From Singapore, stablecoins are escaping the shadow of “trading tools” to enter everyday life: scanning QR codes via Grab to buy a cup of coffee, order food, or pay your phone bill.

OKX Singapore joins hands with Grab to integrate stablecoin payments

OKX Singapore joins hands with Grab to integrate stablecoin payments

Stablecoins usher in a new era of payments

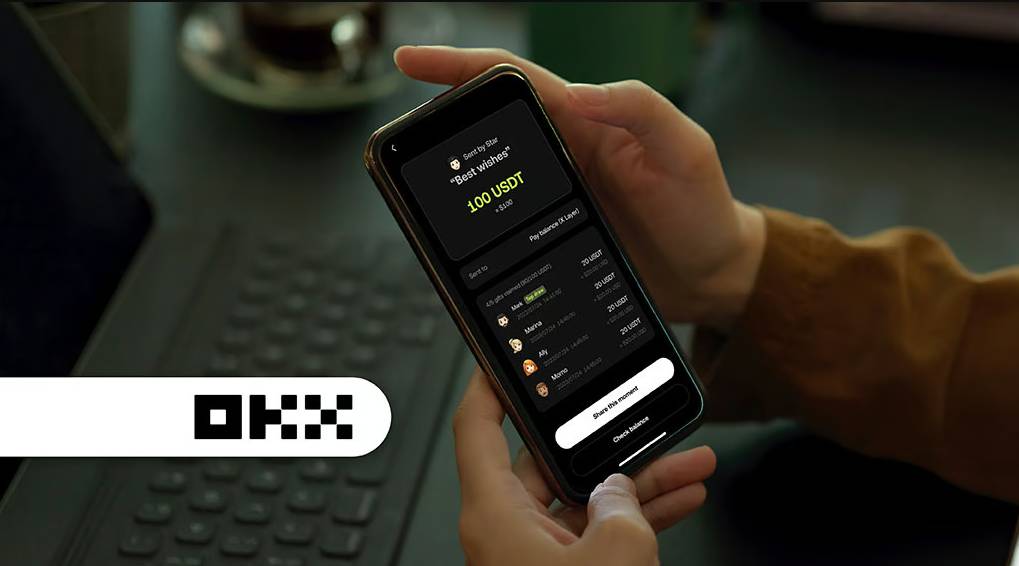

- OKX SG , the Singapore branch of global cryptocurrency exchange OKX, launched a scan-to-pay payment service using stablecoins through Grab , Southeast Asia’s popular ride-hailing and food delivery “super app.” To make this happen, OKX SG partnered with StraitsX, a leading cryptocurrency payment infrastructure provider.

- Users can now use USDT (issued by Tether ) and USDC (by Circle) to pay directly via Grab, thanks to its integration into the GrabPay SGQR network. OKX SG gained this status after being granted a major payment institution license from the Monetary Authority of Singapore more than a year ago.

- To simplify the experience, OKX Pay applies a 3-step conversion mechanism:

Users pay with USDT or USDC.

The system automatically converts to XSGD - a stablecoin Peg to SGD issued by StraitsX.

XSGD is then converted into fiat currency SGD and transferred to the seller.

- Thanks to that, the seller does not need to directly handle or hold digital assets but still receives money legally, in full compliance with regulations.

- Each transaction through OKX Pay is performed on the blockchain and operates under MAS' Purpose Bound Money (PBM) framework.

- According to OKX Singapore CEO, Gracie Lin, OKX Pay expands the use of digital assets from the field of trading and investing to everyday activities: “From a cup of coffee in the morning to dinner with friends.” This is the push for stablecoins to go deeper into real-life commerce.

- In fact, Grab is not new to crypto. Since March 2024, Grab Singapore has been testing allowing users to deposit 5 types of digital assets (BTC, ETH, USDT, USDC and XSGD) directly into the GrabPay wallet.

- By July this year, Grab continued to expand this strategy to the Philippines . Through cooperation with Triple-A and PDAX exchange, Grab users here can now pay directly with crypto. In addition, Grab has also cooperated with Circle to integrate Web3 wallet into the application and joined hands with Axie Infinity to give bonus points to users.

The global stablecoin race

- Stablecoins are Token that are Peg to a reference asset such as fiat money, in order to limit price fluctuations compared to other cryptocurrencies. This helps stablecoins function similarly to traditional currencies, but still retain the advantages of blockchain such as faster cross-border payments and lower fees.

- According to JPMorgan , stablecoin volume has increased from less than $100 billion/month to more than $800 billion/month in the past 5 years. However, the practical application of stablecoins in areas such as remittances and commercial payments is still quite in its infancy.

- Boston Consulting Group (BCG) May 2025 report indicates that 4-6% of stablecoin activity is currently for payments (remittance, commerce, on-chain settlement), while 88% is still tied to transactions/trading.

- The move from Singapore takes place in parallel with other strong changes such as:

Visa is testing stablecoins to speed up cross-border payments.

SWIFT is testing bringing the information transmission system to layer-2 Linea .

Nine major European banks , including ING and UniCredit, are joining hands to issue a euro stablecoin.

China is considering issuing a stablecoin pegged to the yuan.

In Asia, two leading messaging apps LINE NEXT and Kaia launched their own layer-1 blockchain mainnets in late August, and are preparing to launch their stablecoin app “Project Unify”.

Coin68 synthesis