Bittensor (TAO) price has increased by nearly 14% in the past 24 hours, bringing its weekly gains to around 40%. A clear pattern is forming on the chart — which, if confirmed, could push TAO back to its previous All-Time-High set last year.

But one important risk remains. It could determine whether this pattern actually takes off or breaks down before it takes off.

Whales support the rally as an index hits a record high

On- chain data shows whales are still in control of the direction of TAO price .

The Chaikin Money Flow (CMF) index — an indicator that tracks the flow of money from large wallets — rose to 0.40, its highest level since TAO was listed on Binance.

Want more information about Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Bittensor CMF Hits Record High: TradingView

Bittensor CMF Hits Record High: TradingViewDespite a brief dip on 07/10/2023, CMF has been steadily rising since early 09/2023, indicating continued whale inflows. Even during the market crash on 10/10/2023, large investors continued to buy instead of withdrawing.

This is the strongest accumulation phase since Bittensor launched. Whales seem unaffected by market noise, suggesting the spot market is driven by confidence rather than short-term speculation.

Leverage accumulation can break the column

While spot data remains solid (thanks to large wallets), Derivative represent a risk that could derail the rally. Perpetual Futures Contract volume rose from $813 million on October 13, 2023, to over $1.49 billion on October 14, 2023, an 83% increase in a single day. And the bulk of the volume is long-term bets.

TAO Derivative Risk: Glassnode

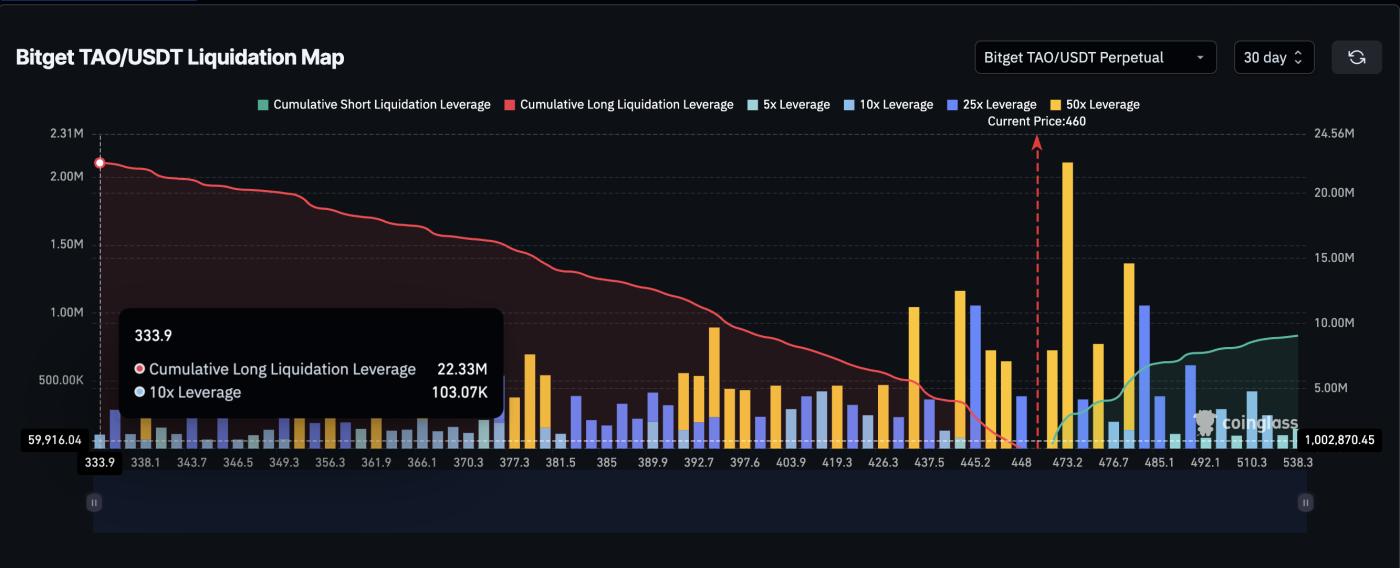

TAO Derivative Risk: GlassnodeOn Bitget alone, long positions total around $22.33 million, while short positions are $9.06 million, creating a long bias of more than 100%. This imbalance shows that traders are betting heavily on the uptrend.

Long-Term Bias Could Strongly Influence TAO Price: Coinglass

Long-Term Bias Could Strongly Influence TAO Price: CoinglassThe problem is that if TAO price corrects even slightly, long positions could be liquidated (Longing squeeze) — causing a rapid decline.

This is a clear Chia : whales are accumulating in the spot market, but strong leverage can wipe out that progress in one sharp move.

