Good morning from Baltimore!

This is a reader-supported publication. To receive new posts and support my work, consider becoming a paid subscriber.

Politics, Capital, and Attention

There are two things that I am trying to understand, both captured very well in Bloomberg’s Tuesday evening homepage.

AI: Can’t go too far these days without someone talking about AI - how it’s a bubble how it’s the future how it’s both a bubble and the future. And the broader question there is about how the stock market can be so divorced from reality (or maybe, it’s just about understanding what reality the stock market inhabits)

The economic decisions of the Trump administration

In the below image, Trump highlights both. He says that the Democrats have shutdown the government, citing a successful economy AND a successful stock market (but sometimes it’s Bidens economy, so you never really know). He says he is open to meeting about healthcare, which is great progress toward ending said shutdown.

But that line about the stock market is interesting. He’s right! It is a record stock market! Presumably, stocks would be cowering at this point.

Tariffs beat down profits (we now have tariffs on trucks, which is a flip-over-the-economic-table kind of move as it will make literally everything more expensive)

The dollar is flailing in the wind - and sure, a weaker dollar helps multinationals, but it also challenges returns

Many of the recent political decisions - no matter how you feel about them! - are creating an isolated United States, which likely isn’t good for economic growth.

Political instability usually rattles investors, but US investors seem to only see the United States of AI and literally nothing else. Ruchir Sharma wrote in the FT that “America is now one big bet on AI” which is true and as he points out, it’s a costly bet:

Outside of the AI plays, even European stock markets have been outperforming the US this decade, and now that gap is starting to spread. So far in 2025, every major sector from utilities and industrials to healthcare and banks has fared better in the rest of the world than in the US.

The US stock market is booming, but it’s all relative. There is a lot of glee in talking about bubbles. If you remove yourself from the situation, it is rather exciting to watch big companies toss around billions of dollars. It’s thrilling to gleefully tweet “the crash is COMING! Buckle up!” There is a sense of stability in the madness - we all know it’s absurd, no one knows if it’s going to work (not even the guys in charge), and it gives everyone something to talk about.

It gives the government immense power

Because the indexes are green, the government can apparently cancel funding that has already been congressionally approved, threaten allies, or bail out Argentina while railing against “globalism”. The feedback loop is simple:

Markets rise → Public confidence holds → Political risk premiums fall → Markets rise again.

I think for a while I thought that the stock market was just ignoring politics. But it isn’t! It is politics now, a political actor that can grant or withhold legitimacy1. Artificial intelligence fuels valuations, those valuations stabilize public confidence, that confidence grants the administration power, and the administration protects the system that sustains it.

The stock market has never been the economy - it’s really a reflection of what the economy dreams it could be in a world where share buybacks translate to meaningful productivity. But as AI swallows up more and more capital, it is both the economy and the stock market - and the government.

