Get the best data-driven crypto insights and analysis every week:

Thanks for reading Coin Metrics State of the Network! Subscribe for free to receive new posts and support our work.

Ethena and the Mechanics of USDe

Key Takeaways:

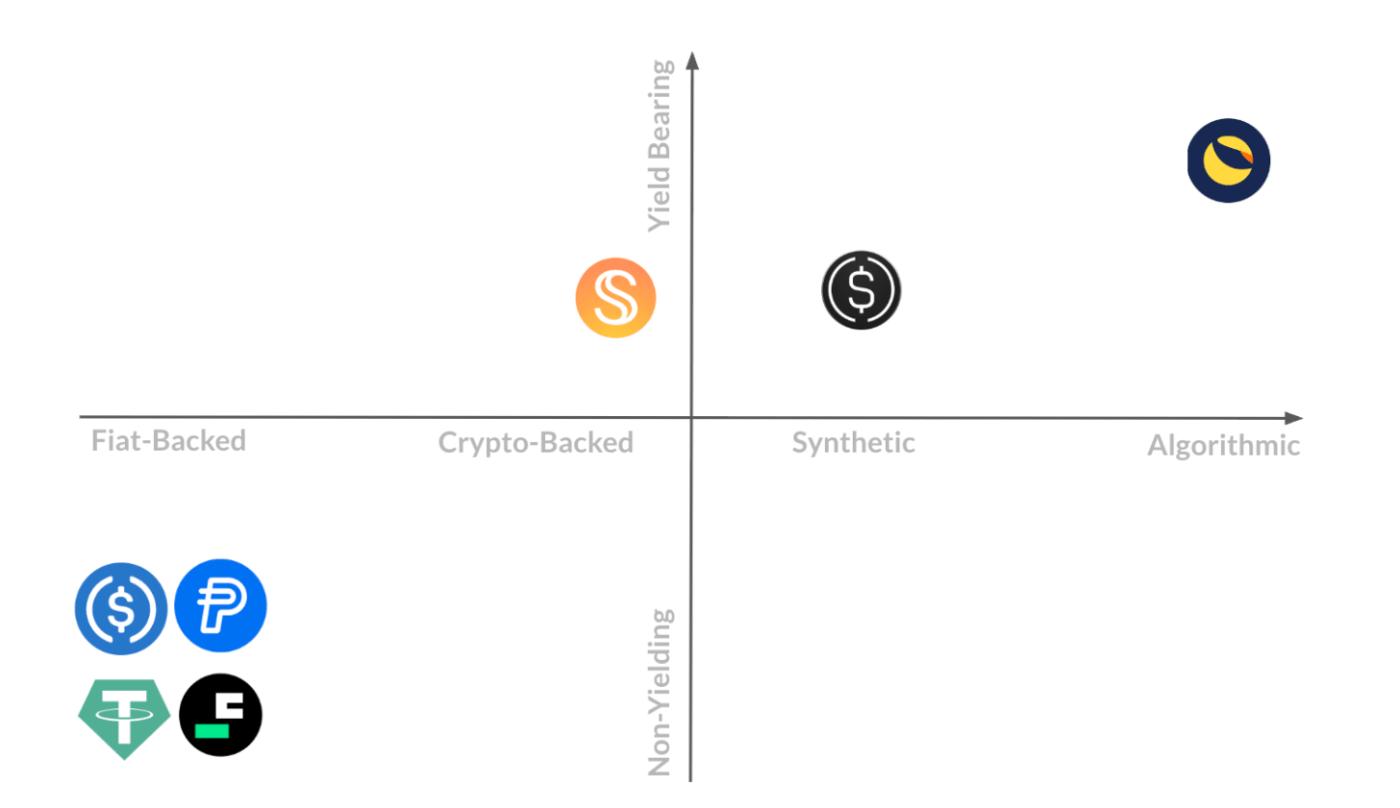

Ethena’s USDe has rapidly grown into the third-largest stablecoin, distinguished as a yield-bearing, synthetic dollar backed by crypto collateral and delta-neutral futures positions rather than fiat reserves.

Staked USDe (sUSDe) accrues yield from perpetual funding rates, ETH staking rewards, and liquid stablecoins, with returns tied to exchange funding dynamics and on-chain yields.

