Ondo Finance urged the US Securities and Exchange Commission (SEC) to delay or reject Nasdaq’s proposal to trade tokenized securities, saying it lacks transparency and could give established market players an unfair edge.

In a Wednesday letter to the regulator, Ondo — a blockchain company that issues tokenized versions of traditional assets — said regulators and investors can’t fairly evaluate Nasdaq’s proposal without public details on how the Depository Trust Company (DTC) will handle blockchain settlements. DTC serves as the main depository for US securities and facilitates their post-trade settlement.

While acknowledging support of Nasdaq’s move toward tokenization, Ondo warned that “Nasdaq’s reference to non-public information implies differential access that deprives other firms of a fair opportunity to comment.”

The company also noted that Nasdaq’s rule cannot take effect until DTC finalizes its system, saying there’s no harm in delaying approval until more features are released. It called on the SEC to prioritize “open collaboration and transparent standards” before making a final decision.

Ondo’s letter responds to Nasdaq’s Sept. 8 filing with the SEC, in which the world’s second-largest stock exchange sought to amend its rules to allow trading in tokenized securities.

Tokenized shares are digital versions of traditional stocks recorded on a blockchain.

If approved, the proposal would let tokenized shares trade alongside traditional ones, with settlements processed through the DTC’s forthcoming system for tokenized securities.

Nasdaq’s proposal was published in the Federal Register on Sept. 22, starting the SEC’s 45-day review period, which runs until early November or late December if extended.

Related: $250M Ondo Catalyst fund signals ‘arms race’ for RWA tokenization

The push for tokenized stocks

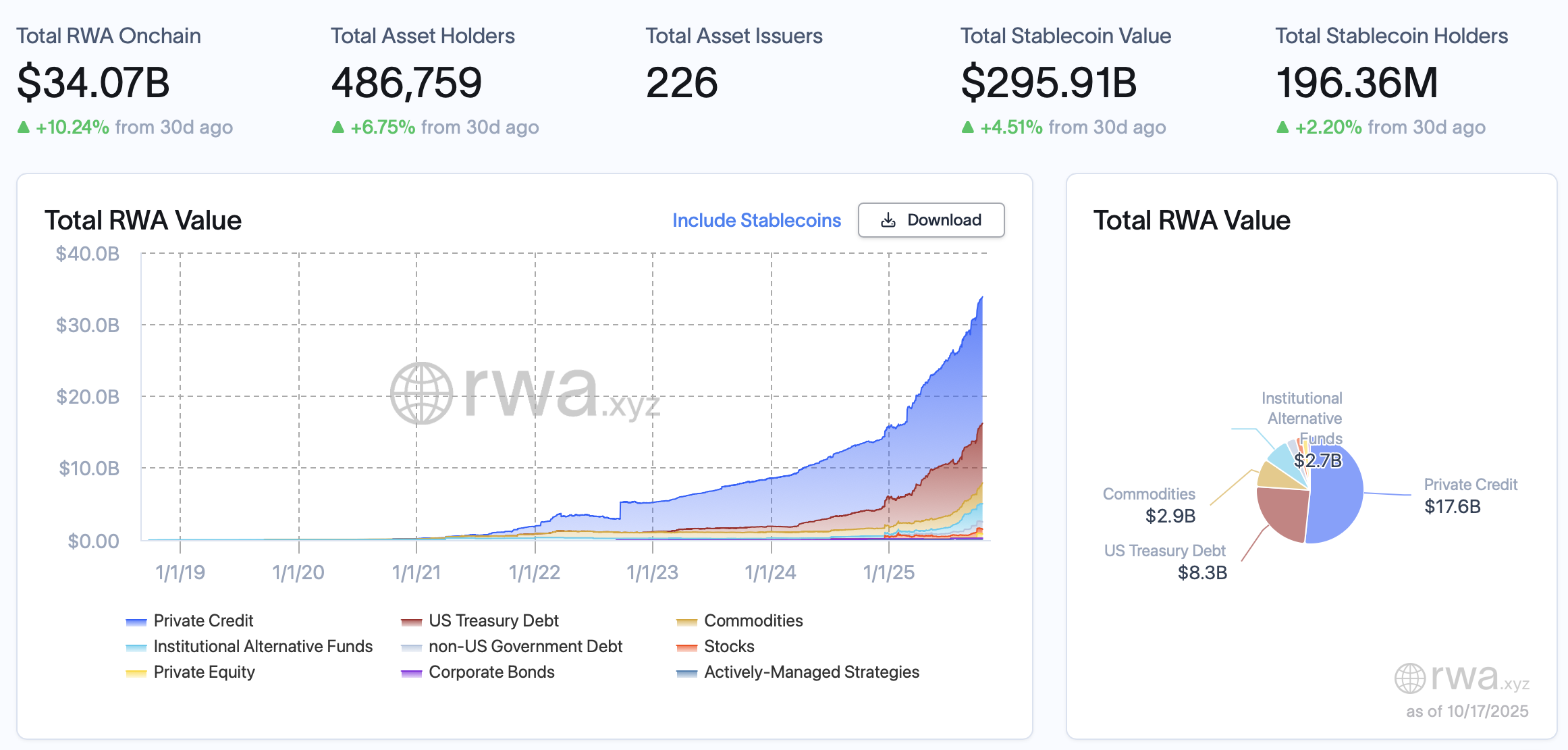

The ongoing debate about the tokenization of Nasdaq stocks is happening while several platforms have already listed or are planning to list tokenized versions of US equities.

On June 30, Robinhood launched a layer-2 blockchain to support trading tokenized US stocks and ETFs for European users. The platform said it would list over 200 US equities and funds as onchain tokens.

Trading platform eToro also announced plans to launch tokenized stocks as ERC-20 tokens on Ethereum. The company said the rollout will include 100 popular US-listed stocks and ETFs, available to trade 24/5.

Kraken is also following the trend. The crypto exchange launched a tokenized securities platform in September, making tokenized shares available to eligible customers in Europe.

Galaxy Digital warned that the ongoing tokenization push could threaten the New York Stock Exchange’s dominance, saying in July that it challenges the liquidity of traditional markets.

Magazine: Robinhood’s tokenized stocks have stirred up a legal hornet’s nest