Solana could rise as much as 10%, buoyed by the launch of the SOL ETF (exchange-traded fund). However, technical indicators show bears are tightening, ready to sell on the rise.

Solana ETF remains in the spotlight with multiple issuers pursuing to offer this financial instrument.

Solana ETF Launch Triggers Positive Signals for SOL Price

Institutional interest in SOL is growing. Bitwise and Canary Capital have confirmed that their Solana ETFs will begin trading today, October 28, 2023, after weeks of regulatory headwinds.

Ryan Rasmussen, head of research at Bitwise, promoted the company's Solana ETF product with the ticker BSOL, marking a gateway for institutions into the SOL market.

Grayscale has highlighted institutional FOMO by touting GSOL, which it bills as the largest U.S. spot Solana fund. The financial instrument has already offered access to SOL in some U.S. brokerage accounts with Staking enabled.

VanEck, too, filed its sixth S-1/a amendment for its Solana ETF on Monday. The filing status was changed to “effective,” and the fee was adjusted down to 0.3%.

Similarly, Hong Kong's first Solana ETF began trading on Monday , marking the first Asian financial instrument.

Against these backdrops, analysts are bullish on Solana, which remains above its three-year support trendline.

Can Solana Surge 10% to $220?

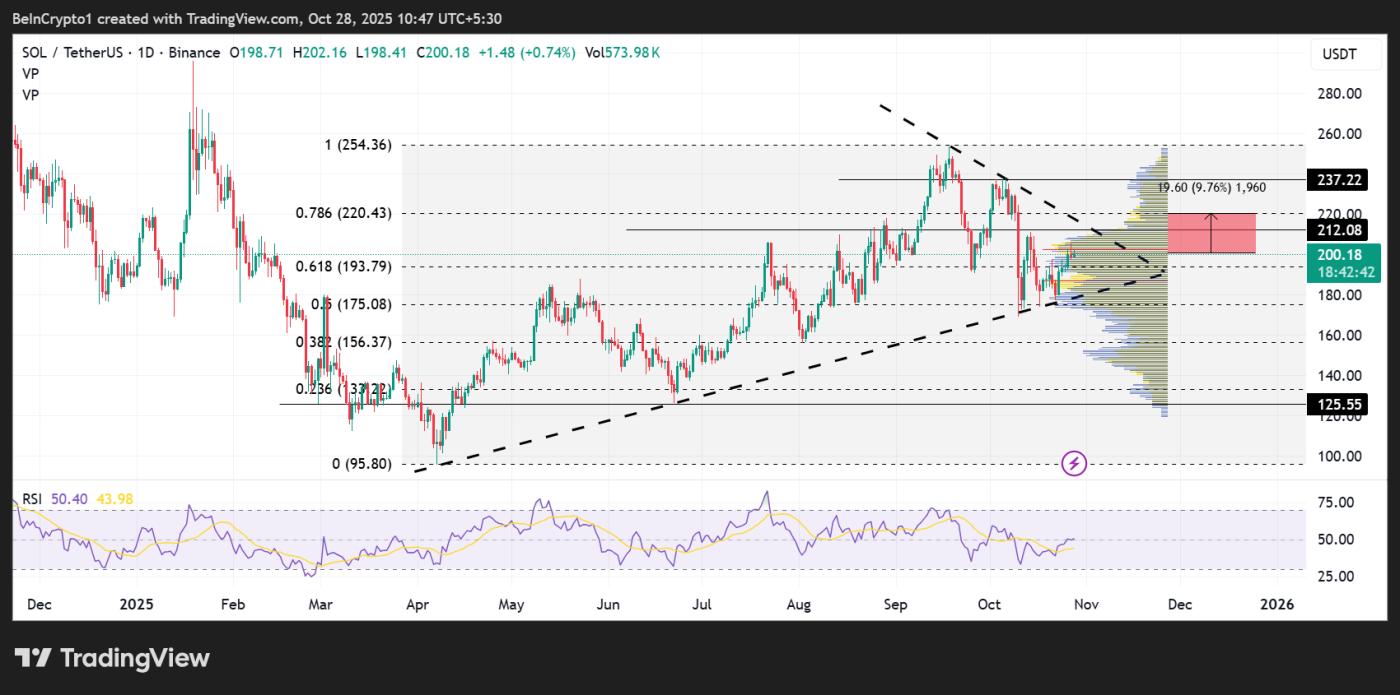

At the time of writing, Solana is trading at $200.18, down slightly by 1% over the past 24 hours. Despite the slowdown, the technical analysis of the SOL/ USDT pair suggests that there may be more upside potential.

Looking back, Solana price has been trading along an ascending trendline since April, suggesting that bullish momentum is building.

However, with upside capped at $254.36, the rejection from the descending trendline led SOL to form a symmetrical triangle. Here, two converging trendlines connect a series of lower highs and higher Dip , suggesting a consolidation phase.

On a breakout, and if the momentum sustains, Solana could rally 9.76% to $220.43. This level coincides with the 78.6% Fibonacci retracement level.

A decisive candle close above this resistance level could see Solana price face the next hurdle at $237.22, a level last tested in early October.

In an extremely bullish scenario, the rally could extend to $254.36, nearly 30% from current levels. The RSI (Relative Strength Index) inspires optimism, showing that momentum is increasing with higher Dip .

Solana (SOL) Price Performance. Source: TradingView

Solana (SOL) Price Performance. Source: TradingViewHowever, with the bearish volume profiles (yellow horizontal bars) overwhelming the bullish volume profiles (blue horizontal bars), Solana price could face significant resistance on a push higher. This suggests that bears are waiting, ready for when the momentum weakens.

If this happens, and Solana price drops below $193.79, which is marked by the most important 61.8% Fibonacci retracement level, bears could take control. This could push the altcoin below the lower trendline of the triangle.

The bulls could find another cheap entry point around $175.08, the 50% Fibonacci retracement level. The bulls are ready to interact with the Solana price, as shown with the blue horizontal bars.

Meanwhile, an analysis of Solana price action on the 4-hour perpetual Futures Contract chart suggests that the main upside momentum may have ended.

However, for some, the Solana price slowdown is due to Binance, with analyst Marty Party accusing the exchange of price manipulation.

“ XEM it play out – when the Solana ETF launches, people will buy longs, Binance will drive the price down. Understand how the market works until Market Structure… 3 Solana ETFs launched this week. Binance sold highly leveraged Longs with liquidations: – 100x leverage to $197, – 50x leverage to $189, – 25x leverage to $184. They will use market makers to wash trade the price down, liquidating Longing late,” he alleged .