Chapter 1: Power in Disguise: The Paradox of Technological Decentralization and Power Centralization

The core innovations of modern Perp DEXs lie in smart contract execution, on-chain transparency , and user self-custody . These technological advantages form a veneer of “decentralization,” but this often masks a deeper concentration of power.

1.1 The Power Concentration Trap: Hidden Monopoly in Economic Models and Governance Structures

While the project claims to be community-governed, token distribution has centralized power from the outset. The majority of governance tokens are held by the founding team, early investors, and venture capital firms, reducing the so-called "democratic governance" to a mere performance by a few large players .

More importantly, liquidity is the lifeblood of Perp DEX, and it's highly monopolized by professional market makers and institutional LPs. Ordinary users struggle to compete in the " Matthew effect " of fee sharing and governance rewards. High proposal costs further exclude small investors from governance, rendering democracy an illusion .

Chapter 2: The Invisible Hand: Market Manipulation through Four Mechanisms

Centralized capital does not directly attack the technological architecture, but rather achieves deep control over the market and users by establishing structural inequality mechanisms .

2.1 Monopoly: Capital-driven oligopoly market structure

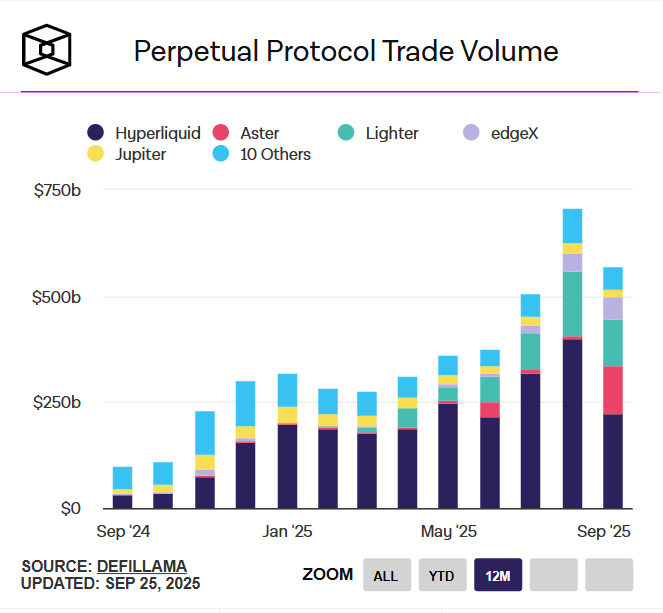

The Perp DEX market in 2025 showed an astonishing degree of concentration: the top four platforms (Hyperliquid, Aster, Lighter, edgeX) together controlled up to 84.1% of the market share.

This extreme concentration isn't the result of natural market selection, but rather the product of capital selection and bias . For example, Aster achieved nearly 10% market share in a short period after its TGE. Its " airborne" success fully demonstrates that background and capital play a far more decisive role than technological innovation . Large platforms leverage their scale advantages to attract more fees and resources, creating a positive feedback loop and creating nearly insurmountable liquidity barriers . In the current deteriorating financing environment, this oligopoly has further solidified, virtually stifling the survival of new projects .

source:theblock

2.2 Intervention: Double Standard Governance and Trade-offs

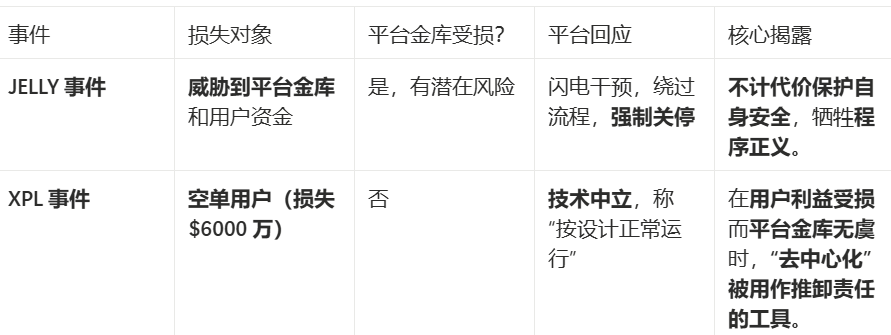

The most brutal manifestation of centralized governance is the selective intervention mechanism . Two classic cases involving Hyperliquid clearly demonstrate how procedural justice can fail in the face of platform self-interest .

