Gold is eroding Bitcoin's market share. Since its August high, Bitcoin's price in gold has fallen 32%. This Bitcoin bear market will be brutal. Holders are advised to sell their Bitcoin and buy gold. This warning, issued on social media by cryptocurrency critic Peter Schiff, is particularly harsh in the current volatile market.

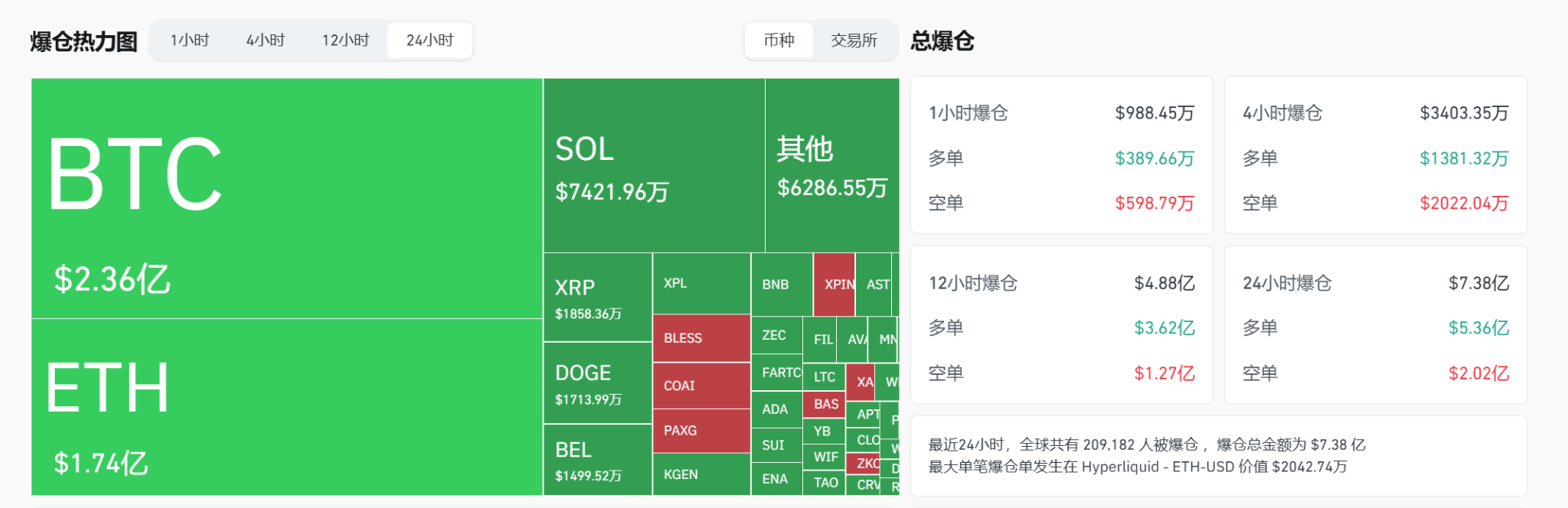

In the early morning hours of October 18th, the cryptocurrency market experienced a period of dramatic volatility, with Bitcoin prices plummeting to as low as $108,000 and Ethereum dropping to a low of $3,826. According to Coinglass data, during this plunge, the total amount of liquidated positions across the network reached $734 million over the past 24 hours, including $536 million in long positions and $198 million in short positions. Meanwhile, the price of gold broke through $3,370 per ounce, setting a new all-time high. This starkly contrasting performance is prompting a profound rethinking of the "digital gold" narrative: What kind of symbiotic or competitive relationship exists between Bitcoin and gold?

Market Performance: Gold Shines, Bitcoin Fades

Data as of October 18th showed that Bitcoin's return rate in October this year was temporarily recorded at -4.95%, which is in stark contrast to the historical average return rate of +20% in October.

Historically, Bitcoin has typically seen an uptick in October – a trend that has occurred in nine of the past ten years, earning it the nickname “Uptober.”

The gold market presents a different picture. Since 2025, gold prices have performed strongly. As of early October, gold led major global assets with a year-to-date return of 53.1%, significantly exceeding Bitcoin's 31.1%. Bank of America Global Research pointed out in its asset flow report in early October that institutional allocations to gold remain low - private client holdings account for only 0.5% of assets under management (AUM), and institutional client holdings account for only 2.3%.

This means that gold still has room to rise further.

Historically, the five gold bull markets since 1970 have seen an average gain of 293% and lasted an average of 43 months. If this trend continues, Bank of America predicts gold could peak at $6,000 per ounce in the spring of 2026.

