#BTC

- Technical Formation: Bullish double bottom pattern suggests potential reversal toward $150,000 resistance

- Institutional Support: Record ETF inflows and recovering institutional demand provide fundamental backing

- Regulatory Development: New York's Digital Assets Office establishment signals growing mainstream acceptance

BTC Price Prediction

BTC Technical Analysis: Bullish Pattern Emerging

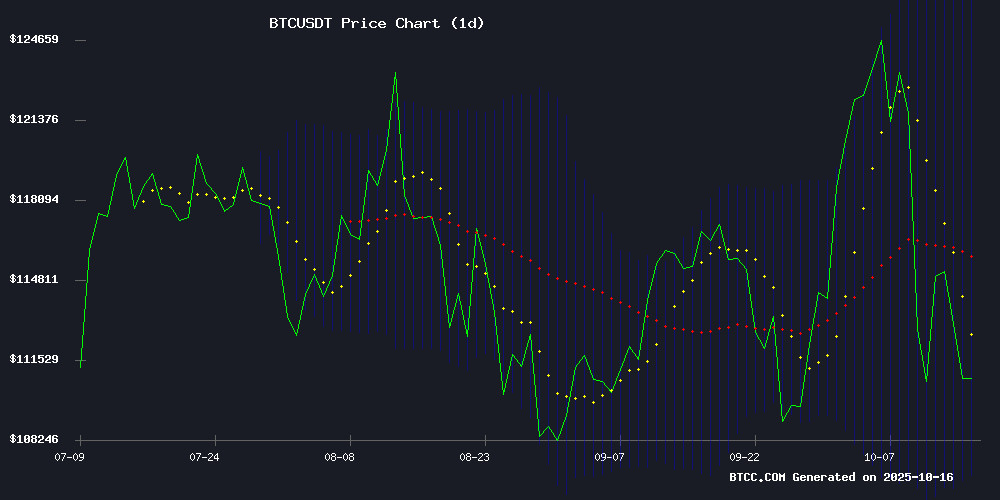

According to BTCC financial analyst Michael, Bitcoin is currently trading at $111,554.25, below the 20-day moving average of $116,861.98, indicating short-term weakness. However, the MACD shows promising signs with the histogram at 1,831.1124, suggesting decreasing bearish momentum. The Bollinger Bands position the current price near the lower band at $106,905.40, which often acts as a support level. Michael notes that the double bottom pattern formation could signal a potential reversal toward the $150,000 resistance level if buying pressure increases.

Institutional Demand and Regulatory Developments Shape BTC Sentiment

BTCC financial analyst Michael observes mixed market sentiment from recent developments. Positive institutional inflows, highlighted by BlackRock's record $2.63 billion ETF inflow, contrast with the $19 billion futures liquidation that caused Bitcoin to retreat from its $126,000 peak. Michael emphasizes that New York's establishment of a Digital Assets Office signals growing regulatory acceptance, while institutional demand recovery provides fundamental support. The combination of technical patterns and institutional interest suggests cautious Optimism for medium-term price appreciation.

Factors Influencing BTC's Price

New York City Establishes Office of Digital Assets and Blockchain

New York City Mayor Eric Adams has signed Executive Order 57, creating the city's first Office of Digital Assets and Blockchain. The move solidifies New York's position as a hub for cryptocurrency and blockchain innovation, with a focus on financial inclusion and regulatory oversight.

The office will operate under Chief Technology Officer Matthew Fraser, with Moises Rendon, a blockchain policy expert, serving as executive director. Collaboration with industry leaders and regulators aims to strike a balance between technological advancement and consumer protection.

"New York has always been the center of innovation," Adams stated. The initiative is designed to modernize city governance while expanding economic opportunities for underbanked communities. First Deputy Mayor Randy Mastro highlighted the city's commitment to staying ahead of emerging economic trends.

Bitcoin Recovers From Flash Crash as Institutional Demand Returns

Bitcoin's price volatility continues to dominate market discussions following a dramatic October 10 flash crash that wiped out $30 billion in leveraged positions. The sell-off coincided with geopolitical tensions as former President Trump threatened China with 100% tariffs, sparking risk-off sentiment across markets.

The cryptocurrency found support at lower levels as institutional buyers returned to spot markets. By October 13, Bitcoin had nearly erased its losses, climbing back to $115,000 before settling at $110,712 - still down 4% from the recovery peak and 8.7% from pre-crash levels.