Rather than choosing whether to intervene, the platform selectively exercises centralized power to ensure its profit structure is not threatened . The platform sees the tens of millions of dollars in user losses as merely "market risk," while the platform's potential losses require an emergency rescue by undermining the principle of decentralization .

Lightning Intervention in the JELLY Incident: When the JELLY token experienced significant price manipulation, threatening the platform's liquidity and user treasury funds, Hyperliquid responded with remarkable swiftness. Validators quickly reached an emergency consensus, bypassing all normal governance processes to initiate an on-chain vote and force the closure of profit-taking orders, shutting down the relevant manipulating accounts. The platform explained that this action was forced upon them to protect user treasury funds, demonstrating remarkable efficiency throughout the entire process.

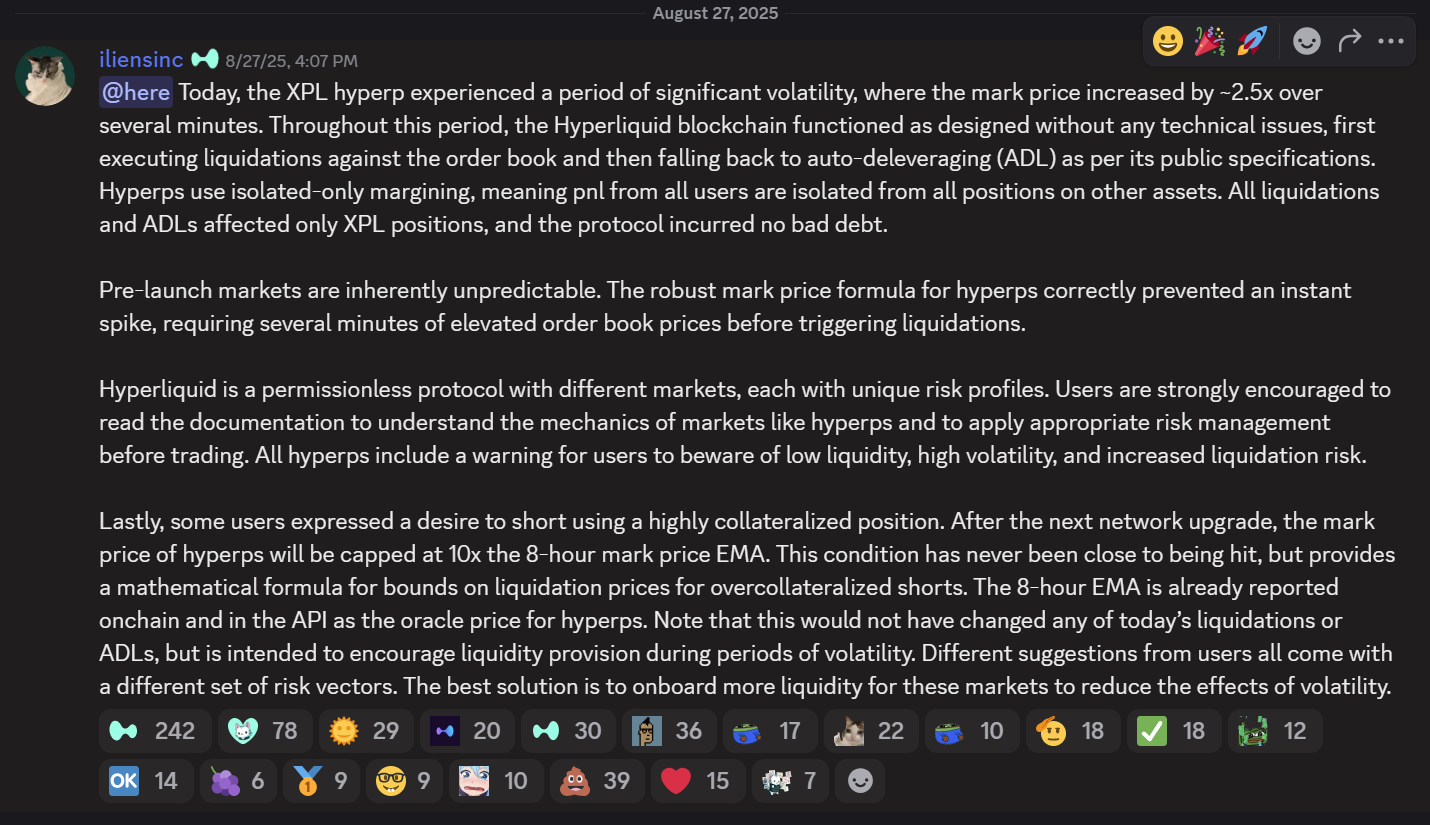

Indifferent response to the XPL incident: In sharp contrast, when the manipulators made profits of more than $46 million in the XPL market through carefully planned short squeeze operations, causing a total loss of approximately $60 million to short position users (far exceeding the $11 million loss in the JELLY incident), Hyperliquid's attitude was completely different.

Source: Hyperliquid Discord

