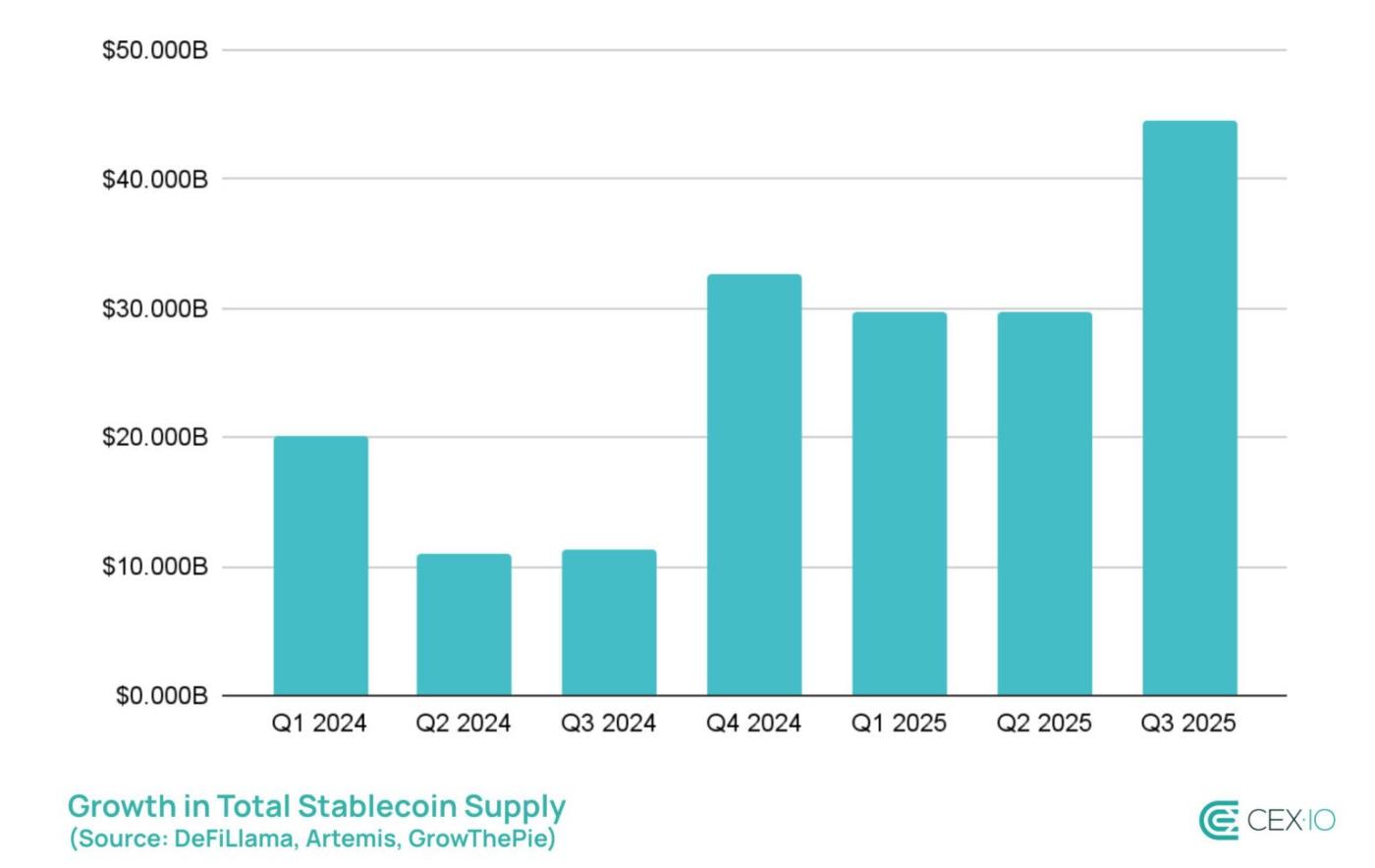

The stablecoin market recorded its strongest quarter in history with a $45 billion increase in supply and $15.6 trillion in transfer volume.

The third quarter of 2025 has seen a significant turning point in the development of the stablecoin market, with performance indicators continuously breaking all previous records. According to the latest report by Cex.io , which aggregates data from Defillama, Coingecko and leading analytics firms, the stablecoin supply expanded by $45 billion during the quarter, representing an 18% growth, bringing the total market value past the $300 billion mark.

This figure reflects not only growth in scale but also a structural shift in how investors and businesses use digital assets.

The growth was driven mainly by the trio of USDT, USDC , and USDe, which accounted for 84% of the total new issuance. Notably, despite the US maintaining restrictions on interest-bearing Token under the Genius Act, USDe and Paypal’s PYUSD emerged as the two fastest-growing assets, up 173% and 152%, respectively. This surge was largely driven by decentralized finance (DeFi) strategies and chain integration through networks like LayerZero’s Stargate Hydra.

