By Roy Sheinfeld

Source: https://blog.breez.technology/the-utility-of-bitcoin-moving-value-like-information-2513eae84676

If you think the trajectory of technology seems like destiny, you wouldn’t be wrong. Over the past few decades, we’ve seen the rise of personal computers, the internet, mobile devices, and now, Bitcoin.

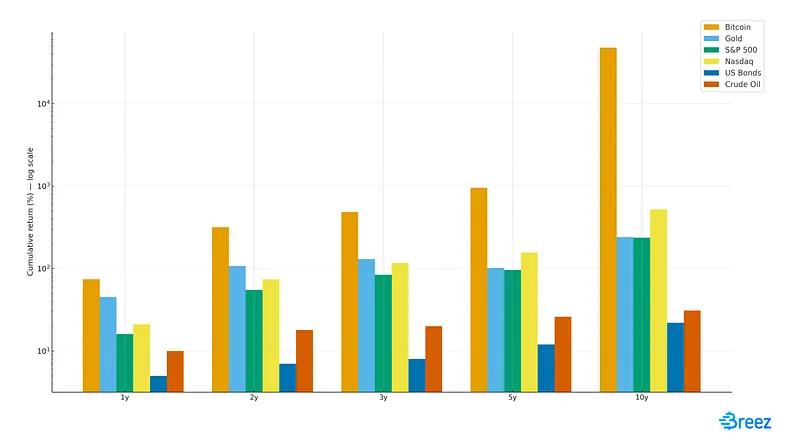

It’s now widely recognized that Bitcoin is the best asset. It’s all about financial literacy, and if you can read a chart, the evidence is clear.

- ROI Comparison (2015 ~ 2025): Bitcoin vs. Major Assets; Horizon Calculation

Source: CaseBitcoin & Market Data (2025) [Chart: ChatGPT ]

What’s less obvious is Bitcoin’s utility and how it will shape our economic lives in the decades ahead.

Besides being an asset (which is gaining the most attention and understanding), Bitcoin is also a method for transferring value. This is its core function. Because it is a currency designed to live on and for the internet, retail adoption will likely come only after it becomes mainstream on the internet. So how does it achieve mainstream adoption on the internet? By commoditizing the transfer of value—enabling anyone to transfer value anywhere, at any time, for any purpose, without the need for an intermediary.

Transferring value is an incredibly important part of our lives, and expanding what's possible in this area means changing our behavior and shaping our society. When Bitcoin is used to transfer value, borders will disappear, traditional institutions like banks will shrink, and new connections will sprout like spring. This transformation will be on a scale comparable to the internet itself.

Physical books are difficult to obtain and easily banned (and sometimes burned). The internet has liberated information, giving far more people access to far more ideas than ever before. Traditional currencies are locked into walled gardens and the preferred paths of market participants. Bitcoin represents the end of that system and the beginning of another.

The Internet liberated information; Bitcoin liberated value.

Payment does not equal value transfer

To understand the potential of this current transformation, and to distinguish it from the clichés that often accompany Bitcoin, think of it as a paradigm shift: from a fiat-based payments paradigm to a Bitcoin-based value transfer paradigm. It sounds abstract, but it’s actually quite simple.

First, let's review something we're all familiar with: payments. A traditional payment is "an instruction to settle a debt," a definition constantly repeated by professional economists. If someone sells you a cup of coffee or gives you a haircut, you owe them something, and by paying them money, you've repaid that debt. Note that in reality, paying them requires instructing an intermediary—a bank, a mobile app, a credit card, a middleman—to actually transfer value.

This is the exact opposite of value transfer. There are two key differences. First, as we've conceptualized, value transfer is direct. Value transfer isn't a directive to an intermediary to perform an action; it's the action itself. Second, value transfer doesn't require a debt to be settled. While a payment is a quid pro quo, value transfer is the thing itself. You can send value however you want, and while it might be a sale, it doesn't necessarily have to be.

Cash makes the distinction between payments and value transfers even clearer. If you pay someone with cash, you're not asking for permission. You're simply transferring value from one person to another. And cash can do more than settle debts; it can be used for more than just payments. Putting some change in a street performer's hat or giving your child pocket money are both simple transfers of value, without the need for a debt. You can use cash to "push" value, not just to trade.