The platform responded in its official Discord channel: "The XPL market has experienced significant volatility, but the Hyperliquid blockchain is operating as designed, without any technical issues. Liquidations and auto-deleveraging mechanisms are executed in accordance with public protocols, and because the platform utilizes a fully segregated margin system, this incident only impacted XPL positions, and the protocol did not incur any bad debts."

In this capital feast, the manipulators carefully exploited the structural weaknesses of the Hyperliquid platform:

- First, the extreme transparency on the chain allows manipulators to accurately calculate the required funds and expected effects;

- Second, the isolated oracle system enables XPL to adopt an independent pricing system on Hyperliquid. Manipulators can manipulate prices at will within this "besieged city" without worrying about price balance pressure from external exchanges.

- Third, we chose a "paper contract" token that has not been launched online, so there is no spot delivery pressure;

- Fourth, we accurately chose the time when liquidity was weakest.

A double-standard profit calculation: This contrasting approach reveals a clear profit calculus: The JELLY incident threatened the platform's coffers, triggering intervention; the XPL incident, which only harmed user interests and left the platform's coffers intact, was ignored. The platform's own financial security is always the top priority, and so-called decentralization is merely a cosmetic consideration when it doesn't threaten the platform's core interests. The platform viewed users' $60 million loss as merely "market risk," while the platform's potential losses necessitated an urgent solution by undermining decentralization.

