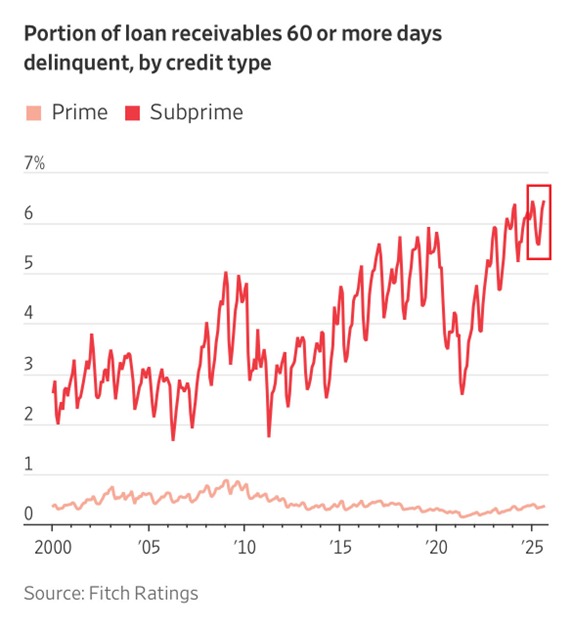

Americans are falling behind on their car payments at alarming rates: Subprime auto loan delinquency rates reached 6.43%, the 2nd-highest on record. The 60-day delinquency rate for subprime auto loans has more than DOUBLED over the last 3 years. Delinquency rates are now ~1.4 percentage points ABOVE the 2008 Financial Crisis peak. Meanwhile, an estimated 1.73 million vehicles were repossessed last year, the highest total since 2009. Is an auto debt crisis forming?

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content