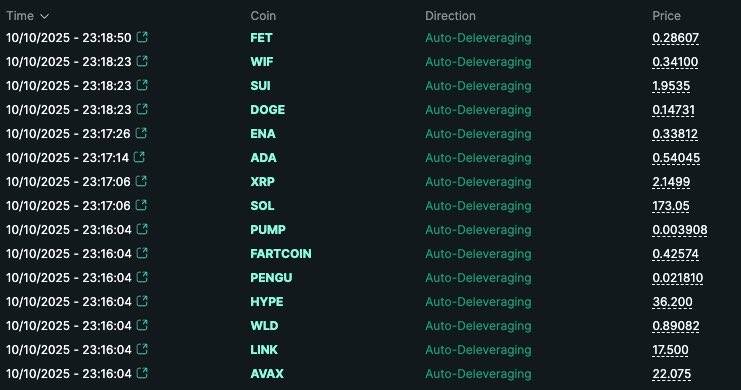

In the flash crash in the early morning of October 11 , in addition to more than 19 billion USD being liquidated in just 24 hours, ADL was also a hot topic in the community when exchanges such as Hyperliquid or Backpack simultaneously activated this mechanism, forcing many positions to be closed. So what is ADL? Let's find out with Coin68 in the article below.

What is Auto-deleveraging (ADL)? Learn about the “last stop” of Derivative trading

What is Auto-deleveraging (ADL)? Learn about the “last stop” of Derivative trading

What is auto-deleveraging (ADL)?

Auto-Deleveraging (ADL) is an automatic mechanism applied on Futures Contract exchanges to close or reduce the leverage of open positions of the most profitable traders. This mechanism is triggered when the market suddenly moves strongly in the opposite direction, leading to a lack of liquidation from liquidated positions.

ADL is designed to protect the exchange's Insurance Fund from the risk of depletion, which often occurs when the amount recovered from liquidated positions is not enough to cover the entire system loss.

What is Auto-Deleveraging?

What is Auto-Deleveraging?

It can be said that Auto-Deleveraging (ADL) is the "last resort" of Derivative exchanges, XEM as an emergency measure when the market suddenly reverses strongly. A typical example of this is the wave