One person pushes value to another — an old-school approach. [Chart: ChatGPT ]

However, cash is being marginalized by financial authorities and is ill-suited to our electronic world, so we are losing the ability to transmit value. We trust these third-party intermediaries, such as banks, credit card companies, and financial service providers, to respect our payment instructions and fulfill our requests, but payment instructions are often rejected or delayed.

More importantly, these payment instructions are constrained to predefined patterns and are governed by the database structures of these intermediaries (for example, a customer paying a merchant, an employer paying an employee, or a bank account paying another ( assuming those banks use the same wire transfer protocol). This may sound a bit exaggerated, but think about platforms like Uber, OnlyFans, AirBnB, and Spotify. On the surface, they all appear decentralized: the platform connects service providers and customers; but payments between the two must take a route predetermined by the platform, which is littered with greedy middlemen along the way—banks, fintech apps, credit card companies, and so on. Each additional middleman adds fees, more potential for failure, more friction in permissions, more regulation, and so on.

This stands in stark contrast to value transfer, which, in simple terms, encapsulates the permissionlessness, immediacy, and flexibility of cash payments without the constraints of holding and transferring physical objects.

But how do we reimagine cash in a digital world? How do we transcend the limitations of payment and embrace the power of value transfer? What if we could send and receive electronic cash peer-to-peer?

Compared to electronic payments, Bitcoin is more programmable, more flexible, and easier to adopt. It allows users to store and transfer value as smoothly and easily as storing and sharing a screenshot on a phone. By treating value as just another form of information, Bitcoin opens up a new paradigm for economic activity across an entire ecosystem of specific uses.

That’s right, it can only be Bitcoin.

Only Bitcoin can facilitate value transfer

Value transfer—the direct movement of value from a sender to a receiver—represents a radical shift in the traditional payments paradigm. So, why hasn't the fintech industry been able to achieve this? Isn't this the very purpose of stablecoins (tokens that attempt to maintain a stable exchange rate with fiat currencies and are transferred over a blockchain network)? Why is Bitcoin such a necessary foundation for an economy based on value transfer?

The short answer is: payments are deeply embedded in the architecture of the fiat currency system, including the fintech industry.

A single fintech payment involves countless intermediaries. Each intermediary needs to earn a commission from the transaction, requiring a fee model. They opt for discrete payments because this is a legal approach for regulated remittance companies. Thanks to Know Your Customer (KYC), Anti-Money Laundering (AML), and risk assessments, remittance companies are an expensive business, resulting in relatively high fees.

Besides the overhead, middlemen inevitably introduce friction. Each intermediary is subject to regulatory constraints, which vary widely across countries and jurisdictions, limiting their market and reach. They also face additional commercial considerations, such as the risk of a major customer in one sector canceling their business due to an unrelated transaction in another. Furthermore, these payments are only as programmable as these intermediaries can legally employ, and they are neither irreversible nor instantaneous. These intermediaries can wait to process these payments at their leisure, and payers can often reverse them at that time.

Stablecoins are often touted as a solution, but they simply replace one fiat-based promise with another. As MiCA and the GENIUS Act demonstrate, stablecoins are vulnerable to currency controls. A stablecoin may be usable for international transactions today, but not next quarter. Due to new regulations, USDT and nine other stablecoins were delisted from European exchanges at the beginning of 2025. Stablecoin issuers face the same external concerns as fintech providers, and they can only program with the permission of authorities. Stablecoins are simply fiat currencies seen through the lens of blockchain. In reality, stablecoins and the fintech industry are just electronic lipstick on the pig lip of traditional payments.

Yes, stablecoins and fintech are just electronic slogans for this traditional payments pig. [Graphics: ChatGPT and Mick Coulas ]

Bitcoin succeeds where fintech and stablecoins fail. Where expensive middlemen demand payment, Bitcoin enables value transfer. Where their operational constraints limit access and usage, Bitcoin is an open, decentralized, and neutral currency network that works for anyone, anywhere, in any time zone . Where they are subject to regulatory scrutiny and become geopolitical pawns, Bitcoin offers a minimal regulatory footprint and is inherently jurisdiction-agnostic. While they restrict programmability to protect established paradigms and privileges, Bitcoin fosters innovation and the programmability that innovation requires.