USDe primarily serves as a savings and yield instrument. Its integration with DeFi protocols like Aave and Pendle enhances capital efficiency and composability, while linking stability to on-chain leverage.

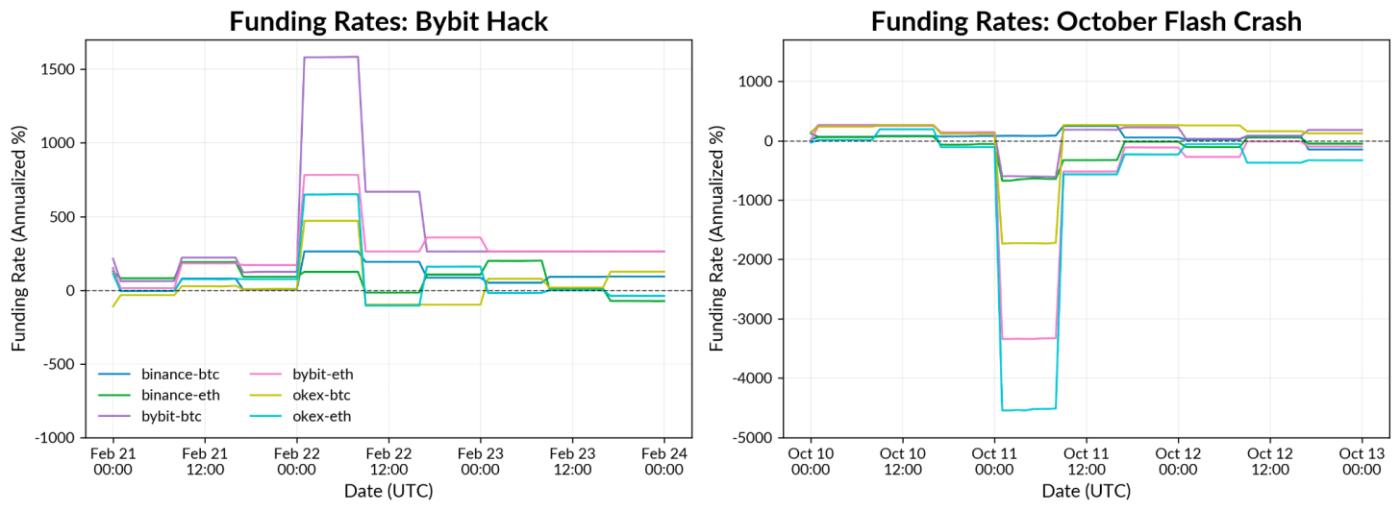

Market stress events like the Bybit hack and October flash crash tested Ethena’s design and risk management, highlighting how funding, exchange, pricing and liquidity dynamics influence the stability of synthetic dollars like USDe.

