Kodiak, the native DEX within the Berachain ecosystem, is positioned to provide an efficient centralized liquidity solution for the PoL ecosystem, complementing the full-scale AMM model of the official DEX, BEX. As the flagship DEX project incubated by Build-a-Bera, Kodiak has been committed since its inception to addressing core issues such as liquidity management, trade execution, and token issuance within the PoL environment, providing users with a more convenient way to participate in the acquisition and distribution of Berachain's governance token, BGT.

It is worth mentioning that Kodiak’s overall transaction volume has exceeded US$4.5 billion, and it is rapidly growing into the liquidity hub of the Berachain ecosystem.

This article will focus on the core mechanisms and unique advantages of Kodiak Finance, analyzing how it reshapes the operation of on-chain liquidity through technology and incentive design.

Kodiak Finance's core functions and mechanisms

Focusing on Kodiak DEX itself, it supports two AMM models, namely v2 (full-range AMM) and v3 (centralized liquidity AMM). These designs are inspired by Uniswap but optimized to adapt to Berachain's unique ecosystem.

Kodiak v2 is the foundational trading model for Kodiak, built directly on Uniswap v2's constant product formula (x*y=k). This model offers full liquidity distribution, a low barrier to entry, and a simple, stable mechanism, making it ideal for low-volatility assets and average users. Furthermore, Kodiak also introduces a fee switch, which collects a portion of transaction fees from the start of the protocol for governance and incentives. This not only enhances the sustainability of the protocol but also ensures that v2 can generate long-term revenue.

In contrast, v3 targets professional LPs and institutional users seeking greater capital efficiency. v3 allows liquidity to be concentrated in a designated price range (for example, BERA/USDC in the 1–1.1 range), limiting funds to active zones. This significantly improves capital utilization and reduces slippage. Kodiak also introduces a virtual reserve mechanism to reduce actual capital tied up.

This mechanism increases the capital utilization rate of v3 by 5-10 times compared to v2. At the same time, because the capital distribution is more accurate, the Impermanent Loss is reduced, and the transaction price is closer to market expectations, making it more suitable for large-scale and high-frequency transactions.

