At 9:47 PM Taiwan time on October 8th (8:47 AM local time in New York), short firm Kerrisdale Capital publicly announced on X that it had short BMNR, the stock of BitMine, the Ethereum treasury company. Kerrisdale stated in a tweet that it was not bearish on Ethereum, but rather believed that the premium BitMine's stock price relative to its net assets, which the treasury company model had created, would soon disappear. Kerrisdale was betting on a return to parity or even a discount.

This short on BMNR isn't Kerrisdale Capital's first foray into cryptocurrency stocks. In mid-2024, it short shares of Bitcoin mining company Riot and Strategy (then known as MicroStrategy), the pioneer of DAT companies. The share prices of short companies experienced significant declines following the announcement of Kerrisdale 'short. However, the stock price of BMNR didn't immediately experience a significant drop after Kerrisdale announced short, and last night's sharp drop was largely in line with the broader market. However, in terms of price alone, BMNR's closing price on October 10th (US$52.47) was down over 10% from its closing price on the 8th (US$60).

A careful short report reveals that Kerrisdale's six reasons for short BitMine stock hit the nail on the head. Compared with his hedging operation of going long on Bitcoin while short Riot and Strategy, this naked short of BMNR also reflects Kerrisdale's extreme pessimism about BitMine.

The "flywheel" has become a "death spiral"

Kerrisdale's reasons for being bearish on BitMine mainly include six aspects:

- The Ethereum content per share was severely diluted : BMNR issued more than 240 million shares through ATM (at-the-market) in just three months, raising over $10 billion, with an average daily financing of approximately $170 million, which severely diluted the Ethereum content per share;

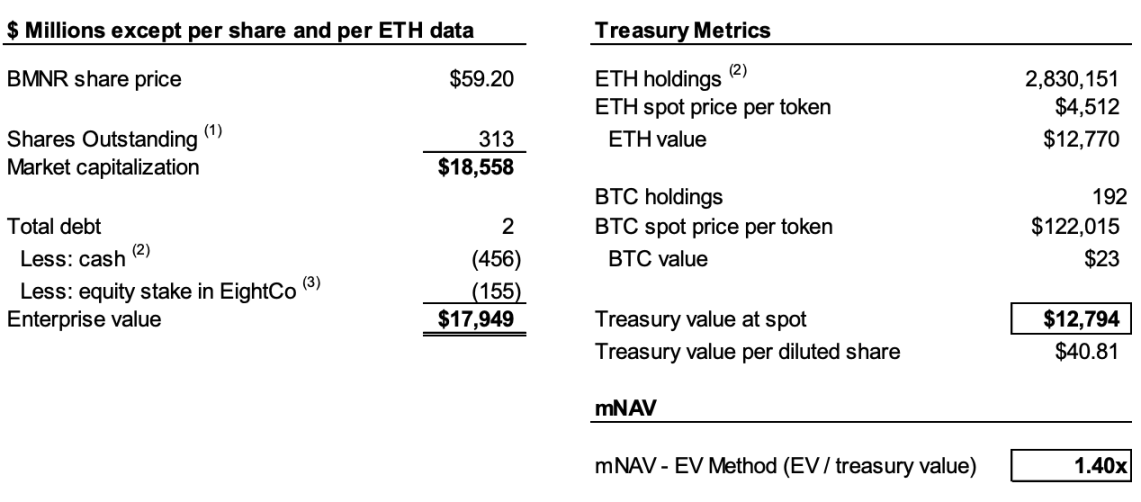

- mNAV continues to decline : BMNR’s market capitalization premium to its net crypto asset value (mNAV) has fallen from 2.0x in August to 1.4x, a trend that continues to deteriorate;

- Using financial tactics to conceal the reality of cashing out : The recent $365 million in "premium" financing was actually a deep discount, and the accompanying warrants significantly diluted the value of the common stock;

- Disclosure opacity : The company stopped disclosing NAV per share and total share capital on August 25th, making it impossible for investors to determine whether the “content” of each share of Ethereum has increased;

- Intensified competition : 154 companies in the United States plan to raise nearly $100 billion for crypto treasury strategies. The launch of ETFs will further weaken the scarcity of DATs.