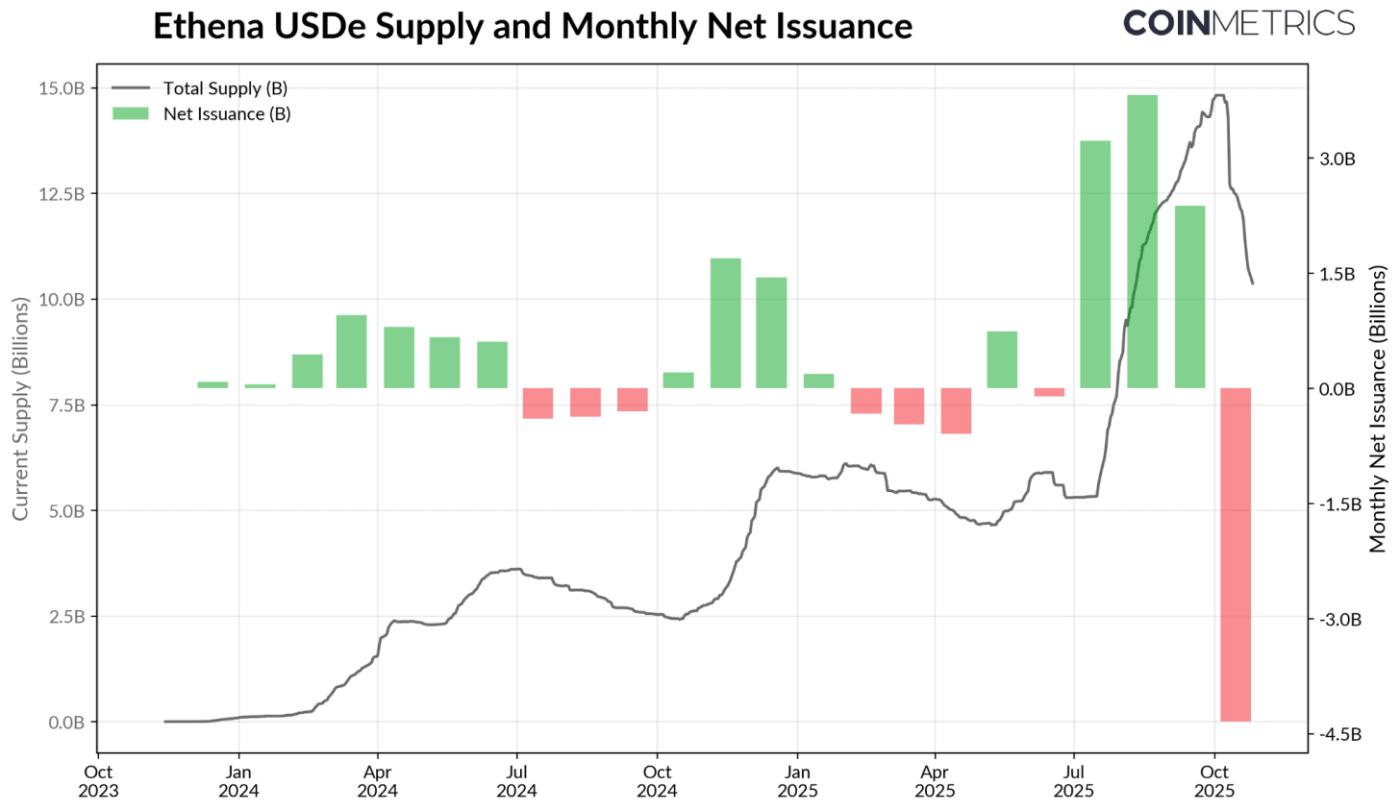

Rise of Ethena’s Synthetic Dollar

Ethena’s USDe, burst onto the scene in 2024, quickly catapulting into the 3rd largest stablecoin by market cap. Now exceeding $10.5B, USDe has emerged as a credible challenger and differentiator to the long standing dominance of USDT and USDC. Its appeal stems from its unique design, a yield-bearing, “synthetic dollar” backed not by cash or Treasuries, but by crypto-assets and delta-neutral hedging strategies in perpetual futures markets.

Source: Coin Metrics Network Data Pro

Yet these features also make it a focal point of discussion around systemic risks in crypto, often drawing comparisons to the death spiral of Terra’s UST. While fundamentally different from USTs self-referential algorithmic design, the Bybit hack in early 2025 and the October 10th flash crash highlighted the vulnerabilities synthetic dollars like USDe can be exposed to during periods of market stress.

This rapid ascent, coupled with recent episodes of market volatility offer an opportunity to examine how Ethena synthetic dollar system functions in practice. In this issue of Coin Metrics’ State of the Network, we break down:

How USDe and its yield-bearing counterpart sUSDe function

The mechanics behind Ethena’s backing and yield generation

Usage profile of USDe & sUSDe across exchanges and DeFi

What recent volatility reveals about the risks of synthetic stablecoins

Backing, Stability & Sources of Yield

Unlike fiat-backed stablecoins like USDT or USDC, which are collateralized by cash and short-term U.S. Treasuries, USDe is backed by crypto-assets and hedging strategies in futures markets rather than traditional reserves. Ethena tokenizes this strategy, known as the “cash and carry trade”, or delta-neutral strategy to maintain a synthetic dollar peg. In practice, each dollar of USDe is created with the protocol taking two opposing positions:

A long position in spot crypto-assets as collateral (primarily BTC, ETH or staked ETH) held at off-exchange custody providers.

An equal and opposite short position in perpetual futures markets on exchanges like Binance, Bybit and OKX.