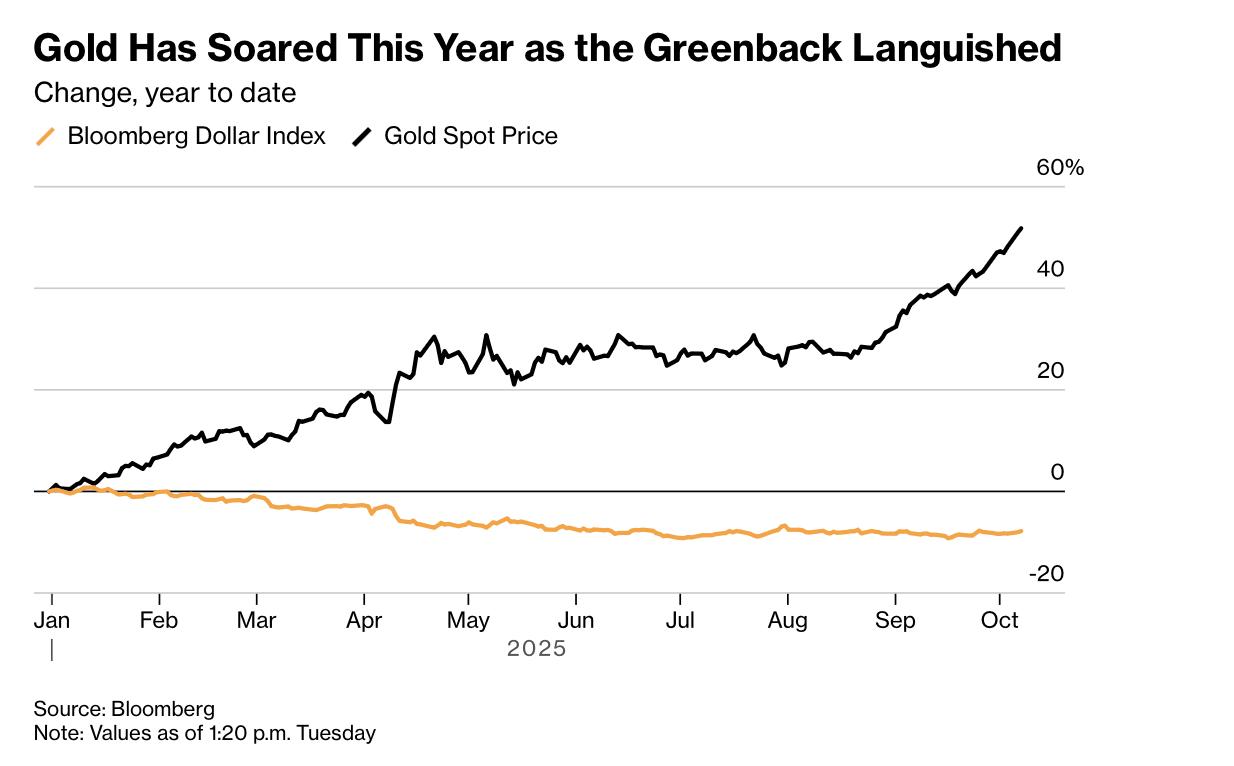

Gold keeps going up too.

Normally, equities and gold move in opposite directions. Stocks up, gold down. Fear or faith, pick one. But not now. The S&P is surging on AI optimism while gold is surging toward $4,000 an ounce. It is up 51% this year, the best performing asset this year2. The dollar is down 10%3. Both fear and faith are rallying simultaneously, which is rare and usually not a great sign.

Odd Lots had a good interview on the push-and-pull here. Viktor Shvets sees a cycle - tech is ripping apart society (apparently a good investment) so people are buying gold as a “hedge against destruction”.

The US equity market doesn’t seem to care. Both are winning right now, but both can’t be right forever. The US equity market is betting everything on one story:

Nearly 40% of US GDP growth this year comes from AI.

According to Morgan Stanley, “roughly 75% of S&P 500 returns, 80% of earnings growth, and 90% of capital expenditures growth” can be attributed to the AI data center build out.

AI companies hold $1.2T in debt, the largest segment in the investment grade market.

Nvidia, Microsoft, and Apple now account for over 20% of the S&P 500 index.

The underlying idea here is that AI surely will generate boundless bounty later, so valuations don’t have to make sense now. Nothing has to make sense now!

The Circle of Joy

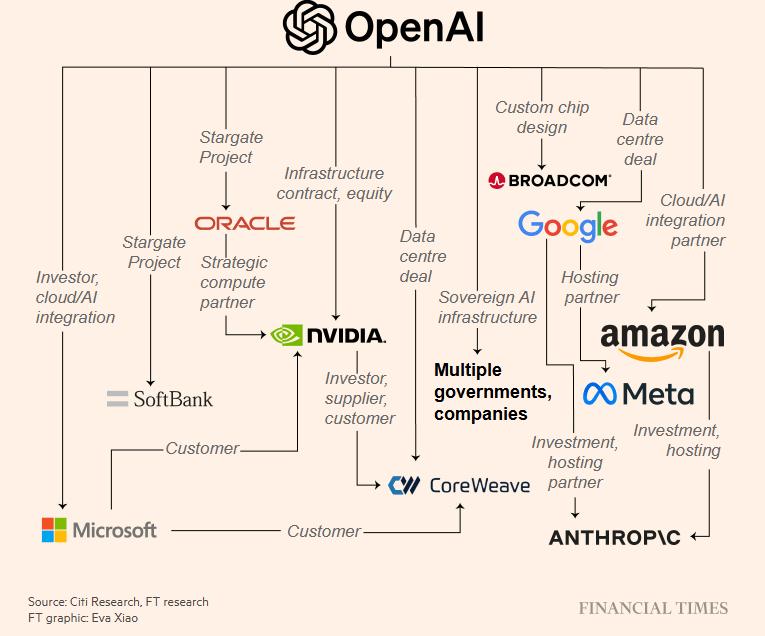

The AI companies are spending a lot of money, primarily with each other. It’s a circular economy of speculation, as Bloomberg wrote about here.