TAO Price Model Faces Breakout Challenge

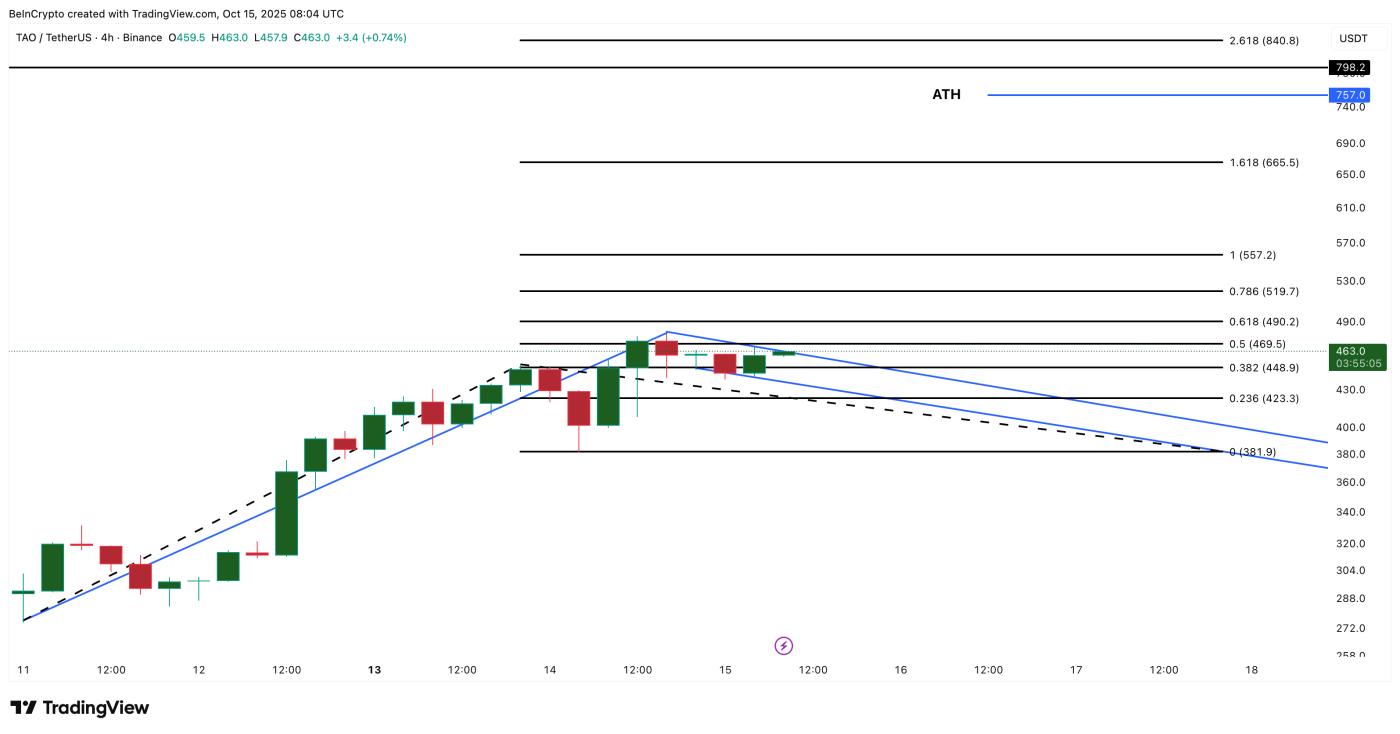

The 4-hour chart shows that Bittensor price is forming a bullish flag pattern — a short consolidation after a strong rally. The flagpole reflects the recent uptrend, while the flag represents the current consolidation before a possible breakout. Based on the flagpole projection, TAO price could potentially reach $797, surpassing the previous All-Time-High .

While the daily chart captures the broader bullishness, the 4-hour chart highlights the detailed structure of the flag—showing that momentum is cooling off after the flagpole and forming a tight consolidation that could soon resolve in either direction.

TAO Price Model: TradingView

TAO Price Model: TradingViewTAO price is trading near $463, facing resistance at $469, the flag’s key breakout trigger point. If broken, the pattern forecasts a 73% upside (as mentioned earlier), opening up targets at $519, $665, the previous high of $757 and beyond.

Bittensor (TAO) Price Analysis: TradingView

Bittensor (TAO) Price Analysis: TradingViewIf the rally fails, the $423 and $381 levels will Vai as support. A close below $381 would invalidate the bullish flag, confirming that the pole broke before the breakout.

Bittensor is at a pivotal point now. Spot whales are buying, leveraged traders are jostling, and $469 will decide who wins.