Berachain itself, with its Proof of Liquidity (PoL) model, has established a new growth path for the ecosystem. Based on this mechanism, liquidity is becoming a core method for participating in network security, governance, and incentive distribution. The PoL mechanism successfully shifts capital from short-term arbitrage to long-term ecosystem development, forming a productive liquidity foundation with sustainable output.

Building on this foundation, Berachain recently officially launched its native lending marketplace, BEND. Built on a licensed fork of Morpho, the protocol supports capital redeployment for a range of core assets, including HONEY, wBERA, wETH, and wBTC. This allows these assets, previously limited to single incentive scenarios, to natively expand capital efficiency.

The launch of the BEND functional module not only opens up leverage space for capital efficiency, but also lays the foundation for the expansion of strategy protocols, yield aggregators and stablecoin tools. It is expected to become an important starting point for promoting the ecosystem to enter the path of compound growth.

What is BEND?

BEND is the native over-collateralized lending protocol launched by Berachain. It aims to build a redistribution and recycling layer for the ecosystem, enabling the liquidity activated by PoL to have a higher frequency and higher efficiency circulation foundation within the ecosystem, and further support the construction of compound interest strategies and more complex financial structures.

Focusing on BEND, it adopts the Morpho authorized fork solution, combined with the hybrid mechanism of "peer-to-peer matching + liquidity pool replenishment".

On the one hand, the agreement can form a more reasonable interest rate structure based on real supply and demand.

On the other hand, pooled liquidity further reduces idle funds caused by untimely matching. This design improves capital efficiency while maintaining security and also lays a foundation for the execution of rotational strategies and structured asset portfolios.

At the same time, the Morpho framework has high scalability and mature audit records, enabling BEND to assume a more flexible financial infrastructure role in its subsequent evolution.