Ethereum consolidates market dominance

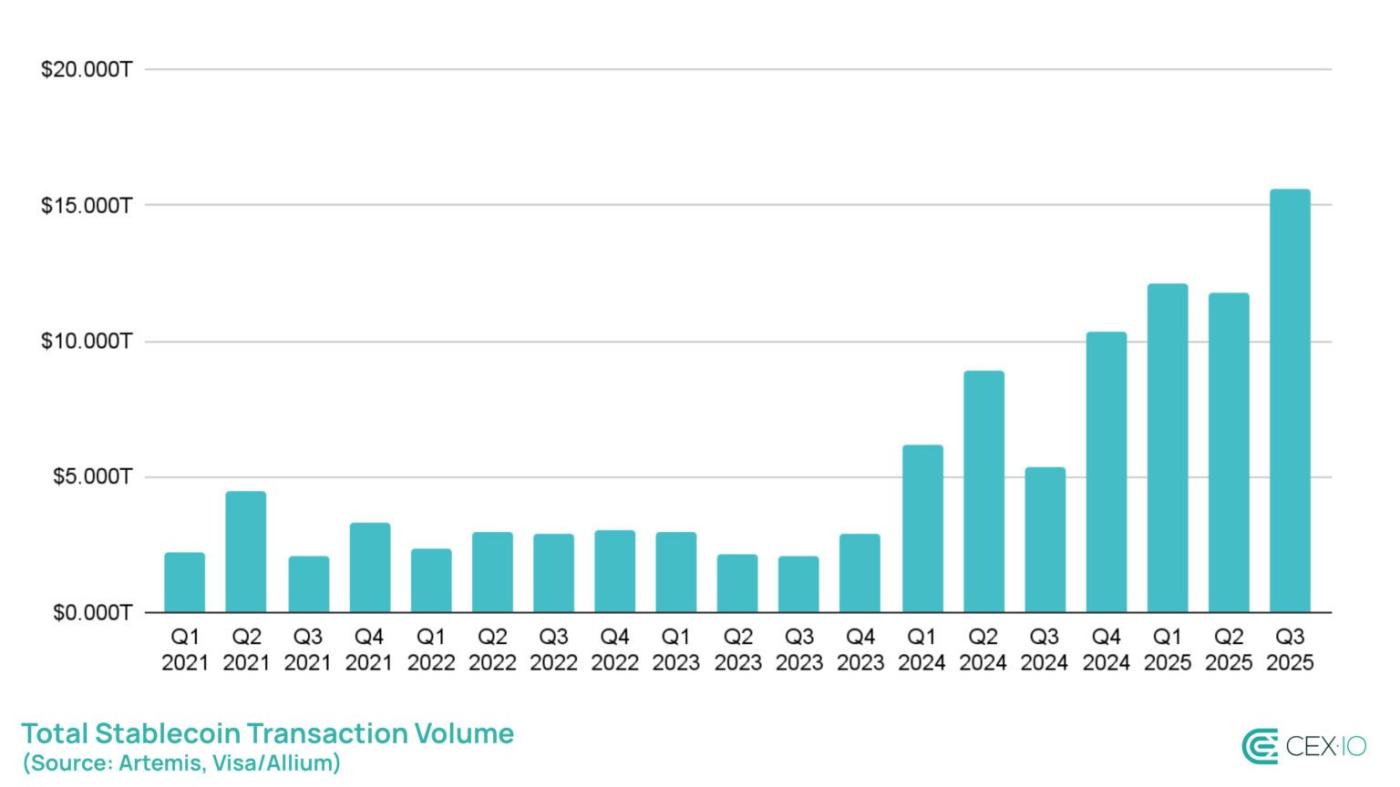

Total on- chain volume hit a record $15.6 trillion in Q3, with automated trading bots accounting for 71% of transactions. However, retail activity also increased significantly, with sub-$250 transactions hitting an All-Time-High in September, pushing the total retail transaction value by 2025 closer to $60 billion.

Ethereum reasserted its dominance in the stablecoin market, accounting for 69% of all new issuance after taking back market share from TRON, the rare network to see a supply decline during the quarter. Layer 2 solutions such as Arbitrum also saw strong growth, fueled by the growth of perpetual contract trading platforms and liquidation migration from other networks.

In terms of volume, the market reached $10.3 trillion, the highest level since 2021. USDT continued to consolidate its leading position when it surpassed the $100 billion monthly volume mark on decentralized exchanges (DEX) for the first time. Notably, USDT surpassed USDC to become the top trading pair on decentralized exchanges, mainly due to the explosive growth of trading activity on the Binance Smart Chain (BSC) network.

The above figures confirm that stablecoins have gone beyond their original Vai as a mere transaction tool, becoming essential infrastructure for payments, liquidation provision, and settlement across the entire DeFi ecosystem. As Q4, which has been the strongest period in stablecoin history, approaches, the question is no longer whether the growth momentum will continue, but rather how concentrated the market will remain around the pillars USDT, USDC , and the ever-expanding Ethereum ecosystem.