If we could go back to the birth of the internet and design a currency optimized for the electronic age, we would create something similar to Bitcoin. It would be Bitcoin.

Bitcoin is everywhere

Apps are vehicles of change. They are nodes in our steady stream of data and essential tools, transforming the way we work, move, love, and think. Apps define the digital environment we humans are adapting to, and we develop apps to adapt to our environment. Value transfer dwarfs payments, and apps are the conduit for that value.

To understand how apps integrate and foster value delivery, think back to the evolution of digital cameras. The first “filmless” cameras hit the market in the mid-1970s, but for the next two decades, they were single-purpose devices. Even the cameras on early cell phones were “just” cameras. They could take pictures, but that was it.

The release of the first iPhone in 2007 revolutionized what digital cameras could do and our relationship with them. It became more than just a camera; the combination of a camera and an app changed everything. Developers quickly integrated cameras into their apps, allowing users to take, edit, and share photos.

The synergy between digital cameras and apps has transformed our reality and our behavior. Apps like TikTok, Instagram, and Pokémon Go have made actions that seemed absurd 20 years ago mainstream—taking photos of hamburgers, chasing invisible monsters in the park, choking yourself—even aspirational. Through mobile apps and photos, we constantly record our lives and appreciate the lives of others. Even Meta's AI glasses are essentially just cameras connected to a universal app.

What Bitcoin did was commoditize value transfer, making it universal and adaptable, like a digital camera on a phone. Any developer building any type of app can integrate value transfer. Messaging apps can let users add value to their messages. Social apps can let users pool funds and split bills with as little as a "like" (like). Building a platform—think Uber, Spotify, AirBnB, OnlyFans—no longer requires millions of dollars or navigating a maze of walled-off payment gardens; any developer can do it.

Payments require bankers and lawyers. Commoditized value transfer only requires Bitcoin and legal tender.

Bitcoin is moving from adolescence to adulthood. Specifically, Bitcoin needs the Lightning Network to increase throughput and strengthen interoperability. In this regard, the Lightning Network needs to find its place as the lingua franca for Bitcoin- based value transfer.

But we've already done it. An ecosystem has emerged consisting of numerous Bitcoin subnetworks—including Spark, Ark, Liquid, Fedimint, Botanix, and Cashu—each with unique advantages. SDKs are now available, allowing any developer to add value transfer features to their apps. To use the analogy of a digital camera, this is 2007, the moment the iPhone first came out, and the moment developers began playing with the camera API.

This is a window of opportunity. The technology is mature, but the market hasn't yet priced in this transformation. Value will soon be mobile like information. If you want to predict the future, it's too late; but if you want to capitalize on this transformation, it's not too late. The integration of Bitcoin-based value transfer and apps is unstoppable, like adding a camera to a smartphone .

Leave a legend for future generations

When value can be transferred like information, everything changes. [Graphic: Google Gemini ]

Payments are the VCRs of our time, the next technology to become obsolete. The new era about to begin will be qualitatively different, like Dorothy stepping out of her black-and-white world and into the vibrant colors of Oz . When value flows as freely as information, economies and industries will transform, and so will society . National borders will become less important. The flow of wealth and value will be like a breeze (a pun intended). Global interaction across political and class barriers will go from being exceptional to commonplace.

The pieces are in place. Bitcoin is rapidly growing, outperforming other assets. The Lightning Network allows any Bitcoin endpoint to interact with any other. A diverse set of protocols has emerged to serve different use cases and preferences. Developers are exploring tools that simplify integrating Bitcoin's value transfer features, and they're exploring new ways to apply and leverage these features, making their applications as indispensable as ChatGPT and Google Maps.

We're living at the end of an era our grandchildren will consider primitive, like the centuries before electricity and running water. We're also living at the beginning of another era they'll consider revolutionary, like the Renaissance and the advent of the internet. Do things that will make them proud, and at the same time, surprise them: how did we ever get by without the tools we created?

(over)