Market observers note strengthening fundamentals beneath the price action. CryptoQuant reports stablecoin liquidity growth of $14.9 billion over 60 days, while whale accumulation signals continued institutional interest. The resurgence of ETF demand and corporate buying provides a bullish counterpoint to short-term technical weakness.

Bitcoin Retreats from $126K Peak Amid $19B Futures Liquidation and Trade Tensions

Bitcoin's meteoric rise to a record $126,000 abruptly reversed as $19 billion in futures positions were liquidated, triggering a market-wide deleveraging event. The sell-off intensified after prices failed to hold above the critical $114,000-$117,000 supply zone, with escalating U.S.-China trade disputes exacerbating downward pressure.

Long-term holders accelerated profit-taking, further stifling recovery prospects. Spot Bitcoin ETF inflows—a key demand indicator—showed signs of weakening, reflecting growing investor caution. The cryptocurrency now hovers near the $108,000-$117,000 range, a historically fragile band where over 5% of circulating supply sits at a loss.

Glassnode data reveals this marks the third breach below Bitcoin's 0.95-quantile model price ($117,100) since August—a threshold whose violation has previously preceded extended consolidation periods. Should the downturn persist, analysts warn of potential retracement toward $108,000, testing the resolve of late entrants.

BlackRock’s Bitcoin ETF Sees Record $2.63B Inflow Amid Institutional Frenzy

BlackRock's iShares Bitcoin Trust (IBIT) has cemented its dominance in the crypto ETF space with a historic $2.63 billion quarterly inflow in Q3 2025. The surge coincides with Bitcoin's rally to $126,000, underscoring growing institutional acceptance of digital assets as a treasury reserve asset.

The fund now holds $93 billion in AUM, representing 3.8% of Bitcoin's total supply. Institutional investors are flocking to regulated vehicles like IBIT for their custodial safeguards and operational simplicity compared to direct crypto custody solutions.

This milestone reflects a broader paradigm shift in global finance. Traditional asset managers are increasingly bridging the gap between conventional markets and digital assets, with BlackRock emerging as a key architect of this convergence.

Bitcoin Demand Pattern Signals Potential Price Pullback

Bitcoin's demand cycle is flashing warning signs as historical data suggests a looming price correction. CryptoQuant analytics reveal a recurring pattern where demand spikes are followed by periods of cooling interest and downward pressure—a trend observable since 2013.

The current rejection at $115,000 and fading inflows into Bitcoin ETFs hint at a test of the $107,000 support level. Market analyst Crypto Rover's 30-day demand chart underscores this volatility, with green surges inevitably giving way to red retreats.

While the $111,581.69 price point remains a short-term focus, the market's rhythm of euphoria and exhaustion persists. As one trader noted, 'Bitcoin's heartbeat has always been irregular—but its pulse keeps strengthening long-term.'

UK Considers Repaying Chinese Victims of $7 Billion Bitcoin Fraud

Zhimin Qian, a Chinese national, orchestrated a fraudulent investment scheme that defrauded over 128,000 individuals in China between 2014 and 2017, amassing $6.8 billion. The stolen funds were converted into Bitcoin, which Qian attempted to launder before fleeing to the UK with false documentation.

The Metropolitan Police seized the Bitcoin stash between 2018 and 2021. Now, UK prosecutors are debating whether to create a victim compensation scheme, potentially returning the funds to those defrauded. However, experts caution that the UK government may still retain a portion of the seized assets.

The case highlights the growing intersection of cryptocurrency and large-scale fraud, with governments grappling over how to handle seized digital assets. Germany's recent sale of seized Bitcoin underscores the complexities of such decisions.

Bitcoin Holds Near $110K as ETF Demand and On-Chain Dynamics Dictate Market Sentiment

Bitcoin's price flirted with the $110,000 level as institutional demand through spot ETFs and key support zones dominated trader focus. BlackRock's IBIT fund now nears $100 billion in assets under management—equivalent to roughly 799,000 BTC—highlighting the growing concentration of supply among institutional players.

U.S. spot ETFs recorded $102 million in net inflows yesterday, marking just two days of outflows in the past ten sessions. This pattern underscores how sustained flow clusters, rather than isolated transactions, drive durable market trends. Academic research on exchange-traded products suggests price movements often precede fund flows, creating a reflexive feedback loop that amplifies momentum—a dynamic evident in recent rallies fueled by billion-dollar inflow days.

