The community is experiencing a major crypto market crash, with recent liquidations wiping out half a billion on the market. Smaller altcoins are going red, here’s why.

- The crypto market continues to decline following the $19 billion crash on Oct. 10, with total liquidations surpassing $540 million in the past 24 hours as both major tokens and smaller altcoins extend their week-long losses.

- Bearish momentum is fueled even further by regulatory warnings from the G20’s Financial Stability Board, lingering effects from mass leveraged liquidations, and escalating U.S-China trade tensions.

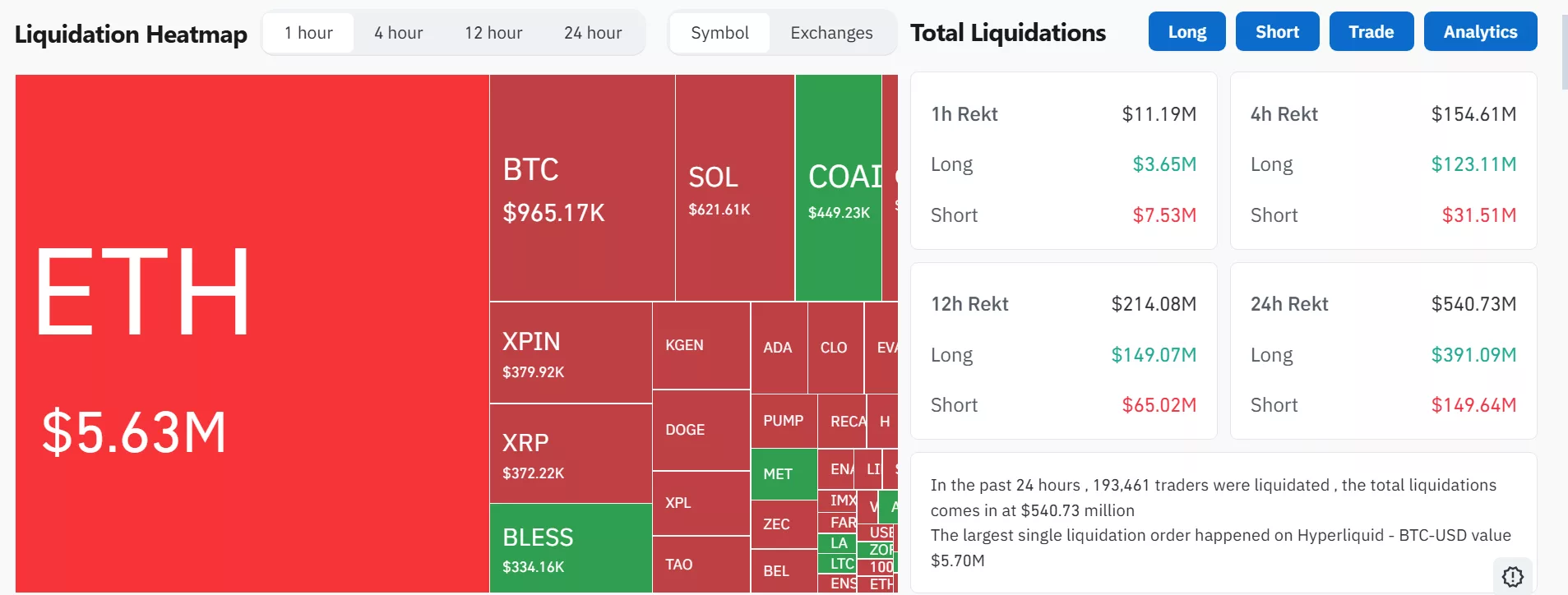

On Oct. 16, the overall crypto market cap once again dropped lower, falling below the $3.9 trillion mark to around $3.78 trillion. Following the 1% drop in crypto market cap, the market has seen mass liquidations amounting to a total of $540 million within the past 24 hours.

Meanwhile, liquidations throughout the past hour alone has surpassed $10 million, reaching about $11.2 million at the time of writing. Ethereum (ETH) leads the charge with $5.63 million in liquidations, followed by Bitcoin (BTC) with nearly $1 million.

Solana (SOL) and other altcoins have also seen major losses, with SOL having lost about $621,610 in liquidated positions and other altcoins contribute a combined $449,270.

At press time, the current momentum is still slightly bullish; with major tokens like Bitcoin, Ethereum and XRP (XRP) seeing modest gains of about 0.3% to around 1% in the past hour and smaller altcoins like Aster (ASTER), Lido DAO (LDO) and Zcash (ZEC) rising by over 1% to around 3%.

However, the overall outlook indicates a long-term bearish trend, considering these tokens have been locked in a state of decline since the beginning of the week. The trend seems to be a continuation of the major $19 billion crypto market crash that occurred on Oct. 10.

Smaller altcoins have been hit the hardest during this crypto market crash. ASTER has gone down more than 12% in the past 24 hours and has continued its week-long plunge by 30%. Similarly, ZEC has declined by more than 12% as well, however it sustained a 25% gradual rise throughout the week. LDO has reflected similar trends to ASTER, having dropped by 11.17% in the past day and falling nearly 20% in the past week.

Meanwhile, PENGU (PENGU) has lost about 3.8% of its value in the past day and 23.5% in the past week. DOGE (DOGE) only dipped slightly by 1.8% in the past day, but has continued its 19% fall for the past seven days.

Major tokens seem more capable of staying afloat during the crypto market crash, but have seen losses deepening since the beginning of the week. In the past 24 hours, Bitcoin dropped slightly by 0.8% to the $111,407 level, while continuing its red streak by 8.4% within the past week. Ethereum is barely hanging on to the $4,000 level after declining by 1.3% within the past day and deepening its week-long drop by 6.4%.

The same can be said about BNB (BNB) and XRP, which have both gone down by 0.7% and 2.1% in the past day respectively. Both have also deepened their week-long downturns, with BNB falling by 7.9% and XRP by 12.7%.

Why is the crypto market crash continuing?

One key factor driving the current crypto market crash is the recent warning from G20’s risk watchdog, the Financial Stability Board. The regulatory body declared that there are “significant gaps” in rules enacted by countries that are attempting to regulate the rapidly developing crypto markets.

According to Reuters, the FSB believes the increasing integration of crypto markets into financial systems could potentially harm global financial stability. Although, the body does admit the risk is considered “limited at present” but have the possibility to rise as more and more institutional players warm up to crypto.

Such a stern warning may have spooked institutional investors, especially those that have recently just joined the crypto space.

Another main driver in the crypto market crash is the lasting residue from the massive leveraged liquidations earlier this week. On Oct. 10, the crypto market lost more than $19 billion in crypto derivatives positions as prices dropped, triggering a wave of margin calls.

Even after the wave ended, the market appears to still be on edge, with data showing high put-option activity as whales short positions to hedge against potential crypto market crashes.

Meanwhile, macroeconomic and geopolitical tensions are intensifying the downturn. The ongoing U.S.-China trade standoff, marked by newly announced 100% tariffs on Chinese tech exports, has rattled global markets.

As a result, cryptocurrencies are now vulnerable to heavy outflows. As liquidity dries up, even moderate sell pressure can cause outsized price swings, making recovery even more difficult for falling tokens.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.