DeFi Data

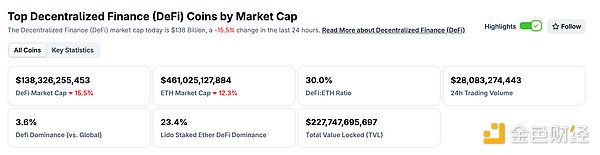

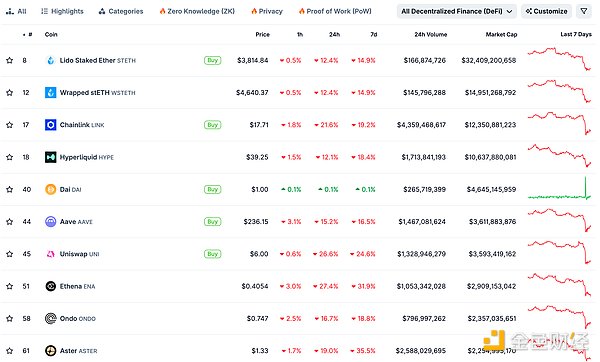

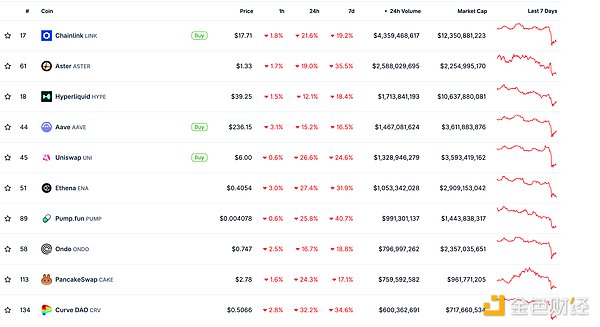

1. Total DeFi token market capitalization: $138.326 billion

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours is $280.83

Data source for decentralized exchange trading volume in the past 24 hours: coingecko

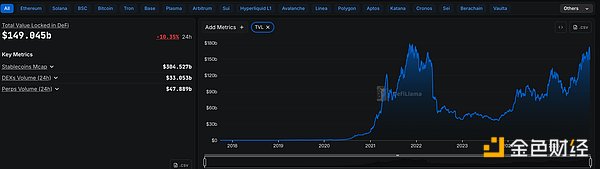

3. Assets locked in DeFi: $149.045 billion

The top ten rankings of DeFi projects with locked assets and locked-in amounts. Source: defillama

NFT Data

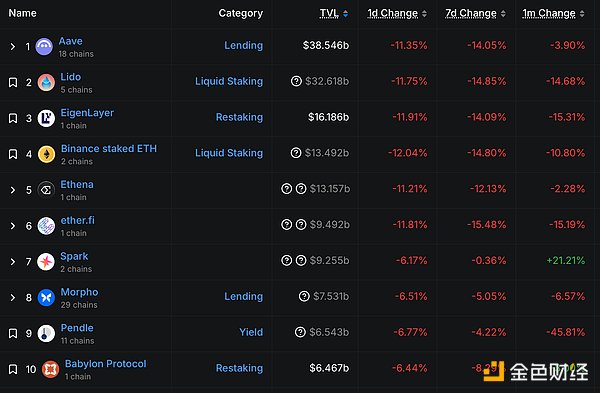

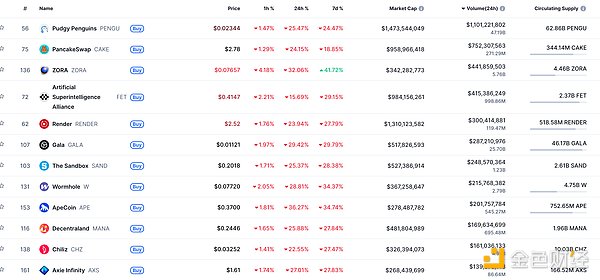

1. Total NFT market capitalization: $16.589 billion

Data source for NFT total market capitalization and top ten projects by market capitalization: Coinmarketcap

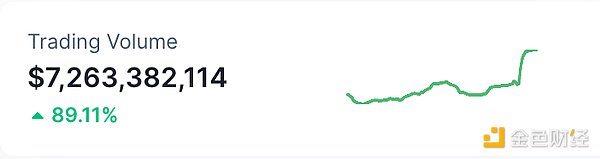

2. 24-hour NFT trading volume: $ 7.263 billion

Data source for NFT total market capitalization and top ten projects by market capitalization: Coinmarketcap