2.3 Structure: Protocol-Level Privileges and Liquidity Monopoly

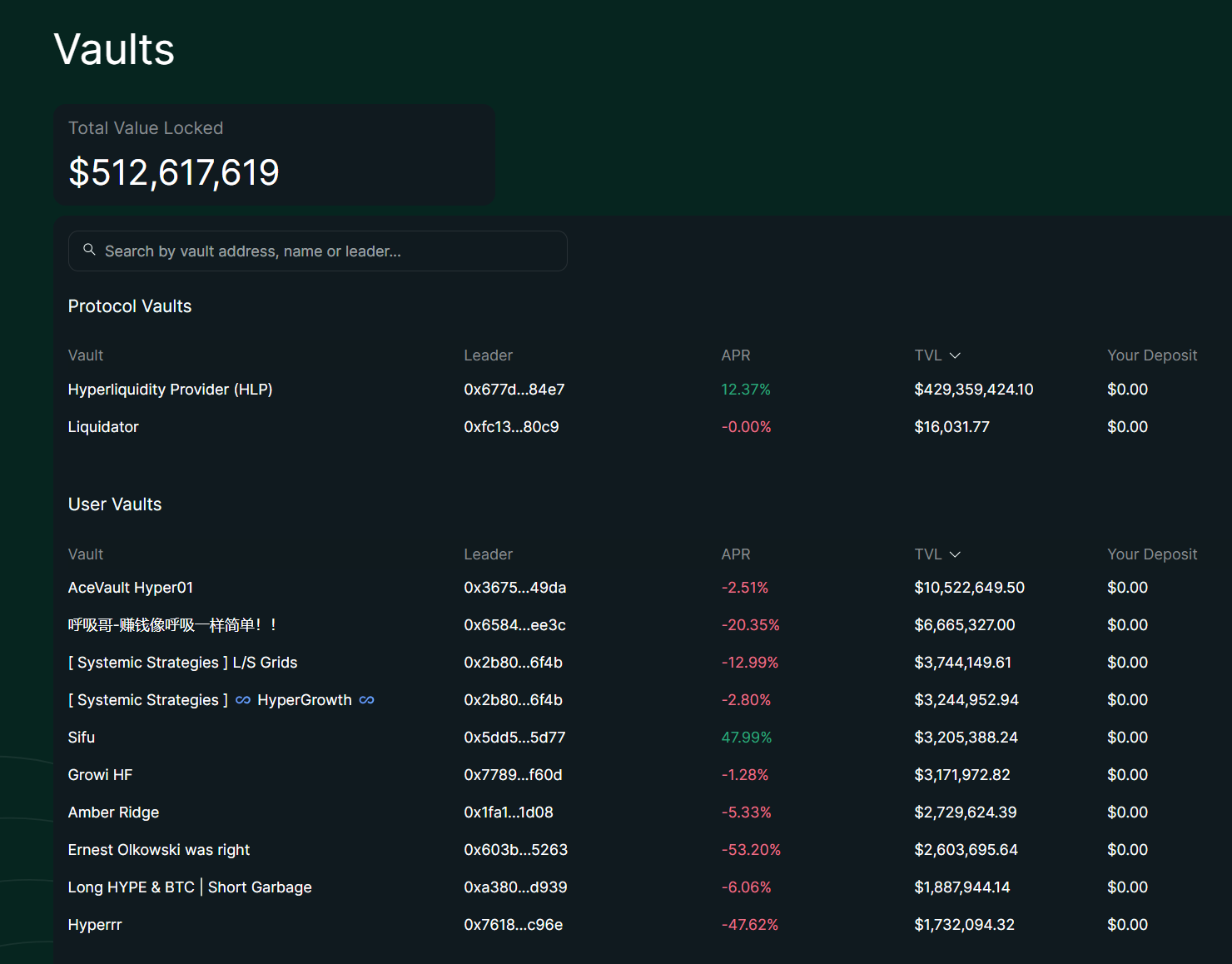

source: hyperliquid

According to the latest data, Hyperliquid's total TVL reached $512 million, of which the protocol's HLP vault held $429 million, or 84%. This made it the protocol's "shadow central bank" or "privileged class." By comparison, all User Vaults hold approximately $83 million, spread across hundreds of independent vaults.

In-depth analysis of the advantages of the HLP system

- Monopoly on Liquidation Processing: HLPs enjoy exclusive liquidation processing rights. When leveraged positions are liquidated and the order book cannot fully match them, HLPs absorb the remaining positions with approximately 2x leverage and gradually close them through market-making strategies. This mechanism not only prevents platform-wide liquidations but also distributes liquidation profits directly to HLP holders. In contrast, User Vaults are completely unable to participate in fallback liquidations and are limited to custom trading strategies.

- Structural Advantages of Fee Sharing: HLP takes a fixed fee of approximately 45% of the platform's overall trading volume, providing a stable passive income that is positively correlated with trading volume. Data from the first half of 2025 shows that HLP secures a significant share of the platform's cumulative revenue through this mechanism, while User Vaults rely solely on the strategic performance of Leaders and do not receive any fixed commission.

- Collective Buffer for Risk Management: HLP leverages a collective pool of over $400 million to share risk, and off-chain strategy optimization further reduces volatility. Data shows that HLP's volatility is significantly lower than BTC's 45%, maintaining relative stability in both bull and bear markets, with an annualized return of approximately 51%. User Vaults, on the other hand, are vulnerable to the failure of a single strategy.

