Bitcoin (BTC) has struggled to regain momentum in recent days, with the price struggling to break above the $115,000 resistance zone.

Despite this short-term weakness, strong bullish indicators are emerging, suggesting that November could favor the uptrend.

Bitcoin has a history

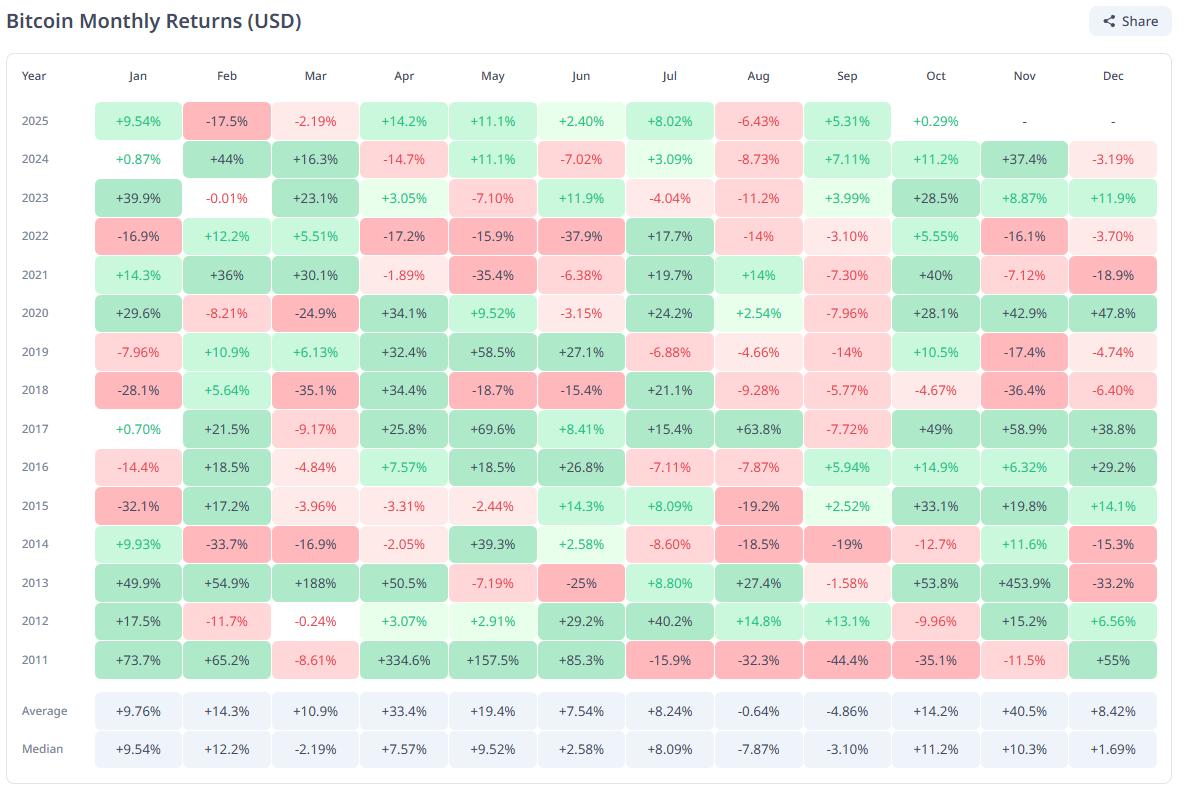

November is traditionally one of Bitcoin 's strongest months. Historical data shows that Bitcoin's Medium return in November is 11.2%, making it the second-best performing month after October. This consistent growth pattern typically fuels investor optimism and increases market participation at the beginning of the month.

Want more information on Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Bitcoin's Historical Monthly Returns. Source: CryptoRank

Bitcoin's Historical Monthly Returns. Source: CryptoRankHowever, in an exclusive conversation with BeInCrypto, Rachel Lin, Co-founder and CEO of SynFutures, emphasized that November 2025 could be different.

