By Doug Colkitt

Compiled by: TechFlow

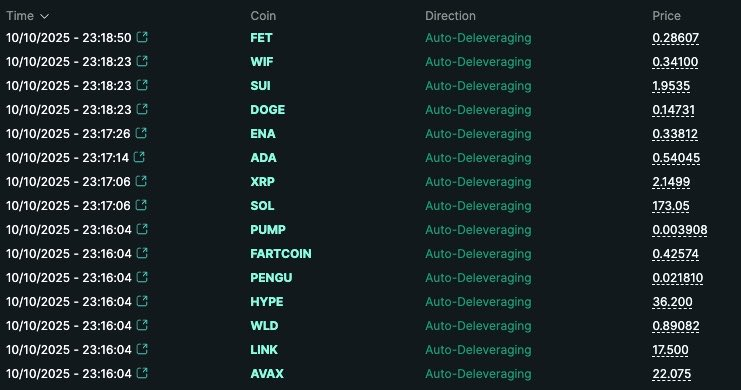

Since many people wake up to find their perps positions liquidated and wonder what "Auto-Deleveraging" (ADL) means, here's a concise guide to getting started.

What is ADL? How does it work? Why does it exist?

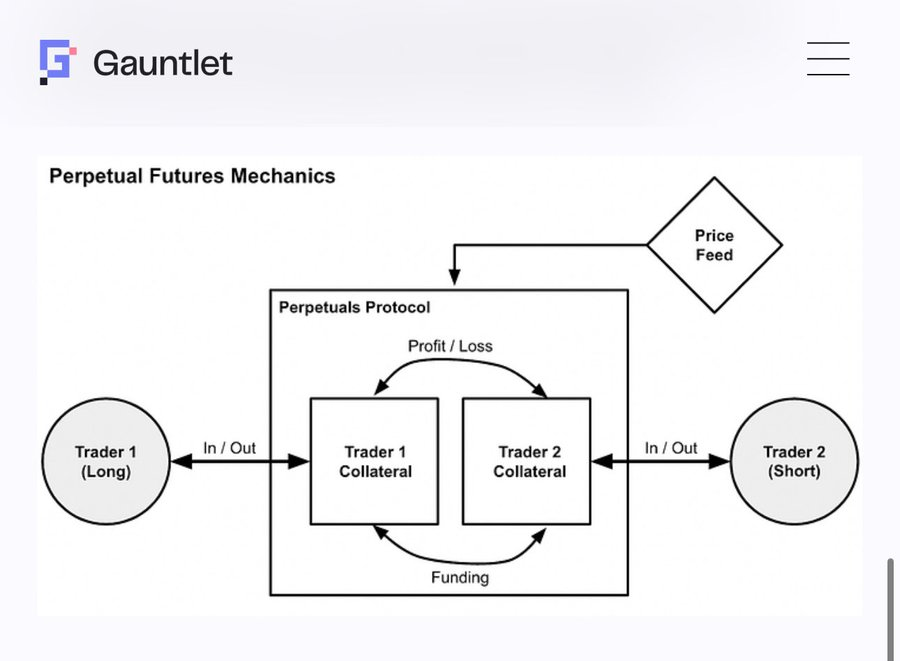

First, we need to understand the perpetual contract market from a broader perspective and its function. Taking the BTC perpetual contract market as an example, it's interesting to note that no real BTC actually exists in this system. Instead, there's a lot of idle cash sitting in the system.

What the perpetual swap market (or any derivatives market more broadly) does is distribute this pile of cash among its participants. It operates through a set of rules designed to create a synthetic instrument that resembles Bitcoin in a system where there is no actual Bitcoin.

The most important rule is that there are longs and shorts in the market, and the long and short positions must be perfectly balanced, otherwise the system will not work properly. In addition, both longs and shorts need to put cash (in the form of margin) into this pool of funds.

This pile of funds will be redistributed among participants as the price of BTC rises and falls.

During this process, when the price of BTC fluctuates too much, some participants will lose all their funds. At this time, they will be forced to exit ("liquidation").

Remember, long positions can only profit if short positions have money to lose (and vice versa). Therefore, when your capital is depleted, you can no longer participate in the market.

Furthermore, every short position must be matched exactly with a solvent long position. If a long position in the system has no funds to lose, then by definition, the corresponding short position on the other side has no funds to profit (and vice versa).

Therefore, if a long position is liquidated, one of two things must happen in the system:

A) A new long position enters the system, bringing new funds to replenish the capital pool;

B) The corresponding short position is closed, thus rebalancing the system.

Ideally, this could all be achieved through normal market mechanisms. As long as willing buyers can be found at a fair market price, no one needs to be forced to act. In normal liquidation operations, this process is typically accomplished through the normal order book of the perpetual contract market.

In a healthy and liquid perpetual contract market, this approach is perfectly fine. Liquidated long positions are sold into the order book, where the best bid in the order book fills the position, creating a new long in the system and bringing in new funds to replenish the liquidity pool. This way, everyone is happy.