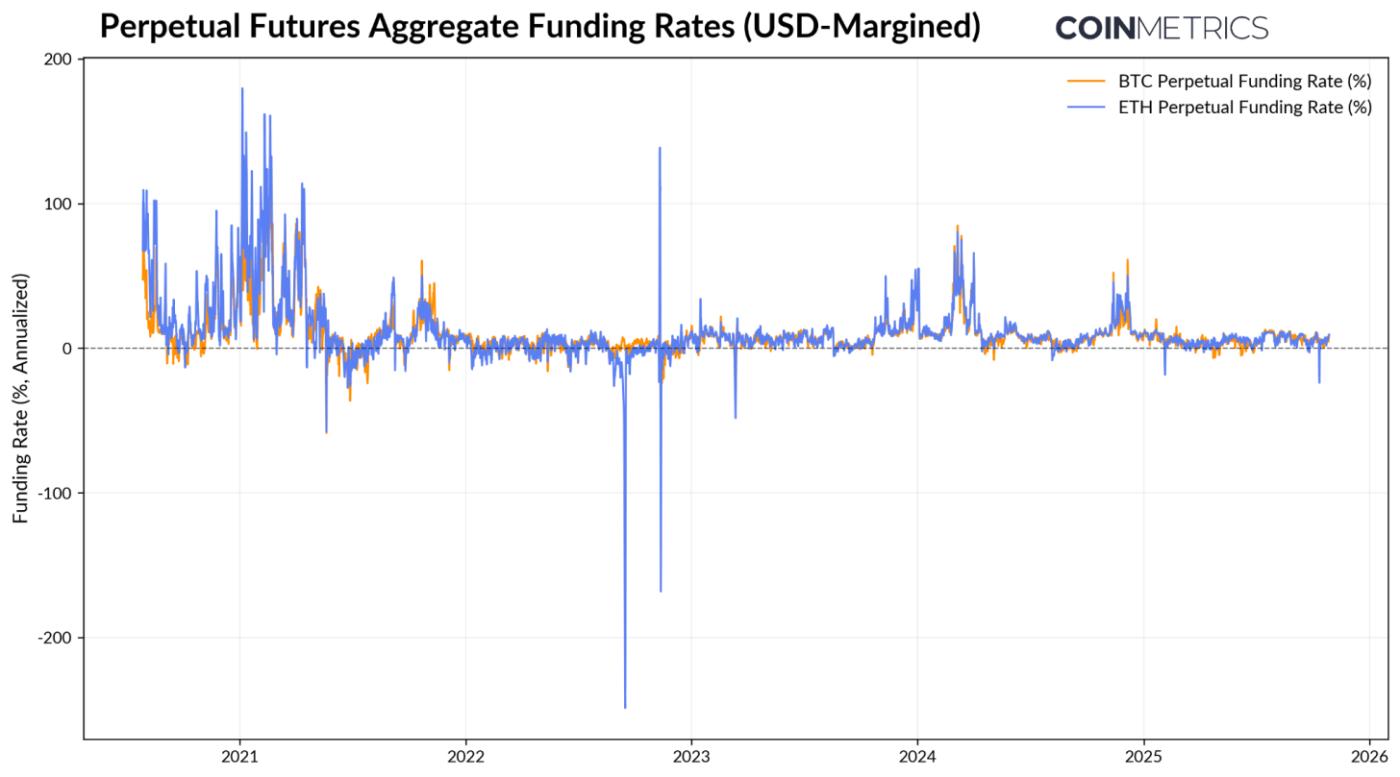

This combination keeps Ethena’s exposure market-neutral, while generating yield from perpetual futures funding rates. To briefly revisit, perpetual futures are derivatives that enable hedging or speculation on crypto-assets, similar to traditional futures contracts but without an expiry date. To keep the price close to the assets underlying spot price, exchanges implement funding payments, periodic fees exchanged between long and short traders. When funding rates are positive, short positions earn a return, allowing Ethena to pass this yield on to sUSDe holders.