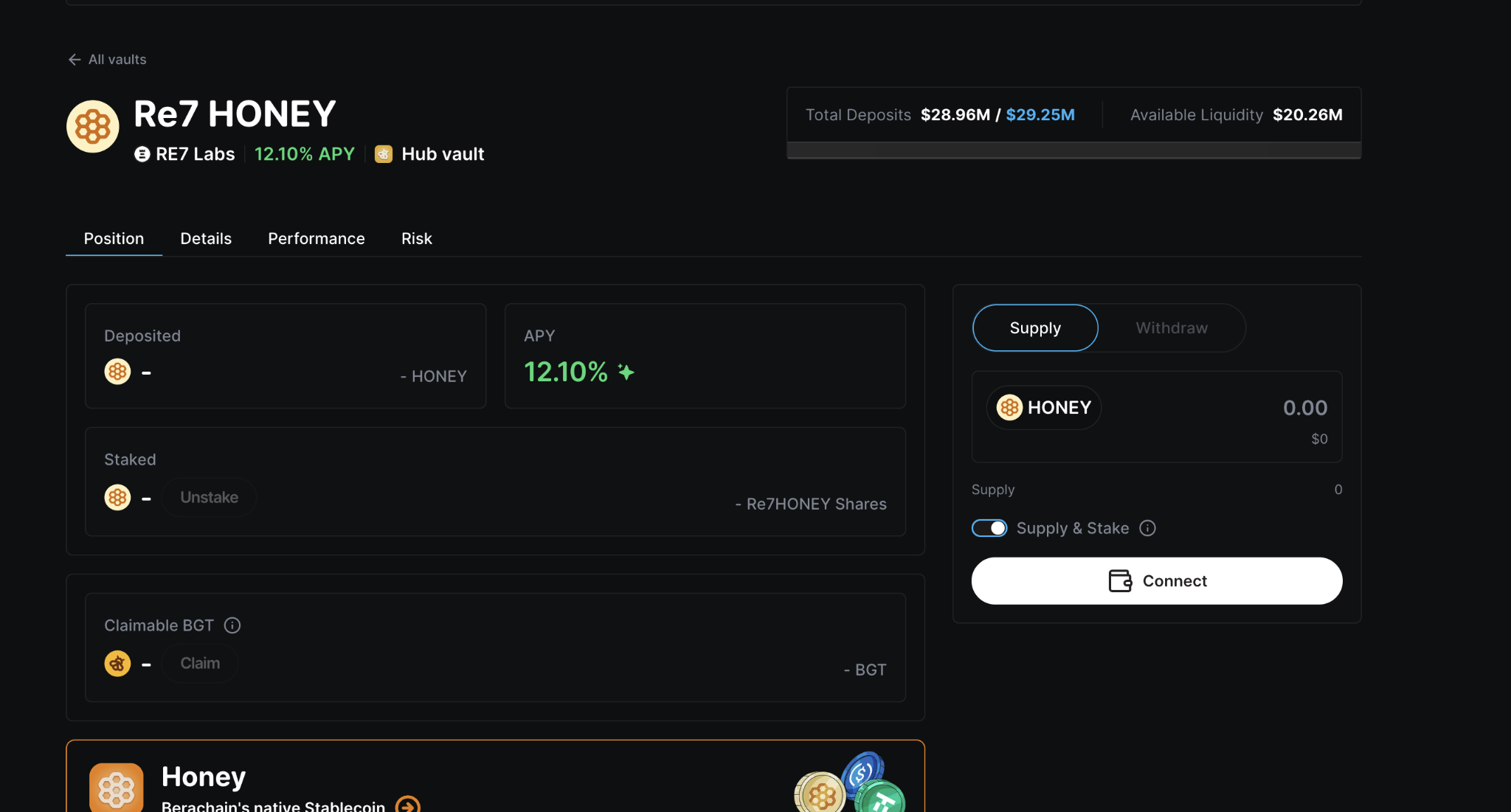

BEND currently utilizes a curated market mechanism, with Re7 Labs, a leading institution-level risk management firm, responsible for the design and operation of the initial vaults, including collateral scope, parameter setting, and liquidation model tuning. This gradual opening approach, while maintaining manageable boundaries, allows the protocol to maintain a stable risk structure in its early stages and establish a standardized system that can be leveraged for subsequent market expansion.

Based on its unique protocol design, BEND itself is able to provide a capital scheduling mechanism for different participants in the ecosystem.

For asset holders

As a lending protocol, BEND itself provides a way to convert assets such as HONEY, wBERA, wETH, wBTC, etc. into native income channels or entry points for recycling strategies.

On the Lend side, BEND currently supports users to pledge HONEY into the lending pool to provide liquidity.

Focusing on HONEY, Berachain's native stablecoin, it is fully collateralized on-chain by a basket of blue-chip stablecoins and serves as the standard settlement unit for transactions, strategy compounding, and value valuation within the Berachain ecosystem. In the PoL incentive model, HONEY serves as the base return measurement asset and a key vehicle for capital participation in governance and incentive cycles.

With the development of stable income strategies and leverage structures within the ecosystem, HONEY's turnover efficiency has gradually become one of the core indicators of the quality of the ecosystem's capital circulation, and has therefore become a credit and leverage benchmark asset that lending protocols such as BEND prioritize.

Currently, the total supply of BEND HONEY is approximately $28.94 million, and borrowers can earn a dual return of Yield + BGT, with an annualized return of over 12%. This means lenders can obtain native PoL-driven returns through a stable underlying treasury without taking on excessive strategic complexity.