Bitcoin's roller coaster ride: From all-time highs to a sharp pullback

Looking back at Bitcoin’s recent market performance, it can be said that it has experienced a roller coaster ride.

On October 5th, the price of Bitcoin surged to $125,689, breaking through its previous high and setting a new all-time record. This surge was primarily driven by factors such as the influx of funds into Bitcoin spot ETFs, Trump's support for cryptocurrencies, and the Federal Reserve's interest rate cuts.

On September 18, Beijing time, the Federal Reserve announced a 25 basis point interest rate cut, lowering the target range of the federal funds rate to 4%-4.25%. This is considered an important sign that the global liquidity easing cycle has officially started, and has further triggered turbulence in global financial markets.

Then, on October 1st, local time, the US federal government shut down due to a lack of funds, marking the first federal government shutdown in nearly seven years. This event catalyzed the spread of "downtrading," with investors seeking alternative stores of value. After Bitcoin hit a record high, the market took a sharp turn for the worse.

On October 8, the price of Bitcoin fell back to around $122,000, and then fell further until it hit a low of $108,000 in the early morning of October 18.

This violent volatility caused a large number of traders to suffer losses. According to Coinglass data, a total of 209,637 people worldwide had their positions liquidated in the past 24 hours. The largest single liquidation occurred in Hyperliquid - ETH-USD, with a value of up to US$20.4274 million.

