Trump's decision to impose a 100% tariff on Chinese imports was like a bombshell, instantly rewriting the trend of the cryptocurrency market.

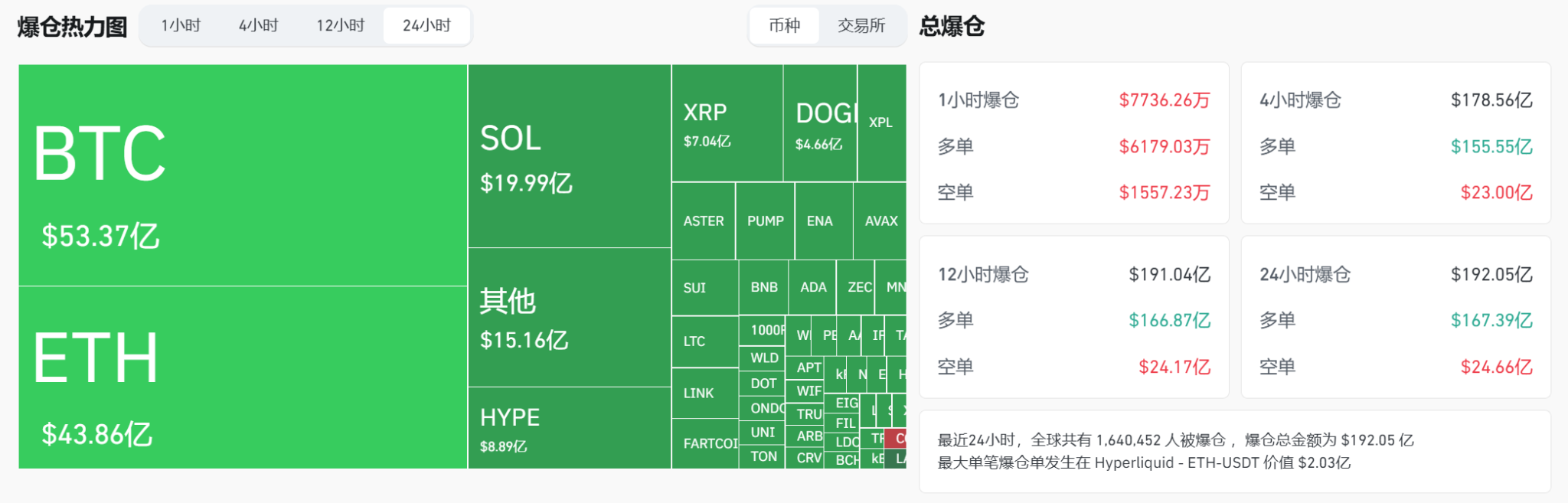

According to CoinGlass data, approximately $19.2 billion worth of open interest has been forced liquidated at press time, a figure that marks the largest single-day liquidation event in cryptocurrency history.

Bitcoin and Ethereum, the two most heavily capitalized blockchains, were hit the hardest. Bitcoin saw liquidations totaling $5.4 billion, while Ethereum lost $4.4 billion. On the Hyperliquid cryptocurrency exchange, a massive $200 million block liquidation order for BTC/USDT was even recorded, demonstrating the severity of the market crash.

As the trade war escalates, risk assets are sold off indiscriminately

The trigger for this cryptocurrency crash points directly to the Trump administration's tough trade policy toward China.

On Thursday, after China's Ministry of Commerce announced export restrictions on products containing more than 0.1% of rare earth elements, Trump responded swiftly, threatening to impose 100% tariffs on all Chinese imports and temporarily canceling his planned meeting with President Xi Jinping. Although Trump later expressed his willingness to meet with Xi and suggested the tariffs could be lifted if China changed its stance before November 1st, market panic had already unleashed itself. This panic quickly spread to the cryptocurrency market, causing nearly all major tokens to experience sharp declines on Friday.

Cryptocurrency is no stranger to global trade tensions. Back on February 3, 2025, when Trump announced tariffs on Canada, Mexico, and the European Union, the cryptocurrency market experienced a network-wide liquidation exceeding $2.2 billion, with over 730,000 individuals liquidated. Ethereum plummeted 26.53% in a single day, its largest intraday drop since May 19, 2021. Trump's tariff policy is essentially a trade barrier, directly raising the cost of imported goods, leading to higher consumer prices, increased costs for businesses, and ultimately, lower profit margins. Driven by rational market expectations, investors quickly lowered their expectations for economic growth, with risky assets bearing the brunt of the sell-off.

High leverage boosts the market, and serial liquidations trigger a vicious cycle

The large scale of this liquidation event is closely related to the high leverage characteristics of the cryptocurrency market.

Coinglass data shows that in this liquidation amount, long position liquidation accounted for an astonishing 87%.

This extremely unbalanced margin call structure suggests that the market was generally bullish before this. Leveraged trading is a double-edged sword, which can amplify profits when the market rises unilaterally, but can also accelerate market collapse when the market reverses.

When the price of Bitcoin plummeted from a high of $122,000 on Friday morning to below $102,000, a large number of highly leveraged long positions triggered forced liquidation, triggering a chain reaction. This kind of chain liquidation caused by high leverage is not new in the cryptocurrency market.

