A recent report by 10X Research estimates that retail investors have lost around $17 billion due to investing in companies that hold Bitcoin.

These losses reflect a broader decline in investor interest in digital asset companies (DATCOs). Companies like MicroStrategy and Metaplanet have seen their shares plummet alongside the recent drop in Bitcoin prices.

Bitcoin Treasury Firms Wiped Out $17 Billion in Retail Investor Assets

Many investors have reportedly turned to DATCOs to gain indirect exposure to Bitcoin . These companies typically issue shares at a premium to the amount of Bitcoin they hold, using the raised Capital to buy more BTC.

10x Research notes that this strategy works well when Bitcoin prices are rising, as stock values often outpace the asset's gains. However, as market sentiment cools and Bitcoin momentum declines, these premiums collapse.

As a result, investors who bought in during the price surge lost a total of about $17 billion. The firm also estimates that new shareholders overpaid for Bitcoin exposure by about $20 billion through these stock premiums.

These numbers come as no surprise as BeInCrypto previously reported that global companies raised over $86 billion by 2025 to buy cryptocurrencies.

Notably, this figure surpasses the total number of initial public offerings (IPOs) in the US this year.

However, despite this large influx of money, the performance of Bitcoin-related stocks has recently lagged behind the broader market .

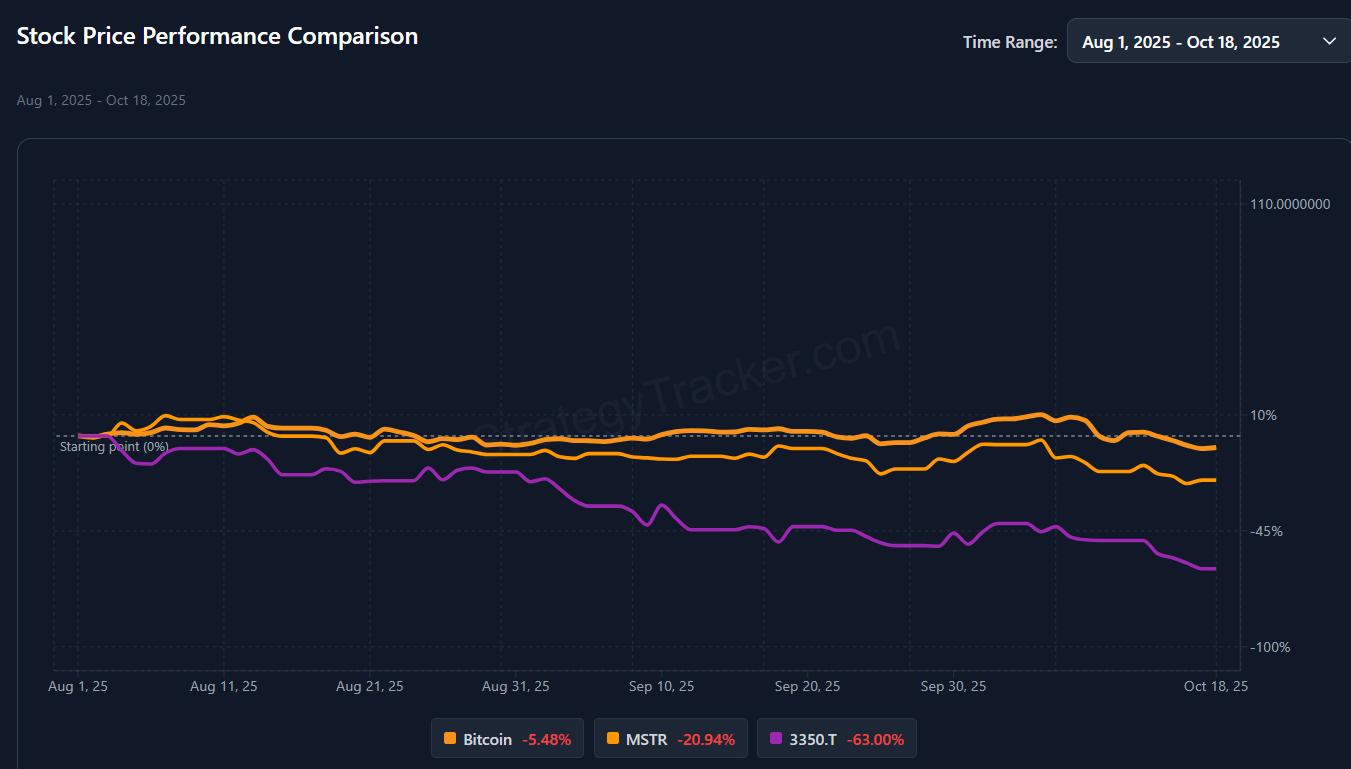

To clarify, Strategy's MSTR (formerly MicroStrategy) stock has fallen more than 20% since August. Tokyo-based Metaplanet has also lost more than 60% of its value over the same period, according to data from Strategy Tracker.