- The Strategy model has failed : The mNAV premium of Strategy (formerly known as MicroStrategy), the originator of DAT, has fallen from 2.5 times to 1.4 times, and the market's confidence in the model has been shaken.

To understand the logic behind short, we first need to explain the core operating logic of DAT companies. As Kerrisdale explains in his report, the core logic is: issuing shares at a price higher than the book value of the tokens → raising funds → buying more tokens → increasing the number of tokens per share → maintaining the premium → issuing more shares, forming a self-reinforcing cycle.

For example, Company A currently has $1 billion worth of Bitcoin on its books and a total share capital of 100 million shares. Company A issues new shares at a price above 10 yuan per share to raise funds. Investors anticipate that continued Bitcoin purchases by the company after the fundraising will increase the "bitcoin content" per share, thereby boosting the stock price. Therefore, they are willing to pay a premium for the new shares. Thus, Company A continues to purchase Bitcoin after the fundraising, increasing the Bitcoin content per share and, consequently, the stock price. Company A can then continue this process to continuously increase its stock price.

However, there are two necessary conditions for this cycle to continue: first, there needs to be a premium on mNAV in the initial phase, or at least the expectation of a subsequent premium; second, the premium and premium rate must be maintained. If the premium rate is zero or even negative, investors would be better off purchasing the corresponding crypto assets directly.

Thus, we can combine points 1, 2, and 4 to explain the bearish outlook. Based on the report, Kerrisdale estimates that as of October 6th, BitMine had issued over 240 million shares, bringing its total share capital to 311.7 million. Although BitMine increased its ETH content from 2.7 ETH/1,000 shares to 7 ETH/1,000 shares through a flywheel between July and August, Kerrisdale estimates that while the company's ETH holdings increased by 65% from August 25th to October 6th, the ETH content per share only increased by 17%.

In other words, what Kerrisdale believes in dilution is that the growth rate of content will continue to fail to keep up with the growth rate of Ethereum holdings. In addition, mNAV has dropped from 2 times in August to 1.4 times. The decline in content growth and the decline in premium may lead to a vicious cycle, causing the two numbers to continue to decline under the influence of each other, and eventually reach parity or even a discount.

If the data still contains an element of speculation, then BitMine's decision to stop disclosing NAV per share and total shares on August 25th reinforces Kerrisdale's judgment. As he said on X: "If earnings per share improve, they should promote it."

"Premium capital increase" is actually "discount cashing out"

On September 22, BitMine announced that it had entered into a securities purchase agreement with an institutional investor to sell 5,217,715 shares of its common stock at $70.00 per share through a registered direct offering, along with warrants to purchase up to 10,435,430 shares of its common stock at an exercise price of $87.50 per share. The company expects gross proceeds from the offering to be approximately $365.24 million, before deducting the placement agent's fees and other estimated offering expenses.

This kind of news, which usually drives up stock prices, was seen by Kerrisdale as a financial move by BitMine to cash out at a discount.

The report stated that the $70 offering price represented a 14% premium to the day's closing price of $61.29, but that each share came with two warrants (with an exercise price of $87.5 and a term of 1.5 years). Based on a Black-Scholes analysis (vol 100%, rate 4%) and factoring in a 40% liquidity discount, each warrant was worth approximately $14.

The Black-Scholes mathematical model, proposed by Fischer Black and Myron Scholes in 1973 and awarded the Nobel Prize in Economics, addresses the question of "what should an option, exercisable only on its expiration date, be worth today, given given conditions?" The calculation involves several parameters. Kerrisdale set the volatility (vol) to 100% (due to the high volatility of such stocks) and the risk-free rate to 4%, calculating that one BitMine warrant issued on September 22nd was worth approximately $14.

