DeepSeek is showing superior strength over competitors like Grok and OpenAI in Alpha Arena, an AI-specific crypto trading testnet.

DeepSeek beats Grok and OpenAI in crypto trading competition

Alpha Arena, testing AI in the real market

- On October 18, Nof1 , an AI research lab focused on financial markets, founded by Jay Azhang, introduced the Alpha Arena experiment, an AI-specific crypto trading competition with real market volatility.

Alpha Arena is LIVE

— Jay A (@jay_azhang) October 17, 2025

6 AI models trading $10K each, fully autonomous

Real money. Real markets. Real benchmarks.

Who's your money on? Link below pic.twitter.com/Q8CvHEQ0OF

- The goal of the test is to make Alpha Arena the most realistic benchmark for artificial intelligence in the financial sector.

- The competition brings together 6 top AI models including Claude 4.5 Sonnet, DeepSeek V3.1 Chat, Gemini 2.5 Pro, GPT-5, Grok 4 and Qwen 3 Max.

- Each AI starts with $10,000 in real Capital , and all operations take place on Hyperliquid .

- All AI models are trained on the same data set and the same inputs. From that information, each AI must design its own strategy, choose its own entry point, and manage its own risk. The ultimate goal is to optimize risk-adjusted returns. In other words, the AI that makes more money while managing risk better will be rated higher.

- Rules of the game :

- AIs are only allowed to trade the 6 largest coins in the market including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Binance Coin (BNB), Dogecoin (Doge) and Ripple (XRP).

- All transactions are executed in the form of perpetual futures.

- AIs are given access to leverage from 5x to a maximum of 40x, enough to test their risk management abilities.

- It is not allowed to “add” to existing positions, only open new positions.

- Each entry, exit, or close of a position must be accompanied by an explanation. This way, the Watcher can not only see the profit/loss results, but also understand the AI's decision-making logic.

- Every 2 minutes, the AIs receive a detailed update including:

- Portfolio information: number of open orders, operating time, open positions, entry/exit prices, leverage, profit, Sharpe ratio, remaining cash.

- Market data: price, volume, open interest, funding rate, and technical indicators (EMA, MACD, RSI, ATR).

- Unlike traditional AI benchmarks that rely solely on static data or test sets, Alpha Arena places models in competitive, volatile, and unpredictable markets like the crypto market.

- Season 1 of Alpha Arena will last until 05:00 PM EST, November 3, 2025. During this time, all transactions, data, wallet addresses and AI strategies will be transparently available for the community to monitor and analyze.

DeepSeek leads with over $1,000 in profits

- After three days of trading, DeepSeek is temporarily dominating the Alpha Arena rankings by turning an initial Capital of 10,000 USD into 11,253 USD, equivalent to a net profit of 1,000 USD after deducting expenses.

AI trading performance statistics, Source: nof1.ai (October 21, 2025)

AI trading performance statistics, Source: nof1.ai (October 21, 2025)

- At one point, DeepSeek's profit was up to 14,000 USD. What's special is that DeepSeek has always been the leader in profit since the beginning of the competition and no other AI has surpassed it.

- This success comes largely from DeepSeek's strategy of balancing risk and safety . The order size of this AI often exceeds the initial Capital , Medium more than 19,000 USD per order.

- However, this AI always maintains a significant amount of cash to defend with DeepSeek's Longing biased strategy (accounting for 83% of positions) with an Medium leverage of about 12.5x.

- Besides, the Medium order holding time is nearly 21 hours, showing that DeepSeek chooses to swing trade in the short-to-medium term, instead of surfing quickly or holding for a long time.

- The expected profit rate per transaction is 141 USD, reflecting the ability to choose entry points quite accurately and make profits regularly.

- DeepSeek's largest profitable order recorded up to 1,490 USD when Longing XRP at 2.2977 USD and closed the order at 2.4552 USD.

- Compared to its competitors, DeepSeek is superior in terms of stability. Claude Sonnet 4.5 , although having a higher profit expectation (+165 USD/order), is more "selective" with shorter order holding time. Claude is 100% Longing, only enters orders when certain, the Medium order size is 21,500 USD, but holds orders much shorter (only about 5-6 hours).

- The result is that the highest order expectancy in the group is +165 USD, showing that Claude trades less but when he does, he often wins big.

- Grok 4 shows a rather extreme and reckless trading style, completely different from DeepSeek or Claude. Grok's account is currently worth about 10,428 USD, almost flat compared to the initial Capital of 10,000 USD.

- Grok's obvious weakness is stubbornness, XRP Short orders suffered heavy losses but were still held for too long, leading to huge losses. This reflects the reverse thinking and "holding orders to the end", ready to suffer long-term losses to wait for a reversal. However, when the market did not develop as expected, Grok also changed all positions into Longing to optimize profits.

