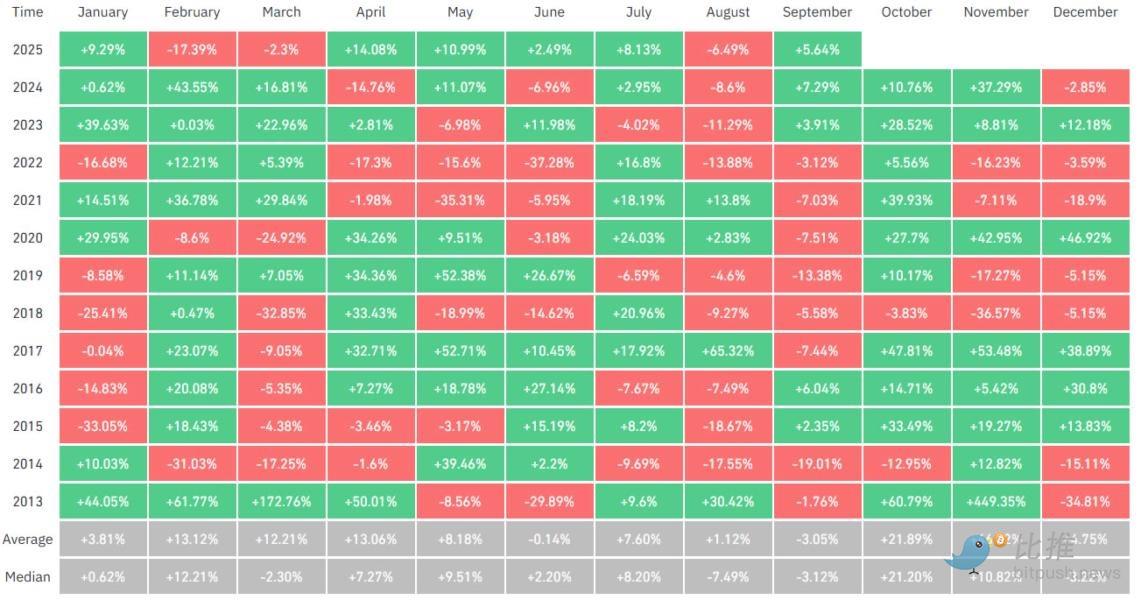

The crypto market saw a strong rebound at the start of October. Several key indicators suggest that this month, dubbed " Uptober " by investors, appears to be fulfilling the historical pattern of an October rally.

Market sentiment reversal

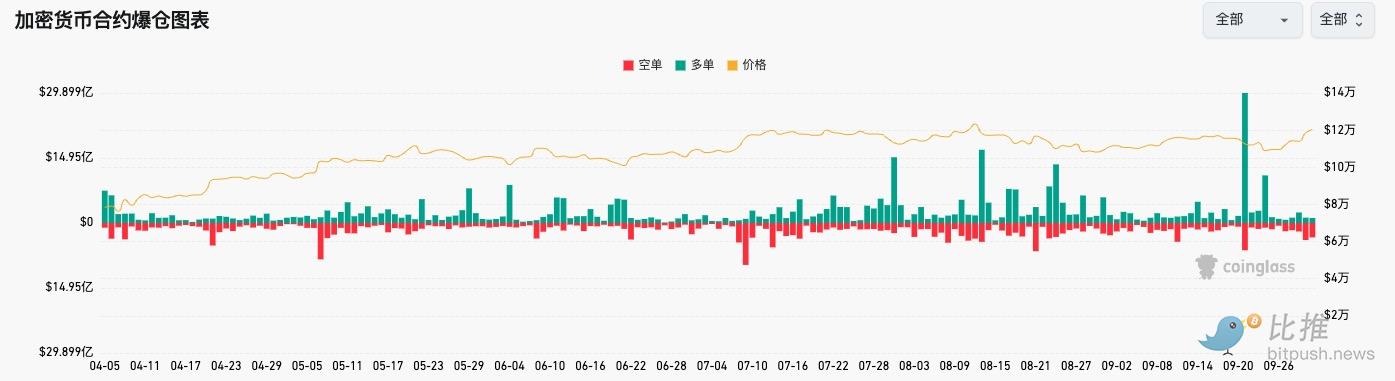

Within the first two days of October, the crypto market experienced a massive short liquidation. According to CoinGlass data, over $700 million in short positions were forced to close globally, including an $11.61 million short position on Ethereum on Hyperliquid.

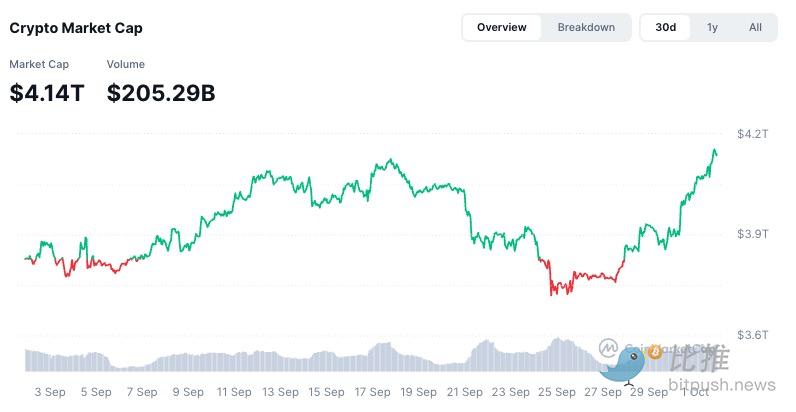

This short squeeze has swept across nearly the entire market, sending all 100 major cryptocurrencies surging. The total cryptocurrency market capitalization has risen by over 6% since the end of September, surpassing $4.14 trillion on October 2nd, reaching a new high since mid-August.