On April 7, 2025, the cryptocurrency market experienced a single-day liquidation of $1.36 billion due to similar reasons, affecting over 440,000 individuals. At the time, Sean McNulty, Head of Asia-Pacific Derivatives at FalconX, a leading digital asset brokerage, noted, "With a sharp rise in put options, selling pressure on cryptocurrencies is likely to continue." Market leverage often rises abnormally in the late stages of a bull market, as investors, driven by fear of missing out (FOMO), tend to increase leverage to chase returns. However, once the market turns, this leverage structure can become an accelerating catalyst for declines.

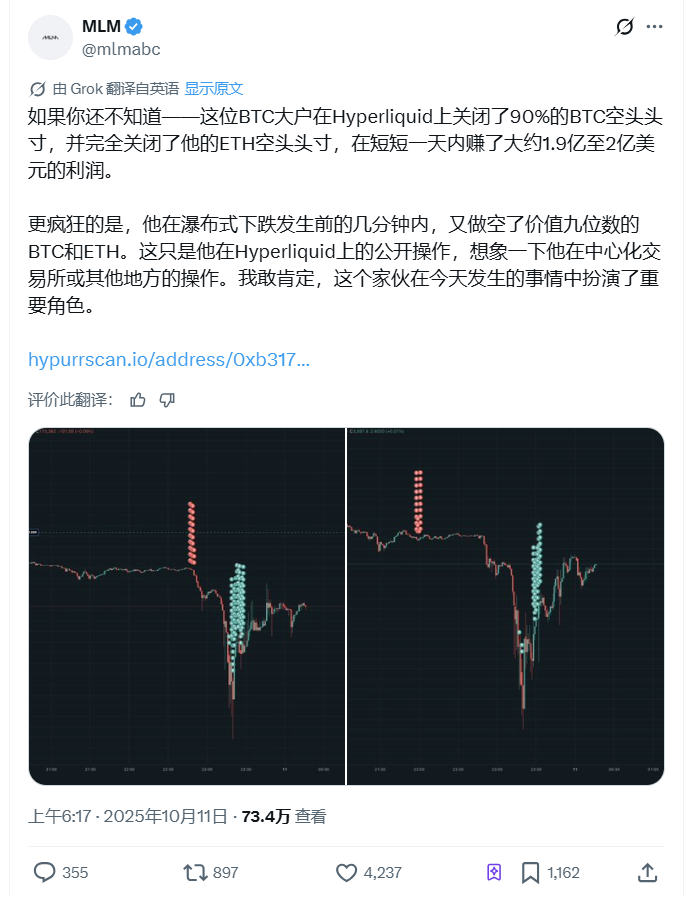

Some people lose money while others gain, and whale make astonishing profits

While the market was in turmoil, a few savvy traders made huge profits.

A "whale" investor on Hyperliquid has been observed to have profited approximately $190 million by short nine-figure sums of Bitcoin and Ether. Cryptocurrency trader @mlmabc, who has been tracking the whale's movements, said on X: "This is just public information on Hyperliquid. Imagine what he's doing on centralized exchanges (CEXs) or elsewhere. I'm pretty sure this person played a major role in what happened today." This isn't the first time a whale has capitalized on market volatility.

During the market crash in July 2024, Tron founder Justin Sun publicly expressed his willingness to negotiate with the German government to buy all of its Bitcoin holdings off-market to minimize the impact on the market.

Compared to institutional investors, retail investors suffered even greater losses in this recent market crash. This is primarily due to the fact that retail investors tend to use higher leverage and have a higher concentration of risk. Institutional investors, on the other hand, have hedged their risk to some extent through derivatives markets and diversified asset allocation. The sharp market volatility has also raised questions about the stability of the cryptocurrency market. Eswar Prasad, a professor of trade policy at Cornell University, once pointed out: "The price of Bitcoin is completely dependent on investor confidence. If 10% of investors choose to sell, the price of Bitcoin could drop to zero the next day."

Where is the market headed? Three key factors determine future trends

Three key factors will determine the future direction of the cryptocurrency market : tariff policy developments, changes in the macroeconomic environment, and adjustments to internal market leverage.

First, the ultimate implementation of Trump's tariff policy will directly impact market sentiment. Trump has indicated that if China changes its stance before November 1, he may cancel the tariffs. This uncertainty will continue to generate market volatility.

Secondly, changes in the macroeconomic environment cannot be ignored. In September 2025, Jeffrey Ding, chief analyst at HashKey Group, noted, "Strong economic indicators have further dampened market expectations for the next rate cut." If the Federal Reserve postpones rate cuts or even considers raising them due to inflationary pressures triggered by the trade war, risky assets will face even greater pressure.

Ultimately, the depth and duration of the market's deleveraging process will determine the depth and duration of the adjustment. Yu Jianing, co-chair of the Blockchain Committee of the China Communications Industry Association, stated in his analysis of the April market crash: "During the previous period of high price consolidation, the market had accumulated a large number of leveraged long positions, lacking effective hedging mechanisms. Faced with the sudden onset of negative macroeconomic conditions, the rapid decline in prices triggered a series of margin calls, further reinforcing the market's downward trend." Lex Sokolin of the venture capital firm Generative Ventures noted: "Many positive catalysts, such as regulation, digital asset treasury companies, and interest rate cuts, are already priced in. Therefore, the market needs a new narrative to maintain its upward momentum."