Last week, $911.85 million in venture capital flowed into the cryptocurrency industry.

According to CryptoRank, the cryptocurrency industry saw an influx of approximately $911.85 million in venture capital across 29 investment rounds last week (September 22-28).

The number of investments has increased compared to the previous week (23), and the investment size has also expanded significantly from $185.51 million, showing that the inflow of funds into the market is gaining strength again.

This week saw the active participation of global VCs like Coinbase Ventures, Pantera, HSBC, and Temasek, along with large-scale funding rounds from Kraken, ETHZilla, and Fnality, as well as the steady growth of seed-stage projects.

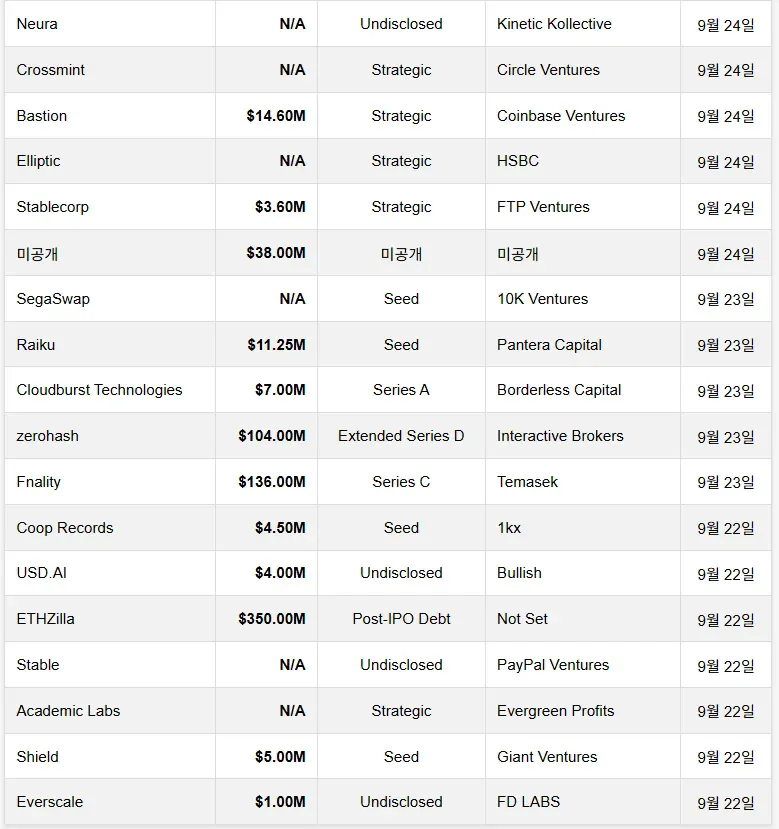

Among the most notable deals were Kraken's $500 million private round, with participation from Tribe Capital. Etherzilla followed with a $350 million post-IPO debt financing, while Fnality secured a $136 million Series C from Temasek. Zerohash also demonstrated the investment fervor in the financial infrastructure sector by securing a $104 million expanded Series D round with participation from Interactive Brokers.

The activities of prominent investment firms also stood out. ▲Coinbase Ventures continued its aggressive investment strategy, participating in multiple projects, including Bastion ($14.6 million), Share ($5 million), and ReddotPay ($47 million).

Pantera Capital placed a bet on Lyku ($11.25 million), HSBC made a strategic investment in blockchain analytics firm Elliptic, and PayPal Ventures made a strategic investment in Stable.

Seed and early-stage investments were also plentiful. Representative examples include Divine ($6.6 million, Paradigm), BULK ($8 million, Robot Ventures), and Shield ($5 million, Giant Ventures). Additionally, Likewa and Cloudburst Technologies ($7 million, Series A) successfully secured funding.

Monthly investment volume showed a slowdown in August (USD 2.05 billion, 112 deals) compared to June (USD 4.81 billion, 118 deals) and July (USD 4.06 billion, 126 deals). However, it rebounded in September, raising USD 2.22 billion (approximately KRW 3.1135 trillion) through 99 investment rounds. As of this month, two rounds have raised USD 47.5 million (approximately KRW 67.8 billion).

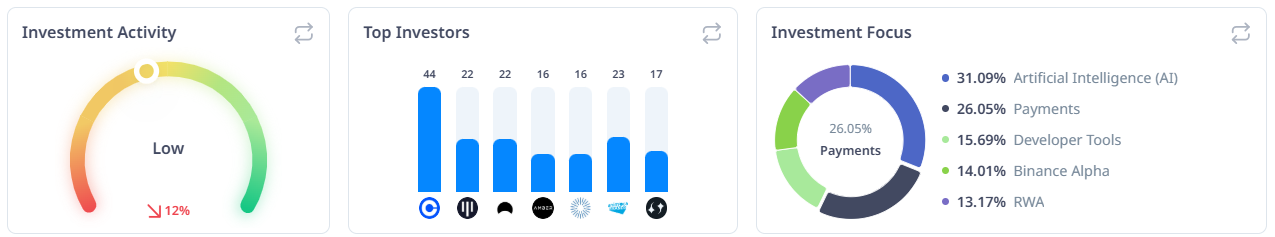

The investment activity index for the past 30 days is 12% lower than the average for the past 12 months, showing a 'low' level, down from the previous week (-10%).

The total number of investment rounds recorded over the past 30 days was 125, an 8.09% decrease from the previous month. Total investment reached $7 billion, a 52.3% increase from the previous month, with the average round size remaining around $3 million to $10 million. The most active investment stage was the "Seed" round.

Looking at investment focus areas, artificial intelligence (AI) accounted for the largest proportion, at 31.09% of the total. This was followed by payments (26.05%), developer tools (15.69%), Binance Alpha (14.01%), and RWA (13.17%).

The major investment firms that have been most active in investing over the past six months are ▲Coinbase Ventures with 44 cases ▲Animoca Brands with 23 cases ▲Pantera Capital with 22 cases ▲Mirana Ventures with 22 cases ▲Celini Capital with 17 cases ▲Amber Group with 16 cases ▲GSR with 16 cases, in that order.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.