Understanding the importance of ADL liquidation mechanism

Perp liquidation mechanism

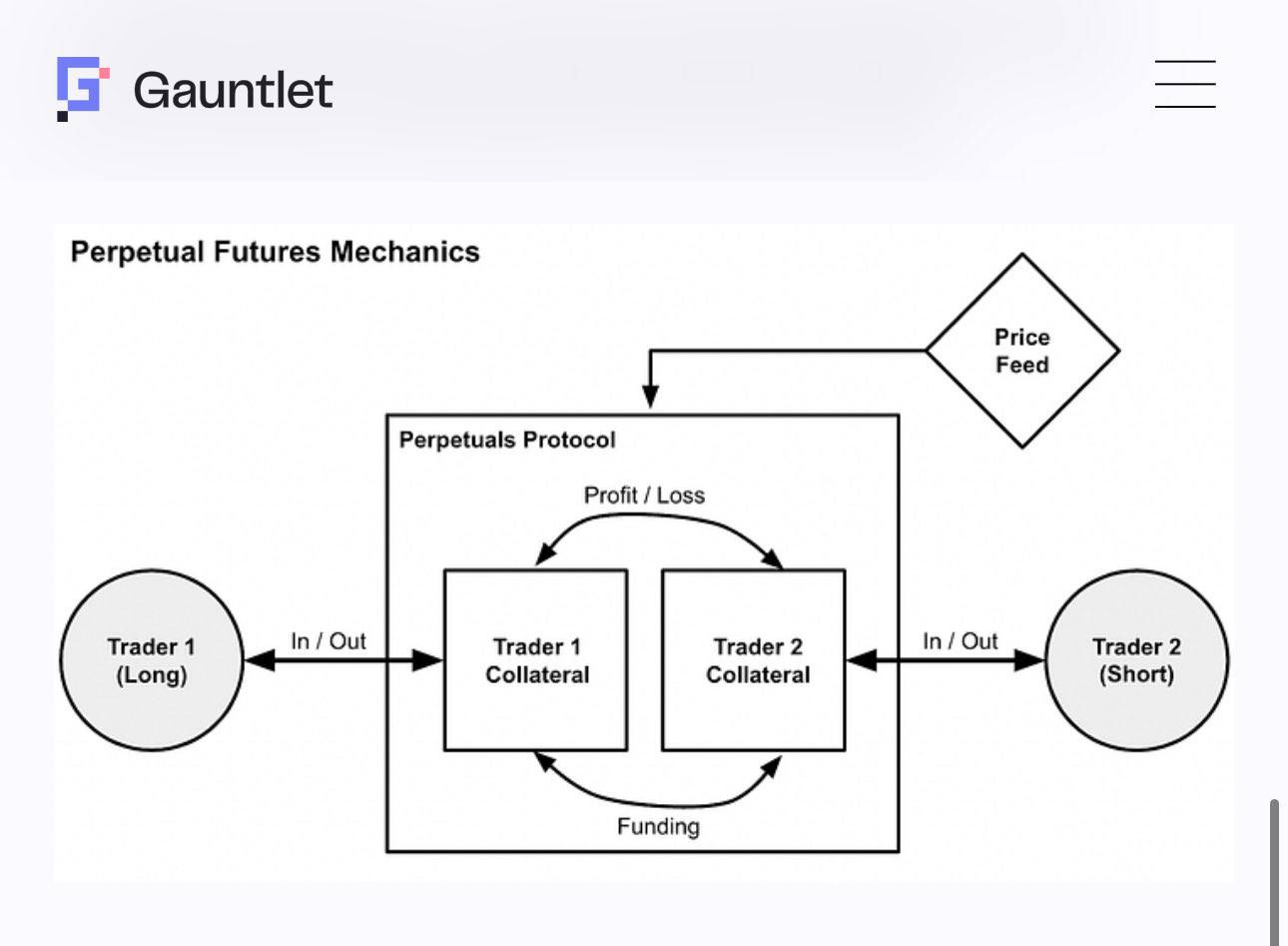

In perpetual Derivative or futures (perp), every Longing (buy) position must always be balanced by a Short (sell) position, creating a two-way system where one side's profit always comes from the other side's loss.

All these positions are based on a common margin pool, where participants deposit assets like USDT, ETH, or BTC as collateral for their trades, and the value of this pool will fluctuate according to the price of the underlying asset.

How Futures Trading Works

How Futures Trading Works

When the price moves strongly in one direction (e.g., the price falls causing the Longing side to lose money), their margin value gradually decreases. When the margin ratio reaches the safety threshold, the system will trigger liquidation to close that position.

The remaining margin is used to cover the position loss, while the winning side will see a corresponding increase in profit in the form of unrealized profit. So what happens if the position loss is too large and the margin is not enough to cover it? This is when the exchange will use the insurance fund to pay, helping to ensure that the market is always in a state of balance and does not lead to system bankruptcy.

However, the limitation of the insurance fund is that its Capital is limited, so in unexpected situations like the crash on October 11, it will not be enough to cover the losing positions. At this time, the ADL mechanism will be activated to force the closure of large winning positions to balance the system and ensure that the fund does not run out.

So what if there are no ADLs?

If an exchange has an Auto-Deleveraging (ADL) mechanism, in extreme conditions, the winning side does not receive enough profit due to lack of margin from the losing side to compensate, leading to the insurance fund being the place to fully cover all losses and the exchange will have to put money in to cover if the fund is not able to cover. If the market continues to move in a negative direction, the exchange may have to suspend trading and the entire market will freeze. This will damage the exchange's reputation, reduce trading Volume , and may lead to legal litigation.

Below is an example of Lighter 's account of the volatility that occurred on the morning of October 11 and the exchange's reaction.

During the 4.5 hour period from 10:30PM EST on October 10, 2025 until 3AM EST on October 11, 2025, Lighter experienced its first serious outage since mainnet private beta in January and public launch on October 1. This is the post mortem of that outage and actions we took since

— Lighter (@Lighter_xyz) October 12, 2025

How ADL works

When is ADL activated?

When the market suddenly moves in the opposite direction such as a flash crash or a large liquidation event, the liquidation of positions will normally occur, but the amount recovered from margin is not enough to cover all losses and the floor's insurance fund is about to be depleted or reaches a critical threshold. At that time, ADL will be automatically activated to prevent the risk of heavy losses, protecting the floor from bankruptcy.

ADL priority order

When ADL is triggered, the system scans all open positions and prioritizes them based on the highest risk level, aiming to target profitable traders to "take" compensation. The order of priority is usually as follows:

- Positions with the highest unrealized profit.

- Highly leveraged positions and high value positions.