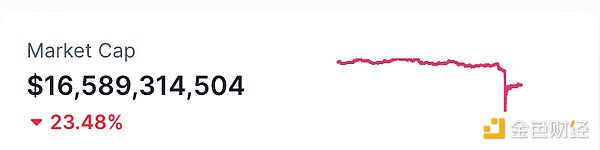

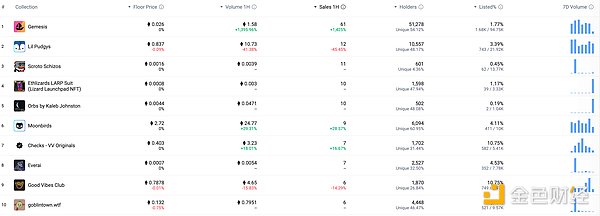

3. Top NFTs in 24 Hours

Top 10 NFTs with the highest sales growth in 24 hours. Source: NFTGO

Headlines

Trump discusses pardoning CZ, raising questions within the White House

Trump is currently discussing the possibility of pardoning Binance founder CZ(CZ), but there are doubts within the White House about the public opinion impact of such a move.

MEME Hotspot

1. After the market crash, three whale addresses bought PEPE, HYPE and other tokens

According to Lookonchain monitoring, following the market crash, the qianbaidu.eth wallet withdrew 657.8 billion PEPE (approximately $4.44 million) from Binance and deposited 8.67 million USDC into Hyperliquid to purchase HYPE. The whale wallet address 0x2bfb spent 4.97 million USDT to purchase 600.88 billion PEPE. The whale wallet address 0x9b83 purchased 140,145 HYPE (approximately $5.5 million) and also long BTC and HYPE.

2. The Chinese meme address with high holdings suffered a floating loss of $3.39 million, with Binance Life accounting for nearly 80% of the total.

According to on-chain analyst Aunt Ai (@ai9684xtpa), a certain address's six Meme token positions on BSC have accumulated a floating loss of US$3.39 million, of which the unrealized loss on Binance Life is as high as US$2.71 million, accounting for 79.7% of the total floating loss. Only Hakimi's position is in a floating profit state.

DeFi Hotspot

1. Solana’s on-chain DEX 24-hour trading volume exceeded $8 billion

According to market news, during last night's massive liquidation event, Solana decentralized exchanges processed over $8 billion in trading volume, with Orca leading the way with $2.49 billion. Data shows that the 24-hour trading volume of four Solana decentralized exchanges—Orca, Meteora, Raydium, and HumidiFi—all exceeded $1 billion.

2. The Renzo community proposes to buy back and burn 10% of the total supply of REZ tokens over the next 6 months

On October 11th, the Renzo community released governance proposal RP 6, which plans to use protocol revenue to repurchase and burn 10% of the total REZ token supply over the next six months. The plan has already launched and completed its first buyback, using revenue from the third quarter of 2025 to burn 1% of the total supply/2.3% of the circulating supply. Upon approval by Renzo governance, the initial 1% of REZ will be included in the planned targets. Over the next six months, 75%-100% of protocol revenue will be used for ongoing buybacks, with 9% of the target 10% being burned and 1% rewarded to ezREZ stakers. The proposal has been published on the governance forum for community discussion.

3.Solayer announces the launch of Solayer Accel accelerator

Solayer has officially launched the Solayer Accel accelerator, a technology R&D-focused, founder-focused program specifically designed for Infini SVM, the fastest production-grade Layer 1 blockchain. Over a seven-week program, eight high-performing teams will be selected for real-time development. The final teams will present their work on Demo Day during the Breakpoint conference in Abu Dhabi on December 12th. Registration closes on October 20th.

4. The Ethereum Foundation’s Institutional Privacy Working Group releases initial public reference materials

The Ethereum Foundation recently announced the establishment of a new privacy cluster, with Kohaku, a wallet privacy stack, and the Institutional Privacy Task Force (IPTF) as key initiatives. On October 9th, the Ethereum Foundation officially unveiled Kohaku. Today, Oskar, head of the IPTF, open-sourced the IPTF's public reference materials, which include (proven) use cases from institutions, specific patterns/specifications, and vendor approaches, as well as detailed information on business sectors and jurisdictions. The IPTF aims to help institutions and businesses join Ethereum, with a focus on ensuring their privacy needs are met in an efficient, secure, usable, and accessible manner.

5. Hemi and Dominari partner to create a regulated DAT and ETF platform

Hemi, a Bitcoin scaling protocol, announced a strategic investment from American Ventures and a partnership with Dominari Securities, a New York-based FINRA-registered broker-dealer, to develop a digital asset treasury (DAT) and exchange-traded fund (ETF) platform. This collaboration will provide regulated access to Bitcoin markets and programmable financial solutions for businesses, institutions, and sovereign entities.

Disclaimer: As a blockchain information platform, Jinse Finance publishes articles for informational purposes only and does not constitute actual investment advice. We encourage you to cultivate sound investment practices and maintain a heightened awareness of risks.