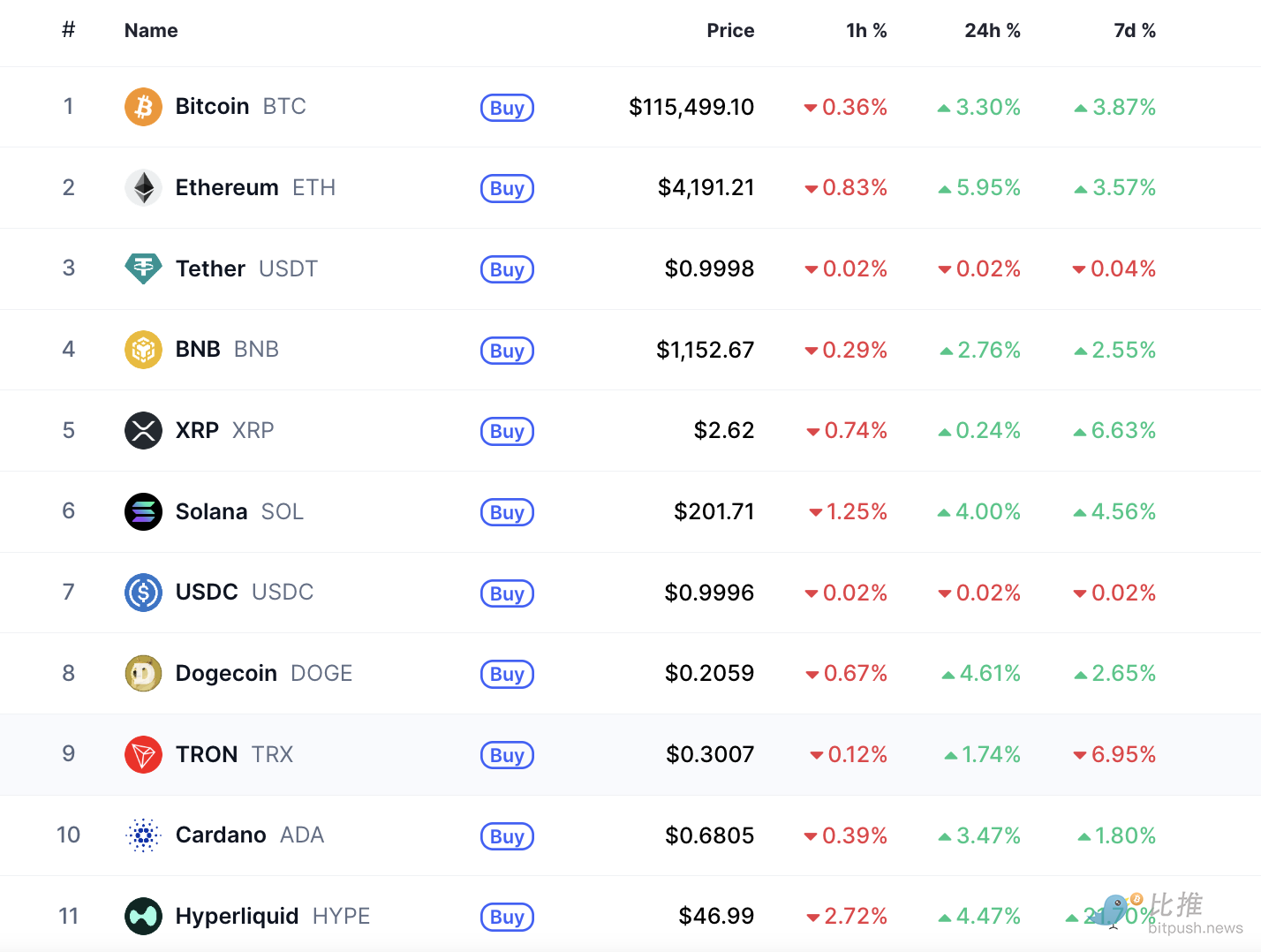

Over the past 24 hours, Bitcoin surged past $115,000, reaching a high of $116,273.31, a nearly 4% daily gain. Ethereum performed even more strongly, rising nearly 7% to $4,216 over the same period. Solana also successfully broke through the $200 mark, surging over 5%.