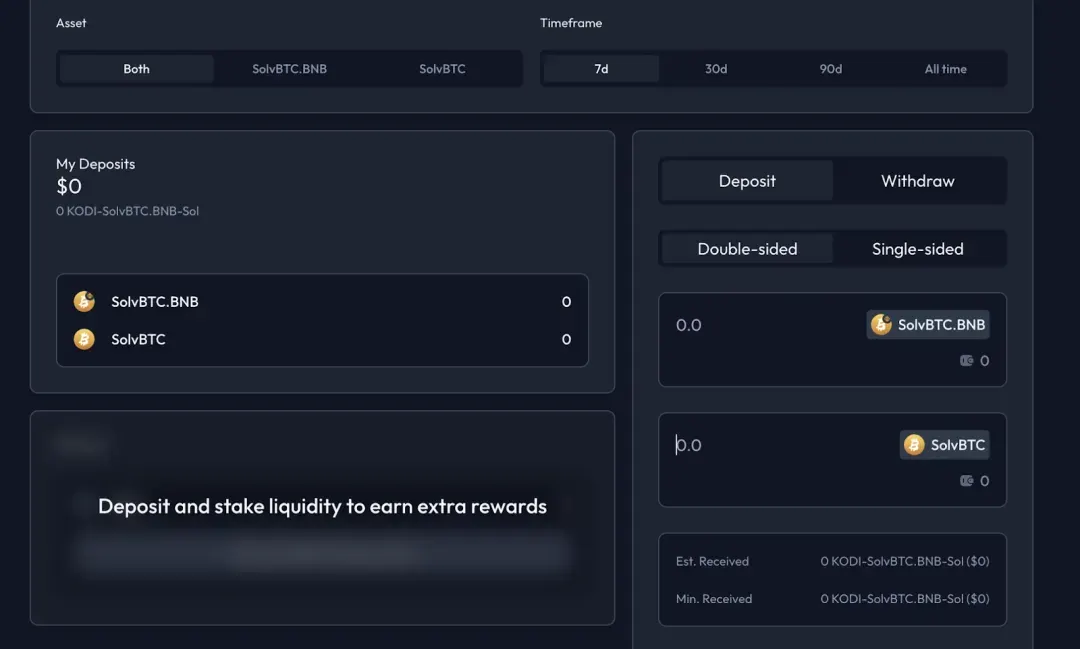

To enable more users to easily benefit from v3's efficient capital utilization, Kodiak has launched Kodiak Islands, an automated liquidity vault. Combining v3's centralized liquidity with intelligent management, Islands utilizes a "set-and-forget" model. Users simply deposit assets (such as BERA or HONEY) once, and the system automatically creates and dynamically rebalances liquidity positions. The underlying algorithm monitors market volatility and pool depth in real time to ensure positions are always within the optimal range, increasing fee capture and reducing management costs.

Kodiak Islands is particularly suitable for ordinary users and institutional LPs who want to make passive profits, which can increase the utilization rate of funds by 5-10 times compared with traditional AMM.

Another key advantage of Islands is its deep integration with Berachain's PoL mechanism. Whitelisted Islands positions not only earn regular fees but also receive ongoing rewards, including BGT governance tokens, and contribute to network consensus security through PoL. Depositing assets earns users Island LP tokens, representing their share of liquidity. These tokens can be used for secondary circulation within the DeFi ecosystem, for example:

- Stake to Kodiak Farms to earn extra incentives;

- Used as collateral to access lending protocols such as Beraborrow to release liquidity;

- Continue to be used in derivative scenarios such as options and funds.

When market fluctuations cause Islands positions to deviate from their optimal range, Kodiak automatically rebalances using the full liquidity of BEX, the official decentralized exchange (DEX), to ensure the depth and stability of the ecosystem. For users, this means eliminating the need for frequent manual adjustments while still providing multiple incentives, with APRs in some pools reaching 10%–50%.

To further attract long-term LPs, Kodiak has launched Sweetened Islands, which combines standard Islands with rewards and subsidies and a lock-up period multiplier. Incentives are derived from PoL emissions, protocol revenue, and project token subsidies, with the longer the lock-up period, the higher the multiplier. Some core trading pairs (such as BERA-WETH and WBTC-BERA) have achieved annualized returns of 500%–1000% at peak times. This sustainable liquidity subsidy, achieved through PoL, is a more stable and long-term approach to injecting depth into the ecosystem than short-term mining.

Optimized trading experience

Kodiak's trading experience benefits not only from its deep liquidity but also from the high TPS and low latency of Berachain's underlying infrastructure. Leveraging its PoL-optimized chain, Kodiak's matching and settlement speeds approach those of centralized exchanges. Even during volatile market conditions, Kodiak's matching and confirmation processes are completed swiftly, significantly reducing slippage and front-running costs – a crucial advantage for large-scale and strategic traders.

Based on this, Kodiak's built-in intelligent routing engine automatically scans local pools and connected aggregators (such as 0xProject) the moment a user places an order. It then splits the order based on pool depth and price conditions, matching orders across multiple paths in parallel to achieve the optimal overall transaction price. This multi-path order splitting not only reduces the price impact on individual pools but also allows large orders to be filled with lower slippage.

Combined with the high capital density and depth provided by v3's centralized liquidity, Kodiak can reduce slippage to 0.01%–0.1% on most major pools, ensuring transaction prices are closer to expected quotes. For institutional investors, this means achieving near-CEX execution quality on-chain while enjoying the advantages of self-custody and transparency.

Kodiak's unique trading experience is made possible by a high-performance chain that provides speed and stability, intelligent routing that optimizes costs, and centralized liquidity that ensures depth. This makes it the most suitable decentralized trading platform on Berachain for institutional market makers and high-frequency trading strategies.

