Overall Market Outlook: A Transition from Cautious to Cautiously Optimistic

Entering late October 2025, the cryptocurrency market showed clear signs of recovery after a period of adjustment. The cautious sentiment that dominated the market over the past two months began to gradually dissipate, especially after the sharp market correction on October 11th, when investor sentiment shifted from panic to gradual rationality. Multiple key indicators suggest that the market bottom has been effectively tested, and new long power is accumulating.

The market recovery is not only reflected in prices, but also more profoundly in the multi-dimensional improvements in capital flows, institutional participation, and the regulatory environment. Since late October, net capital inflows into the market have turned positive, Altcoin ETFs have been approved in batches, and expectations for global monetary policy easing have risen. These factors have collectively injected new vitality into the market.

Data as of October 29 shows that the total market capitalization of cryptocurrencies has rebounded to $3.97 trillion, a 2.06% increase from the previous week. The market fear index has also rebounded from a low to 39, indicating that investor sentiment, while still cautious, has improved significantly.

Positive changes in market structure are also reflected in the completion of the deleveraging process. The crash on October 11th liquidated a large number of highly leveraged positions, and in the four weeks leading up to October 22nd, the total amount of liquidations across the network gradually decreased, effectively curbing excessive speculation in the derivatives market. Currently, Bitcoin contract open interest has returned to a healthy level, and funding rates remain positive but have not overheated, indicating a more solid market foundation.

ETF Market: The Core Vehicle for Large-Scale Inflows of Institutional Funds

Bitcoin spot ETFs: A key indicator of institutional allocation demand

The most prominent highlight in the cryptocurrency market in October was concentrated in the ETF sector, with fund flows and institutional behavior jointly confirming the return of market confidence. Bitcoin spot ETFs saw a cumulative net inflow of $4.57 billion this month.

As of October 29, the total assets under management of Bitcoin spot ETFs have climbed to a record high of $154.8 billion, accounting for 6.8% of the total market capitalization of Bitcoin, making it an important reservoir of funds in the market.

Looking at weekly data, there was a net inflow of $446 million from October 20th to 27th. BlackRock's IBIT fund performed particularly well, attracting $324 million in a single week, and its current holdings have exceeded 800,000 BTC. This data highlights the strong bullish stance of leading financial institutions on Bitcoin.

For traditional financial markets, ETF fund inflows are a core indicator reflecting market expectations. Compared to the subjectivity of social media buzz and the limitations of technical analysis in candlestick charts, ETF fund flows can more objectively reflect the true allocation intentions of institutions and long-term funds.

Institutional allocation behavior: Crypto assets are becoming an important component of investment portfolios

A significant characteristic of this round of market gains is the "increased institutionalization."

Leading financial institutions continue to increase their investment in crypto assets: Morgan Stanley has opened up Bitcoin and Ethereum allocation channels to all wealth management clients; JPMorgan Chase allows institutional clients to use Bitcoin as loan collateral, further enriching the application scenarios of crypto assets.

Latest data shows that the average allocation ratio of crypto assets by institutions has risen to 19%, a record high; and 85% of institutions said they have completed their crypto asset allocation or plan to start it in the near future.

This indicates that crypto assets are gradually becoming a standardized component of institutional portfolios, rather than marginalized speculative assets.

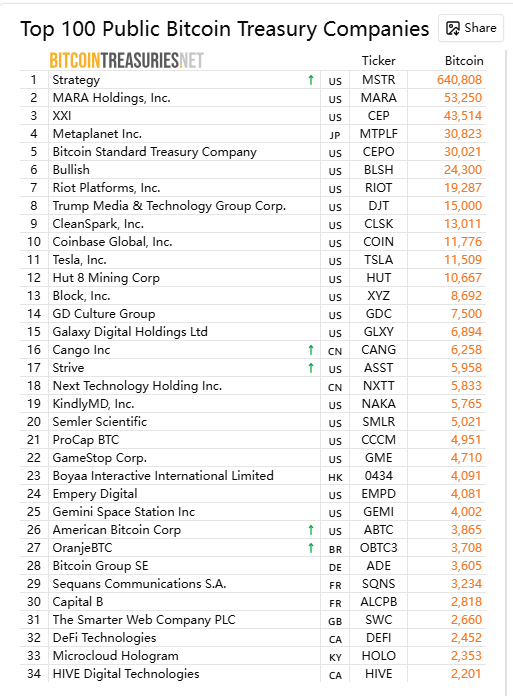

In terms of corporate asset allocation, traditional financial entities such as Block, Inc. have included cryptocurrencies in their balance sheets, such as holding more than 8,000 Bitcoins, worth approximately $550 million, demonstrating their recognition of long-term value.