Behind this round of rapid rise is the overall recovery of market risk appetite - as Sino-US trade tensions show signs of easing, coupled with the market's expectations for loose liquidity, the long sentiment of crypto assets has been ignited.

Behind this round of rapid rise is the overall recovery of market risk appetite - as Sino-US trade tensions show signs of easing, coupled with the market's expectations for loose liquidity, the long sentiment of crypto assets has been ignited.

Macroeconomic benefits

The most important catalyst comes from the "easing" of Sino-US relations.

According to Reuters, the Chinese and US delegations reached a preliminary trade framework agreement on the eve of the APEC summit, covering the purchase of key agricultural products, the suspension of rare earth export restrictions and the avoidance of additional tariffs of up to 100%.

U.S. Treasury Secretary Scott Bessent publicly stated that China and the United States have reached a "very substantive framework agreement" and that the United States "no longer considers" imposing a 100% tariff on China.

Beyond political and policy expectations, investors are more sensitive to shifting signals at the liquidity level.

The Federal Reserve will hold an FOMC meeting this week. Data from the CME Fed Watch tool shows that the probability of the Federal Reserve cutting interest rates by 25 basis points in October is 97.3%, and the probability of a cumulative rate cut of 50 basis points in December is 95.5%.

As a high-beta asset, Bitcoin naturally benefits from these environmental shifts. Daniel Liu, CEO of Republic Technologies, stated, "This surge isn't driven by a reversal of intrinsic on-chain structure, but rather by global investors reassessing the value of crypto assets within their macro portfolios. Bitcoin is being viewed as a hedge against policy uncertainty and currency devaluation, and its correlation with the US tech sector is increasing."

On-chain signaling

However, on-chain activity has yet to fully recover. The number of active addresses, average daily transactions, and total transaction fees have yet to return to mid-September levels.