“Global trade tensions, inflation, and recession fears have weighed heavily on all risk assets, and Bitcoin is no exception. We have seen it trading in the $104,000 to $108,000 range recently. Looking ahead, I think November will likely bring consolidation or a mild recovery — not a sharp rally unless a strong catalyst emerges. If trade tensions worsen, Bitcoin could retest the $90,000 region. But if support holds above $110,000, we could easily see a 10 to 20% recovery towards $120,000 to $140,000 by the end of the month, especially with ETF inflows remaining steady and whales quietly accumulating,” Lin said.

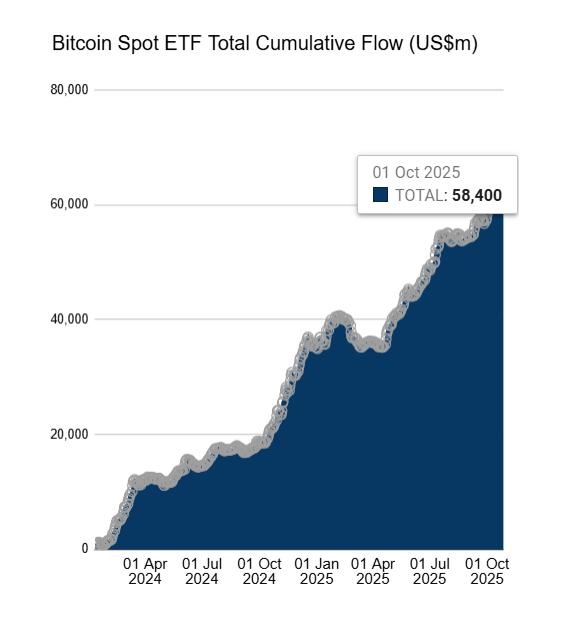

However, a sign of strength is the performance of Bitcoin exchange-traded funds (ETFs). In October alone, Bitcoin ETFs recorded a total net inflow of $3.69 billion. The month started with cumulative inflows of $58.4 billion and ended with $62.1 billion, reflecting a significant increase in investor exposure to BTC through managed investment products.

Bitcoin Spot ETF Net Inflow. Source: Farside

Bitcoin Spot ETF Net Inflow. Source: FarsideThese flows suggest that institutional investors continue to view Bitcoin as a valuable asset in diversified portfolios. Lin also noted that even after some mid-month outflows, the overall trend remains clearly positive.

“On October 21 alone, we saw nearly half a billion dollars in new inflows led by BlackRock and Fidelity. This shows that confidence remains strong. Institutions increasingly see Bitcoin as “digital gold,” a hedge against inflation, recessions, and global instability… Interestingly, this behavior mirrors on- chain activity. Every time we have a correction, the inflows quickly resume, whales accumulate, and ETFs eventually hold a larger portion of the total Bitcoin supply, now over 6%. With improved regulation and reduced fees, access for traditional investors has become easier and cheaper than ever,” Lin told BeInCrypto.