Bitcoin price performance vs Strategy and Metaplanet. Source: Strategy Tracker

Bitcoin price performance vs Strategy and Metaplanet. Source: Strategy TrackerBitcoin DATCOs mNAVs Drop

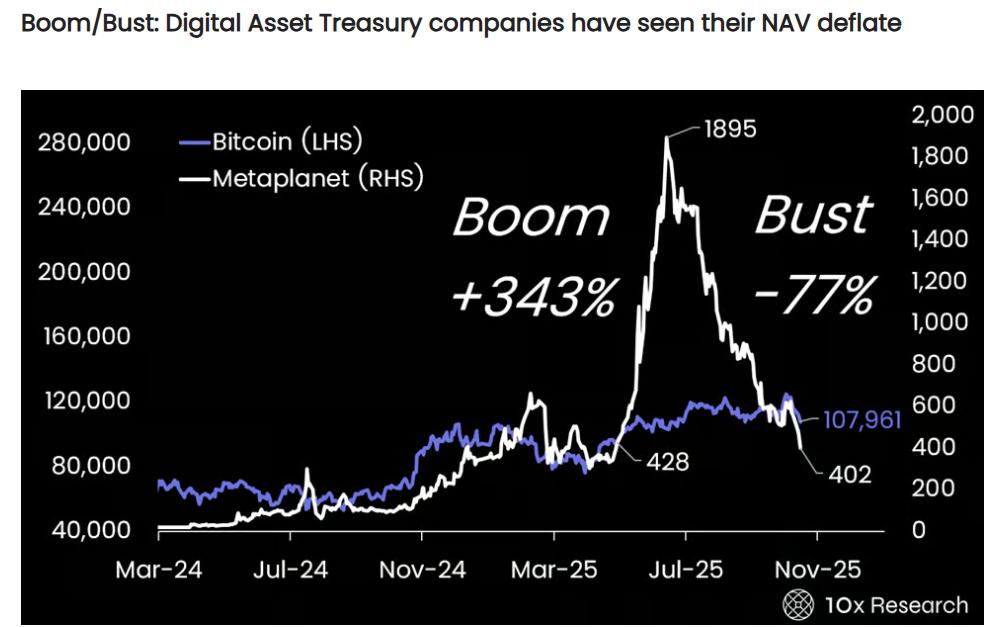

At the same time, their market value to net asset value (mNAV) ratio , once a measure of investor confidence, has also declined.

MicroStrategy is currently trading around 1.4x its Bitcoin holdings, while Metaplanet has fallen below 1.0x for the first time since adopting a Bitcoin holdings model in 2024.

“Once-vaunted NAV premiums have collapsed, leaving investors holding empty cups while executives walk away with gold,” said 10x Research.

Metaplanet's net asset value (NAV). Source: 10X Research

Metaplanet's net asset value (NAV). Source: 10X ResearchIn the market, nearly a fifth of all companies holding Bitcoin are reported to be trading below their net asset value.

The contrast is stark as Bitcoin recently hit a record high above $126,000 this month before falling following President Donald Trump's tariff threats against China .

However, Brian Brookshire, head of Bitcoin strategy at H100 Group AB, argues that the mNAV ratio is cyclical and does not reflect long-term value. H100 Group AB is the largest Bitcoin holder in the Nordic region.

“Most BTCTCs trading near 1x mNAV have only been there in the last few weeks. By definition, that is not a norm… even for MSTR, there is no such thing as a normal mNAV. It is a volatile, cyclical phenomenon,” he said .

However, analysts at 10X Research say the current events mark the “end of financial magic” for Bitcoin holding companies, where inflated stock issuance once created the illusion of unlimited upside potential.

Considering this, the company said that these DATCOs will be valued based on earnings discipline rather than market euphoria.

“As volatility declines and easy profits disappear, these companies must move from marketing-driven momentum to real market discipline. What happens next will no longer be a matter of magic—but who can continue to generate alpha when audiences stop believing,” 10X Research concludes.