Source: Coin Metrics Market Data Pro

As seen in the chart above, aggregated futures funding rates for BTC and ETH have been positive during bull markets, averaging about 11 % annualized in 2024 and ~5% in 2025. Sustained high rates suggest an environment where the market is paying to be long, allowing Ethena to capture that spread through its delta-neutral strategy. However, during episodes of market stress, such as Luna and 3AC, the FTX collapse in November 2022, and October 2025 flash crash, funding has flipped negative, testing the protocols stability and yield generation.

Where Does the Yield Come From?

While funding rates from perpetual swaps are the primary source of Ethena’s revenue, the protocol complements this income with two additional sources of yield:

Perpetual Futures Funding Rates: Yield generated from the spread between long spot and short futures positions.

Staking Yield: ETH staking yield earned from Ethereum’s consensus and execution layers.

Interest on Liquid Stablecoins (USDtb, USDC, USDT): Fixed rate on USDC from Coinbase, or returns from short-term U.S. Treasury exposure via BlackRock’s BUIDL fund.

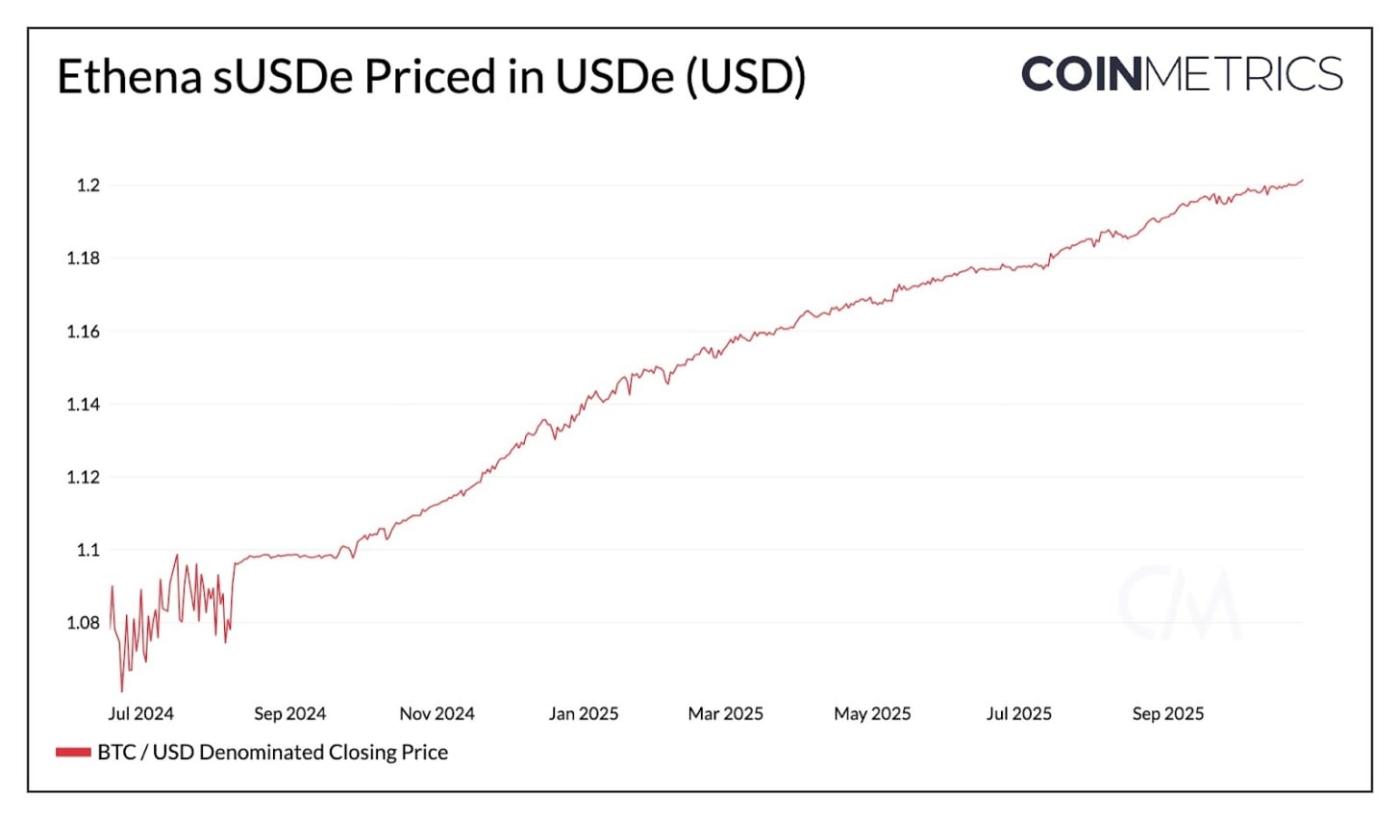

The rewards generated from these sources are passed on to holders of staked USDe (sUSDe). sUSDe automatically accrues earnings through an ERC-4626 vault standard, appreciating in price over USDe. Therefore, the growth of Ethena’s synthetic dollar supply and revenues are driven by the interplay of these sources of yield, increasing its appeal in bullish market conditions.

Source: Coin Metrics Network Data Pro

Ethena Reserve Fund

To manage risk during less favorable conditions, Ethena maintains a Reserve Fund that acts as an insurance buffer against negative funding rates or unexpected losses. When funding rates are high, the protocol leans more heavily on delta-neutral strategies, while during periods of lower funding rates, it shifts towards stablecoin holdings to preserve backing, and provide the baseline treasury bill rate.

The assets in the reserve fund are held in this contract, and consist of liquid stablecoins (currently $41.8M in USDtb, Ethena’s stablecoin backed by tokenized treasuries from BlackRock’s BUIDL).

Usage Profile of Ethena’s USDe & sUSDe

Having established how Ethena works under the hood, understanding where and how its assets (USDe & sUSDe) are used, provides context on its unique usage and risk profile. Unlike stablecoins like USDT or USDC which are used for trading, and change hands more frequently for payments or settlement, USDe serves as a savings and yield instrument rather than a medium of exchange.

