XRP is under heavy pressure as whales sell more than $50 million worth of Ripple Token per day, causing a steady decline.

This comes as traders and investors await the potential approval of an XRP ETF for physical delivery this month. However, technical indicators suggest further losses could be on the cards, even with positive ETF news.

Whales dump XRP, selling pressure increases

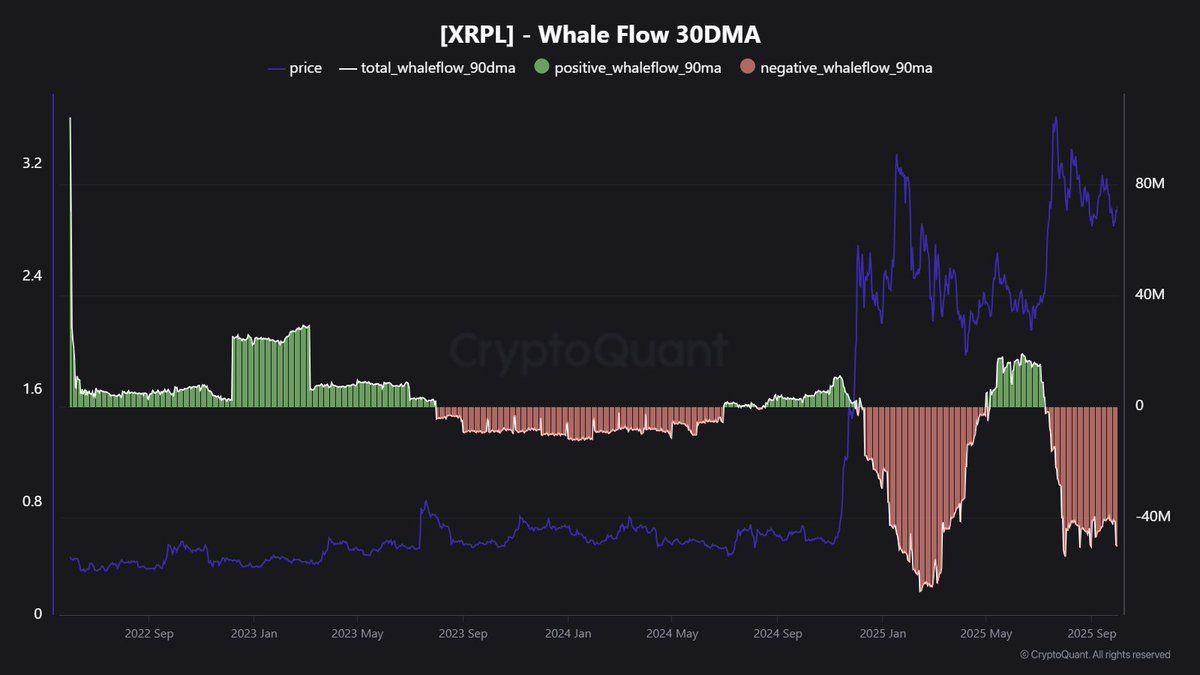

XRP whales, holding more than 1,000 Token, are increasing their selling. Data from Whale Flow, using a 30-day moving Medium , shows that about $50 million worth of XRP is leaving whale wallets every day.

This trend creates strong selling pressure , negatively affecting market sentiment. Analysts refer to CryptoQuant's flow chart, which shows a steady net withdrawal since early 2024.

Whale Flow 30DMA shows $50 million daily outflow from XRP whales since early 2024. Source: JA_Maartun/X

Whale Flow 30DMA shows $50 million daily outflow from XRP whales since early 2024. Source: JA_Maartun/XThis level of selling is worrying analysts, many of whom warn that the current downtrend could accelerate unless there is a clear bullish shift , potentially putting pressure on retail investors.

