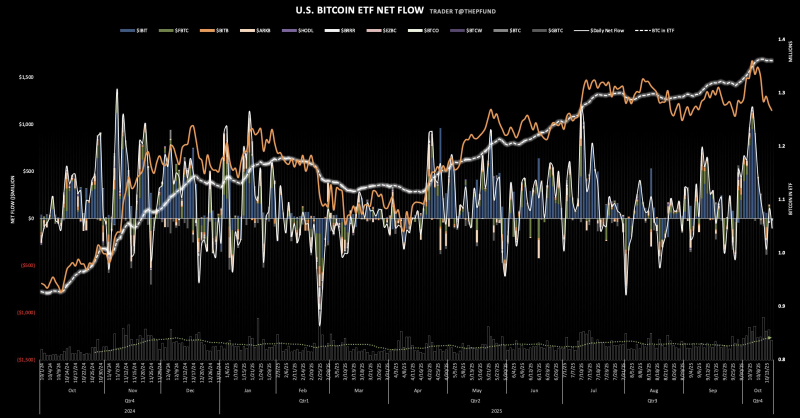

Bitcoin and Ethereum are attracting attention in the US spot cryptocurrency ETF market due to their contrasting fund flows. According to Trader T's monitoring, the US spot Bitcoin ETF market saw a net outflow of $104.12 million (KRW 147.7 billion) the previous day. Looking at the fund flows by major asset managers, Grayscale (GBTC) recorded the largest net outflow of $82.9 million, followed by Invesco (BTCO) and BlackRock (IBIT) with net outflows of $11.1 million and $10.12 million, respectively.

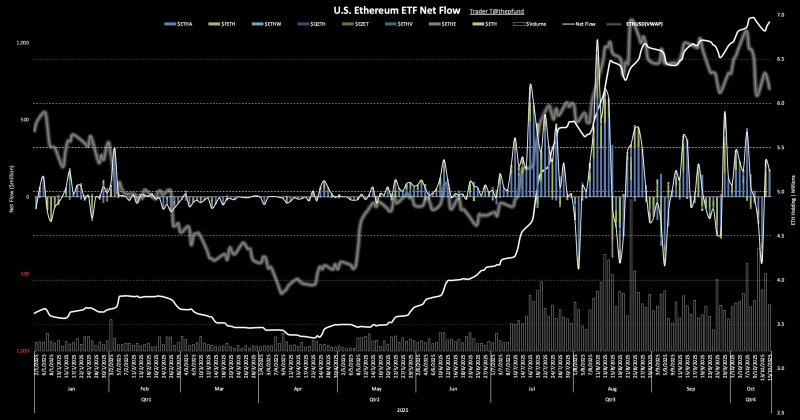

Meanwhile, the US spot Ethereum ETF market recorded a net inflow of $106.92 million (KRW 151.7 billion) on the same day, demonstrating positive investor sentiment. BlackRock's ETHA recorded the largest net inflow of $106.38 million, followed by Bitwise (ETHW) with $12.31 million and Fidelity (FETH) with $1 million. However, 21Shares (TETH) recorded a net outflow of $7.98 million.

Attention is focused on how the Bitcoin and Ethereum ETF markets will trend going forward and how investor sentiment will change.

Joohoon Choi joohoon@blockstreet.co.kr

Meanwhile, the US spot Ethereum ETF market recorded a net inflow of $106.92 million (KRW 151.7 billion) on the same day, demonstrating positive investor sentiment. BlackRock's ETHA recorded the largest net inflow of $106.38 million, followed by Bitwise (ETHW) with $12.31 million and Fidelity (FETH) with $1 million. However, 21Shares (TETH) recorded a net outflow of $7.98 million.

Attention is focused on how the Bitcoin and Ethereum ETF markets will trend going forward and how investor sentiment will change.

Joohoon Choi joohoon@blockstreet.co.kr