Panda Factory

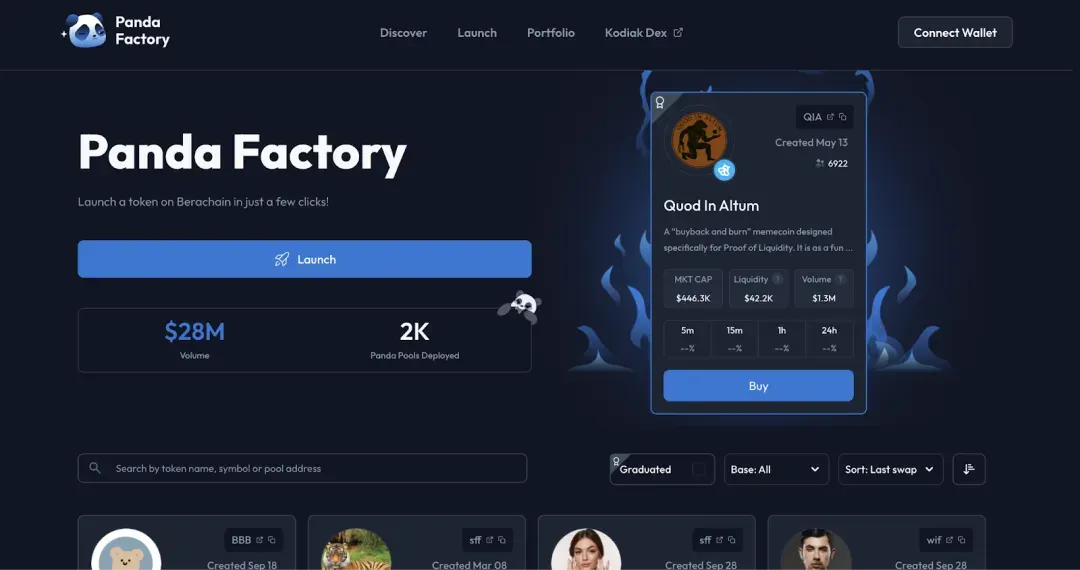

Panda Factory is a codeless token deployment tool launched by Kodiak, specifically designed for issuing memecoins and other highly volatile assets. It uses a custom bonding curve to determine the initial price and ensures that initial liquidity cannot be withdrawn, thus avoiding the security risks of traditional launch models. Once launched, new tokens immediately gain trading depth on the Kodiak DEX and receive PoL rewards, significantly improving the cold start efficiency of new assets.

At the same time, the Baults module is responsible for automatically compounding the BGT earnings of the Islands vault, helping users maximize their yields and further amplifying the incentive effect brought by PoL.

Kodiak and Infrared dual hub configuration

Currently, in the Berachain ecosystem, Kodiak and Infrared Finance together form the dual hubs in the PoL flywheel:

- Infrared focuses on the derivation and circulation of LSD (liquidity staking) assets. Through products such as iBERA and iBGT, it converts pledged capital into liquid assets, providing a continuous and stable source of funds for the PoL ecosystem.

- Kodiak is responsible for the generation, allocation and transaction execution of liquidity, allowing funds to be efficiently utilized in the ecosystem and forming considerable market depth.

The two form a complementary model of supply and dispatch: Infrared ensures a stable influx of funds, while Kodiak drives the continuous circulation of funds within the ecosystem, providing a solid driving force for Berachain's PoL flywheel. This division of labor not only improves network security and capital efficiency, but also provides a stable liquidity and settlement foundation for upper-layer DeFi applications.

Furthermore, Kodiak is one of Berachain's top three validators, directly participating in the PoL consensus through node operation, channeling its accumulated liquidity value back into ecosystem governance and network security. This dual role positions Kodiak as both a liquidity hub and a security pillar, further strengthening its role as a foundational infrastructure.

Conclusion

Overall, Kodiak's functional design is highly modular and composable. LPs created by users on Kodiak can not only obtain PoL incentives, but can also be used as collateral assets in derivative scenarios such as lending, perpetual contracts, and options, releasing more liquidity and profit opportunities for funds.

With the deep integration of DEX, Islands, and PoL, as well as the dual-hub flywheel formed with ecosystem partners such as Infrared, Kodiak is growing from a single trading platform to the core liquidity infrastructure and economic driver on Berachain, providing continuous support for the security, capital efficiency, and governance weight of the entire network.