This wave of growth not only swept away the weak shadow of September, but also rekindled investors' expectations for the year-end market.

Bitcoin (BTC), as a bellwether, has led this round of rebound, with a 10.3% increase in the past four days. It is now trading at $120,500, a 40-day high.

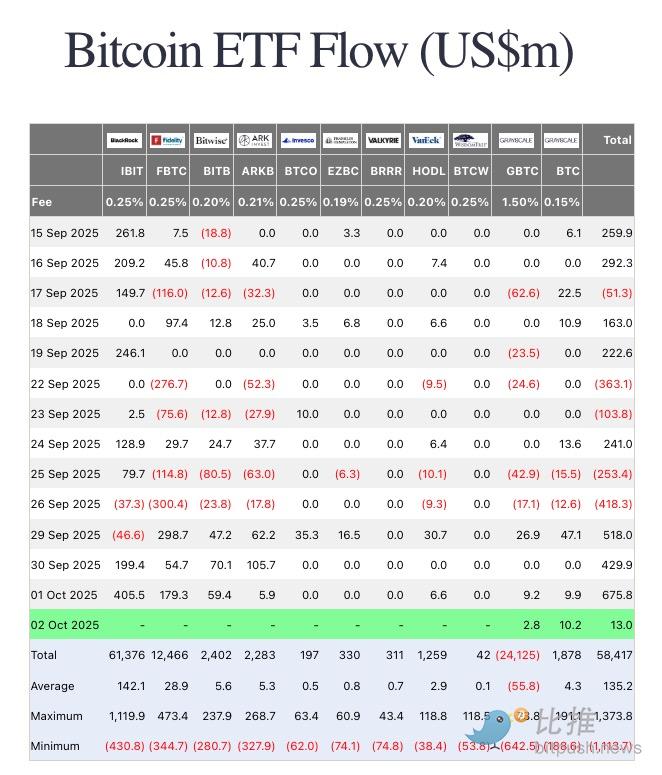

Meanwhile, Bitcoin ETF inflows hit their highest level since mid-September. According to Farside Investors data:

Bitcoin ETFs attracted $675.8 million in net inflows on Wednesday;

Among them, BlackRock's IBIT fund attracted $405.5 million in a single day;

Fidelity’s FBTC fund attracted $179.3 million;

Bitwise's BITB fund attracted $59.4 million.

It is worth noting that this is the third consecutive trading day that Bitcoin ETFs have seen daily inflows exceeding $100 million. In the first three days of this week alone, the cumulative inflow has exceeded $1.6 billion, and on September 26, the market saw a single-day outflow of $418 million.

Expectations of interest rate cuts are rising, and funds are shifting from "risk aversion" to "value-added"

The latest ADP non-farm payroll data showed that the US lost 32,000 jobs in September, significantly lower than the market expectation of a +52,000 job loss. This weak employment situation is seen as a sign of economic slowdown, leading to widespread market expectations that the Federal Reserve will cut interest rates again at the FOMC meeting on October 29th. The CME FedWatch tool currently indicates a 97.3% probability of a 25 basis point rate cut in October.

This means that the global liquidity environment is expected to further ease, and the combination of "expectations of interest rate cuts + downward US Treasury yields + weakening US dollar" is the perfect soil for the strengthening of assets such as Bitcoin and gold.

Dovile Silenskyte, head of digital asset research at WisdomTree, said: "Bitcoin combines 'safe-haven attributes' and 'growth asset potential'. It can protect against inflation like gold and has growth potential like technology stocks."

On-chain data: Selling pressure from long-term holders is weakening, and a bottom range is forming.

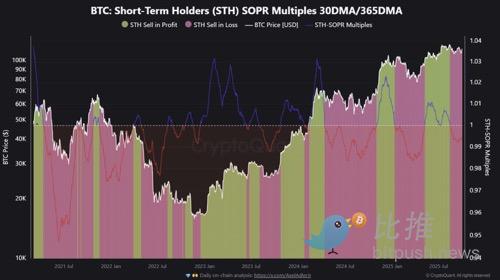

According to Glassnode data, the short-term holder realized value ratio (STH-RVT) has continued to shrink since May, indicating that short-term speculative behavior has cooled down and the market has entered a "healthy accumulation period."

At the same time, the change in the net position of long-term coin holders (LTH Net Position Change) turned into a neutral range, which means that the large-scale profit-taking wave is nearing its end.

