- Technical indicators suggest short-term downward pressure, but key support levels remain resilient.

- Cooling inflation and news of institutional acquisitions have injected positive momentum into the market.

- The long-term target of $200,000 remains achievable with fundamental support.

BTC Price Prediction

BTC Technical Analysis

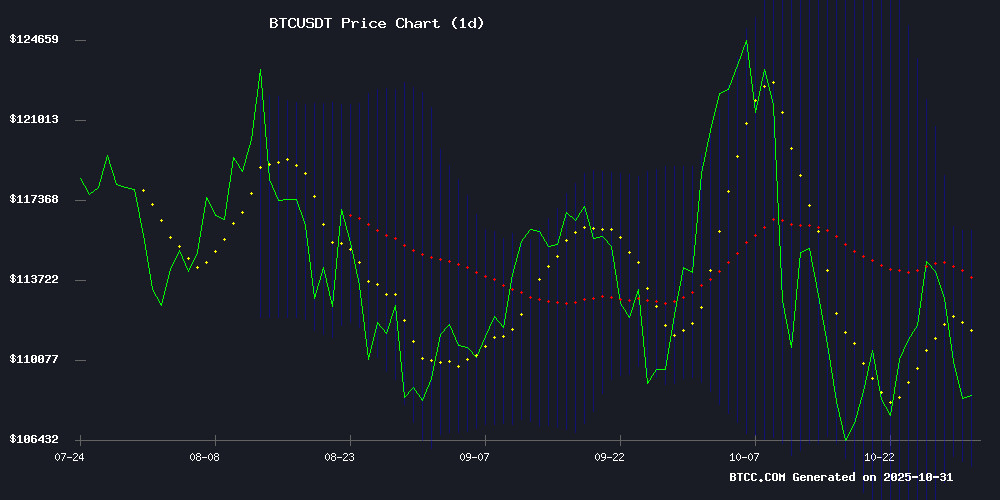

According to BTCC financial analyst Mia, the current BTC price of 109,553.23 USDT is slightly below the 20-day moving average of 110,647.97, indicating slight short-term pressure. The MACD indicator shows 1228.605 below 3320.636, with the histogram showing a negative value of -2092.031, indicating weak momentum. The Bollinger Bands show the price below the middle band but close to the lower band support level of 105,350.97; holding this level could lead to a technical rebound.

Market sentiment analysis

BTCC financial analyst Mia points out that cooling inflation and news of Anthony Pompliano's talks to lead a $750 million Bitcoin acquisition have boosted market confidence. While technical indicators suggest short-term downward pressure, positive fundamentals could push prices toward the $200,000 target, and investors should pay attention to key support levels.

Factors affecting the price of BTC

With inflation cooling, Bitcoin is poised for a breakout – is the $200,000 target within reach?

U.S. inflation rose just 0.1% in May, easing market concerns but still remaining above the Federal Reserve's 2% target. The Consumer Price Index ( CPI ) rose 0.1% month-over-month, bringing the annual inflation rate to 2.4%. The core CPI, excluding food and energy, also rose 0.1%, below the expected 0.3%, while the annual core CPI came in at 2.8%, also below the expected 2.9%.

Clothing prices unexpectedly declined, and despite tariff concerns, this marks the fourth consecutive month that inflation has fallen short of expectations. However, with inflation still above the Federal Reserve's target, the likelihood of an interest rate cut remains low, despite political pressure.

Bitcoin's technical outlook is bullish, with the weekly price holding firmly above key moving averages. The OBV indicator broke through the December 2025 high, indicating continued buying pressure following the pullback in March and April. The CMF indicator further corroborates the upward momentum, fueling market speculation that it may challenge the $200,000 mark.

Anthony Pompliano in talks to lead $750 million Bitcoin acquisition project

Cryptocurrency influencer Anthony Pompliano is in talks to become CEO of ProCapBTC, a company planning a $750 million Bitcoin acquisition strategy. The funding will include $500 million in equity and $250 million in convertible bonds, to be realized through a merger with SPAC Columbus Circle Capital 1, which completed a $250 million Nasdaq IPO last month.

This move demonstrates growing institutional interest in Bitcoin as a government asset, and Pompliano's involvement adds credibility to this ambitious accumulation plan. According to the Financial Times, this deal could be one of the largest corporate-specific Bitcoin acquisitions since the pioneering government strategy of the Michael Strategy.

How high can the price of BTC rise?

According to a comprehensive analysis by BTCC financial analyst Mia, BTC is currently in a technical adjustment phase, but fundamental factors are providing strong support. From a technical perspective, if the price can hold the key support level of 105,350 USDT (lower Bollinger Band), it is expected to retest the 20-day moving average resistance level of 110,647 USDT. A break above this level would target 115,944 USDT.

| Technical indicators | Current value | Signal Interpretation |

|---|---|---|

| Current price | 109,553.23 USDT | Below the 20-day moving average |

| 20th MA | 110,647.97 | Short-term resistance level |

| MACD | -2092.031 | Weak kinetic energy |

| Bollinger Bands Upper Rail | 115,944.97 | Key resistance level |

| Bollinger Band lower rail | 105,350.97 | Important support level |

Combining factors such as cooling inflation and institutional acquisitions, if market sentiment continues to improve, the medium-term target of $150,000 is expected, and the long-term target of $200,000 remains achievable with fundamental support. Investors should closely monitor the defense of the $105,350 USDT support level and changes in trading volume.