Indian Motorcycles has been sold by Polaris Inc. to private equity firm Carlwood LP for $478 million, marking a major shift in the American cruiser market. The Polaris Indian Motorcycles sale was announced recently, and Polaris stock jumped 8.99% on the news, closing at $61.36 as investors welcomed the company’s decision to exit the motorcycle business.

Harley-Davidson Faces New Competition After Polaris Indian Motorcycle Sale

The transaction transfers the Indian Motorcycle brand and its Spirit Lake, Iowa manufacturing facility to Carlwood LP. Polaris acquired the bike company out of bankruptcy in 2011 but struggled to make the division consistently profitable.

Polaris CEO Mike Speetzen stated:

“Polaris and Indian Motorcycle both stand to benefit from this deal, which will enable each business to move faster, deliver industry-leading innovation, and lean further into our respective market strengths.”

Indian Motorcycles contributed approximately $478 million, or 7% of Polaris‘ revenues for the trailing twelve-month period ended June 30, 2025. About 900 employees will transition to the new standalone true american bike company.

Speetzen added:

“For Polaris, the sale will further strengthen our focus on the areas of our portfolio that offer the strongest growth potential and allow us to accelerate investments in key initiatives and create wins with customers and dealers. It also will unlock greater long-term value for Polaris and our shareholders, with immediate value creation that we expect will become increasingly meaningful over time.”

Also Read: Alphabet: How Search, Cloud Business May Boom GOOGL Stock

Polaris projects the transaction will add about $50 million to its annualized adjusted EBITDA and increase adjusted earnings per share by roughly $1.00. The company plans to close the deal in the first quarter of 2026.

Speetzen also said:

“Under Polaris’ ownership and investment, Indian Motorcycle has been re-established as a celebrated brand and major player in the global motorcycle market. With its current product portfolio, global dealer network, category expertise and manufacturing resources, the Business is well positioned to succeed as a standalone company with a dedicated focus on its industry.”

Carlwood LP has selected Mike Kennedy to serve as CEO of the independent Indian bike organization. Kennedy previously served as CEO of RumbleOn and Vance & Hines, and spent 26 years at Harley-Davidson.

Also Read: 97% of US Importers Are Small Businesses: Aug 1 Tariffs Crushes Their Dreams

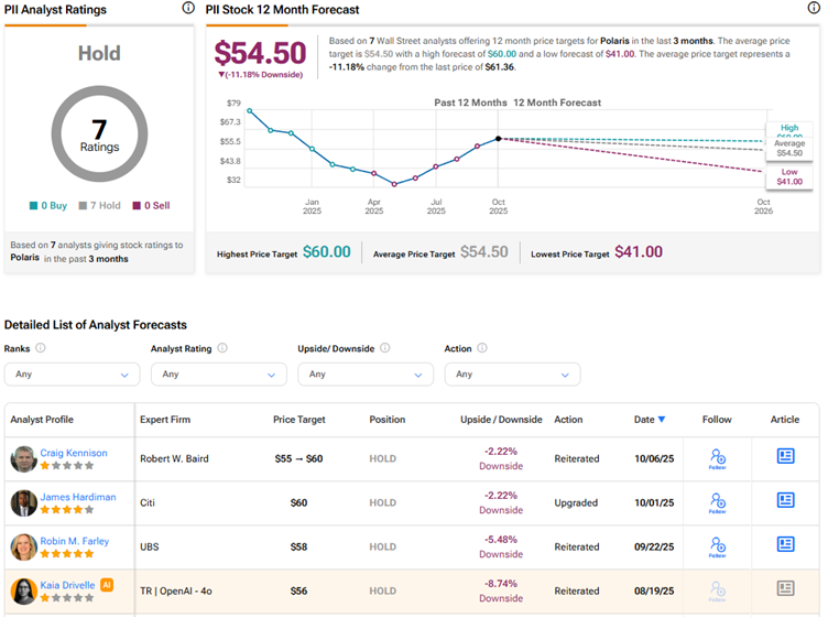

As we saw, analysts are keeping a Hold rating on Polaris stock, with the 12-month average target being at $54.50. For Polaris Indian Motorcycles shareholders, the divestiture creates financial flexibility. Harley-Davidson faces a potentially revitalized competitor in the cruiser market under new ownership.