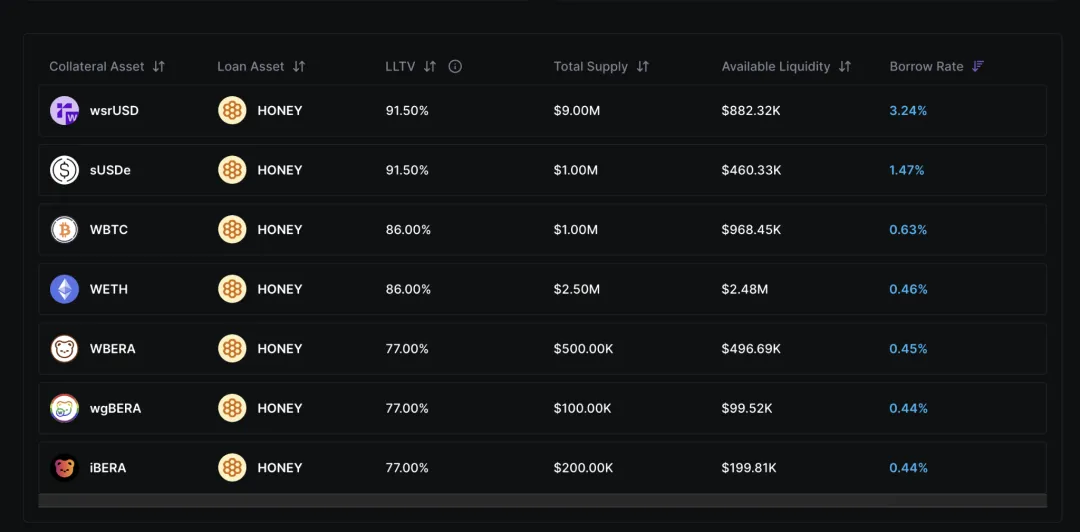

On the Borrow side, we can use assets such as wsrUSD, wETH, wBTC, wBERA, sUSDe, wsrUSD, iBERA, wgBERA, etc. as collateral to lend HONEY assets from the pool for further income.

Judging from the operational data, BEND demonstrated high capital efficiency and a friendly lending environment in the early stages of its launch. As of now, the total lending amount in the market is approximately US$8.71 million, which also means that a certain scale of capital demand has begun to form on the liquidity release side.

Currently, the protocol's borrowing rates remain relatively low, with most assets costing less than 1%. Even in the more volatile wsUSDe market, borrowing rates are only around 3%. This low-cost lending environment allows users to execute recycling strategies or release idle capital with minimal interest pressure, making it highly attractive to participants in the PoL ecosystem seeking to maximize returns.

In terms of capital utilization efficiency, BEND sets different liquidation thresholds for asset types. The LLTV of stablecoin markets such as wsrUSD/sUSDE is as high as 91.5%, which is particularly suitable for some investors to implement revolving loan strategies.

The LTV ratio for mainstream assets like WBTC and WETH is also set at around 86%. This means users can leverage their assets at a near 1:1 collateralization ratio, significantly increasing their leverage potential. Compared to the 75%-85% LTV range commonly seen in traditional lending protocols, this Morpho-based structure is more conducive to building efficient circulation strategies and enhancing liquidity retention within the ecosystem. The community sees this as a further boost to the PoL incentive flywheel.

At the same time, the protocol maintained high available liquidity during its launch phase, with loanable funds in most markets close to the total supply, ensuring borrowers have virtually no waiting time or slippage costs. This "instant lending" experience enhances BEND's compatibility with high-frequency strategies, structured yield instruments, and subsequent application integration, paving the way for the subsequent integration of more stablecoins, limited partner assets, and even strategic collateral.

With the combination of stable liquidity, low-cost leverage, and high LLTV, users can not only realize the income from idle assets, but also build a richer fund allocation path through BEND, promoting it to gradually become one of the mainstream entrances for Berachain's fund-side strategy construction.

For B-side users

In addition to targeting consumer users, the BEND product also has the potential to serve business users. Based on this lending system, BEND can serve as a capital circulator for strategy developers and DeFi module builders, enabling them to design stablecoin reserve modules, leveraged yield structures, or interest rate arbitrage paths. For DAOs, ecosystem projects, and treasury managers, it provides leveraged allocation and yield-enhancing capabilities for low-volatility assets.

Similarly, with the integration of more protocol layer modules, DEX can further improve liquidity returns by pledging LP assets, stablecoin issuers can manage reserve efficiency more flexibly, yield aggregators can build strategy portfolios based on circular lending, and even consumer applications (such as GameFi or NFT models) can obtain native funding support through BEND.

Conclusion

Focusing on the Berachain ecosystem, PoL v2 provides Berachain with an “incentive allocation mechanism for productive capital,” while BEND transforms this liquidity into a “programmable path for using funds.”

As the lending market deepens, interest rate curves gradually take shape, and the cumulative effect of strategic agreements intensifies, the ecological capital cycle is expected to gradually enter a self-reinforcing stage, and Berachain will accelerate its transition from a liquidity participation network to a strategy-driven and capital-efficiency-oriented financial system.