These two data points together to one conclusion: Bitcoin is building new structural support in the $115,000 to $120,000 range, similar to the consolidation phase in March and April this year.

If the current supply and demand structure remains stable, the market is very likely to see a breakthrough in mid-October.

JPMorgan Shill: Bitcoin may reach $165,000

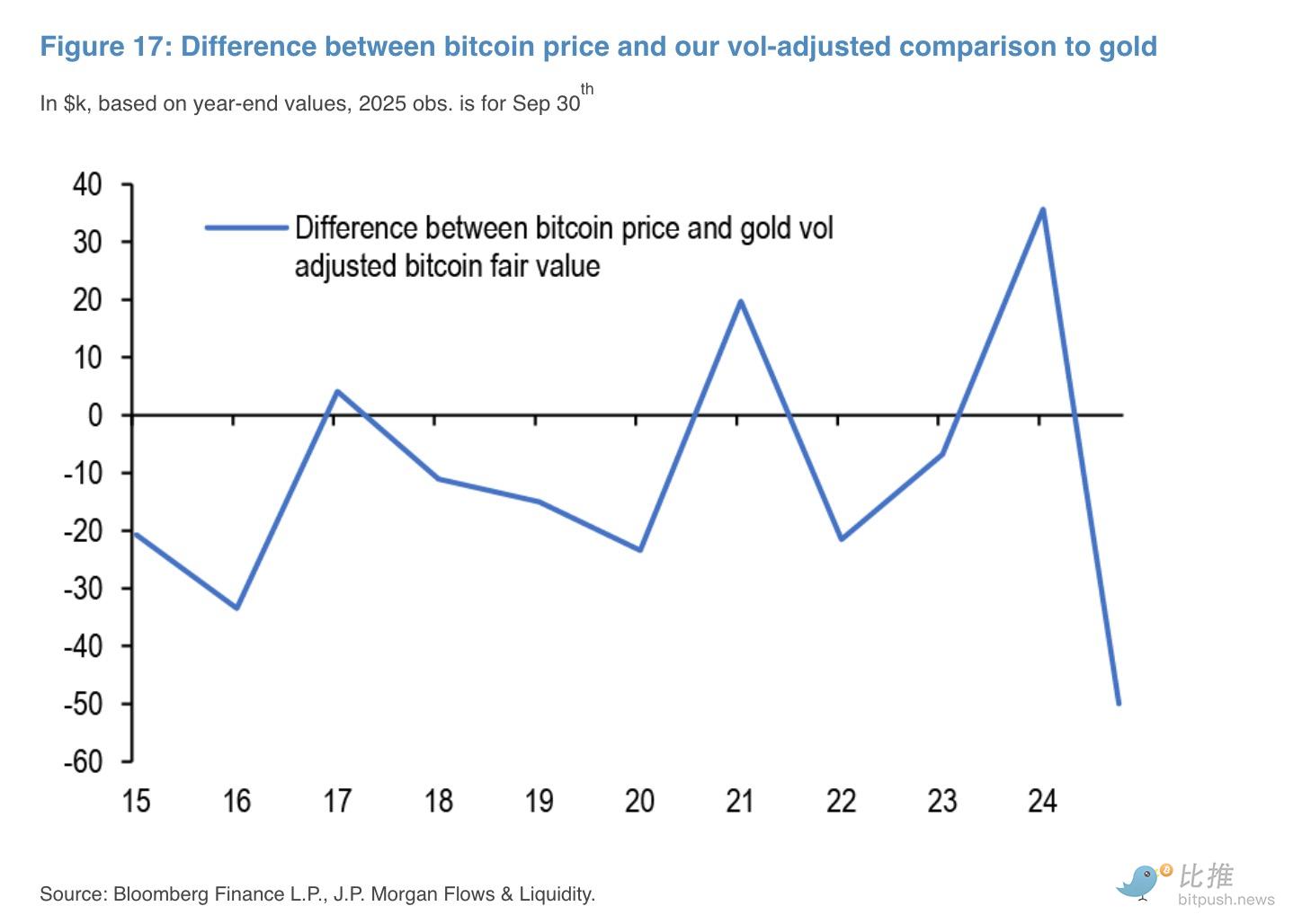

JPMorgan Chase's latest report points out that Bitcoin is currently seriously undervalued relative to gold.

The report estimates that based on volatility-adjusted valuations, Bitcoin should have about 42% upside potential; this means that its theoretical price should be around US$165,000; if it is on par with gold ETFs and physical gold investments, Bitcoin's total market value will reach approximately US$3.3 trillion.

“Since the end of 2024, the valuation gap has shifted from Bitcoin being overvalued at $36,000 to being undervalued at $46,000,” said Nikolaos Panigirtzoglou, managing director at JPMorgan and the report’s author.

In other words, investors are reembracing the "debasement trade"—facing fiscal deficits, inflation, and geopolitical risks, they're pouring money into scarce assets like gold and Bitcoin. If historical trends hold, October tends to be the most sustained period of upward movement throughout the year. With easing supply-side pressures, capital inflows, and policy turning points, Bitcoin may be poised to reach a new target range of $160,000 to $200,000.

Author: Bootly

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush