I 've seen a lot of discussion about Ethena's depegging during this weekend's market turmoil. USDe (Ethena's stablecoin) briefly depegged to around $0.68 before recovering. Here's the Binance chart everyone's been citing:

But after digging into the data and talking to many people over the past few days, it is now clear that this statement is incorrect and the USDe is not unpegged.

The first thing to understand is that the most liquid place for USDe is not actually on an exchange, but on Curve. Curve has hundreds of millions of dollars in standing liquidity, while any exchange, including Binance, only has tens of millions of dollars in liquidity.

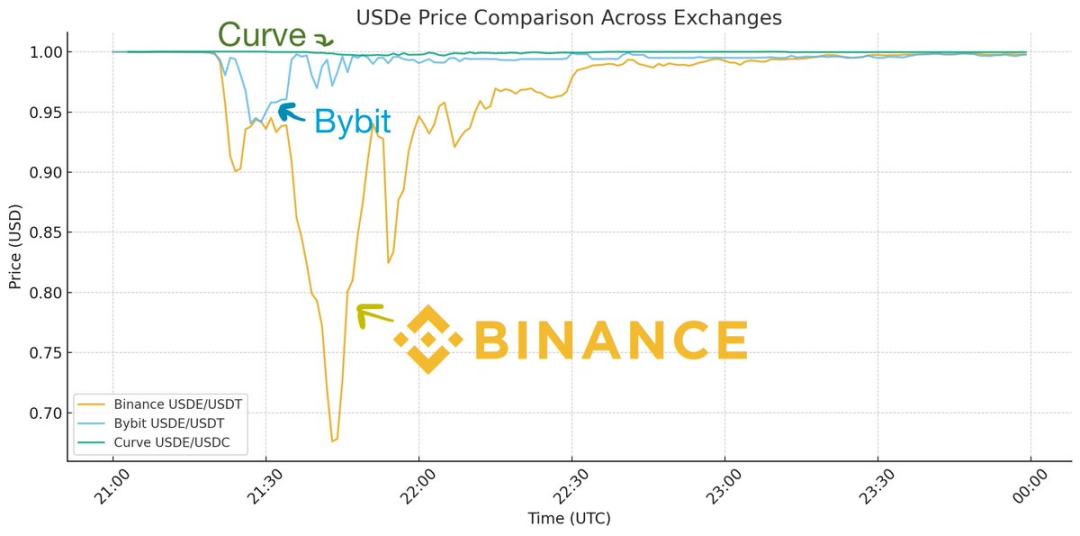

So if you only look at the chart of USDe on Binance, it looks like it’s off the peg. But if you overlay other liquidity venues for USDe, you get a different picture:

We can see that while USDe saw price drops on every centralized exchange, the declines were uneven. Bybit briefly dipped to $0.95 before quickly recovering, while Binance experienced a significant de-pegging and took a long time to regain its peg. Meanwhile, the price on Curve only dropped 0.3%. What explains this discrepancy?

Remember, every exchange was under immense load that day, the largest liquidation event in cryptocurrency history. Binance was extremely unstable during this period, with deposits and withdrawals blocked due to an API outage. Market makers were unable to move positions, and no one was able to intervene to arbitrage.

It's like a fire on Binance, but all roads are blocked, preventing firefighters from getting in. This caused the situation to spiral out of control on Binance, but everywhere else, the fire was quickly extinguished by liquidity bridges. As Guy shows in his post, USDC also briefly de-pegged by a few cents on Binance due to the same general instability issue; liquidity simply couldn't access it, but this wasn't a de-pegging event for USDC either.

So, with API instability, it’s not surprising that prices on exchanges diverge significantly, as no one can secure a position. But why did the price drop on Binance fall so much more than on Bybit?

The answer is twofold. First, Binance lacks a primary dealer relationship with Ethena, preventing direct minting and redemption on the platform (a feature that Bybit and other exchanges have integrated). This allows market makers to remain on the platform and conduct arbitrage. This is crucial; otherwise, market makers would have to withdraw funds from Binance, transfer them to Ethena for peg arbitrage, and then withdraw their positions. In a crisis like this with an API outage, no one could do this.

Secondly, Binance's oracle was poorly executed, and it began liquidating positions that shouldn't have been liquidated. A good liquidation mechanism wouldn't trigger during a flash crash. If you're not the primary trading venue for an asset (Binance isn't the primary trading venue for USDe), you should reference the prices of the primary venues. If you only look at your own order book, you'll over-liquidate. This caused Binance to begin liquidating USDe at around $0.80, triggering a chain reaction. This is a key reason why Binance is refunding users whose USDe positions were liquidated (which, as far as I know, other exchanges haven't done). They made the mistake of looking at their own prices instead of the true external price.

So this was a Binance-specific flash crash that could have been avoided with better market structure. USDe actually remained relatively stable against its peg all day on Curve, a major trading venue. This is really different from the de-pegging situation you're describing.

If you remember USDC during the Silicon Valley banking crisis in 2023, this was a true depegging scenario:

During the Silicon Valley banking crisis, USDC's price plummeted on every exchange, leaving nowhere to sell it for $1. Redemptions were effectively halted, so $0.87 was its true price, which is what depegging means.

This time, it was a price dislocation specific to Binance. This is an important lesson for market infrastructure, but understanding the nuances is crucial if you’re trying to infer the mechanics of USDe from this weekend’s events.

Throughout this incident, USDe remained fully collateralized at $1 on major trading venues, and its collateral actually increased over the weekend due to price volatility. That said, this market instability was ultimately beneficial, as it provided lessons for the industry. Guy's post explains how any exchange, including Binance, can avoid this kind of issue in the future.

In short: USDe is not decoupled, there is a problem with the price on Binance.