Ethereum ETFs and Fund Rotation: Strategic Adjustments Behind Short-Term Outflows

In contrast to the strong performance of Bitcoin spot ETFs, Ethereum ETFs were relatively weak in October, with a cumulative net inflow of $930 million.

From a market perspective, this phenomenon can be interpreted as a "fund rotation signal": on the one hand, some funds are shifting from Ethereum to Bitcoin and Solana, which have clearer short-term upside potential;

On the other hand, it could also be that institutions are reallocating funds to prepare for the deployment of new types of ETF products (such as Ethereum futures ETFs and Altcoin ETFs) and to prepare for a new round of allocation.

This rotation phenomenon is not uncommon in history. A similar situation occurred in early 2024, after which Ethereum saw a significant return of funds after the Cancun upgrade.

Altcoin ETFs: Batch Approvals Open New Liquidity Channels

On October 28, the US market saw its first batch of Altcoin ETFs, covering three major Altcoin projects: Solana, Litecoin, and Hedera. These included the SOL ETF launched by Bitwise and Grayscale, as well as the LTC ETF and HBAR ETF, which were approved by Canary Capital for trading on Nasdaq.

This development signifies further acceptance of crypto assets within the traditional financial system. It's worth noting that the first batch of Altcoin ETFs is just the beginning of the market.

According to publicly available data, there are currently 155 Altcoin ETFs awaiting approval, covering 35 mainstream Altcoin assets. The market expects their initial inflows to exceed the combined initial inflows of the first two rounds of Bitcoin and Ethereum ETFs. If all of these ETFs are approved, it will bring an unprecedented "liquidity shockwave" to the crypto market.

Historically, Bitcoin ETFs have attracted over $50 billion in investment since their launch, while Ethereum ETFs have brought in $25 billion in new assets.

Essentially, ETFs are not only financial products, but also "standardized channels" for funds to enter the crypto market. When these channels expand from Bitcoin and Ethereum to Altcoin such as SOL, XRP, LINK, and AVAX, the valuation system of the entire crypto market will be restructured, and the liquidity and pricing efficiency of small and medium-sized cryptocurrencies are expected to improve significantly.

Institutional investors are deepening their presence in the Altcoin ETF sector: ProShares plans to launch the CoinDesk 20 ETF, which will track the performance of 20 crypto assets including BTC, ETH, SOL, and XRP; REX-Osprey has launched the 21-Asset ETF, innovatively allowing holders to earn staking rewards on tokens such as ADA, AVAX, NEAR, SEI, and TAO, further enriching the return model of ETF products. For Solana alone, there are currently 23 ETFs awaiting approval. This intensive deployment clearly indicates that institutional investors' risk appetite for crypto assets is gradually increasing, and the risk curve is extending from Bitcoin to the entire DeFi ecosystem.

Macroeconomic Environment: Driven by both expectations of loose liquidity and favorable policies

Federal Reserve Monetary Policy: Rate Cut Expectations Open Up Liquidity Space

Besides ETF factors, expectations of looser liquidity at the macro level are another core variable driving market trends.

On October 29th, market data showed a 98.3% probability of the Federal Reserve cutting interest rates by 25 basis points. This expectation had already been priced into market movements—the US dollar index weakened, risk assets rose collectively, and Bitcoin prices broke through the $114,900 mark. From a funding perspective, a rate cut means a decrease in the overall cost of capital in the market, and excess funds need to find higher-yielding outlets.

Against the backdrop of a lack of clear growth highlights in traditional markets (such as stocks and bonds) in 2025, the crypto market, which still has "narrative space," has become the focus of attention for funds, attracting funds from traditional markets to migrate to the crypto field.