Technicals and ETF hopes collide

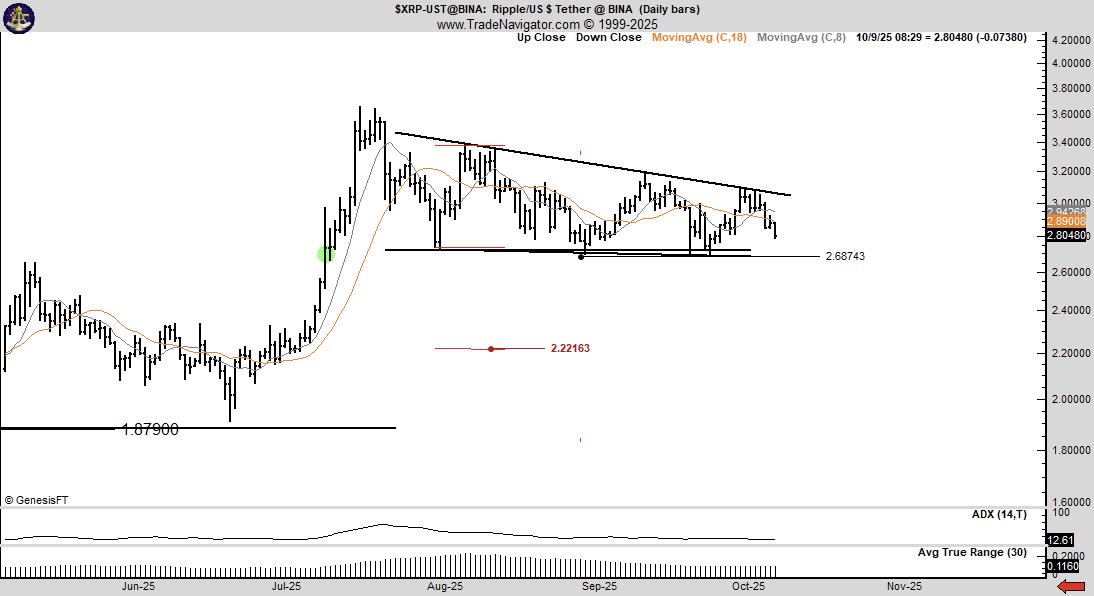

Peter Brandt, a popular chart analyst, recently flagged XRP as a “short candidate” if it completes a descending triangle pattern.

His technical view points to a risk of further downside unless there is a strong recovery by the bulls. A break at the support level that Brandt identified could lead to a sharper decline.

Descending triangle and key support level. Source: PeterLBrandt/X

Descending triangle and key support level. Source: PeterLBrandt/X“This is on my short list $XRP but the condition is to complete a descending triangle,” Peter Brandt notes .

A descending triangle is a bullish reversal pattern whose upside potential depends on price not breaking below the lower trendline of the technical pattern.

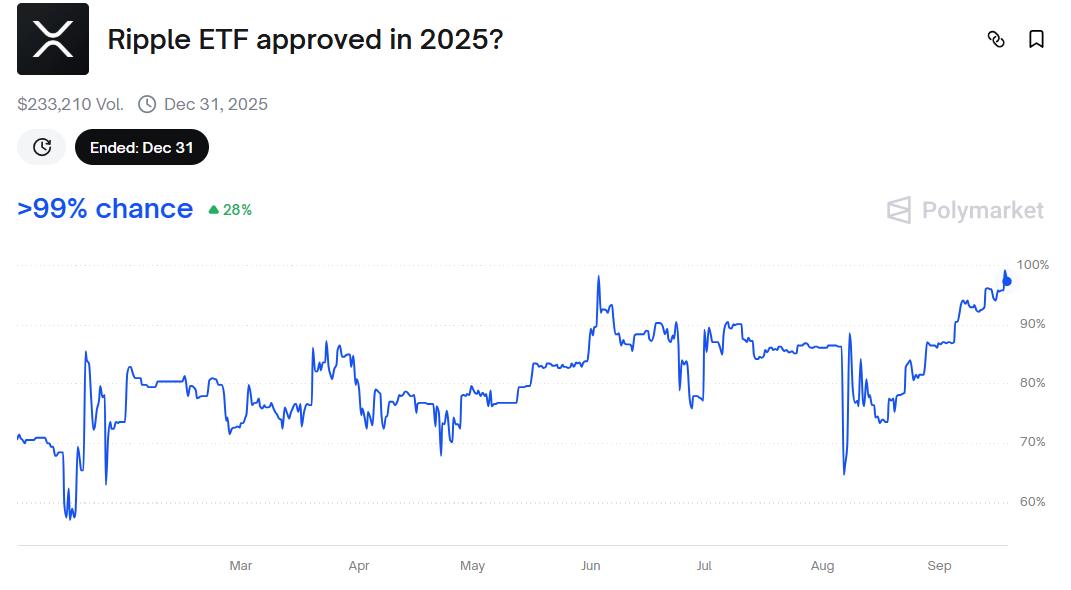

Hopes for a spot XRP ETF are also gaining traction. Some market commentators, including “Steph is Crypto,” have suggested that the SEC (Securities and Exchange Commission) could approve an XRP ETF as early as October 18.

Such news could spark a bullish move, although some warn it could trigger a “sell the news” pullback, especially if whales use it as an exit point.

However, regulatory experts urge patience. According to Trackinsight and CF Benchmarks , immediate SEC approval is in doubt.

Despite the uncertainty, recent positive signals from regulation have improved the likelihood of an ETF filing by 2025, especially after legal clarity around Ripple and a more favorable environment for cryptocurrencies in the US.

Polymarket's odds show a probability of over 99% that the SEC will approve an XRP ETF by 2025. This suggests bettors believe approval is almost certain.

Possibility of XRP ETF approval. Source: Polymarket

Possibility of XRP ETF approval. Source: PolymarketUltimately, XRP ’s next move could depend on fundamental developments like an ETF decision or large-scale whale action. With sentiment Chia and confidence on both sides, the coming weeks look to be pivotal for the digital asset.

XRP Price Performance. Source: BeInCrypto

XRP Price Performance. Source: BeInCryptoAt the time of writing, XRP is trading at $2.83, down 0.00966% over the past 24 hours.