- Technical support : The Bollinger Band middle line and the 20-day moving average form a key support zone of 110,000-105,500.

- Institutional catalysts : SEC policy easing and corporate investment initiatives will introduce new liquidity.

- Long-term valuation anchor : Halving cycle and on-chain activity indicate a possible supercycle between 2028 and 2032.

BTC Price Prediction

BTC Technical Analysis: Short-term correction may lead to renewed upward momentum

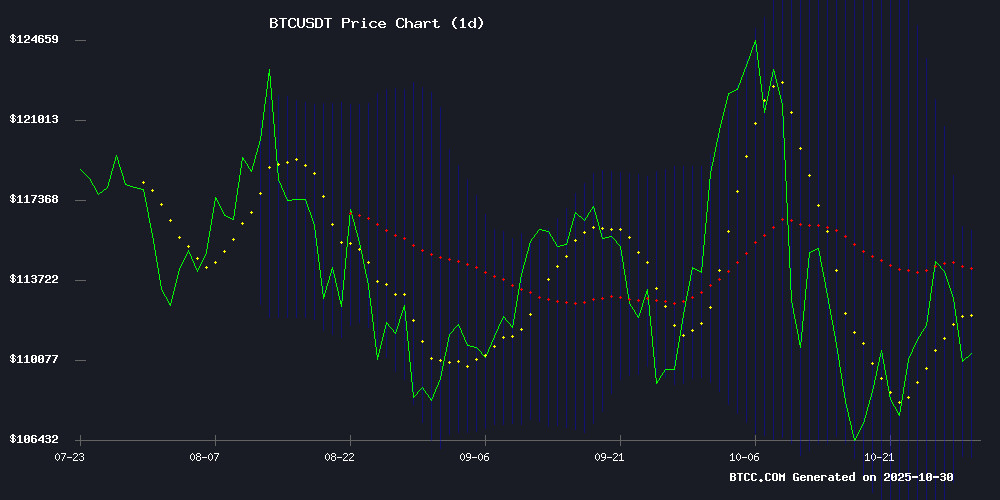

According to technical analysis by BTCC financial analyst Emma, the current BTC price of 109,179.67 USDT is slightly below the 20-day moving average (110,745.37), indicating short-term downward pressure. The MACD indicator is negative (-1,631.62), but the Bollinger Bands (105,536.67-115,954.07) maintain a stable width, meaning volatility has not yet increased significantly. Emma points out, "The price is testing the support of the Bollinger Band's middle line. If it holds above the 105,500 area, it will maintain its medium-term upward structure."

Market Sentiment: Institutional Movements Dominate BTC Strategic Deployment

BTCC analyst Emma, interpreting recent market dynamics, pointed out: "Events such as Michael Saylor's participation in the Pakistan crypto conference and the SEC's approval of Trump's media Bitcoin investment plan show a continued increase in institutional participation. VanEck's warning about the risk of listed companies' Bitcoin net asset value reflects that the market is moving towards mature pricing." She added that these fundamental developments strengthen the probability of a breakout from the 110,000-116,000 range on the technical front.

Factors affecting the price of BTC

Michael Saylor supports Pakistan's cryptocurrency ambitions at a milestone conference.

Pakistan's push for digital finance has garnered significant support, with MicroStrategy Executive Chairman Michael Saylor meeting with senior government officials to discuss Bitcoin 's role in sovereign reserves and monetary policy. This meeting, dubbed a "landmark discussion," included Finance Minister Muhammad Aurangzeb and Blockchain Minister Bilal Bin Saqib.

Saylor, who owns the world's largest corporate Bitcoin reserve, praised Pakistan's "knowledge leadership" in crypto adoption. The country aims to become a leader in digital assets in the Global South, and Minister Aurangzeb emphasized its ambition to set regulatory standards for the digital economy.

Bitcoin investors remain stable amid global uncertainty

Bitcoin's resilience above $100,000 demonstrates growing investor confidence in its store-of-value claim, despite geopolitical tensions and volatility in traditional markets. The cryptocurrency briefly dipped below the key technical level of $106,500, indicating short-term bearish momentum, but on-chain data shows no large-scale sell-off occurred.

