Crypto data giant DefiLlama earlier today pulled Aster’s perpetuals data from its tracking page after spotting XRP trading volumes that mirrored those on Binance almost tick-for-tick, raising doubts about how the newest DEX challenger was reporting activity.

If a new exchange can mirror Binance volumes too closely, it raises a question of how much of the demand is real and whether leaderboards tell the whole story.

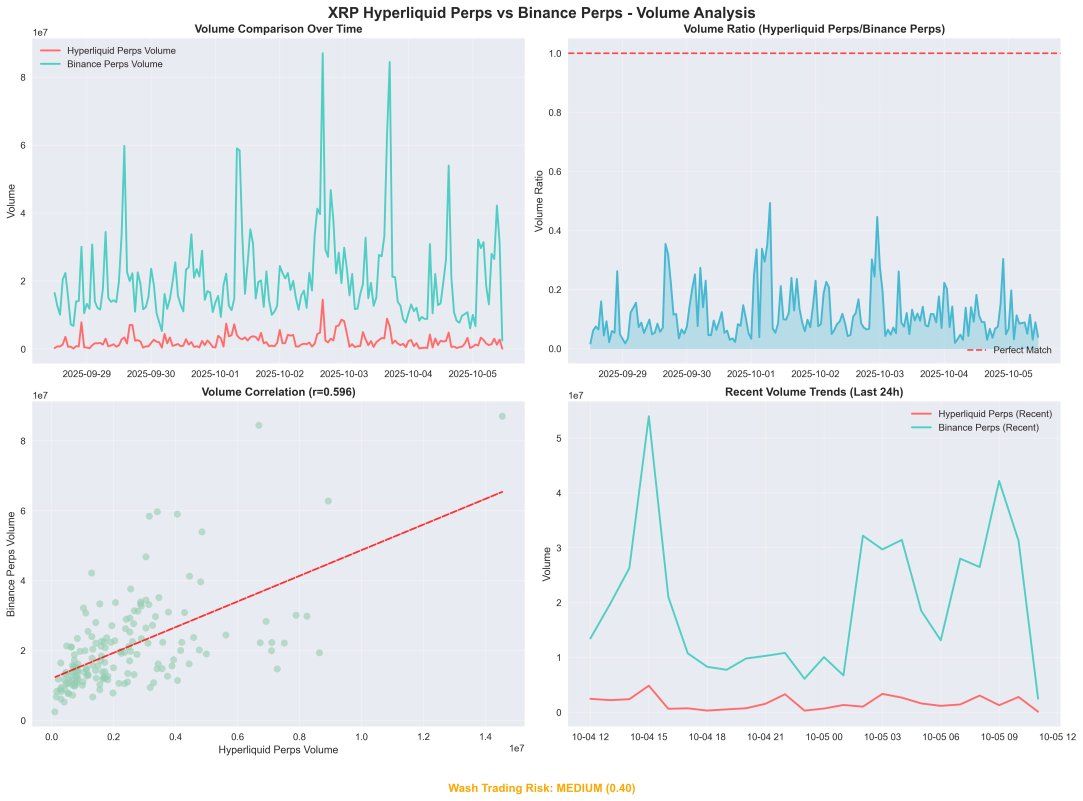

Earlier Monday, DefiLlama’s pseudonymous founder 0xngmi noted on X that Aster’s volumes, pointing out data from XRP perpetuals, began moving in near-perfect sync with Binance’s volumes.

That alleges possible wash trading or data manipulation, since organic decentralized order flow typically diverges.

“Until we can get that data to verify if there’s wash trading, Aster perp volumes will be delisted,” 0xngmi wrote on X.

We've been investigating aster volumes and recently their volumes have started mirroring binance perp volumes almost exactly

— 0xngmi is hiring (@0xngmi) October 5, 2025

Chart on the left is XRPUSDT on aster, you can see the volume ratio vs binance is ~1

Chart on the right is XRP perp volume on hyperliquid, where there's… pic.twitter.com/MwVD7rRyEn

Like other perp DEXs, such as Hyperliquid, Aster lets traders take long or short positions on crypto assets with leverage, but without going through a centralized exchange.

It recently rose to the top of DefiLlama’s leaderboard for daily fees and volume across perp DEXs, even briefly overtaking Hyperliquid.

Aster’s ASTER is among the hottest tokens in the crypto market in recent weeks, zooming from 9 cents to over $2 in a little under three weeks, per CoinGecko data. That has given early buyers returns of over 1,500%, making it among the best performing tokens in several months.

XRP and ether ETH$4,570.06 volumes were major contributors to Aster’s metrics.

In one wash trading risk model, Aster still showed a “low” score, but the one-to-one volume correlation with Binance raised enough red flags for a delisting. Hyperliquid, by contrast, showed a looser 0.59 correlation with Binance volumes and kept its metrics despite a “medium” score.

Meanwhile, Binance itself listed ASTER with a “Seed Tag” earlier Monday. The timing drew attention because Aster counts Binance co-founder Changpeng “CZ” Zhao as an advisor, and Zhao has been among Aster’s most vocal proponents on X in the past week.

ASTER price were down 10% in the past 24 hours amid a general market retreat and DefiLlama’s data delisting. All losses have since reversed after Binance announced plans to list the token.

Aster did not immediately respond to CoinDesk's request for comment