Decentralized AI network Bittensor is set to undergo its first halving event in December, and TAO is outperforming the rest of the altcoin market in anticipation.

TAO’s tokenomics are modeled after Bitcoin’s, and as a result, the TAO token undergoes a halving event roughly every four years, depending on the mining rate. The network’s first halving is slated for December 10.

Until 2024, BTC typically followed a pattern in which it would undergo a halving, block rewards would be cut in half, and the asset would then trend upwards to a new all-time high over the next year or two. 2024, however, marked the first time BTC reached a new all-time high before a halving, rather than after.

That being said, the market appears to be anticipating a bullish move for TAO ahead of its first halving, as TAO is up 50% over the last 30 days, and was also one of the strongest altcoins off its liquidation lows on October 10.

TAO is the second best-performing top 100 altcoin over the last 30 days, only trailing Zcash, which has surged 400% in the same timeframe.

Impact on the Bittensor Ecosystem

Sami Kassab, a managing partner at Bittensor investment fund Unsupervised Capital, published his Bittensor halving thesis on Oct. 14, and expects TAO’s strong price action to continue.

“If you dig back into the lore of Bitcoin's first halving, the mood feels eerily familiar: pessimists convinced that Bitcoin would death spiral, while optimists believed the system would adapt because the incentives demanded it, “ said Kassab.

However, the Bittensor halving has a potential knock-on effect that Bitcoin has never had to deal with: its subnets.

Bittensor sub-networks earn TAO emissions based on their contributions to the network as a whole, and while on the surface, the halving means there will be less circulating supply for miners and validators to sell, it also means less liquidity will flow through each subnet.

According to Kassab, this liquidity constraint should amplify volatility, and the direction of net flows could have an outsized price impact on subnets, both positive and negative.

“So our view is: we think subnet flows are about to turn positive. And in a post-halving world where volatility is higher and liquidity is tighter, that’s a tailwind for subnet tokens,” he concluded.

Subnets Soar

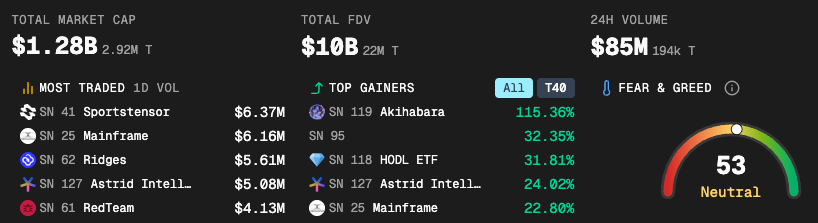

Bittensor subnets currently command a cumulative market capitalization of $1.28 billion according to TaoStats, which is just over 30% of TAO’s 4.26 billion market cap, led by Subnet 64, Chutes, and Subnet 62, Ridges.

The total subnet valuation is now up nearly 100% since August as more subnets continue to come online.

One notable subnet and Bittensor infrastructure firm, the Yuma Group, is led by Barry Silbert, founder and CEO of Digital Currency Group. Yuma currently powers 14 different subnets, which account for $71 million of the circulating subnet valuation.

“Institutions are starting to recognize how quickly Bittensor is evolving into an important component of global AI infrastructure,” Yuma COO Greg Schvey told The Defiant.

“At Yuma Asset Management, our goal is to bridge capital into the network in a way that supports the Bittensor ecosystem. By offering traditional financial products like these, we’re able to provide investors with access that would otherwise require unique technical expertise,” Schvey added.