Tether joins hands with Antalpha to raise $200 million to establish a global Tokenize gold vault. Photo: Zengo

Tether joins hands with Antalpha to raise $200 million to establish a global Tokenize gold vault. Photo: Zengo

“Stablecoin tycoon” wants to turn gold into digital assets

- Tether , the giant behind the world's leading stablecoin USDT , is raising at least $200 million with Antalpha Platform Holding to set up a digital asset Treasury (DAT) company.

- According to Bloomberg , the expected Capital raised will be poured into DAT to buy and store XAUT , a gold Token issued by Tether itself and backed 1:1 by physical gold.

- In the context of gold prices continuously hitting new peaks and increasing demand for shelter in recent times, this plan could reshape the way the market looks at Tokenize gold.

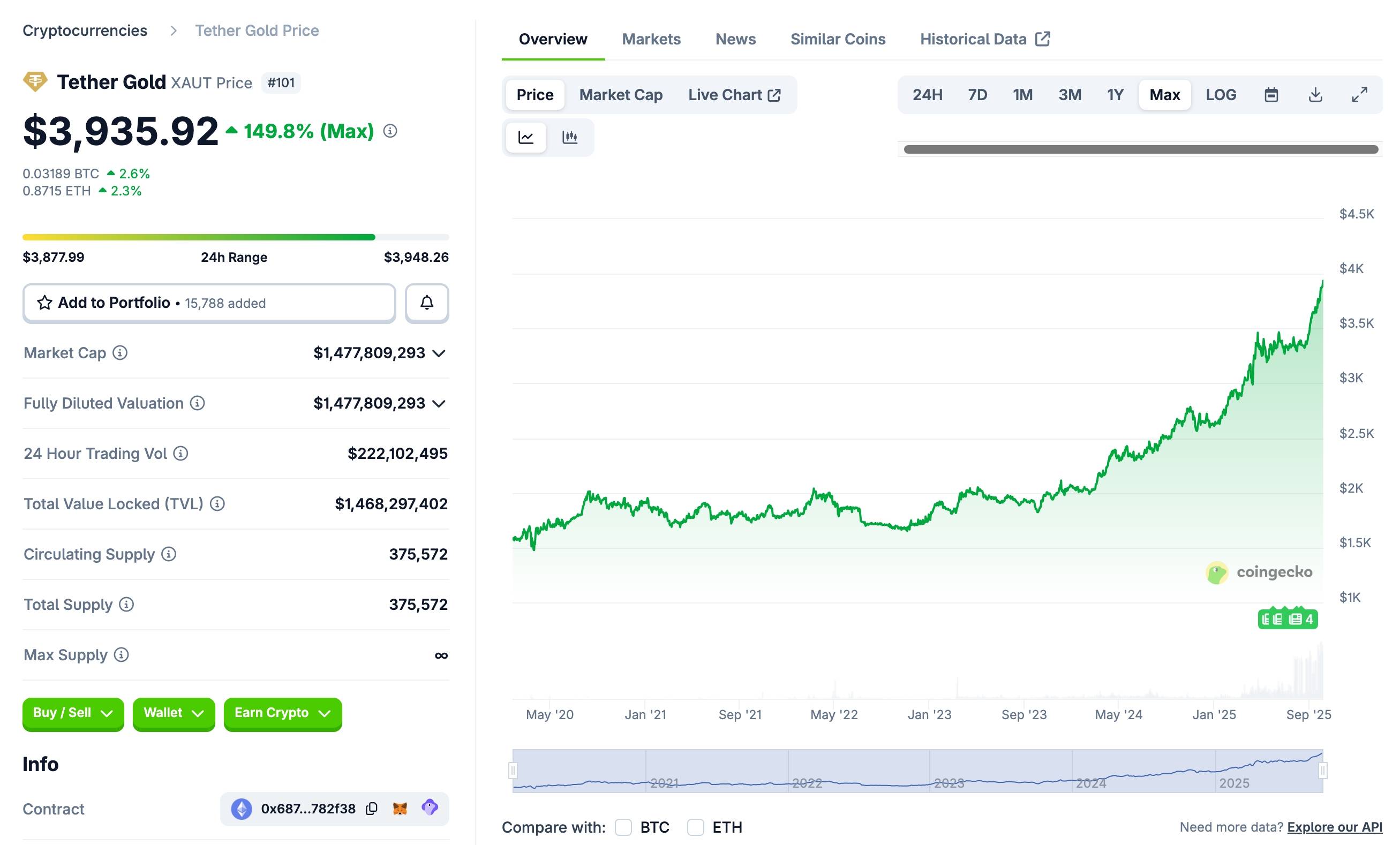

- As of the end of the second quarter of 2024, there will be approximately 250,000 XAUT in circulation, equivalent to more than 7.66 tons of real-life gold. XAUT's current market Capital is approaching $1.5 billion.

Market Capital of the XAUT gold Token issued by Tether . Source: CoinGecko (October 6, 2025)

Market Capital of the XAUT gold Token issued by Tether . Source: CoinGecko (October 6, 2025)

- At the end of May 2025, Tether CEO Paolo Ardoino revealed that his company is holding more than 100,000 Bitcoins and 50 tons of gold after 2024, a resounding success with a profit of 13 billion USD.

- In parallel with the plan to collect Tokenize gold, Tether is also negotiating to raise 15-20 billion USD from a group of strategic investors, with the goal of raising the company's valuation to about 500 billion USD. If successful, this will be a leap forward to put Tether on par with global technology giants such as OpenAI and SpaceX.

Antalpha extension arm

- Antalpha Platform Holding is a Singaporean financial services company with close ties to Bitmain Technologies, the world's largest Bitcoin Mining Rig manufacturer, with over 80% of the global market share.

May 2025: Tether buys 8.1% of Antalpha shares when the company IPOs.

June 2025: Antalpha announces partnership with Tether to launch XAUT-backed lending and full-stack infrastructure.

In the near future: Antalpha plans to open vaults in major financial centers, allowing investors to exchange XAUT directly for physical gold, seamlessly connecting digital assets and tangible assets.

- According to sources, this Capital raising process has the participation of Cohen & Co. as the main advisor, to ensure the process is professionally designed and attractive to institutional investors.

Coin68 synthesis