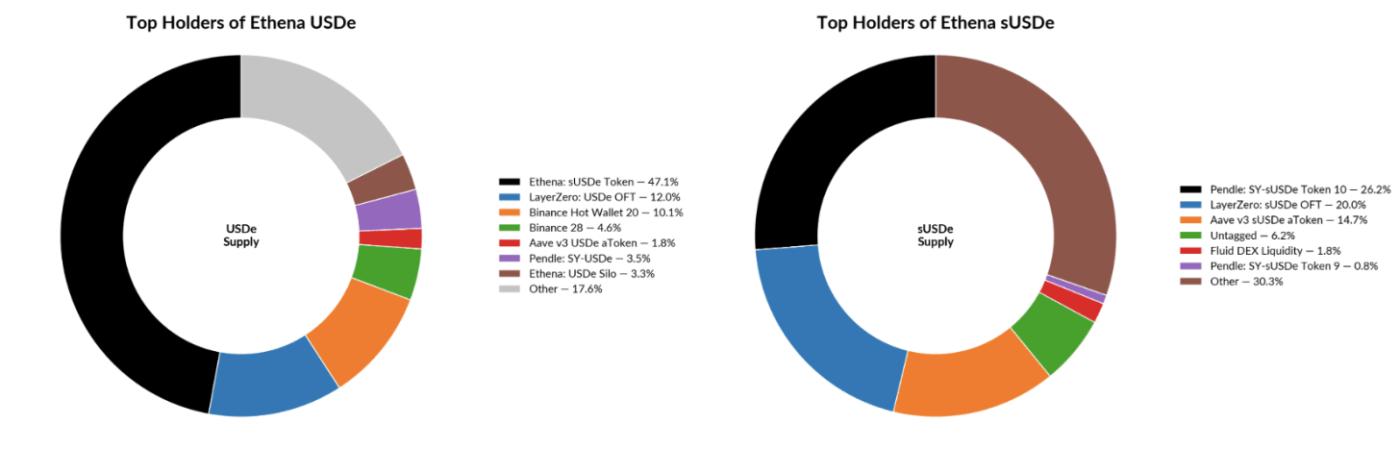

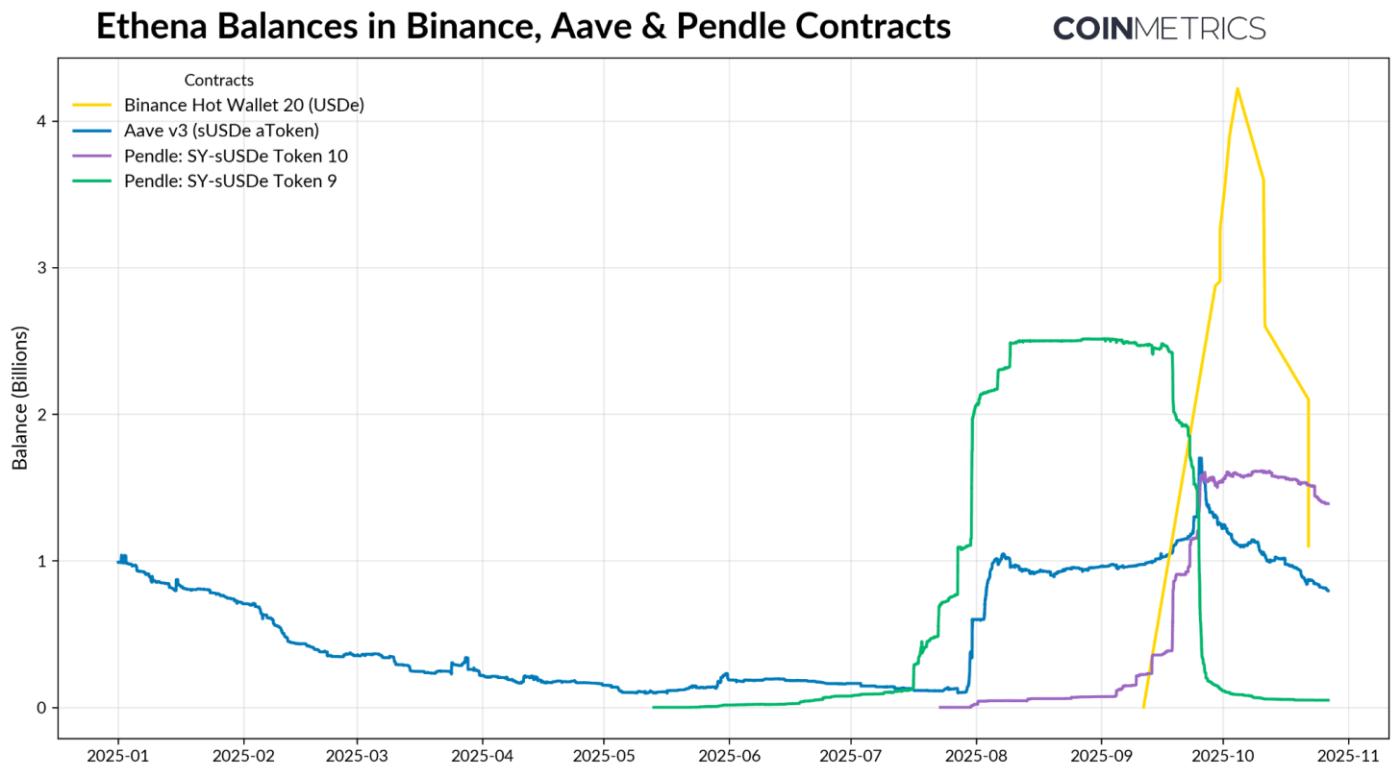

From the snapshots of balances across top holder accounts above (as of October 2025), we see that roughly half of USDe supply is staked to receive the yield-bearing sUSDe. Around 13% sits in LayerZero’s OFT bridge, facilitating cross-chain liquidity, while two Binance wallets own roughly 14% of supply. Following the exchange’s integration of USDe as a margin collateral asset for futures trading and Binance Earn in September, over 4B in USDe quickly flowed into Binance. But this was soon met with 2.9B in outflows as a result of USDe’s dislocation on Binance, briefly dropping to $0.67.

On the other hand, most of sUSDe supply resides in DeFi protocols. Together, Aave (lending) and Pendle (yield tokenization) account for over one third of all sUSDe in circulation, as users deploy the token for collateralized loans and on-chain yield strategies. This creates a “yield amplification” loop, with USDe staked to mint sUSDe, which is deposited into Pendle tokenized, and reused as collateral on Aave, enhancing capital efficiency and composability while also embedding deeper links to on-chain leverage and liquidity dynamics.