Gold continues to attract traditional safe-haven flows due to ongoing Middle East conflicts and persistent inflation. Bitcoin's stability suggests a paradigm shift: institutional investors may now view digital assets as a legitimate hedge against macroeconomic instability.

CryptoQuant data shows unusually stable net inflows, with neither panic selling nor speculative inflows dominating market activity. This balance suggests that sophisticated holders are adopting a strategic wait-and-see approach rather than reacting impulsively to external impulses.

SEC approval of Trump media's Bitcoin purchase plan could unlock billions of dollars in cryptocurrency investment.

Trump Media & Technology Group (TMTG) has received regulatory approval from the U.S. Securities and Exchange Commission (SEC) to use $2.3 billion in institutional funds for Bitcoin acquisitions. The company's amended registration statement is now in effect, granting it broad autonomy over Bitcoin purchases without requiring the specification of a specific allocation amount.

The documents reveal strategic flexibility—TMTG can acquire Bitcoin-related securities or liquidate its holdings depending on market conditions, reinvesting the proceeds in cash equivalents. This move coincides with the company's expansion into the cryptocurrency space through its Truth.fi fintech platform, launched earlier this year.

Although TMTG has registered 84.7 million shares for potential resale, representing approximately 30% of its outstanding shares, management confirmed that there are currently no plans to postpone the registration of additional securities under the $12 billion agreement. The stock continues to trade on Nasdaq under the ticker symbol DJT.

Bitcoin price rebounds: Bulls aim for a new round of gains

Bitcoin's price action has shown resilience, rebounding from a low of $103,200, and traders are now targeting a break above the $106,800 resistance level. This rally occurred after failing to break the $110,000 mark, a failure that led to a drop below key support levels of $107,000 and $104,000.

A technical turnaround occurred after BTC/USD broke above the $105,000 bearish trendline on the Kraken hourly chart, while simultaneously pushing the price above the 23.6% Fibonacci retracement level. Currently, the cryptocurrency is hovering around $105,800, testing the 100-hour moving average, and market sentiment leans towards a new round of bullish momentum.

The key resistance level is at $106,750 – this level coincides with the 50% retracement level of the recent drop from $110,411. A decisive break above this area at the close would confirm the recovery argument and pave the way for further gains.

VanEck warns publicly traded companies face the risk of Bitcoin's net asset value parity.

Matte W. Sigel, Head of Digital Asset Research at VanEck, has identified a key valuation threshold for companies holding Bitcoin. Currently, at least one company ($SMLR) is trading near net asset value parity—its market capitalization fully reflects the value of the Bitcoin reserve. This turning point exposes a structural weakness in equity financing strategies.

"When the share price is below net asset value, continuously issuing new shares to acquire Bitcoin will destroy shareholder value," Sigel points out. This warning echoes the mistakes of over- leveraged mining companies in the last cycle. In such scenarios, the risk of equity dilution outweighs the potential gains for shareholders.

VanEck proposed three defensive measures: a share issuance ban based on net asset value, a preferred share buyback program, and adjustments to compensation structures. The proposal targets executive incentive mechanisms that may favor growth over per-share value. Boards of publicly traded companies face increasing pressure to implement safeguards before the market forces a correction through share price declines.

What will be the trend of BTC in the next 10 years?

Based on a combination of technical indicators and market dynamics, BTCC analyst Emma offers a ten-year outlook:

| stage | Price range | Driving factors |

|---|---|---|

| 2025-2028 | 90,000-180,000 | The fourth halving effect and ETF inflows |

| 2029-2032 | 150,000-300,000 | Enterprise balance sheet configuration and Layer 2 expansion breakthrough |

| 2033-2035 | 250,000+ | Global regulatory framework established, use cases for alternative fiat currencies explode. |

The key risk lies in the potential regulatory coordination challenges around 2030, but Bitcoin's position as digital gold will continue to be reinforced amid monetary policy uncertainty.