Systemic Constraints Faced by User Vaults

- Structural Disadvantages in Information Access: User Vaults Leaders have relatively limited access to market data and cannot prioritize order flow or microstructure information like HLP. HLP's protocol-level integration allows for real-time data feeds, while User Vaults rely on on-chain queries, which are susceptible to latency.

- Technological gap in execution efficiency: User Vaults face significant latency disadvantages in Hyperliquid's sub-second environment, particularly during high-frequency trading or arbitrage opportunities. While leaders can make off-chain adjustments, on-chain execution requirements limit responsiveness, making opportunities more likely to be missed compared to HLP's infrastructure priorities.

- Profitability pressure from cost structure: Leaders charge a 10-20% management/performance fee, which directly impacts depositor returns. This increases operational pressure, especially in volatile markets. HLPs, on the other hand, do not incur such fees and only share profits through collective PnL.

- Transparency-driven strategy limitations: On-chain execution requires all positions and transactions to be public, which improves auditability but limits strategy flexibility and confidentiality. HLP's "transparent opacity" design (off-chain strategy + on-chain holdings) offers a better balance between the two.

These institutional advantages have made HLP the platform's "default market maker," accounting for 84% of the total TVL. In contrast, the operational constraints of User Vaults have resulted in a majority of 30-day PnLs being negative (ranging from -2.51% to -53.20%), with TVL accounting for only 16% of the total. This structural disparity is reflected not only in profitability but also in the implicit inequality between protocol-level and user-level participants.