Nvidia invested $100 billion in OpenAI to build out AI infrastructure, and so OpenAI could buy $100 billion worth of Nvidia chips. OpenAI has signed about $1 trillion in deals this year. They are raising a bunch of debt to fund this because they do not have the revenue (right now, it’s about $12 billion) to finance the deals. xAI is raising money from Nvidia to buy Nvidia processors?

OpenAI is buying 6 gigawatts of AMD chips over the next few years and also has the ability to buy up to 10% of AMD shares for the cost of one penny each?

Everyone is making money because they are all making money from each other.

Bain & Co. estimates this wave of AI infrastructure spending will require $2 trillion in annual revenue by 2030 to justify it which is more than the combined 2024 revenues of Apple, Amazon, Alphabet, Microsoft, Meta, and Nvidia.

The companies primarily make money through (1) subscriptions and (2) money paid to use these data centers.

But the companies have two headwinds.

The $2T required here is more than 5x the annual subscription market, meaning they are going to need for a lot of people to pay for this. A lot of people don’t want to pay.

The hardware depreciates in two to three years. Unlike the fiber laid during the dot-com boom, none of this will mature into durable capacity, as the WSJ highlighted.

So what do you do when you need 5x the global subscription software market to cover costs?

You make a social media app.

Everyone Gets a Social Media Company

OpenAI launched Sora, a TikTok-like app that’s more focused on creation and posting than being “social” (whatever that means anymore) and Meta launched Vibes, another AI video feed. The goal here is likely to sell ads, in the same way that TikTok does. Carcinization and advertisement (adinization?): everything is destined to be a crab, everything is destined to be an ad.

This is interesting for a few reasons.

AI is extraordinarily expensive but still searching for demand: Training frontier models will likely cost billions of dollars. But only a small fraction of people pay for these services. Some companies are starting to abandon it. Building a social media company is a sign that they’re chasing volume. They need eyeballs, data, and ads to offset the costs of scaling.

Social media is a last-resort monetization model: When tech companies can’t make enough money on software licensing, subscriptions, or enterprise products, they default to attention. It’s reliable: people scroll; advertisers pay. The thing to watch here is that people are increasingly upset by social media, with almost 50% of teens saying that it harms people their age. John Burn Murdoch argues that we have passed peak social media.

It signals a maturity problem: Right now, the supply of AI capabilities is growing faster than actual use cases. The economy hasn’t figured out what to do with all this intelligence yet, so it’s turning it into spectacle. And there are clear consequences - the technology is good. It’s good enough to be used maliciously and it will be. And there is very little talk of policy or guardrails to rein it in.

It mirrors the late-stage tech pivot pattern: We saw this with crypto: when speculative returns dried up, projects pivoted to “community” and “social.” We saw it with Web3: when utility collapsed, companies turned to “metaverse” marketing (ahem, some of them changed the name of their whole company). Now we’re seeing it with AI: a turn toward social platforms that keep the narrative alive and keep investors engaged.

AI was sold as the end of slop but what it delivered was more slop. The market rewards attention, not utility, and both AI and politics has adapted to that logic.

The story that’s supposed to justify $2 trillion in annual revenue by 2030 has pivoted to... selling ads on AI-generated TikTok videos. That’s maybe the big payoff. That’s what’s sustaining the market confidence that’s granting political latitude. Gold traders see this. That’s why they’re hedging. Equity traders see it too but they just think the story lasts long enough to get a bag and get out.

The Government

And the bags are plentiful. AI’s sheer power - social media app or not - gives the government political cover. As long as portfolios are green, the electorate stays somewhat calm. The administration is effectively borrowing confidence from the AI bubble. Speculation has become governance.

Understanding this loop explains both of those questions I had.

The market stays green because of AI speculation.

That market stability creates political latitude.

That latitude allows the administration to do otherwise-impossible things.

And the administration protects the AI investments that sustain the loop.