The US core CPI data for September also supported expectations of an interest rate cut.

September's core CPI rose 0.2% month-on-month, lower than the expected 0.3%, indicating continued easing of inflationary pressures. With the government shutdown ongoing and the job market cooling, a Federal Reserve rate cut in October is highly probable. According to the latest data from CME's FedWatch Tool, the probability of a 25 basis point rate cut in October is as high as 96.7%, and the probability of a cumulative 50 basis point rate cut in December is 94.8%.

Global debt cycle and liquidity creation

According to Raoul Pal's global debt cycle analysis, the current total global debt has reached approximately $300 trillion, of which about $10 trillion (mainly US Treasury bonds and corporate bonds) is about to mature, requiring a large-scale liquidity injection to prevent debt yields from soaring. Raoul Pal estimates that every additional $1 trillion in liquidity will drive returns of 5-10% for risky assets such as stocks and cryptocurrencies.

For the crypto market, the $10 trillion debt refinancing process is expected to result in $2-3 trillion flowing into risk assets, potentially driving BTC up from its 2024 low of $60,000 to over $200,000 by 2026. This relationship between the debt cycle and liquidity creation fundamentally restructures the operating logic of the crypto market. The traditional four-year halving cycle may give way to a broader global liquidity cycle, further strengthening the correlation between the crypto market and traditional financial markets.

Policy environment: Regulatory environment is becoming more favorable, and the compliance process is accelerating.

This round of market benefits comes not only from the funding side, but also from policy support.

On October 27, the White House nominated former crypto lawyer Michael Selig to be the chairman of the U.S. Commodity Futures Trading Commission (CFTC). His past friendly attitude towards the crypto industry has injected confidence into the market. At the same time, the U.S. Securities and Exchange Commission (SEC) updated the creation mechanism for exchange-traded products (ETPs), allowing crypto ETFs to be redeemed in place, which greatly simplifies the ETF operation process and lowers the threshold for institutional participation.

The current regulatory attitude towards the US crypto market has shifted from "suppression" to "guiding compliance." The government is no longer simply restricting crypto innovation, but rather promoting the development of the crypto industry within a compliant framework by improving the rule system, thus laying the foundation for the long-term healthy operation of the market.

In addition, Trump's pardon of Binance founder CZ(CZ) is also seen as an important signal of the improvement of the US cryptocurrency regulatory environment.

Globally, regulatory frameworks are becoming increasingly clear. Kenya has passed the Virtual Asset Service Providers Act 2025, establishing a dual regulatory system involving the Central Bank and the Capital Markets Authority. The implementation of the European MiCA framework and the launch of dual-currency ETFs in Hong Kong have further clarified the global regulatory environment and reduced compliance uncertainty.

Geopolitical factors: Easing US-China trade tensions boost risk assets

From October 25th to 26th, the Chinese and US trade teams held a new round of consultations in Kuala Lumpur, reaching preliminary consensus on several important trade and economic issues. The easing of trade tensions between the two countries significantly boosted global risk appetite. As a result, spot gold and silver opened lower, crude oil prices strengthened, and US stock futures rose across the board. The cryptocurrency market, as a key representative of risk assets, also benefited from the improved macroeconomic environment. This breakthrough signifies a reduction in trade friction between the world's two largest economies, creating a more favorable environment for global capital flows. As a highly globalized asset class, the cryptocurrency market naturally benefits from this.

Reconstructing Market Cycle Theory: From Halving Narrative to Liquidity Narrative

Arthur Hayes: The four-year cycle is dead, the liquidity cycle is immortal.

In his blog post "Long Live the King," published in late October, former BitMEX CEO Arthur Hayes challenged traditional cyclical theories in the crypto market. He argued that while some traders expect Bitcoin to soon reach its cycle peak and crash in 2026, the current market logic has fundamentally changed—the "four-year halving cycle" of Bitcoin has become invalid, and the core variable truly determining market trends is the "global liquidity cycle," especially the resonance between the monetary policies of the US dollar and the Chinese yuan.