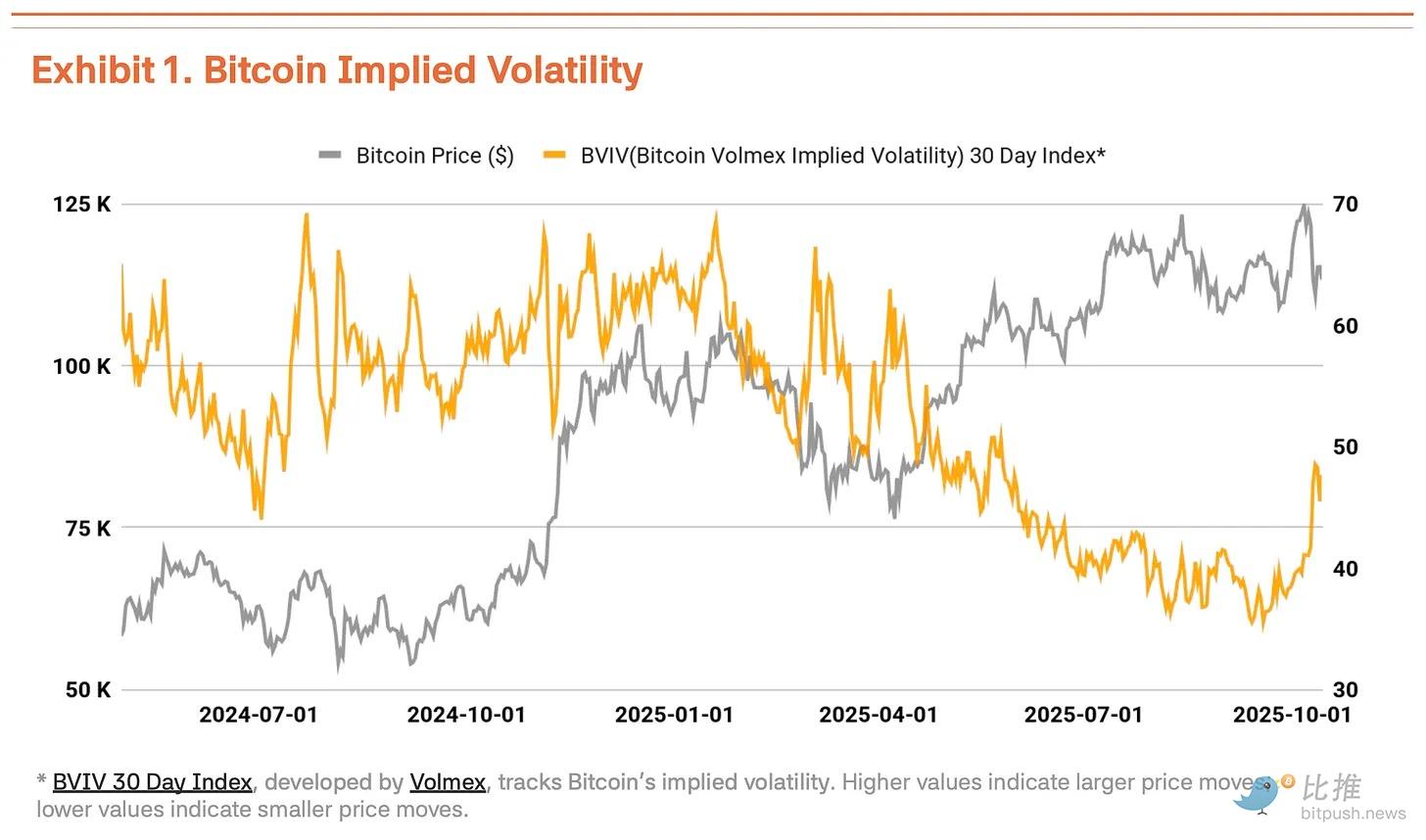

Tiger Research's latest report argues that despite a strong market reaction, "on-chain signals haven't confirmed a market reversal," and therefore, "investors must carefully discern the difference between a rebound and a reversal." The firm maintains its bullish outlook for Bitcoin in Q4, with a target of $200,000, but emphasizes that "volatility will increase significantly in the coming weeks."

Technically, BTX has successfully broken through the $113,000-114,500 range, turning short-term resistance into support. If it can maintain above $115,800, the next target could be $120,000, where a large number of option sellers are actively taking defensive positions and placing short-term take-profit orders. Conversely, if the price falls below $112,500 again, be wary of a pullback to $108,000. This could be especially true if the Federal Reserve sends hawkish signals in this week's policy statement or if there are unexpected setbacks in the US-China negotiations.

summary

Looking back at October, the market was buoyed by the buzzword "Uptober"—historically, October has always been one of Bitcoin's strongest months for growth. However, policy shocks earlier this month disrupted this traditional trend. On October 11, Trump announced a 100% tariff increase on Chinese products, along with restrictions on critical software exports. Subsequently, China also imposed restrictions on rare earth exports, further escalating trade friction between the two countries and triggering a sharp pullback in global assets. Bitcoin experienced its largest single-day drop of 16%, falling below $105,000, leaving many highly leveraged traders penniless.

Now, with the resumption of negotiations, signals of policy easing, and the market's continued strengthening of pricing in a return to easing, Bitcoin's logic as an "emerging safe-haven asset" may be gradually gaining acceptance among mainstream investors. Some analysts believe that amidst the current uncertainty surrounding geopolitics and monetary policy, crypto assets may be poised for a period of repricing, which will lay a new logical foundation for future market trends.

Author: Bootly

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush