Early Acceleration Phase

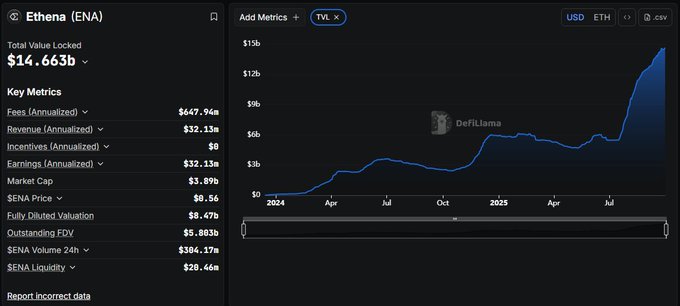

Ethena's TVL from December 2023 to mid-2024 was 0-3.6 billion.

Plasma's TVL from September 2025 was 0-7 billion, and from October 2025 it was 7 billion-?

Mid-Term Growth Phase

Average returns declined, competition intensified, new inflows slowed, and both TVL and price declined. Mature Inflection Point Stage

Ethena TVL 2.5B-6B from December 2024 to mid-2025

Sustainable Expectation Stage

Ethena TVL 6B-15B from mid-2025 to the end of 2025

Plasma is a chain, potentially offering a higher dimension. It's not solely driven by TVL growth; other aspects can also develop. I'm optimistic about the development of the payments landscape, including native ecosystem applications and node staking openness. These are not yet implemented, and the price will definitely have significant cyclicality. We will plan to ambush it for the ENA 0.2 moment in the long term.

Other stablecoin chains will quietly participate, but they won't be as excited as Plasma. Competition is increasing, expectations are decreasing, and the second-in-command may change, but the first-in-command remains.

Ecosystem projects require more careful research. Don't rush into them blindly because they seem relevant. The risks outweigh the benefits. Aptos, Sui, and Bera's ecosystem projects didn't end well. Resources are limited, so achieving success is a significant achievement.

On the contrary, migrating protocols can gain new growth points and have been market-tested.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content