The gold "bull" suddenly staged a "high diving".

After breaking through its all-time high of $4,300, gold prices have plummeted over 6% in the past 24 hours, wiping out $2.1 trillion in market capitalization—more than half the total market capitalization of the entire cryptocurrency market at the time. According to TradingView data, this drop also marked the largest single-day drop since 2020.

Over the past few months, gold's rise has been driven by three main forces:

Central bank gold buying spree - According to data from the World Gold Council (WGC), central banks around the world's net gold purchases reached 483 tons in the first half of 2025, a year-on-year increase of 26%.

Geopolitical safe-haven demand - tensions in the Middle East and the expansion of the US deficit have made gold a "safe anchor".

Expectations of a weak dollar - Expectations of a Fed rate cut once pushed down real interest rates and pushed up gold prices.

However, when prices break through the psychological range too quickly, liquidity risks emerge. Some large funds choose to take profits, and the gap between retail and institutional demand widens, forming a typical "crowded trade"—when everyone is bullish, it is the prelude to a correction.

It’s worth noting that the decline in gold prices hasn’t triggered a systemic panic. Futures market data shows that open interest in COMEX gold contracts fell only 4%, and ETF holdings also remained stable, suggesting that institutional investors are viewing this as a short-term fluctuation rather than a trend reversal.

However, some speculative funds have begun to shift to more resilient asset classes - among which Bitcoin has become the main recipient.

Bitcoin benefits?

Bitcoin unexpectedly benefited from gold's volatility. As gold prices retreated from their highs, BTC rebounded strongly from a low of $108,200 to $113,800, a daily gain of approximately 5%, bringing its market capitalization back to $2.1 trillion. This performance mirrored a slight rebound in US stocks, with the S&P 500 index rising over 1%, indicating a rebound in market risk appetite.

Against the backdrop of a pullback in both gold and crude oil and a sideways movement in the Nasdaq, Bitcoin's steady trend was interpreted by the market as a "precursor to capital rotation."

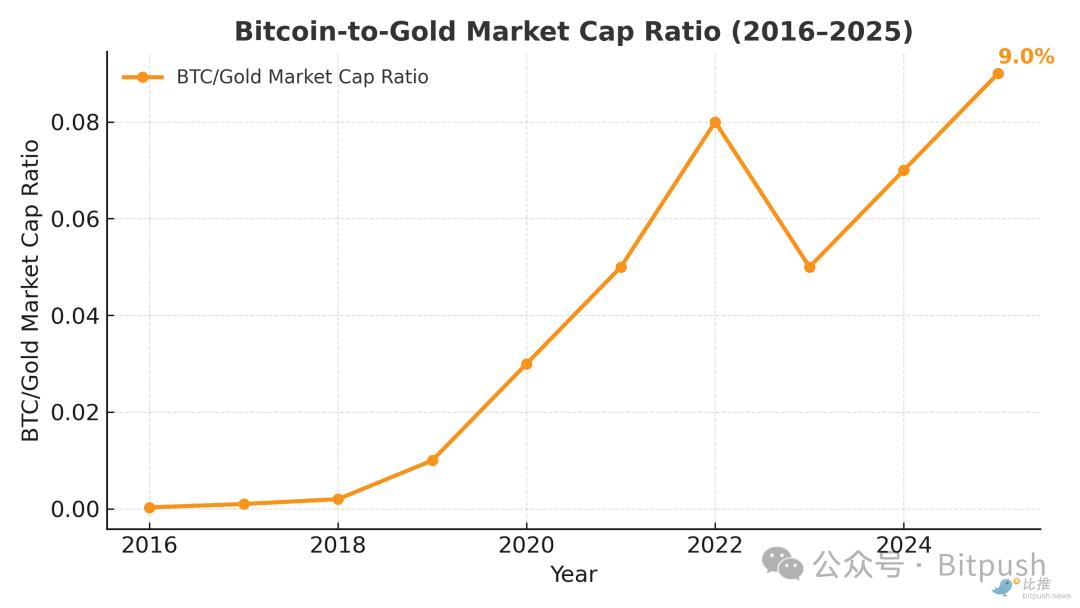

Data confirms this trend. According to The Block, since mid-August, the BTC/gold ratio has fallen from 37 to 25, reaching its lowest point since April 2025. Over the past two months, Bitcoin has fallen 12%, while gold has surged 30%. This dynamic is shifting: as gold shows signs of peaking, the market is re-evaluating the appeal of digitally scarce assets.

From a broader perspective, Bitcoin remains a lightweight within the traditional financial system. Despite reaching a market capitalization of $2.1 trillion, this represents only one-fourteenth the value of gold and less than 2% of global financial assets. It is precisely this significant market capitalization gap that institutions view as a potential source of future growth.

From a broader perspective, Bitcoin remains a lightweight within the traditional financial system. Despite reaching a market capitalization of $2.1 trillion, this represents only one-fourteenth the value of gold and less than 2% of global financial assets. It is precisely this significant market capitalization gap that institutions view as a potential source of future growth.

Bitwise estimates in its latest report that shifting just 3%-4% of gold portfolios to Bitcoin would be enough to double the price of BTC to between $160,000 and $200,000. Specifically, reallocating just 1% of the $30 trillion gold market capitalization (approximately $300 billion) could increase Bitcoin's market capitalization by over 15%.