Gold and Bitcoin: Historical Patterns of Lagged Correlation

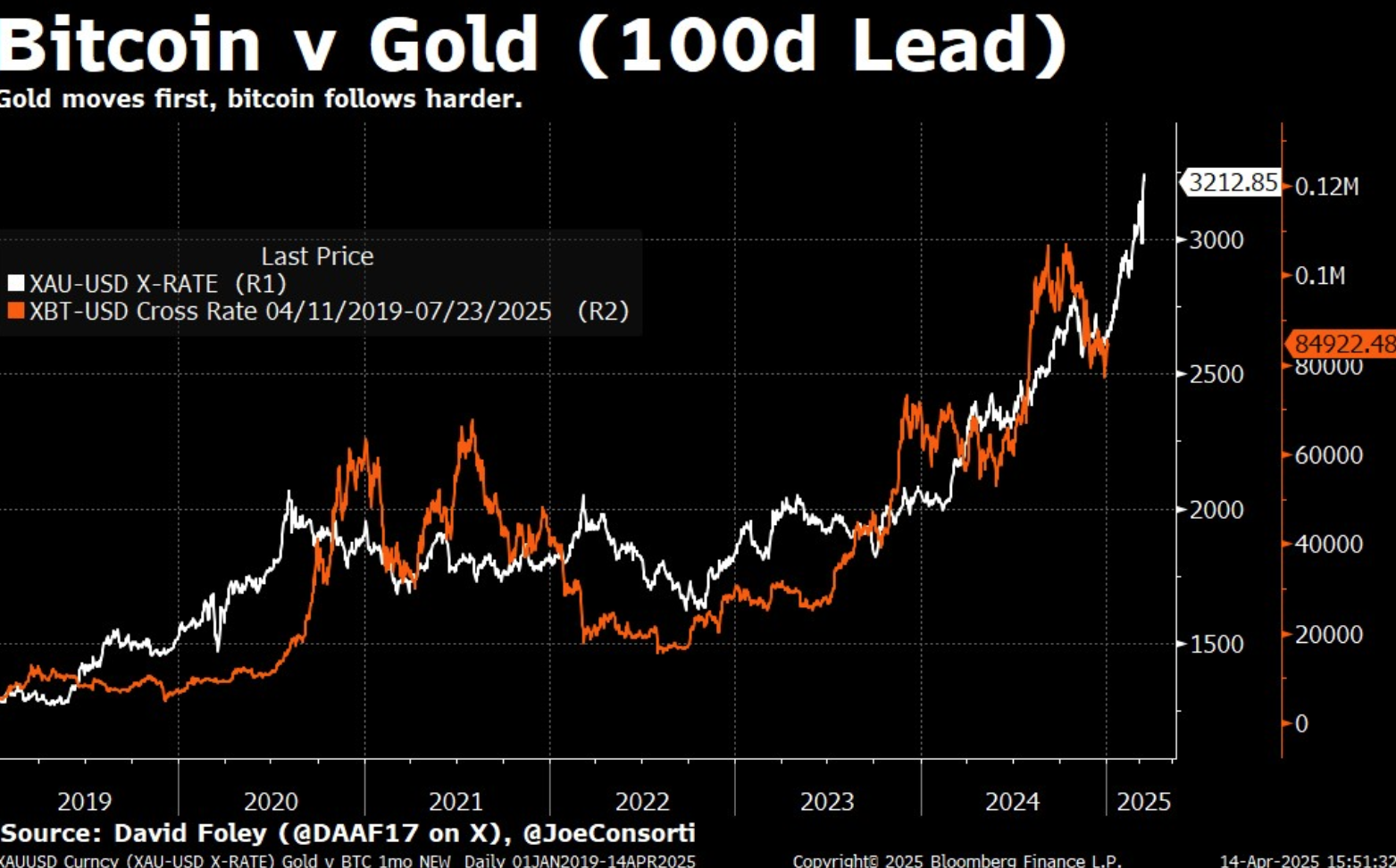

Despite the divergence in short-term performance, historical data reveals an interesting phenomenon: there is a significant lagged correlation between gold and Bitcoin.

Whenever gold hits a new high, Bitcoin usually follows and breaks through the previous high within 100-150 days.

Looking back at history, after gold rose 30% in 2017, Bitcoin hit its historical peak of $19,120 in December of the same year; after gold broke through $2,075 in 2020, Bitcoin rose to $69,000 in November 2021.

This correlation stems from the complementary roles of the two in times of economic uncertainty: gold, as a traditional safe-haven asset, is usually the first to reflect inflation expectations and monetary easing signals; while Bitcoin, due to its rigid supply and decentralized nature, has become a latecomer in the "digital gold" narrative.

Joe Consorti, head of growth at Theya, noted that Bitcoin’s lag behind gold’s trend is related to its market maturity—institutional investors need longer to complete the allocation transition from traditional assets to crypto assets.

Currently, the surge in gold prices resonates with the uncertainty of Federal Reserve policy, which may indicate that Bitcoin is expected to rebound in the coming months.

Market Divide: Critics vs. Advocates

In light of Bitcoin's recent weakness, renowned cryptocurrency critic Peter Schiff's views have rekindled market attention. Schiff noted, "Since its August high, Bitcoin has fallen 32% in gold terms. This Bitcoin bear market will be brutal. I recommend Bitcoin holders sell their Bitcoin and buy gold." He has long been skeptical of Bitcoin's "digital gold" narrative, arguing that it's not just "digital gold," but even "digital silver."

Schiff's views reflect those of a conservative group of investors in the market, who favor traditional safe-haven assets like gold. Data supporting this view shows that the market capitalization of gold ETFs has surpassed the collective size of US spot Bitcoin ETFs. However, Bitcoin bulls offer a different perspective.

Bloomberg analyst Eric Balchunas believes that although gold ETFs have regained their lead in the short term, he still insists that "in the long run, BTC ETFs will grow three times as fast as gold ETFs."

This view reflects Bitcoin's growth potential as an emerging asset class. Citigroup last week updated its Bitcoin price forecast, predicting it will reach $132,000 by the end of the year and $181,000 within the next 12 months. JPMorgan Chase and Global X are even more bullish, predicting Bitcoin could reach $165,000 and $200,000, respectively.

Future Outlook: Symbiosis and Prosperity of Gold and Bitcoin

Despite Bitcoin's short-term weakness, from a medium- to long-term perspective, gold and Bitcoin are not simply substitutes, but rather complementary. Bitcoin's status as a growth asset means it may outperform gold in trading during periods of heightened risk aversion or a reversal of risk appetite. If risk aversion deepens, its currency-alternative properties will have greater potential to flourish, theoretically allowing Bitcoin's price to rise further than gold's.

Based on market trading depth, Bitcoin's trading properties outperform gold. This means that if risk aversion deepens, its currency-like properties will have greater scope for further development, and Bitcoin's price potential could theoretically exceed that of gold. Conversely, if financial volatility subsides and risk appetite reverses, downward pressure on Bitcoin's price could also be more pronounced. Regarding future investment strategies, the Bank of America strategy team recommends that investors allocate to US dollars and zero-coupon bonds for short-term hedging to mitigate the potential impact of the "spread of subprime consumer lending risks." For long-term allocations, investors should focus on "anti-currency devaluation" assets such as gold and industrial metals, as well as low-cash flow tech stocks related to the AI industry chain. Meanwhile, investors should avoid interest rate-sensitive cyclical stocks and crude oil-related assets. The market is closely monitoring upcoming economic data and policy developments.