Hayes points out that the past three crypto bull and bear cycles (2009-2013, 2013-2017, and 2017-2021) seemingly followed the pattern of "bull market after halving, a four-year cycle," but in essence, each cycle coincided with the "credit expansion cycle" of the US dollar or the Chinese yuan: From 2009 to 2013, the Federal Reserve launched unlimited quantitative easing (QE), and China simultaneously launched large-scale credit issuance; from 2013 to 2017, the expansion of RMB credit fueled the ICO boom, injecting liquidity into the crypto market; from 2017 to 2021, the Trump and Biden administrations successively launched "helicopter money" policies, resulting in a global liquidity glut. When the pace of credit expansion in the US dollar or the Chinese yuan slowed down, the Bitcoin bull market also ended—essentially, Bitcoin is a "barometer" of global monetary easing, rather than being driven independently by the halving event. Entering 2025, the "halving-driven" logic completely collapsed: the monetary policies of both the US and China have entered a "new normal of sustained easing," with political pressure demanding that monetary and fiscal policies remain loose, and liquidity no longer tightening according to the traditional cycle. The US needs to dilute its high debt through "economic recovery," and the Trump administration continues to pressure the Federal Reserve to cut interest rates and expand fiscal spending; China, in order to cope with deflationary pressures, is also gradually releasing credit, with both countries continuously injecting funds into the market. Based on this, Hayes concludes: "The four-year cycle is dead; the real cycle is the liquidity cycle. As long as the US and China continue to maintain loose monetary policies, Bitcoin will continue its upward trend." This means that the future trend of the crypto market will no longer be constrained by the "halving timetable," but will depend on "the direction of monetary policy of the US dollar and the RMB." He concludes with "The king is dead, long live the king," implying the end of the traditional halving cycle and the official start of a new cycle dominated by liquidity.

Raoul Pal: The 5.4-Year Cycle Theory Reconstructs Traditional Cycle Models

Raoul Pal, a former Goldman Sachs executive and founder of Real Vision, proposed the "5.4-Year Cycle Theory," which fundamentally restructures the traditional 4-year Bitcoin halving cycle. He argues that the traditional 4-year cycle is not driven by the Bitcoin protocol itself (the halving event), but rather by the coincidence of the past three cycles (2009-2013, 2013-2017, and 2017-2021) with the "global debt refinancing cycle," and that the end of each cycle stemmed from monetary tightening policies, not the halving event itself. The core trigger for this theoretical shift is the structural change in the US debt structure in 2021-2022: in a near-zero interest rate environment, the US Treasury extended the average weighted maturity of its debt from approximately 4 years to 5.4 years. This adjustment not only changed the US debt refinancing timeline but, more importantly, reshaped the pace of global liquidity release, thus postponing the cyclical peak of Bitcoin from the traditionally expected fourth quarter of 2025 to the second quarter of 2026, while also indicating that the fourth quarter of 2025 will be a crucial window for a market rebound. From a data perspective, Raoul Pal's model further predicts that the second quarter of 2026 will see a historical peak in global liquidity; when the US Institute for Supply Management (ISM) Manufacturing Index breaks through 60, Bitcoin will enter a rapid upward "banana zone," with a target price range of $200,000 to $450,000. This prediction is based on in-depth research into the relationship between debt cycles and asset prices, providing a new perspective for understanding market trends.

in conclusion

The crypto market in October 2025 is at a critical turning point. The traditional halving cycle theory is giving way to a global liquidity cycle narrative. Institutional funds are pouring in on a large scale through standardized channels such as ETFs, the regulatory environment remains favorable, and on-chain data confirms increased market activity. These factors are collectively propelling the market into a new phase. Unlike previous cycles, this round of market developments is driven by more diversified, institutionalized, and fundamental factors.

The market is clearly shifting from a "fringe speculative asset" to a "mainstream asset allocation," and the valuation system is being restructured. While short-term volatility is inevitable, the medium- to long-term outlook for the crypto market remains optimistic given the backdrop of global liquidity easing, increased institutional participation, and continuous technological innovation. Investors need to recognize the changes in market structure, understand the market's operating logic from a broader perspective, and maintain risk awareness to seize opportunities amidst change and achieve their investment goals. As the crypto market further integrates into the global financial system, its correlation with traditional financial markets will increase, requiring investors to possess a more comprehensive analytical framework and more professional investment strategies.