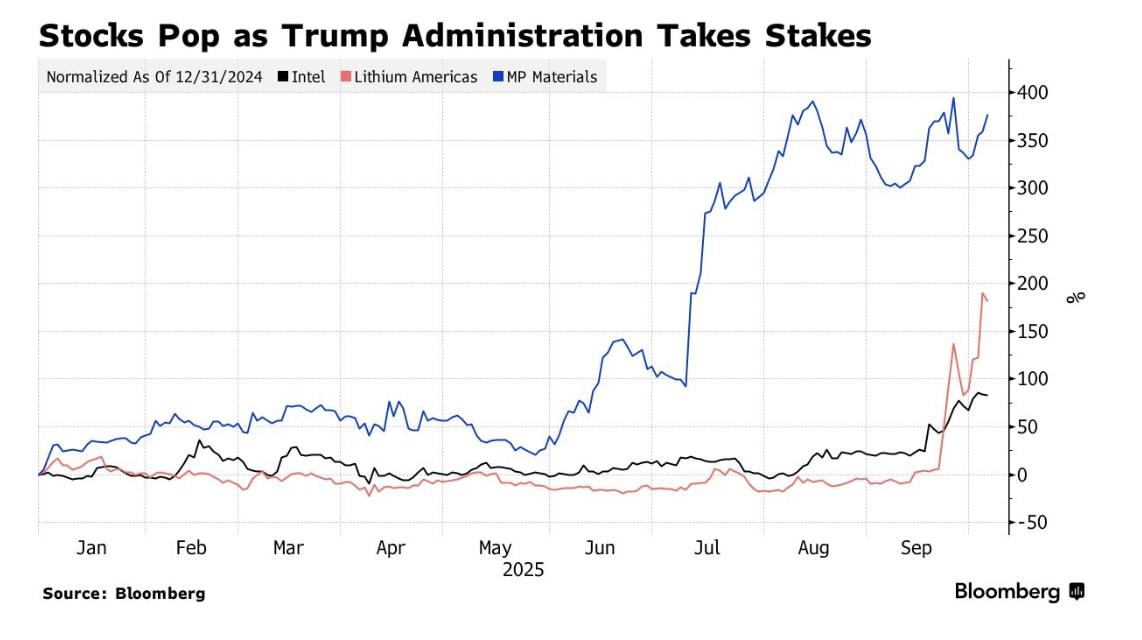

Investors are trying to bet on which company the Trump administration will invest in next.

Intel roared up 82% after Trump shoveled $10 billion into them for a 10% stake.

The government invested $35 million in a Vancouver-based mining business partly owned by Trump donor John Paulson, giving Paulson approximately $70 million additional dollars.

If the government invests in your company, you’re rich! Apparently the grid is next! A far cry from Reagan’s quip that “the nine most terrifying words in the English language are ‘I’m from the government and I’m here to help.’ Now, the nine most terrifying words “I’m from the government and I’m blocking your datacenter” or something. It’s a very strange form of socialism!

Outside of AI, the US economy is wobbling.

Manufacturing activity has contracted.

ADP data showed that in 3 out of the past 4 months, the private sector lost jobs.

Carlyle Group developed their own proprietary labor market data (necessary during a shutdown) based on their portfolio companies and real estate investments that apparently shows a completely flattened labor market.

But other components of the economy - like inflation and GDP growth - don’t show signs of a recession. The labor market does, which is very strange.

Which is why both gold and equities keep climbing. The equity market believes the AI story overrides everything else. The gold market believes something is fundamentally breaking. They’re both reacting to the same underlying reality, but they just have different theories about what happens next.

I spoke with Austan Goolsbee of the Chicago Federal Reserve about the labor market, and our conversation will be up tomorrow as their data says something else - but everything is confusing. The reality is confusing.

So: the stock market inhabits a different reality where AI speculation is all that really matters. We are in a rate-cutting cycle, with loose fiscal policy - might as well spend a ton of money on everything. The Mag7 will be completely fine either way.

And what explains the Trump administration’s economic decisions? Well, as long as the stocks stay up4, the administration has room to do things that would be impossible during volatility. Cancel appropriations. Block elected representatives from being sworn in. Invest public money in donor companies!

The stock market has become an emotional infrastructure that allows speculative sovereignty and has created an economy that governs through its own price chart.

Both gold and equities are surging because they’re hedging different kinds of collapse. Gold trades on fear of the system. AI trades on faith in the story. That both are rallying tells you something about where we are.

This is what it means to live in the United States of AI. Democracy as an asset class or something. For now, the line keeps going up. But speculation isn’t stability, and the permission government borrows from investors is never really its own.

This is a reader-supported publication. To receive new posts and support my work, consider becoming a paid subscriber.

Thanks for reading.

This is not a new idea! The bond vigilantes are another good example of this

Citadel’s Ken Griffin is very concerned that people view gold as safer than the dollar and Ray Dalio says that well yes, gold is certainly much safer than the dollar.

China is trying to become the world’s custodian of gold reserves, in an attempt to expedite dedollarization. It might be working.

The teflon Trump thing is more than just the stock market - he can get away with saying stuff that President Biden would have never been able to say. Why? I don’t know.