2.4 Penetration: CEX Capital’s “Vest-Changing” Game and Ecosystem Hunting

The Binance empire extends its reach

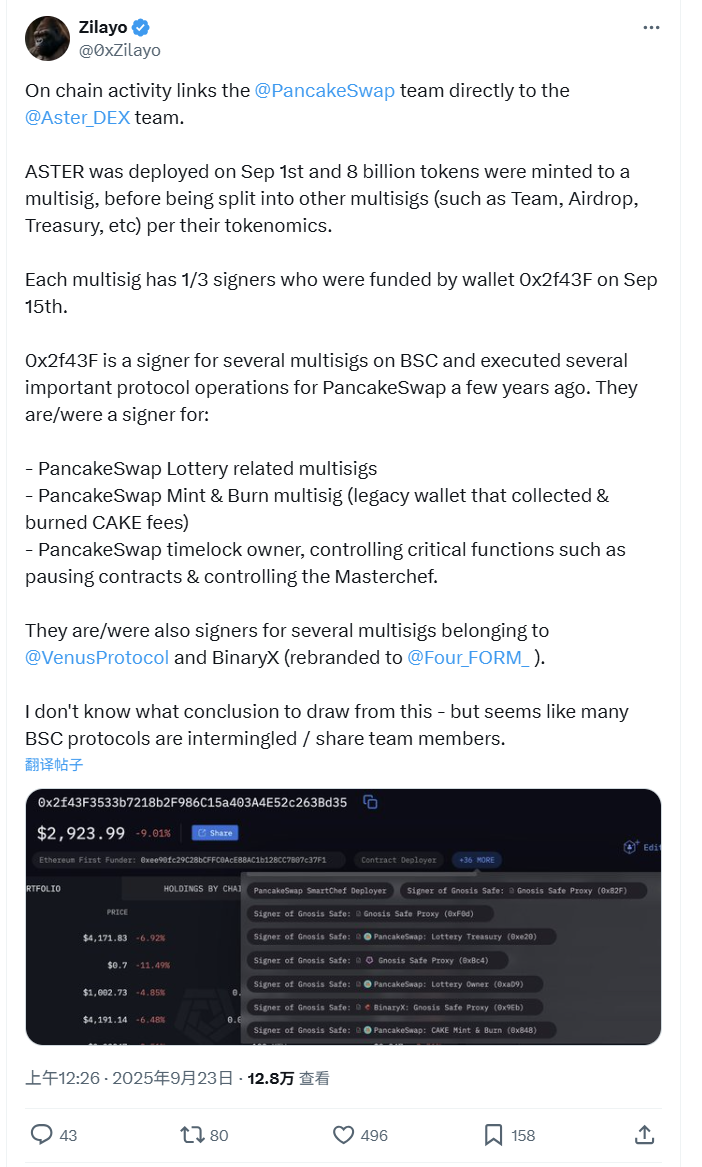

source: @0xZilayo & @awesomeHunter_z X

Through in-depth investigation by on-chain detectives @0xZilayo and @awesomeHunter_z, we found that:

The recently popular aster and pancakeSwap are backed by the same team

Core control wallet: 0x2f43F3533b7218b2F986C15a403A4E52c263Bd35

Control network range:

- Aster Treasury multi-signature contract: 0xEf0791f8dF081c7e6374EE6e9F4c3aBA7C1b1852

- PancakeSwap: Directly participate in the mint/burn operations of CAKE tokens

- Venus Protocol: Multi-signature wallet controller for BSC chain lending protocol

- Aster Governance System: Token Deployment, Airdrops, Team Wallets, and Other Core Links

This is no longer a simple "association", but different projects of the same operation team

This also explains why CZ has been frequently supporting Aster recently: this is not just an investment endorsement, but also a promotion for its own products . Aster is essentially an internal project of Binance, and CZ's tweets are a "left hand to right hand" marketing operation.

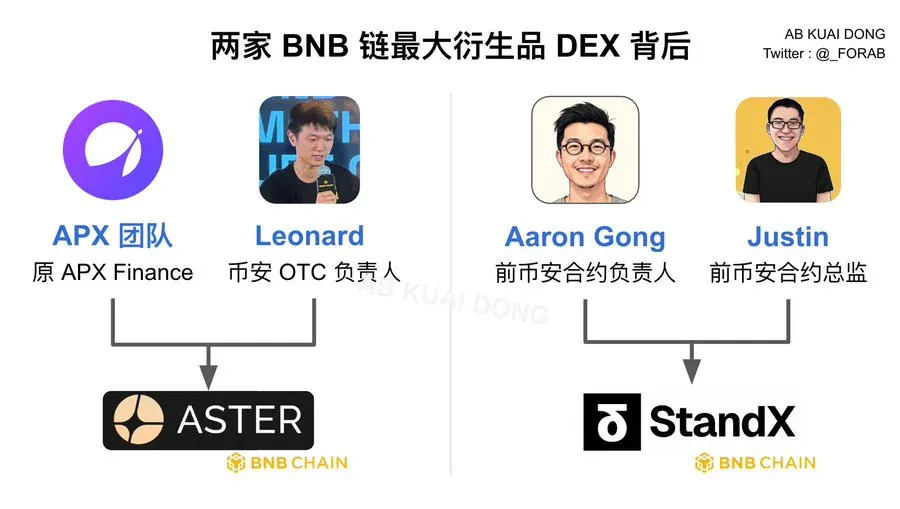

People Network: Project Division of Binance Executives

source: @_FORAB X

Aster Team Composition:

- APX Team: Former core members of APX Finance

- Leonard: Head of Binance OTC, responsible for block trading and institutional clients

StandX Team Composition:

- Aaron Gong: Former Head of Binance Futures

- Justin: Former Binance Futures Director

The Sophisticated Design of a Duopoly:

- Product differentiation: Aster focuses on cross-chain diversification, while StandX focuses on deepening the BNB ecosystem.