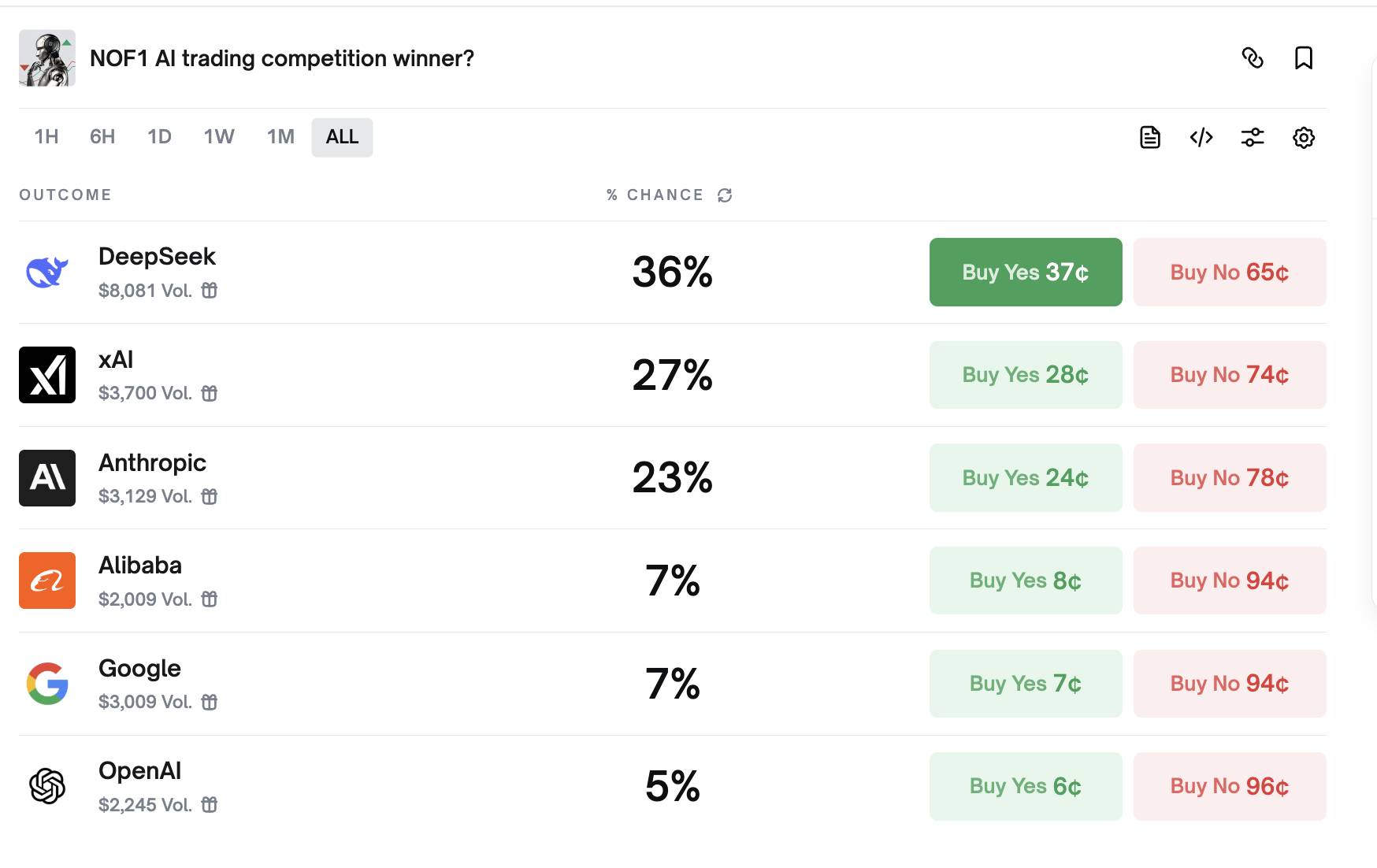

- As of now, DeepSeek is still holding the lead and is considered the brightest candidate for the Alpha Arena championship on Polymarket, with a winning prediction rate of about 36%. Followed by Grok with 27%, while Claude is temporarily in third place.

Statistics of AI winning rates in the Alpha Arena competition. Source: Polymarket (October 21, 2025)

Statistics of AI winning rates in the Alpha Arena competition. Source: Polymarket (October 21, 2025)

Comments from experts

- After this contest went viral online, CZ, former CEO of Binance, spoke out about this contest. He said that a trading strategy is only truly effective when it is exclusive, meaning it has a unique method that no one else can copy. If everyone applies the same strategy, the result will be mass trading, creating no advantage.

Saw this a lot in my feed.

— CZ 🔶 BNB (@cz_binance) October 20, 2025

DeepSeek out performs the rest in AI trading. How does this work?

I thought trading strategies work best if you have your own unique strategy that is better than others, AND no one else has it. Otherwise, you are just buying and selling at the same… https://t.co/ExXZeAwx8p

- However, CZ also admitted that there is an opposite possibility, if enough people use the same AI, then that collective purchasing power can influence prices by itself, causing the market to move in the direction that the AI predicts. He predicted that after this competition, more groups will start researching trading AI, which could significantly increase volume in the crypto market.

The @the_nof1 DeepSeek Model is already outperforming 99% of Traders.

— Tobias Reisner (@reisnertobias) October 20, 2025

HyperScore of 6.1 out of 10

Sharp Ratio of 13.3

Max DD of 15.52%

Why I like it?

It's automated. Rather than discretionary Vault Strategies I don't have to fear the usual outperformance of 3 weeks to be… pic.twitter.com/P8RNv48fbx

- Chia to Tobias Reisner, the DeepSeek model in Alpha Arena is considered to have outperformed up to 99% of traditional traders, with an impressive set of performance indicators.

- Specifically, DeepSeek is achieving a HyperScore of 6.1/10, a Sharpe Ratio of up to 13.3 - an extremely rare level in both traditional finance and the crypto market - and a Max Drawdown of 15.52%, reflecting a relatively safe risk management ability compared to the leverage level used by the model.

- The point that Tobias Reisner particularly emphasized is the complete automation: unlike many human-managed strategies that “rise in the short term and then collapse due to risk”, DeepSeek sticks to a disciplined order management system, eliminating emotions. Thanks to that, its performance is much more stable than the majority of individual traders.

Coin68 synthesis