Bitcoin is setting important levels

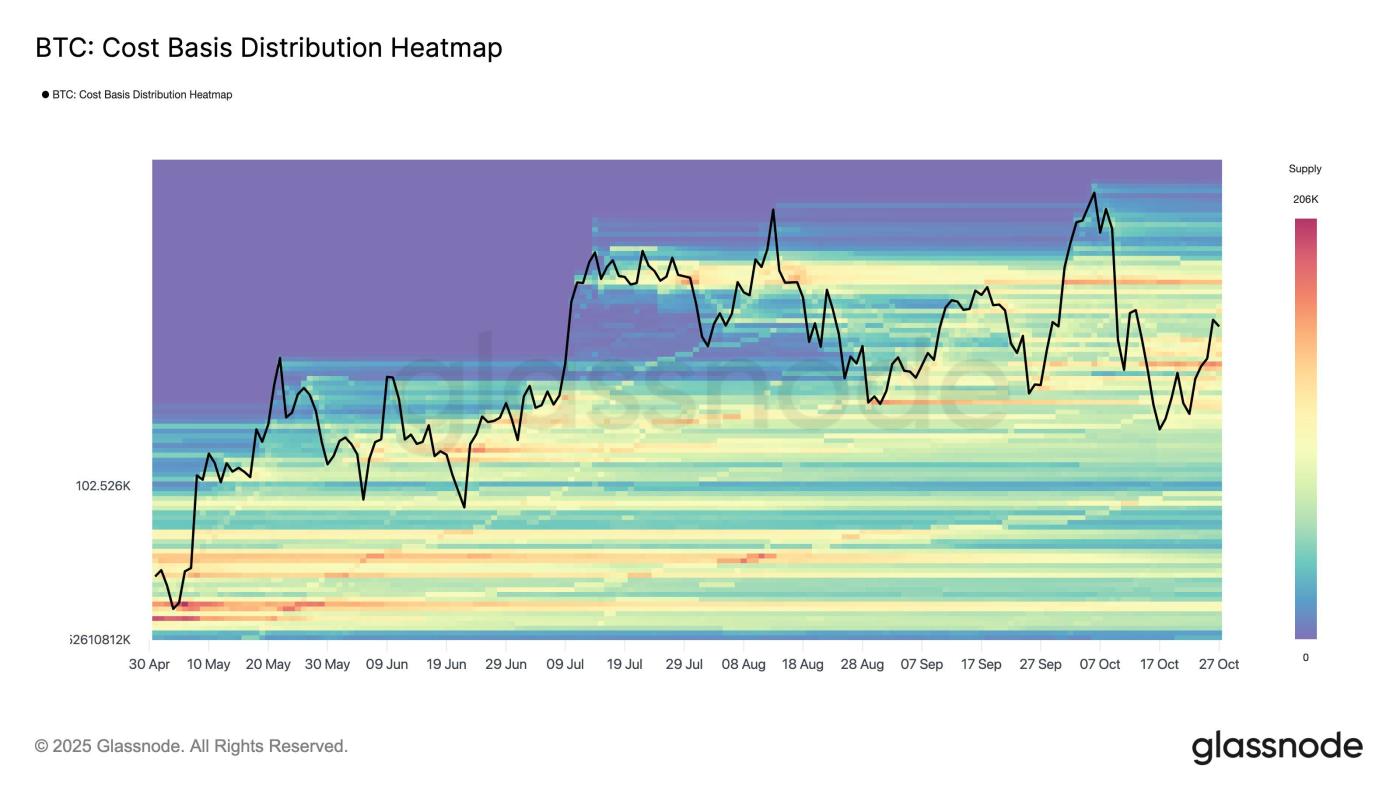

On- chain data provides an additional layer of information aboutBitcoin's current position. The cost basis distribution heat map highlights significant support around $111,000 and notable supply pressure near $117,000. This range defines the battleground between recent buyers looking to protect positions and profit takers looking to exit after the recent rally.

A breakout in either direction could set the trajectory for the coming weeks. If the bulls can push above the $117,000 supply zone, momentum could intensify. Conversely, if $111,000 fails to hold, sentiment could turn bearish, leading to short-term corrections.

Bitcoin cost base distribution heat map. Source: Glassnode

Bitcoin cost base distribution heat map. Source: GlassnodeBTC price waiting for breakout

At the time of writing, Bitcoin is trading at $114,518, just below the key resistance level of $115,000. With investor sentiment growing bullish, BTC could soon break above this barrier. A confirmed breakout could spark fresh momentum, pushing Bitcoin to higher resistance levels in November.

Bitcoin's short-term target remains the All-Time-High (ATH) of $126,199, which would require a 10.2% increase from current levels. To achieve this, BTC must overcome strong resistance zones at $117,261 and $120,000, which could temporarily slow progress due to large supply from profit takers.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingViewHowever, if Bitcoin fails to sustain momentum above $115,000, short-term weakness could re-emerge. A drop to $110,000 is still possible if buyers lose confidence. Any move below this support level would invalidate the bullish outlook.