But sometimes there isn’t enough liquidity in the order book, or at least not enough liquidity to complete the trade without losing more than their remaining funds on the original position.

This becomes a problem because it means there isn’t enough cash in the pool to satisfy the needs of other participants.

Typically, the next "rescue mechanism" is for a "vault" or "insurance fund" to step in. The vault is a special pool of funds supported by the exchange that steps in and absorbs the other party to liquidation in the event of an extreme liquidity event.

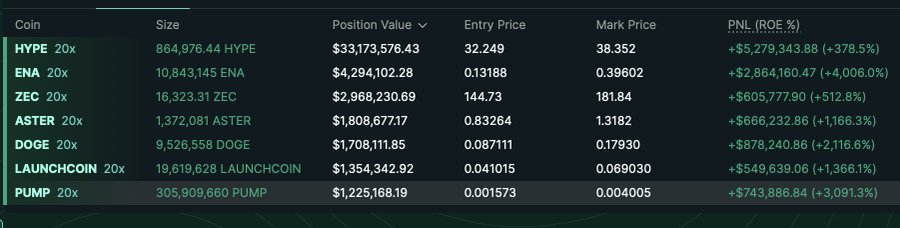

Vaults tend to be quite profitable in the long term because they offer the opportunity to buy at a significant discount and sell at a high price during periods of extreme price volatility. For example, Hyperliquid’s vault earned around $40 million in a single hour tonight.

But the vault is not magic; it is just another participant in the system. Like everyone else, it needs to inject funds into the pool, abide by the same rules, and has a limit on the amount of risk it can take and the amount of capital it can contribute.

Therefore, the system must have a final "rescue step".

This is what we call "auto-deleveraging" (ADL). It's a last resort and a (hopefully) rare occurrence, as it involves forcibly exiting someone's position rather than paying them. It happens so rarely that even experienced perpetual swap traders typically barely notice it.

Think of it like an overbooked flight. First, the airline uses market mechanisms to address the overbooking problem, such as increasing compensation to entice passengers to switch to a later flight. But if no one takes it, some passengers must be forced off the plane.

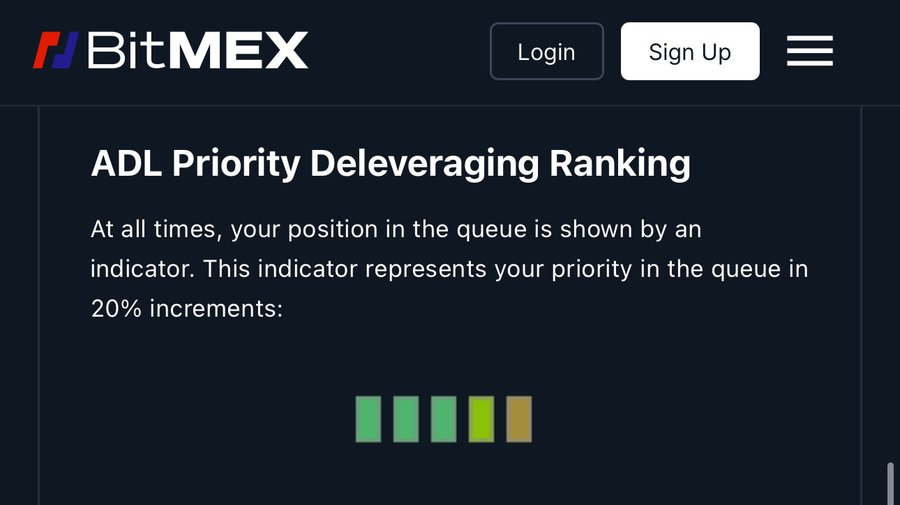

If the longs run out of money and no one is willing to step in to take their place, the system has no choice but to force at least some of the shorts out and close their positions. The process for selecting who to close positions and the price at which they close them varies widely across exchanges.

Typically, the ADL system selects profitable positions to be liquidated using a ranking system based on criteria including: 1) most profitable; 2) leverage; and 3) position size. In other words, the largest, most profitable "whales" are sent home first.

People naturally resent ADL because it seems unfair. You're being forced out of your position just when it's at its peak of profitability. But to some extent, its existence is necessary. No matter how good an exchange is, there's no guarantee that there won't be an infinite number of losers on the other side to fill the pool.

Think of it like a winning streak at Texas Hold'em. You go into the casino, beat everyone at the table, then move on to the next table and beat everyone again, then the next table. Eventually, everyone else in the casino runs out of chips. That's the essence of ADL.

The beauty of perpetual contract markets is that they are always zero-sum games, so the entire system will never be insolvent overall.

There's no real Bitcoin depreciating here. Just a bunch of boring cash. Like the laws of thermodynamics, value is neither created nor destroyed in this system.

ADL is a bit like the ending of the movie "The Truman Show." The perpetual contract market creates a very beautiful simulation, as if it is the real world linked to the spot market.

But at the end of the day, it's all virtual. Most of the time, we don't have to think about it... but sometimes, we push the boundaries of this simulation.