Risks & Reflexivity in Synthetic Dollars

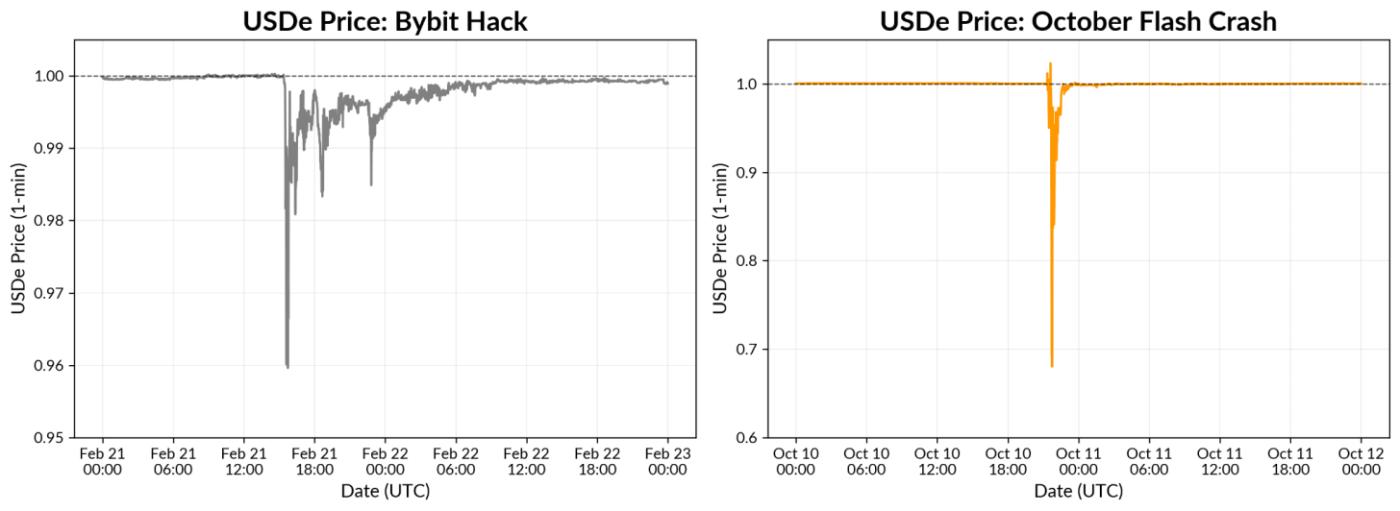

Market stress events in 2025 offer a real-world view into how Ethena’s synthetic dollar system behaves under volatility. We can see this through the lens of the February Bybit hack, and the October 10th flash crash, both of which unfolded going into the weekend as traditional markets paused.

Source: Coin Metrics Reference Rates

Despite the disruption, funding rates across major venues remained positive, allowing Ethena’s short futures positions to continue generating yield and cushioning the protocol alongside its reserve fund. The incident highlighted exchange and custody risk: while Ethena’s collateral held in off-exchange custody remained secure, protecting it from Bybit’s potential insolvency, the event showed the importance of venue diversification and reducing single points of failure across trading and custody infrastructure.

The October 10th flash crash presented a sharper but shorter-lived depeg. On Binance, USDe traded as low as ~$0.65 amid collapsing liquidity, cascading liquidations, and auto-deleveraging (ADL) mechanisms that deepened the price drop. Funding rates flipped sharply negative across venues, but the dislocation remained localized, driven by thin order books and pricing divergence between centralized exchanges and DeFi venues. The episode highlighted the sensitivity of USDe’s peg to venue-specific liquidity and the challenge of maintaining consistent pricing across interconnected markets.

Source: Coin Metrics Market Data Pro

While Ethena remains resilient and operational, these episodes revealed the dynamics and risks of synthetic dollars like USDe. Negative funding can pressure protocol income and test the reserve, while exchange disruptions emphasize the need for venue diversification and liquidity conditions. Off-exchange custody safeguards collateral but still depends on functioning markets for pricing and arbitrage. As Ethena’s assets become more integrated across DeFi, its stability increasingly reflects broader leverage and liquidity cycles, linking its growth and resilience to the health of both centralized and on-chain markets.

Coin Metrics Updates

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.