- Other risk indicators like Insurance Loss Ratio or Mark Price. Small positions, low profits or low leverage will not be affected.

How is ADL performed?

The ADL process occurs at each level of position to ensure system balance:

- Step 1 - Scan and select targets : The system will scan all open positions and classify them according to pre-set criteria.

- Step 2 - Intervene to close position : The system will close part or all of the position of the trader at the top priority (starting from top 1).

- Step 3 - Asset Transfer : Profits from closed positions are transferred directly to the Insurance Fund to offset losses from previously liquidated positions.

- Step 4 - Continue the loop : If top 1 is not enough, the system will continue with top 2, top 3,... positions until the insurance fund is fully funded. The trader with ADL will receive a notification and can open a new position afterwards.

Benefits of a floor having ADL

Despite the strong opposition from traders whose orders were closed, ADL is still a necessary mechanism for the sustainability of the exchange and the entire market. The advantages of ADL are:

- Maintaining System Balance : Derivative is a “zero-sum” game, the winner’s profit is the loser’s loss, Longing only wins if Short has money to lose (and vice versa). Therefore, ADL helps maintain this balance by forcing the position of the big winner to close to transfer assets to compensate the loser.

- Prevent exchange bankruptcy : ADL automatically reallocates assets from big winners to cover losses, keeping the exchange running smoothly. Without it, a massive liquidation could cause the exchange to lose heavily, leading to bankruptcy.

- Reduce Systemic Risk : ADL prioritizes closing positions with high profits, high leverage, and the largest size, helping the market quickly return to balance without manual intervention.

How to avoid ADL?

To avoid ADL during extreme market fluctuations, you need to pay attention to the following:

- Don't use high leverage : ADL will prioritize closing high leverage positions first. Therefore, even if you are making a big profit, with low leverage, the ADL rate will be lower than other positions.

- Partial Profit Closing : When your position is making a big profit, consider closing the position in parts to reduce risk when the market is volatile.

- Prioritize using large and reputable exchanges : Exchanges such as Binance, Bybit, Hyperliquid,... will often have large insurance funds, enough to cover in bad situations.

Exchanges activated ADL in the 10/11 flash crash

Hyperliquid

This is the first ADL activation in Hyperliquid ’s 2 years of operation. This action is aimed at helping the project avoid bad debt and maintain 100% uptime. The most notable point is the decisive decision to close all open positions on the platform, without exception, demonstrating a commitment to transparency and prioritizing community interests.

TLDR: During recent volatility, Hyperliquid had 100% uptime with zero bad debt. This was Hyperliquid's first cross-margin ADL in more than 2 years of operation. ADL does not change the outcome for any liquidated users. While some specific ADL providing trades were unfavorable,…

— jeff.hl (@chameleon_jeff) October 11, 2025

Binance

Although ADL was not activated, due to a serious system error from Ethena , a series of Token such as wBETH, BNSOL and USDe plummeted, causing a wave of liquidation of Longing positions of these assets.

Due to significant market fluctuations over the past 16 hours and a significant influx of users, some users have encountered issues with their transactions. I deeply apologize for this. If you have incurred losses attributable to Binance, please contact our customer service to… https://t.co/9Q7GZuFY5H

— Yi He (@heyibinance) October 11, 2025

By the evening of October 11, Binance confirmed that it had paid $283 million in compensation to affected users and clarified that this was not a targeted cyber attack.

Backpack

Although it also activates ADL, unlike Hyperliquid, Backpack has encountered many controversies from users. After being liquidated, many traders have added money to the exchange but it "disappeared" from their accounts, the reason being that while the system is processing, the new deposit will automatically be used to cover the remaining loss, completing the payment cycle between the two Longing and Short sides, leading to unnecessary misunderstandings for users.

The timeline over the past few days has been out of control. Some absurd things. Some things deserved. Here's my perspective.

— Armani Ferrante (@armaniferrante) October 13, 2025

- When the market crashed during the industry's largest liquidation event in history, a lot of people got liquidated. This hurts a lot of people. The…

However, what is noteworthy is the way Backpack compensates the affected people, when the project announced that they will compensate in the form of KFC vouchers. This makes many people think that the exchange is ignoring the actual damage of traders.

Summary

Above is a summary article about the Auto-Deleveraging (ADL) mechanism as well as its importance to exchanges and Derivative markets. Coin68 hopes that readers can understand how this mechanism works to be able to better manage positions in transactions.

Note : The information in the article is not XEM investment advice, Coin68 is not responsible for any of your decisions.