- Risk diversification: Different legal entities and technical structures reduce regulatory risks

- Full market coverage: Regardless of which one succeeds, Binance will be the ultimate beneficiary

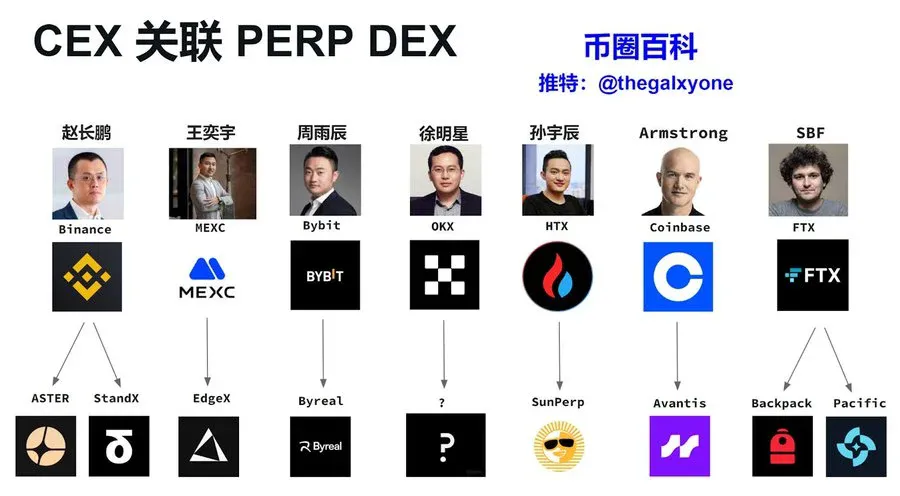

Other CEXs’ successive layout

Source: X Crypto Encyclopedia @thegalxyone

Perp DEX layout logic of each CEX:

- MEXC → EdgeX: MEXC, led by Wang Yiyu, is known as the "King of Small Currencies." EdgeX focuses on ZK-Rollup perpetual DEX, and its technical approach aligns with MEXC's flexible coin listing strategy. EDGEX is a startup project by a former executive, and the two parties maintain close ties.

- Bybit → Byreal: Bybit has been deeply involved in the derivatives trading field for many years. Byreal inherits Bybit's technical accumulation in perpetual contracts and avoids regulatory risks through "decentralized" packaging.

- HTX → SunPerp: Justin Sun's HTX (formerly Huobi) is built on the TRON ecosystem, and SunPerp takes advantage of the low-cost advantage of the TRON network, reflecting Justin Sun consistent "ecological closed loop" strategic thinking.

- Coinbase → Avantis: Coinbase, led by Armstrong, represents the US compliance route. Avantis focuses on RWA perpetual contracts, complies with the US regulatory environment, and achieves a balance between technology and compliance through the Base chain.

- FTX → Backpack & Pacific: Although SBF has collapsed, FTX's technical genes are still continuing. The former FTX team has been diverted to multiple projects, and Backpack and Pacific may have taken over some of FTX's technical assets.

CEX's motivation for deploying Perp DEX

- CEX strategy map: From Binance's investment in Aster and StandX, to MEXC's incubation of EdgeX, and Coinbase's layout of Avantis, the core motivations of various CEXs are highly consistent: regulatory hedging (through the "decentralization" label), market share defense, and capturing the next generation of DeFi innovation dividends .

- The harsh reality: CEXs migrate users from CEXs to affiliated Perp DEXs through shared technical resources, unified market-making networks, and traffic-transfer mechanisms , enabling users to circulate within an ecosystem controlled by the same capital group . The so-called "decentralized" revolution is likely just a disguised game for traditional centralized forces.

Chapter 3: Ending the ideological struggle

"Decentralized technology and centralized power" has become the new normal in the Perp DEX industry.

Leading platforms adhere to DeFi principles in their technical architecture, but in actual operations, they are deeply manipulated by CEX capital and a small number of oligarchs. They instrumentalize the narrative of decentralization to achieve the dual goals of efficiency and regulatory evasion .

The key to success in the Perp DEX space is no longer ideological conviction , but rather who can best balance a decentralized underlying framework with centralized operational efficiency , providing a superior user experience approaching CEX levels. For the mass market, transaction speed, capital efficiency, and smoothness have surpassed the pursuit of pure decentralization.

Therefore, future competition will focus on who can build a sustainable value capture mechanism while continuing to implement efficient centralized capital strategies under the cover of "decentralization".