On-chain metrics reveal distribution into strength, with mid-tier accumulation accelerating during October's upward push. Long-term holders increasingly spent coins at new highs, a characteristic late-stage impulse behavior, while ETF inflows absorbed the selling pressure. The $107,000-$109,000 band now serves as dense realized support, though a breakdown could expose the $93,000-$95,000 range.

Overhead resistance looms between $114,000-$117,000 where profit-taking has repeatedly stalled advances. Derivatives markets add further nuance to the technical landscape as Bitcoin tests the upper bounds of its current trading range.

Bitcoin's Volatility Sparks Debate as Gold Gains Traction

Bitcoin's recent price plunge has reignited criticism from economist Peter Schiff, who challenges its reputation as "digital gold." The cryptocurrency fell sharply to $110,201 on October 10 amid macroeconomic uncertainty, while gold rallied past $4,100—a divergence Schiff cites as evidence of Bitcoin's instability.

"The Friday bitcoin flash crash wasn’t a buying opportunity but a warning," Schiff declared on X. His skepticism contrasts with crypto advocates who view dips as entry points, highlighting the ideological divide between traditional and digital asset investors.

Gold's steady ascent during market turmoil reinforces its status as a haven, casting doubt on Bitcoin's ability to serve a similar role. The debate underscores broader questions about cryptocurrency maturity during periods of geopolitical stress.

Bitcoin Builds Bullish Double Bottom Pattern, Eyes $150K Breakout

Bitcoin is carving out a potential double bottom pattern on the 4-hour chart, signaling a possible reversal toward $150,000 if key resistance at $116,000 gives way. Analyst Trader Tardigrade notes the formation of a higher low—a classic bullish setup resembling a "W" shape—as BTC consolidates between $109,000 and $123,000.

The cryptocurrency remains anchored within a long-term ascending channel dating back to 2015. Historical rebounds from this channel's lower boundary have preceded major rallies, with the current structure suggesting institutional accumulation. A decisive close above the neckline could trigger algorithmic buying pressure, propelling Bitcoin toward the $125,000–$150,000 range.

Bitcoin's Record Rally Stumbles Amid $19B Futures Deleveraging

Bitcoin's surge to $126.1k faltered under macroeconomic pressures and a historic $19 billion futures deleveraging event, marking one of the largest leverage resets in market history. The reversal below the $117k–$114k cost-basis zone exposed fragility among top buyers, with on-chain data revealing sustained distribution by Long-Term Holders since July.

ETF inflows declined by 2.3k BTC this week, signaling waning institutional demand. While Binance drove spot market sell-offs, Coinbase saw offsetting buying activity. Futures markets collapsed to multi-month lows in Estimated Leverage Ratio, with funding rates suggesting a cautious reset phase.

Can Bitcoin (BTC USD) Price Reclaim $120k Amid Elon Musk Backing?

Bitcoin hovered near a multi-week low as Elon Musk's endorsement clashed with IMF warnings. The cryptocurrency traded around $112,000, down 0.44% on the day and 7.63% for the week, still below its all-time high of $126,198.

Musk called Bitcoin "energy-based" and "inflation-proof" in a public post, marking his strongest support in years. His comments contrasted Bitcoin with fiat currencies, which he noted governments can expand at will. This intervention stabilized BTC sentiment after repeated tests of the $110K-$115K range.

The IMF struck a cautious tone in its latest market assessment, flagging complacency amid trade tensions, debt burdens, and stretched valuations. The fund specifically called for tighter regulation of digital assets, including stablecoins, while urging fiscal restraint.

How High Will BTC Price Go?

Based on current technical indicators and market developments, BTCC financial analyst Michael projects Bitcoin could reach $150,000 in the medium term. The bullish double bottom pattern, combined with strong institutional ETF inflows and improving regulatory clarity, creates favorable conditions for upward movement. However, Michael cautions that volatility from futures market deleveraging and trade tensions could create temporary setbacks.

| Price Level | Probability | Key Drivers |

|---|---|---|

| $120,000 | High | ETF demand, technical rebound |

| $135,000 | Medium | Institutional accumulation, pattern completion |

| $150,000 | Medium-Low | Macro adoption, regulatory clarity |