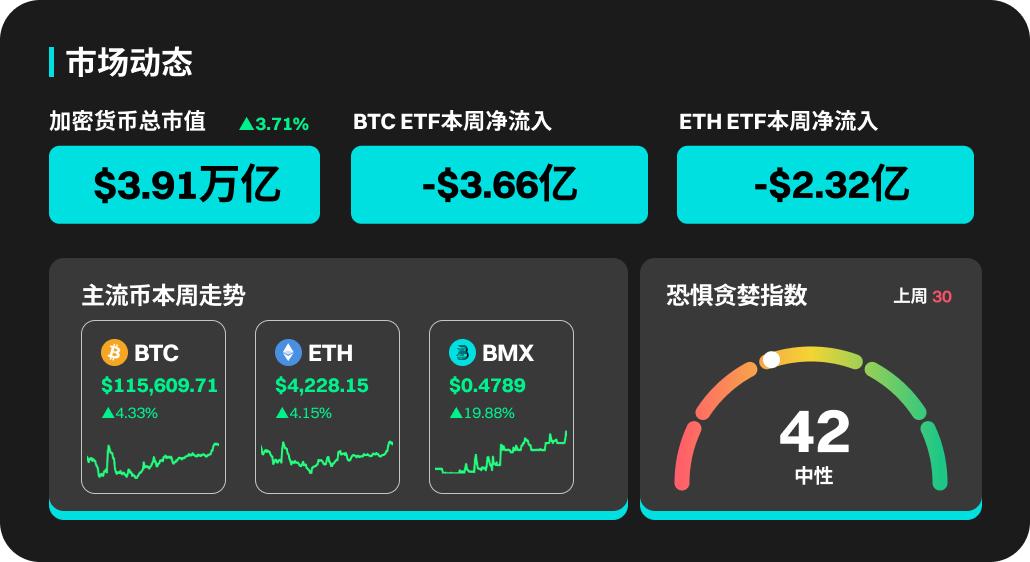

According to BitMart's market report on October 27, the total market value of cryptocurrencies in the past week was 3.91 trillion, up 3.71% from the previous week.

Crypto market dynamics this week

Bitcoin spot ETFs continue to experience net outflows, totaling approximately $366 million. Since peaking in early October, BTC has been fluctuating between $106,000 and $112,000, with short-term upward pressure capped by the MA20 resistance level. The current candlestick pattern has seen consecutive small real bodies, indicating a strong wait-and-see market sentiment. Trading volume has significantly decreased compared to the previous period, and capital inflows and outflows have slowed. The MACD indicator remains below the zero axis, with the red bar shortening and turning green again, indicating continued weakening momentum and limited short-term rebound potential. If the price remains below $116,000, a retest of the $108,000 and $105,000 support levels is warranted. Conversely, a breakout above the MA30 with significant volume could reopen potential for a rebound.

Ethereum (ETH) has continued its weak and volatile pattern over the past week, fluctuating around $3,800. Short-term pressure is being exerted by the dual MA20 and MA60 levels. While downward buying pressure is limiting the downside, the overall rebound momentum is still lacking. The MACD lines are near their lows but haven't formed a golden cross, with the candlestick chart shortening below the zero axis, indicating a weakening of bearish momentum but a lack of bullish momentum. If ETH fails to hold above the $3,850-3,900 range, the market may continue to consolidate at low levels. A subsequent breakout above the upper moving averages with significant volume would confirm a short-term rebound.

This week's popular currencies

Popular cryptocurrencies, including PAYAI, SEDA, VIRTUAL, ZEC, and HYPE, all saw strong performance. PAYAI saw a 1141.6% price increase this week. SEDA saw a 167.4% increase. VIRTUAL saw a 90.9% increase, with a 24-hour trading volume of 0.6 billion. ZEC and HYPE saw weekly gains of 43.2% and 27.6%, respectively.

U.S. market and hot news

Despite several companies releasing relatively strong earnings reports, overall market price movements remained subdued as investors awaited updates on a potential meeting between Xi Jinping and Trump, which could determine the trajectory of the ongoing Sino-US trade war. On Wednesday, Trump told reporters at the White House that he expected to reach agreements with China on trade, soybeans, and even nuclear weapons, stating, "I believe we will ultimately make a great trade deal with China." On October 23, the White House announced that Trump would meet with Xi Jinping on October 30 during his visit to Asia. Asset prices cautiously reflected Trump's optimistic outlook—the S&P 500 closed slightly higher, BTC rose 2.1%, and ETH fell 0.3%. Meanwhile, gold prices fell sharply as investors took profits following last week's surge in gold prices.

The Federal Reserve will hold its policy meeting on October 28-29.

The Bank of Japan will hold its next monetary policy meeting on October 29.

The Federal Reserve will announce its interest rate decision on October 30, and Federal Reserve Chairman Powell will hold a monetary policy press conference.

US Senate Democrats ask Trump advisers to elaborate on cryptocurrency investments and other issues on October 31

Nasdaq has applied to the US SEC to add XRP, SOL, ADA, and XLM to its cryptocurrency index. The final decision is expected before November 2nd.

Unlock popular sections and projects

Wallet section

The Wallet sector performed exceptionally well this week, with an overall gain of 44.5%, becoming a focal point for investors. With growing market demand for on-chain asset security and self-management, several wallet tokens experienced a strong rebound, with representative projects such as KARAT, TPAY, GMD, and SWTH leading the gains. This rebound in funding coupled with updated project narratives led to significant outperformance of the broader market over the past week. Overall, the Wallet sector's surge reflects a renewed market focus on self-custodial wallets, account abstraction (AA), and decentralized identity (DID). Amidst the resurgence of crypto capital and the advancement of application-layer innovation, wallet projects are gradually evolving from "tool products" to "entry points into the ecosystem," generating increasing interest from both investors and developers.

Grass (GRASS) will unlock approximately 181 million tokens at 9:30 PM Beijing time on October 28, accounting for 72.4% of the current circulation and worth approximately US$79.3 million.

Jupiter (JUP) will unlock approximately 53.47 million tokens at 10:00 PM Beijing time on October 28, accounting for 1.72% of the current circulating supply and worth approximately $23 million.

Zora (ZORA) will unlock approximately 167 million tokens at 8:00 AM Beijing time on October 30, accounting for 4.55% of the current circulating supply and worth approximately $15.9 million.

Sui (SUI) will unlock approximately 43.96 million tokens at 8:00 AM Beijing time on November 1st, accounting for 1.21% of the current circulating supply and worth approximately $113 million.

Risk Warning:

Use of BitMart services is entirely at your own risk. All cryptocurrency investments (including returns) are highly speculative in nature and involve substantial risk of loss. Past, hypothetical, or simulated performance is not necessarily indicative of future results.

The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve significant risks. You should carefully consider whether trading or holding digital currencies is appropriate for you based on your personal investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.