Therefore, if BitMine's actual financing amount is deducted from the two warrants, now valued at $14, it is only $220 million, equivalent to an actual issue price of $42 per share, a discount of approximately 31% to the closing price that day. Kerrisdale believes that while this deal may not be a loss for investors, if a DAT company needs to raise funds at a substantial discount, it has already eliminated one of the necessary conditions for the flywheel to turn, further demonstrating that BitMine's model is showing signs of fatigue.

DAT is no longer scarce

The report states that when MicroStrategy launched its Bitcoin treasury strategy in 2020, the market lacked compliant and convenient crypto asset investment tools, and DATs became a "leverage alternative." However, to date, over 150 companies in the US market have announced similar strategies, with plans to raise nearly $100 billion. Furthermore, the SEC's streamlined ETF approval process is expected to usher in an "ETF tsunami," with lower-cost, higher-liquidity Ethereum investment channels potentially rapidly taking over the market.

Kerrisdale noted that even the most established firm, Strategy, has seen its mNAV premium plummet from a year-to-date peak of 2.5x to 1.4x, indicating that market confidence in the DAT model has wavered. Even Strategy itself abruptly rescinded its commitment in August to only issue new shares at a 2.5x premium. Once such trust and discipline collapse, it's difficult to repair. Therefore, if the market lacks confidence in Strategy, and even in Strategy itself, imitators will inevitably fail first.

Kerrisdale summed it up best at the beginning of his report: We're not short Ethereum, but short the idea that investors should still pay a premium for ETH. If you want to own ETH, just buy it directly, stake it, or buy an ETF. BMNR's selling point is that it's "more valuable than ETH itself," but its strategy is mediocre, competition is fierce, disclosures are opaque, ETH per share growth is slowing, and so-called "premium financing" is actually dilution (plus the lack of scarcity). Against this backdrop, the BMNR premium is destined to continue to decline.

Kerrisdale, who loves short short, and the controversial DAT

Kerrisdale Capital is one of Wall Street's most active "long-short hedge + event-driven" funds, renowned for its aggressive public short short. In recent years, it has focused its efforts on sectors with unrealistic valuations, such as cryptocurrency, quantum technology, and SPACs. Kerrisdale previously targeted Marathon Digital and Cipher Mining between late 2023 and early 2024, each resulting in a single-day drop of 5% to 8%. In addition to cryptocurrency-related stocks, Kerrisdale short quantum computing stocks IonQ and D-Wave Quantum in the first half of the year. However, both saw only slight declines on the day the short report was released, with both subsequently experiencing significant gains.

Sahm Adrangi, founder and chief investment officer of Kerrisdale Capital, began his career at Deutsche Bank, specializing in high-yield bonds and leveraged loan debt financing. He also served as an advisor to creditor committees on bankruptcy and out-of-court restructurings at Chanin Capital Partners. He then worked as an analyst at Longacre Management, a $2 billion distressed debt hedge fund.

Sahm Adrangi is known for short and exposure of fraudulent Chinese companies in 2010 and 2011, including China Marine Food Group, China-Biotics, and Lihua International. His short short targets, China Education Alliance and ChinaCast Education Corp., were subsequently investigated and penalized by the SEC.

Kerrisdale isn't a fund that only short , long. However, it has recently focused its efforts on companies with inflated valuations, with DAT being its latest target. As mentioned at the outset, this kind of confident naked short position must reveal fundamental flaws in its logic. Kerrisdale 'short record this year hasn't been particularly impressive, with most of its short companies turning positive after brief declines. However, its unique insights into the DAT model shouldn't be overlooked.

Since the beginning of this year, while a large number of US-listed companies have begun experimenting with the DAT model for Bitcoin, Ethereum, and even other Altcoin, and while prominent investors have championed this approach, Web3 industry figures, including Vitalik, have expressed some concerns. These concerns now appear to be well-founded. While DAT stock prices can indeed soar in markets with hot concepts and ample liquidity, such bubble-like growth will eventually become unsustainable.

We do not deny that when the overall market is improving, DAT companies can add fuel to the fire, but when the bubble fades, whose eyes will be blinded by the ashes raised by these long-carbonized firewood?