Market data suggests this “micro-rebalancing” is already happening:

- In the futures market, CME Bitcoin holdings increased by 22% compared to August, and institutional holdings accounted for 71%.

- In the ETF channel, BlackRock's IBIT fund saw a net inflow of US$1.85 billion this month, achieving seven consecutive weeks of net subscriptions.

- The skewness indicator of the options market narrowed from -8% to -2%, indicating that market panic has significantly eased.

These signs together depict a new trend: Bitcoin is gradually shedding the label of a highly volatile speculative asset and steadily evolving towards the role of "non-correlated allocation" in the investment portfolio.

Bitcoin vs. Traditional Finance Market Cap Ratios

Asset Class | Estimated total market capitalization (USD) | Share of global liquidity | Remark |

|---|---|---|---|

Gold | ≈ $30 trillion | About 16% of global wealth | Traditional “hard currency” benchmarks |

Global Equities | ≈ $110 trillion | About 60% | Including major indices and ETFs |

Global Bonds | ≈ $140 trillion | About 75% | Including sovereign bonds and corporate bonds |

Global M2 Money Supply (Fiat M2) | ≈ $110 trillion | — | “Liquidity that can be printed” |

Bitcoin (BTC) | ≈ $2.1 trillion | < 2% of Gold | “Digitally scarce assets” |

Ethereum (ETH) | ≈ $420 billion | < 0.5 % | “Smart Contract Layer” represents |

Data sources: TradingView, Bitwise, IMF World Economic Outlook 2025 estimates.

The logic of capital rotation

1. Macro Background

The latest IMF data shows that global total debt increased by $14 trillion in the first half of 2025, reaching $337 trillion, a record high. Although the global average nominal interest rate has fallen by about 120 basis points from its 2023 peak, it remains significantly higher than pre-pandemic levels.

In a high-debt environment, “assets that cannot be printed” have regained attention.

Gold has become a safe haven due to its historical trust, while Bitcoin has become a new generation's choice due to its "code-based scarcity." The difference lies in the following: gold's liquidity is limited by its physical form, with high transportation, storage, and customs clearance costs; Bitcoin, on the other hand, is borderless, divisible, and can be transferred across borders in minutes, all for as little as a few dollars.

Over the past six months, the trends of gold and Bitcoin have shown a clear “risk cycle divergence”:

- When market expectations are for easing (2024Q4 – 2025Q1), gold strengthens due to “lower real interest rates”;

- When the market shifts to risk appetite (after 2025Q2), Bitcoin benefits from "liquidity preference".

In short, gold and Bitcoin represent different stages of monetary policy expectations:

Macro cycle | Policy Status | Leading assets | Drive logic |

|---|---|---|---|

Early stages of easing | Interest rates fall, inflation remains high | gold | Hedging against falling real interest rates |

Loose mid-to-late period | Liquidity rebounds and risk appetite improves | Bitcoin | Liquidity Spillover and Risk Repricing |

The current market may be in the early stages of Phase 2. CME FedWatch shows that the probability of the Federal Reserve cutting interest rates by 25 basis points in October is as high as 99.4%. The release of liquidity is creating upward conditions for high-beta assets.

2. Intergenerational wealth redistribution

Cerulli Associates predicts that by 2045, $84 trillion in wealth will be transferred from baby boomers to millennials and Generation Z. Of the latter, approximately 54% already hold crypto assets, compared to only 8% of boomers. This suggests that over the next 20 years, asset preferences will systematically shift toward digital assets.

Although the logic of fund rotation is valid, there are still two potential risks in the short term:

- Volatility aggregation: After BTC's annualized volatility (30 days) fell to a low of 27% in early October, a rapid repricing in the market could trigger a short-term correction.

- Policy variables: If the Fed slows down its rate cuts or the geopolitical situation deteriorates again, gold may regain safe-haven buying and interrupt the pace of capital migration.

In the medium term, the "substitution relationship" between gold and Bitcoin is not zero-sum, but more likely to be complementary: gold is more stable as a central bank reserve asset, while Bitcoin provides a higher beta coefficient and digital liquidity in private capital and high-liquidity markets.

summary

The current market changes are not simply "gold falling and Bitcoin rising", but funds are being re-allocated.

Gold still has value in the early stages of interest rate and liquidity cycles. However, as digital assets are gradually accepted by institutions and liquidity improves, some safe-haven funds are shifting from "physical gold" to "cryptocurrency Bitcoin."

For ordinary investors, you can pay attention to these three points:

- Flexible allocation: holding gold and Bitcoin at the same time, adjusting the ratio at different stages to reduce overall volatility;

- Seize opportunities from volatility: When the Bitcoin market is relatively calm, use tools such as options to plan for possible future trends;

- Track capital flows: Pay attention to the inflow and outflow of funds in Bitcoin ETFs, as well as the changes in the on-chain addresses of large institutions, to determine the rhythm of capital rotation.

In an era of depreciating fiat currencies and volatile policies, the competition for store of value has shifted from "visible metals" to "invisible codes." Generally speaking, the current market is characterized by the coexistence of "gold's old anchor" and "Bitcoin's new Sina." Which will prevail in the short term will depend on which direction capital flows more rapidly.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Invest with caution and make informed decisions based on your own circumstances. Risks are at your own risk.